HORNGREN'S COST ACCT >IA<

16th Edition

ISBN: 9780136675464

Author: Datar

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.24E

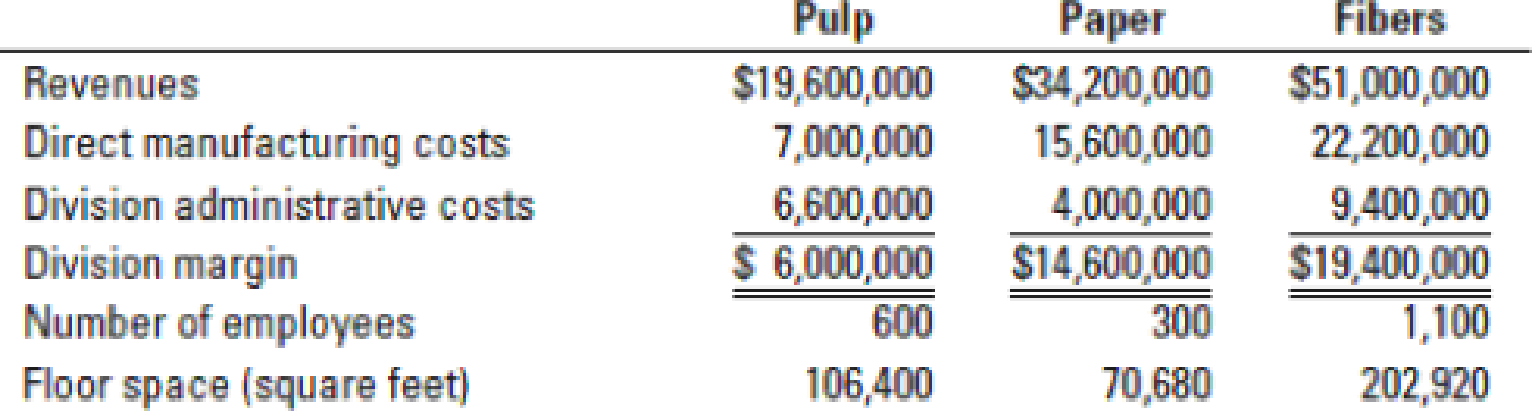

Cost allocation to divisions. Bergen Corporation has three divisions: pulp, paper, and fibers. Bergen’s new controller, David Fisher, is reviewing the allocation of fixed corporate-overhead costs to the three divisions. He is presented with the following information for each division for 2017:

Until now, Bergen Corporation has allocated fixed corporate-overhead costs to the divisions on the basis of division margins. Fisher asks for a list of costs that comprise fixed corporate overhead and suggests the following new allocation bases:

| Fixed Corporate-Overhead Costs | Suggested Allocation Bases | |

| Human resource management | $ 4,600,000 | Number of employees |

| Facility | 6,400,000 | Floor space (square feet) |

| Corporate administration | 9,200,000 | Division administrative costs |

| Total | $20,200,000 |

- 1. Allocate 2017 fixed corporate-overhead costs to the three divisions using division margin as the allocation base. What is each division’s operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)?

Required

- 2. Allocate 2017 fixed costs using the allocation bases suggested by Fisher. What is each division’s operating margin percentage under the new allocation scheme?

- 3. Compare and discuss the results of requirements 1 and 2. If division performance incentives are based on operating margin percentage, which division would be most receptive to the new allocation scheme? Which division would be the least receptive? Why?

- 4. Which allocation scheme should Bergen Corporation use? Why? How might Fisher overcome any objections that may arise from the divisions?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Bethany Corporation has three divisions: pulp, paper, and fibers. Bethany's

new controller, Paul Wagner, is reviewing the allocation of fixed corporate-overhead costs to the three divisions. He is presented with the following information for each division for 2017:

Until now, BethanyCorporation has allocated fixed corporate-overhead costs to the divisions on the basis of division margins. Wagner asks for a list of costs that comprise fixed corporate overhead and suggests the following new allocation bases:

Read the requirements3.

Requirement 1. Allocate 2017fixed corporate-overhead costs to the three divisions using division margin as the allocation base. What is each division's operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)?

Allocate the fixed corporate-overhead costs, then calculate the division operating margins in dollars and as a percentage of revenue. (Round allocation…

Cost allocation to divisions. Bergen Corporation has three divisions: pulp, paper, and fibers. Bergen’s new controller, David Fisher, is reviewing the allocation of fixed corporate-overhead costs to the three divisions. He is presented with the following information for each division for 2017:

Cost allocation to divisions. Bergen Corporation has three divisions: pulp, paper, and bers. Bergen’s new controller, David Fisher, is reviewing the allocation of xed corporate-overhead costs to the three divisions. He is presented with the following information for each division for 2017:

Chapter 14 Solutions

HORNGREN'S COST ACCT >IA<

Ch. 14 - Prob. 14.1QCh. 14 - Why is customer-profitability analysis an...Ch. 14 - Prob. 14.3QCh. 14 - A customer-profitability profile highlights those...Ch. 14 - Give examples of three different levels of costs...Ch. 14 - What information does the whale curve provide?Ch. 14 - A company should not allocate all of its corporate...Ch. 14 - What criteria might managers use to guide...Ch. 14 - Once a company allocates corporate costs to...Ch. 14 - A company should not allocate costs that are fixed...

Ch. 14 - How should a company decide on the number of cost...Ch. 14 - Show how managers can gain insight into the causes...Ch. 14 - How can the concept of a composite unit be used to...Ch. 14 - Explain why a favorable sales-quantity variance...Ch. 14 - How can the sales-quantity variance be decomposed...Ch. 14 - Flexible-budget variance, sales-quantity,...Ch. 14 - Sales-volume, sales-mix, and sales-quantity...Ch. 14 - Cost allocation in hospitals, alternative...Ch. 14 - Customer profitability, customer-cost hierarchy....Ch. 14 - Customer profitability, service company. Instant...Ch. 14 - Customer profitability, distribution. Best Drugs...Ch. 14 - Cost allocation and decision making. Reidland...Ch. 14 - Cost allocation to divisions. Rembrandt Hotel ...Ch. 14 - Cost allocation to divisions. Bergen Corporation...Ch. 14 - Prob. 14.25ECh. 14 - Variance analysis, working backward. The Hiro...Ch. 14 - Variance analysis, multiple products. Emcee Inc....Ch. 14 - Market-share and market-size variances...Ch. 14 - Click here to open your MyFinanceLab Study Plan...Ch. 14 - Customer profitability. Bracelet Delights is a new...Ch. 14 - Customer profitability, distribution. Green Paper...Ch. 14 - Customer profitability in a manufacturing firm....Ch. 14 - Customer-cost hierarchy, customer profitability....Ch. 14 - Allocation of corporate costs to divisions. Cathy...Ch. 14 - Cost allocation to divisions. Forber Bakery makes...Ch. 14 - Prob. 14.36PCh. 14 - Cost-hierarchy income statement and allocation of...Ch. 14 - Variance analysis, sales-mix and sales-quantity...Ch. 14 - Market-share and market-size variances...Ch. 14 - Variance analysis, multiple products. The Robins...Ch. 14 - Customer profitability and ethics. KC Corporation...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Young Company is beginning operations and is considering three alternatives to allocate manufacturing overhead to individual units produced. Young can use a plantwide rate, departmental rates, or activity-based costing. Young will produce many types of products in its single plant, and not all products will be processed through all departments. In which one of the following independent situations would reported net income for the first year be the same regardless of which overhead allocation method had been selected? a. All production costs approach those costs that were budgeted. b. The sales mix does not vary from the mix that was budgeted. c. All manufacturing overhead is a fixed cost. d. All ending inventory balances are zero.arrow_forwardA manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardDuweynie Pottery, Inc., is divided into two operating divisions: Pottery and Retail. The company allocates Power and General Factory department costs to each operating division. Power costs are allocated on the basis of the number of machine hours and general factory costs on the basis of square footage. No effort is made to separate fixed and variable costs; however, only budgeted costs are allocated. Allocations for the coming year are based on the following data: Use the rounded values for subsequent calculations. Support Departments Operating Divisions Power General Factory Pottery Retail Overhead costs $150,000 $171,600 $97,000 $55,000 Machine hours 2,000 2,500 7,000 3,000 Square footage 2,500 1,700 4,000 6,000 Round all allocation ratios to four significant digits. Round all allocated amounts to the nearest dollar. Required: 1. Allocate the support service costs using the direct method. Note: Input to two decimal places. Allocation…arrow_forward

- Duweynie Pottery, Inc., is divided into two operating divisions: Pottery and Retail. The company allocates Power and General Factory department costs to each operating division. Power costs are allocated on the basis of the number of machine hours and general factory costs on the basis of square footage. No effort is made to separate fixed and variable costs; however, only budgeted costs are allocated. Allocations for the coming year are based on the following data: Use the rounded values for subsequent calculations. Support Departments Operating Divisions Power General Factory Pottery Retail Overhead costs $150,000 $171,600 $97,000 $55,000 Machine hours 2,000 2,500 7,000 3,000 Square footage 2,500 1,700 4,000 6,000 Round all allocation ratios to four significant digits. Round all allocated amounts to the nearest dollar. Required: 2. Allocate the support service costs using the sequential method. The support departments are ranked in order of…arrow_forwardAllocation of corporate costs to divisions. Cathy Carpenter, controller of the Sweet and Salty Snacks is preparing a presentation to senior executives about the performance of its four divisions. Summary data related to the four divisions for the most recent year are as follows: Under the existing accounting system, costs incurred at corporate headquarters are collected in a single cost pool ($1.2 million in the most recent year) and allocated to each division on the basis of its actual revenues. The top managers in each division share in a division-income bonus pool. Division income is defined as operating income less allocated corporate costs. Carpenter has analyzed the components of corporate costs and proposes that corporate costs be collected in four cost pools. The components of corporate costs for the most recent year and Carpenter’s suggested cost pools and allocation bases are as follows:arrow_forwardElba Consulting Associates (ECA) is organized into three divisions (Manufacturing, Retail, and Entertainment). Many support services, such as human resources, legal, and information technology, are provided by corporate staff. The corporate staff costs are allocated to the divisions based on divisional revenue. The resulting divisional operating profit (computed as divisional revenues less divisional direct costs less corporate cost allocations) is used to evaluate and compensate all division managers. The compensation plan consists of a fixed salary plus a bonus, which depends on the actual divisional operating profit compared to the target profit. The fixed salary for all three division managers is $500,000. The bonus consists of two parts. First, there is a "target bonus," which is a flat $25,000 for meeting the operating profit target. Second, there is an "incentive bonus," which is equal to 0.2% of salary for every thousand dollars of operating profit in excess of the target. The…arrow_forward

- Management of XYZ Media has decided to allocate the costs of the paper's two service/support departments (administration and human resources) to the two revenue generating/producing departments (advertising and circulation.) Administration costs are to be allocated on the Pesos of Assets Employed. ; Human Resources costs are to be allocated on the basis of Number of Employees. The following costs and allocated bases are available. (Convert the fractions on the allocated bases into percentages rounded to the whole number). Department - Administration: Direct Costs - P781,500 Number of Employees - 10 Pesos of Assets Employed - P387,100 Department - Human Resources: Direct Costs - P492,700 Number of Employees - 7 Pesos of Assets Employed - P291,700 Department - Advertising: Direct Costs - P957,800 Number of Employees - 12 Pesos of Assets Employed - P762,400 Department - Circulation: Direct Costs - P1,352,600 Number of Employees - 25 Pesos of Assets Employed - P1,870,300…arrow_forwardBaldwin Enterprises has two service departments, Personnel and Legal, and two operating divisions, Eastern and Western. Personnel costs are allocated on the basis of employees and Legal costs are allocated on the basis of hours. A summary of Baldwin operations follows: Personnel Legal Eastern Western Employees - 40 120 40 Hours 10,800 - 5,400 1,800 Department direct costs $ 300,000 $ 160,000 $ 1,200,000 $ 790,000 Required: Allocate the cost of the service departments to the operating divisions using the direct method. Allocate the cost of the service departments to the operating divisions using the step method. Start with Legal. Allocate the cost of the service departments to the operating divisions using the reciprocal method.arrow_forwardOxmoor Corporation has two service departments (Maintenance and Human Resources) and three production departments (Machining, Assembly, and Finishing). The two service departments service the production departments as well as each other, and studies have shown that Maintenance provides the greater amount of service. On the basis of this information, which of the following cost allocations would likely occur under the step-down method? Maintenance cost would be allocated to Finishing. Machining cost would be allocated to Assembly. Maintenance cost would be allocated to Human Resources. Human Resources cost would be allocated to Maintenance. Both maintenance cost would be allocated to Finishing and maintenance cost would be allocated to Human Resources.arrow_forward

- Cost allocation and decision making. Reidland Manufacturing has four divisions: Acme, Dune, Stark, and Brothers. Corporate headquarters is in Minnesota. Reidland corporate headquarters incurs costs of $16,800,000 per period, which is an indirect cost of the divisions. Corporate headquarters currently allocates this cost to the divisions based on the revenues of each division. The CEO has asked each division manager to suggest an allocation base for the indirect headquarters costs from among revenues, segment margin, direct costs, and number of employees. The following is relevant information about each division:arrow_forwardBalding, Ltd. is composed of 5 divisions. Each division is allocated a share of the overhead of Balding to make divisional managers aware of the cost of running the corporate headquarters. The following information relates to the Metro Division: Sales $6,100,000 Variable Operating Costs $3,640,000 Traceable Fixed Operating Costs $1,560,000 Allocated Corporate Overhead $200,000 If the Metro Division is closed, 100% of the traceable fixed operating costs can be eliminated. What will be the impact on the overall profitability of Balding if the Metro Division is closed? Select one: A. Decrease by $900,000 B. Decrease by $5,900,000 C. Decrease by $4,340,000 D. Decrease by $2,460,000 E. Decrease by $700,000arrow_forwardHannah Gilpin is the controller ofBlakemore Auto Glass, a division of Eastern Glass and Window. Blakemore replaces and installs windshields.Her division has been under pressure to improve its divisional operating income. Currently,divisions of Eastern Glass are allocated corporate overhead based on cost of goods sold. Jake Myers,the president of the division, has asked Gilpin to reclassify $50,000 of installation labor, which is includedin cost of goods sold, as administrative labor, which is not. Doing so will save the division $20,000 in allocatedcorporate overhead. The labor costs in question involve installation labor provided by traineeemployees. Myers argues, “the trainees are not as efficient as regular employees so this is unfairlyinflating our cost of goods sold. This is really a cost of training (administrative labor) not part of cost ofgoods sold.” Gilpin does not see a reason for reclassification of the costs, other than to avoid overheadallocation costs. Describe Gilpin’s…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY