HORNGREN COST ACCT NON-MAJORS W/ACCESS

17th Edition

ISBN: 9781323703748

Author: Datar

Publisher: Pearson Custom Publishing

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 15.25E

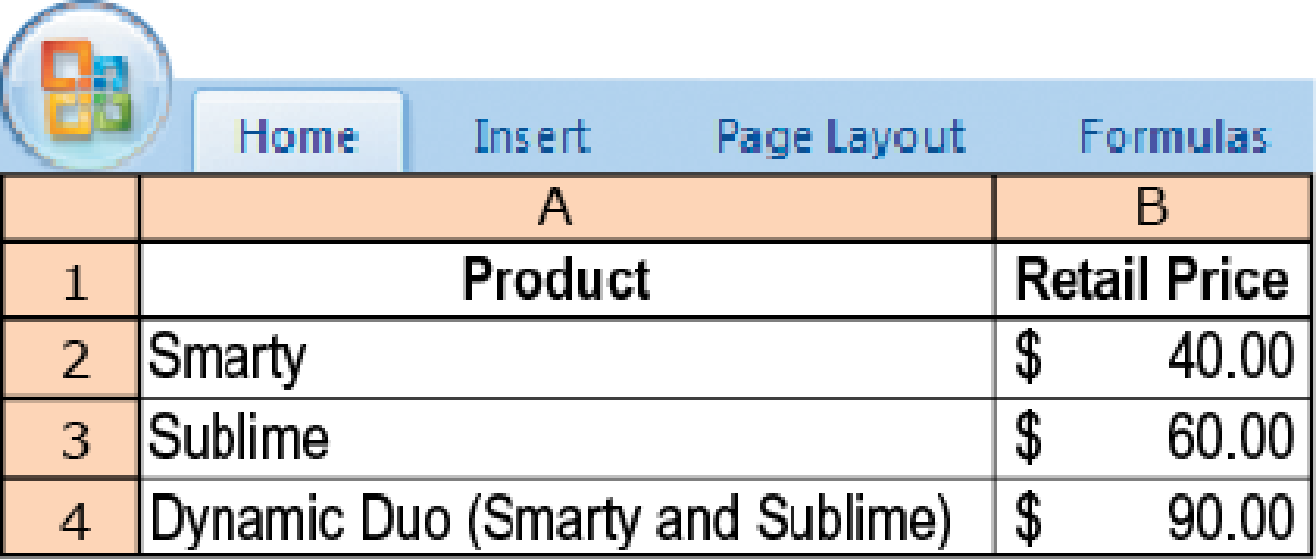

Revenue allocation, bundled products. Couture Corp sells Samsung 7 cases. It has a Men’s Division and a Women’s Division. Couture is now considering the sale of a bundled product called Dynamic Duo consisting of Smarty, a men’s case, and Sublime, a women’s case. For the most recent year, Couture sold equal quantities of Smarty and Sublime and reported the following:

- 1. Allocate revenue from the sale of each unit of Dynamic Duo to Smarty and Sublime using the following: Required

- a. The stand-alone revenue-allocation method based on selling price of each product

- b. The incremental revenue-allocation method, with Smarty ranked as the primary product

- c. The incremental revenue-allocation method, with Sublime ranked as the primary product

- d. The Shapley value method

- 2. Of the four methods in requirement 1, which one would you recommend for allocating Couture’s revenues to Smarty and Sublime? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ivanhoe Trivia Co. manufactures and sells two trivia products, the Square Trivia Game and the Round Trivia Game. Last quarter’s operating profits, by product, and for the company as a whole, were as follows:

Square

Round

Total

Sales revenue

$12,800

$6,670

$19,470

Variable expenses

4,980

2,930

7,910

Contribution margin

7,820

3,740

11,560

Fixed expenses

2,810

4,200

7,010

Operating income

$ 5,010

$(460

)

$ 4,550

Forty percent of the Round Game’s fixed costs could have been avoided if the game had not been produced or sold.If the Round Game had been discontinued before the last quarter, what would operating income have been for the company as a whole?

Operating income without round

$ _______

Fortunate Inc. is involved in retailing and has three profit centers classified as “East” and “West” and “South.” East Division sold 38,000 units during the year for a selling price of $25 each—These items cost $15 each and had $2.50 of variable selling expenses (sales commissions) that could be directly traced to the units. West Division sold 16,000 units during the year for a selling price of $27 each—These items cost $17 each and that had $3 of variable selling expenses (sales commissions) that could be directly traced to the units. South Division sold 42,000 units during the year for a selling price of $26 each—These items cost $16 each and had $2 of variable selling expenses (sales commissions) that could be directly traced to the units. Fixed Division Operating Costs that could be directly traced to the divisions were $160,000 for East Division and $95,000 for West Division, and $200,000 for South Division. There were $230,000 of Corporate Costs (which was $20,000 for…

Milden Company has an exclusive franchise to purchase a product from the manufacturer and distribute it on the retail level. As an aid in planning, the company has decided to start using a contribution format income statement. To have data to prepare such a statement, the company has analyzed its expenses and has developed the following cost formulas:

Cost

Cost Formula

Cost of good sold

$30 per unit sold

Advertising expense

$186,000 per quarter

Sales commissions

8% of sales

Shipping expense

?

Administrative salaries

$96,000 per quarter

Insurance expense

$10,600 per quarter

Depreciation expense

$66,000 per quarter

Management has concluded that shipping expense is a mixed cost, containing both variable and fixed cost elements. Units sold and the related shipping expense over the last eight quarters follow:

Quarter

Units Sold

ShippingExpense

Year 1:

First

32,000

$

176,000…

Chapter 15 Solutions

HORNGREN COST ACCT NON-MAJORS W/ACCESS

Ch. 15 - Prob. 15.1QCh. 15 - Describe how the dual-rate method is useful to...Ch. 15 - How do budgeted cost rates motivate the...Ch. 15 - Give examples of allocation bases used to allocate...Ch. 15 - Why might a manager prefer that budgeted rather...Ch. 15 - To ensure unbiased cost allocations, fixed costs...Ch. 15 - Prob. 15.7QCh. 15 - What is conceptually the most defensible method...Ch. 15 - Distinguish between two methods of allocating...Ch. 15 - What are the challenges of using the incremental...

Ch. 15 - Prob. 15.11QCh. 15 - What is one key way to reduce cost-allocation...Ch. 15 - Describe how companies are increasingly facing...Ch. 15 - Distinguish between the stand-alone and the...Ch. 15 - Identify and discuss arguments that individual...Ch. 15 - Single-rate versus dual-rate methods, support...Ch. 15 - Single-rate method, budgeted versus actual costs...Ch. 15 - Dual-rate method, budgeted versus actual costs and...Ch. 15 - Support-department cost allocation; direct and...Ch. 15 - Support-department cost allocation, reciprocal...Ch. 15 - Direct and step-down allocation. E-books, an...Ch. 15 - Reciprocal cost allocation (continuation of...Ch. 15 - Allocation of common costs. Evan and Brett are...Ch. 15 - Allocation of common costs. Gordon Grimes, a...Ch. 15 - Revenue allocation, bundled products. Couture Corp...Ch. 15 - Allocation of common costs. Jim Dandy Auto Sales...Ch. 15 - Single-rate, dual-rate, and practical capacity...Ch. 15 - Prob. 15.28PCh. 15 - Fixed-cost allocation. Central University...Ch. 15 - Allocating costs of support departments; step-down...Ch. 15 - Support-department cost allocations;...Ch. 15 - Common costs. Tate Inc. and Booth Inc. are two...Ch. 15 - Prob. 15.33PCh. 15 - Support-department cost allocations;...Ch. 15 - Revenue allocation, bundled products. Boca Resorts...Ch. 15 - Support-department cost allocations; direct,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Segmented Income Statement, Management Decision Making FunTime Company produces three lines of greeting cards: scented, musical, and regular. Segmented income statements for the past year are as follows: Kathy Bunker, president of FunTime, is concerned about the financial performance of her firm and is seriously considering dropping both the scented and musical product lines. However, before making a final decision, she consults Jim Dorn, FunTimes vice president of marketing. Required: 1. CONCEPTUAL CONNECTION Jim believes that by increasing advertising by 1,000 (250 for the scented line and 750 for the musical line), sales of those two lines would increase by 30%. If you were Kathy, how would you react to this information? 2. CONCEPTUAL CONNECTION Jim warns Kathy that eliminating the scented and musical lines would lower the sales of the regular line by 20%. Given this information, would it be profitable to eliminate the scented and musical lines? 3. CONCEPTUAL CONNECTION Suppose that eliminating either line reduces sales of the regular cards by 10%. Would a combination of increased advertising (the option described in Requirement 1) and eliminating one of the lines be beneficial? Identify the best combination for the firm.arrow_forwardDevelop a profit-and-loss statement for the Westgate division of North Industries. This division manufactures light fixtures sold to consumers through home improvement and hardware stores. Cost of goods sold represents 40% of net sales. Marketing expenses include selling expenses, promotion expenses, and freight. Selling expenses include sales salaries totaling $3 million per year and sales commissions (5% of sales). The company spent $3 million on advertising last year,and freight costs were 10% of sales. Other costs include $2 million for managerial salaries and expenses for the marketing function and another $3 million for indirect overhead allocated to the division. a. Develop the profit-and-loss statement if net sales were $20 million last year.b. Develop the profit-and-loss statement if net sales were $40 million last year.c. Calculate Westgate’s break-even sales.arrow_forwardFunTime Company produces three lines of greeting cards: scented, musical, and regular.Segmented income statements for the past year are as follows: Kathy Bunker, president of FunTime, is concerned about the financial performance of her firmand is seriously considering dropping both the scented and musical product lines. However,before making a final decision, she consults Jim Dorn, FunTime’s vice president of marketing.Required:1. CONCEPTUAL CONNECTION Jim believes that by increasing advertising by $1,000($250 for the scented line and $750 for the musical line), sales of those two lines wouldincrease by 30%. If you were Kathy, how would you react to this information?2. CONCEPTUAL CONNECTION Jim warns Kathy that eliminating the scented and musicallines would lower the sales of the regular line by 20%. Given this information, would it beprofitable to eliminate the scented and musical lines?3. CONCEPTUAL CONNECTION Suppose that eliminating either line reduces sales of theregular cards by…arrow_forward

- Toxaway Company is a merchandiser that segments its business into two divisions—Commercial and Residential. The company’s accounting intern was asked to prepare segmented income statements that the company’s divisional managers could use to calculate their break-even points and make decisions. She took the prior month’s companywide income statement and prepared the absorption format segmented income statement shown below: TotalCompany Commercial Residential Sales $ 750,000 $ 250,000 $ 500,000 Cost of goods sold 500,000 140,000 360,000 Gross margin 250,000 110,000 140,000 Selling and administrative expenses 240,000 104,000 136,000 Net operating income $ 10,000 $ 6,000 $ 4,000 In preparing these statements, the intern determined that Toxaway’s only variable selling and administrative expense is a 10% sales commission on all sales. The company’s total fixed expenses include $72,000 of common fixed expenses that…arrow_forwardDevelop a profit-and-loss statement for the Westgate division of North Industries. This division manufactures light fixtures sold to consumers through home improvement and hardware stores. Cost of goods sold represents 40 per cent of net sales. Marketing expenses include selling expenses, promotion expenses and freight. Selling expenses include sales salaries totalling €3 million per year and sales commissions (5 per cent of sales). The company spent €3 million on advertising last year, and freight costs were 10 per cent of sales. Other costs include €2 million for managerial salaries and expenses for the marketing function and another €3 million for indirect overhead allocated to the division. Develop the profit-and-loss statement if net sales were €20 million last year. Develop the profit-and-loss statement if net sales were €40 million last year. Calculate Westgate’s break-even sales?arrow_forwardToxaway Company is a merchandiser that segments its business into two divisions—Commercial and Residential. The company’s accounting intern was asked to prepare segmented income statements that the company’s divisional managers could use to calculate their break-even points and make decisions. She took the prior month’s companywide income statement and prepared the absorption format segmented income statement shown below: Total Company Commercial Residential Sales $ 930,000 $ 310,000 $ 620,000 Cost of goods sold 623,100 170,500 452,600 Gross margin 306,900 139,500 167,400 Selling and administrative expenses 288,000 128,000 160,000 Net operating income $ 18,900 $ 11,500 $ 7,400 In preparing these statements, the intern determined that Toxaway’s only variable selling and administrative expense is a 10% sales commission on all sales. The company’s total fixed expenses include $69,000 of common fixed expenses that…arrow_forward

- Toxaway Company is a merchandiser that segments its business into two divisions—Commercial and Residential. The company’s accounting intern was asked to prepare segmented income statements that the company’s divisional managers could use to calculate their break-even points and make decisions. She took the prior month’s companywide income statement and prepared the absorption format segmented income statement shown below: TotalCompany Commercial Residential Sales $ 975,000 $ 325,000 $ 650,000 Cost of goods sold 663,000 182,000 481,000 Gross margin 312,000 143,000 169,000 Selling and administrative expenses 300,000 134,000 166,000 Net operating income $ 12,000 $ 9,000 $ 3,000 In preparing these statements, the intern determined that Toxaway’s only variable selling and administrative expense is a 10% sales commission on all sales. The company’s total fixed expenses include $64,500 of common fixed expenses that would continue to be incurred even if the Commercial…arrow_forwardToxaway Company is a merchandiser that segments its business into two divisions—Commercial and Residential. The company’s accounting intern was asked to prepare segmented income statements that the company’s divisional managers could use to calculate their break-even points and make decisions. She took the prior month’s companywide income statement and prepared the absorption format segmented income statement shown below: Total Company Commercial Residential Sale 750,000 250,000 500,000 Cost of goods sold 500,000 140,000 360,000 Gross margin 250,000 110,000 140,000 Selling and administrative expresses 240,000 104,000 136,000 Net operating income 10,000 6,000 4,000 In preparing these statements, the intern determined that Toxaway’s only variable selling and administrative expense is a 10% sales commission on all sales. The company’s total fixed expenses include $72,000 of common fixed expenses that would continue to…arrow_forwardOmega Company has the following two customers: Woodruff Ensley Sales $900,000 $800,000 Cost of Goods Sold 360,000 160,000 Other expenses excluding sales commissions 640,000 130,000 If the company pays a 4% sales commission based on customer profit, this will encourage a salespersons' efforts to sell to:arrow_forward

- Analyzing profitability Father Furniture Company manufactures and sells oak tables and chairs. Price and cost data for the furniture follow: Father Furniture has three sales representatives: Adam, Ben, and Caleb. Adam sold 100 tables With 6 chairs each. Ben sold 110 tables With 4 chairs each. Caleb sold 80 tables with 8 chairs each. Requirements Calculate the total contribution margin and the contribution margin ratio for each sales representative (round to two decimal places). Which sales representative has the highest contribution margin ratio? Explain Whyarrow_forwardSunland Beauty Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 21% of sales. The income statement for the year ending December 31, 2022, is as follows. SUNLAND BEAUTY CORPORATIONIncome StatementFor the Year Ended December 31, 2022 Sales $71,200,000 Cost of goods sold Variable $30,616,000 Fixed 8,560,000 39,176,000 Gross profit $32,024,000 Selling and marketing expenses Commissions $14,952,000 Fixed costs 10,660,400 25,612,400 Operating income $6,411,600 The company is considering hiring its own sales staff to replace the network of agents. It will pay its salespeople a commission of 7% and incur additional fixed costs of $9,968,000. Calculate the company’s break-even point in sales dollars for the year 2022 if it hires its own sales force to replace the network of agents. Break-even…arrow_forwardSegmented Income Statements: Analysis of Proposals to Improve Profits Shannon, Inc., has two divisions. One produces and sells paper party supplies (napkins, paper plates, invitations); the other produces and sells cookware. A segmented income statement for the most recent quarter is given below: Party Supplies Division Cookware Division Total Sales $500,000 $750,000 $1,250,000 Less: Variable expenses 425,000 460,000 885,000 Contribution margin $ 75,000 $290,000 $ 365,000 Less: Direct fixed expenses 85,000 110,000 195,000 Segment margin $ (10,000) $180,000 $ 170,000 Less: Common fixed expenses 130,000 Operating income $ 40,000 On seeing the quarterly statement, Madge Shannon, president of Shannon, Inc., was distressed and discussed her disappointment with Bob Ferguson, the company's vice president of finance. MADGE: "The Party Supplies Division is…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Profitability index; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Md5ocNqKHq8;License: Standard Youtube License