Horngren's Financial & Managerial Accounting, The Financial Chapters, Student Value Edition (5th Edition)

5th Edition

ISBN: 9780133851731

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 15.8SE

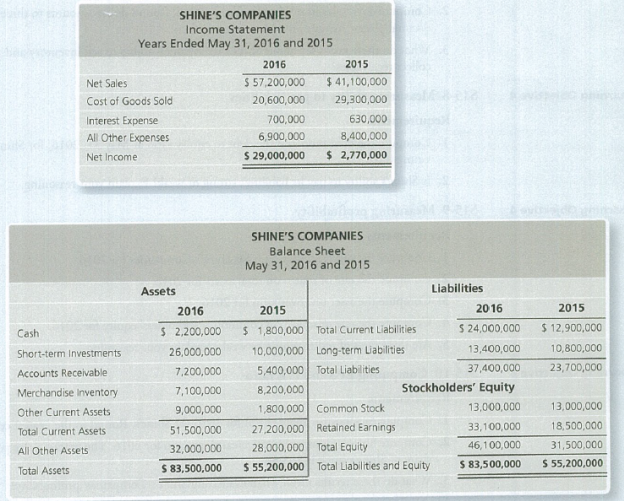

Shine's Companies, a home improvement store chain, reported the following summarized figures:

Shine's has 100,000 common shares outstanding during 2016.

Measuring ability to pay liabilities

Requirements

- 1. Compute the debt ratio and the debt to equity ratio at May 31, 2016, for Shine’s Companies.

- 2. Is Shine’s ability to pay its liabilities strong or weak? Explain your reasoning.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The below tables shows Dynamic Mattress’s year-end 2016 and 2018 balance sheets, and its income statement for 2017.

Dynamic MattressYear-End Balance Sheet for 2016(figures in $ millions)

Assets

Liabilities and Shareholders’ Equity

Current Assets:

Current Liabilities:

Cash

$

46

Bank loans

$

46

Marketable securities

23

Accounts payable

140

Accounts receivable

123

Inventory

215

Total current assets

$

407

Total current liabilities

$

186

Fixed assets:

Gross investment

$

263

Long-term debt

38

Less depreciation

83

Net worth (equity and retained earnings)

363

Net fixed assets

$

180

Total assets

$

587

Total liabilities and net worth

$

587

Dynamic MattressYear-End Balance Sheet for 2017(figures in $ millions)

Assets

Liabilities and Shareholders’ Equity

Current Assets:

Current Liabilities:

Cash

$

176.0

Debt due within a year (bank…

The below tables shows Dynamic Mattress’s year-end 2016 and 2018 balance sheets, and its income statement for 2017.

Dynamic MattressYear-End Balance Sheet for 2016(figures in $ millions)

Assets

Liabilities and Shareholders’ Equity

Current Assets:

Current Liabilities:

Cash

$

22

Bank loans

$

22

Marketable securities

11

Accounts payable

80

Accounts receivable

111

Inventory

155

Total current assets

$

299

Total current liabilities

$

102

Fixed assets:

Gross investment

$

251

Long-term debt

26

Less depreciation

71

Net worth (equity and retained earnings)

351

Net fixed assets

$

180

Total assets

$

479

Total liabilities and net worth

$

479

Dynamic MattressYear-End Balance Sheet for 2017(figures in $ millions)

Assets

Liabilities and Shareholders’ Equity

Current Assets:

Current Liabilities:

Cash

$

32.0

Debt due within a year (bank…

Win's Companies, a home improvement store chain, reported the following summanzed figures

E (Click the icon to view the income statement.)

E (Click the icon to view the balance sheets.)

Win's has 20,000 common shares outstanding during 2018.

Read the requirements

Requirement 1. Compute Win's Companies' current ratio at May 31, 2018 and 2017

Begin by selecting the formula to calculate Win's Companies' current ratio. Then enter the amounts and calcu ale the current ratio for 2018 and then 2017. (Round your answers to two decimal places, X.XX.)

Current ratio

(i Balance Sheets

Income Statement

Win's Companies

Win's Companies

Balance Sheet

Income Statement

May 31, 2018 and 2017

Years Ended May 31, 2018 and 2017

Assets

Liabilities

2018

2017

2018

2017

2018

2017

Net Sales Revenue

24

57 200 $

39,800

Cash

$.

2.300 $

1300 Total Current Liabilities

22,000 $

12,900

Cost of Goods Sold

22.500

25,500

12,200

11,300

Short-term Invesiments

29 000

13.000 Long-term Liabilities

Interest Expense

500

320…

Chapter 15 Solutions

Horngren's Financial & Managerial Accounting, The Financial Chapters, Student Value Edition (5th Edition)

Ch. 15 - What part of the Libertys annual report is written...Ch. 15 - Horizontal analysis of Liberty's balance sheet for...Ch. 15 - Vertical analysis of Liberty's balance sheet for...Ch. 15 - Which statement best describes Liberty's acid-test...Ch. 15 - Liberty's inventory turnover during 2017 was...Ch. 15 - Prob. 6QCCh. 15 - Prob. 7QCCh. 15 - Liberty's rate of return on common stockholders'...Ch. 15 - The company has 2,500 shares of common stock...Ch. 15 - Prob. 10AQC

Ch. 15 - What ate the three main ways to analyze financial...Ch. 15 - What is an annual report? Briefly describe the key...Ch. 15 - Prob. 3RQCh. 15 - What is trend analysis, and how does it differ...Ch. 15 - Prob. 5RQCh. 15 - Prob. 6RQCh. 15 - Prob. 7RQCh. 15 - Briefly describe the ratios that can be used to...Ch. 15 - Prob. 9RQCh. 15 - Briefly describe the ratios that can be used to...Ch. 15 - Briefly describe the ratios that can be used to...Ch. 15 - Prob. 12RQCh. 15 - Prob. 13RQCh. 15 - Prob. 14RQCh. 15 - Prob. 15RQCh. 15 - Prob. 15.1SECh. 15 - Performing horizontal analysis McDonald Corp....Ch. 15 - Calculating trend analysis Variline Corp. reported...Ch. 15 - Performing vertical analysis Hoosier Optical...Ch. 15 - Preparing common-size income statement Data for...Ch. 15 - Shine's Companies, a home improvement store chain,...Ch. 15 - Shine's Companies, a home improvement store chain,...Ch. 15 - Shine's Companies, a home improvement store chain,...Ch. 15 - Prob. 15.9SECh. 15 - Prob. 15.10SECh. 15 - Prob. 15.11SECh. 15 - Using ratios to reconstruct a balance sheet...Ch. 15 - Prob. 15.13SECh. 15 - Prob. 15.14SECh. 15 - Prob. 15.15ECh. 15 - Computing trend analysis Grand Oaks Realty's net...Ch. 15 - Prob. 15.17ECh. 15 - Prob. 15.18ECh. 15 - Prob. 15.19ECh. 15 - Prob. 15.20ECh. 15 - Analyzing the ability to pay liabilities Big Bend...Ch. 15 - Analyzing profitability Varsity, Inc.s comparative...Ch. 15 - Prob. 15.23ECh. 15 - Using ratios to reconstruct a balance sheet The...Ch. 15 - Prob. 15.25ECh. 15 - Computing earnings per share Falconi Academy...Ch. 15 - Prob. 15.27APCh. 15 - Prob. 15.28APCh. 15 - Prob. 15.29APCh. 15 - Prob. 15.30APCh. 15 - Using ratios to evaluate a stock investment...Ch. 15 - Prob. 15.32APCh. 15 - Preparing an income statement The following...Ch. 15 - Computing trend analysis and return on common...Ch. 15 - Prob. 15.35BPCh. 15 - Prob. 15.36BPCh. 15 - Determining the effects of business transactions...Ch. 15 - Prob. 15.38BPCh. 15 - Prob. 15.39BPCh. 15 - Prob. 15.40BPCh. 15 - Prob. 15.41CPCh. 15 - Lance Berkman is the controller of Saturn, a dance...Ch. 15 - Prob. 15.1CTEI

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following selected financial information for Cascabel Corporation to answer questions Cascabel Corporation Balance Sheet December 31, 2015 Assets Liabilities and stockholders' equity Current assets Current liabilities Cash 2 Accounts payable 36 Short-term investments 10 Accrued liabilities 25 Accounts receivable 52 Total current liabilities 61 Inventory 57 Other current assets 8 Long-term debt 102 Total current assets 129 Total liabilities 163 Long-term assets Stockholders' equity Net Plant 195 Common stock (10) 110 Retained earnings 51 Total stockholders'…arrow_forwardThe financial statements for Tyler Toys, Inc. are shown in the popup window: LOADING... . Calculate the debt ratio, times interest earned ratio, and cash coverage ratio for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $14,146,575 $13,566,748 Cost of goods sold $-8,448,000 $-8,132,335 Selling, general, andadministrative expenses $-998,406 $-980,458 Depreciation $-1,497,529 $-1,471,013 EBIT $3,202,640 $2,982,942 Interest expense $-376,217 $-354,594 Taxes $-1,074,041 $-998,772 Net income $1,752,382 $1,629,576 Right-click on the table and select Copy to Clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its…arrow_forwarda) Calculate the following ratios for 2016 and 2015, showing detailed calculations as to how you arrive at each number. A ROE B Gross profit margin C Total asset turnover D Inventory turnover E Current ratio F Debt-to-equity G Interest coverage ratio. b) Using the financial statements and the ratios calculated above (and any other ratios you like to calculate), discuss the performance of Cobham PLC in 2016. c) Critically discuss the need for the public limited companies to prepare a Statement of Cash Flows and explain the usefulness of the information contained therein from the perspective of a financial analyst.arrow_forward

- The statement of members equity for Bonanza, LLC, follows: a. What was the income-sharing ratio in 2016? b. What was the income-sharing ratio in 2017? c. How much cash did Thomas Dunn contribute to Bonanza, LLC, for his interest? d. Why do the member equity accounts of Idaho Properties, LLC, and Silver Streams, LLC, have positive entries for Thomas Dunns contribution? e. What percentage interest of Bonanza did Thomas Dunn acquire? f. Why are withdrawals less than net income?arrow_forwardUse the following selected financial information for Cascabel Corporation to answer questions Cascabel Corporation Balance Sheet December 31, 2015 Assets Liabilities and stockholders' equity Current assets Current liabilities Cash Accounts payable Accrued liabilities 2 36 Short-term investments 10 25 Accounts receivable 52 Total current liabilities 61 Inventory 57 Other current assets Long-term debt 102 Total current assets 129 Total liabilities 163 Long-term assets Stockholders' equity Net Plant 195 Common stock 110 Retained earnings Total stockholders' equity Total liabilities and equity 51 161 324 Total assets 324 Cascabel Corporation Income Statement For the Year Ended December 31, 2015arrow_forwardThe comparative statements of Dubai Company are presented below. All sales were on account. The allowance for doubtful accounts was $3,200 on December 31, 2017, and $3,000 on December 31, 2020. Required: Compute the following ratios for 2021. (Weighted average common shares in 2021 were 62,500.) Earnings per share. Return on common stockholders’ equity. Return on assets.arrow_forward

- Use the following information for Short Exercises S15-6 through S15-10. Accel’s Companies, a home improvement store chain, reported the following summarized figures: Accel’s has 10,000 common shares outstanding during 2018. Evaluating current ratio Requirements Compute Accel’s Companies’ current ratio at May 31, 2018 and 2017. Did Accel’s Companies’ current ratio improve, deteriorate, or hold steady during 2018?arrow_forwardPerform the DuPont analysis of ABC Corporation’s Return on Equity. Show all the steps and write a short paragraph explaining what the analysis reveals. Note the years: Write your analysis of how things changed from 2015 to 2016. Select Financial Data for ABC Corp. 2016 2015 Sales 1100 1000 Earnings After Tax 105 100 Total Assets 1800 1500 Total Equity 630 600arrow_forwardThe comparative statements of Dubai Company are presented below. All sales were on account. The allowance for doubtful accounts was $3,200 on December 31, 2017, and $3,000 on December 31, 2020. Required: Compute the following ratios for 2021. (Weighted average common shares in 2021 were 62,500.) Times interest earned. Asset turnover. Debt to assets.arrow_forward

- The comparative statements of Dubai Company are presented below. All sales were on account. The allowance for doubtful accounts was $3,200 on December 31, 2017, and $3,000 on December 31, 2020. Required: 1- Compute the following ratios for 2021. (Weighted average common shares in 2021 were 62,500.) Earnings per share. Return on common stockholders’ equity. Return on assets. Current. Acid-test. Accounts receivable turnover. Inventory turnover. Times interest earned. Asset turnover. Debt to assets. 2. Based on the ratios calculated, discuss briefly the improvement or lack thereof in financial position and operating results from 2020 to 2021 of Dubai Company.arrow_forwardAt May 31, 2016, FedEx Corporation reported the following amounts (in millions) in its financial statements: 2016 2015 Total Assets $ 13,200 $ 12,300 Total Liabilities 8,316 7,503 Interest Expense 300 300 Income Tax Expense 480 290 Net Income 1,080 1,000 Required: 1.Compute the debt-to-assets ratio and times interest earned ratio for 2016 and 2015. (Round your answers to 2 decimal places.)arrow_forwardThe condensed financial statements of John Cully Company, for the years ended June 30, 2017 and 2016, are presented below. Compute the following ratios for 2017 and 2016. Return on assets. (Assets on 6/30/15 were $3,349.9.) Return on common stockholders’ equity. (Stockholders’ equity on 6/30/15 was $1,795.9.) Debt to assets ratio. Times interest earned.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License