Concept explainers

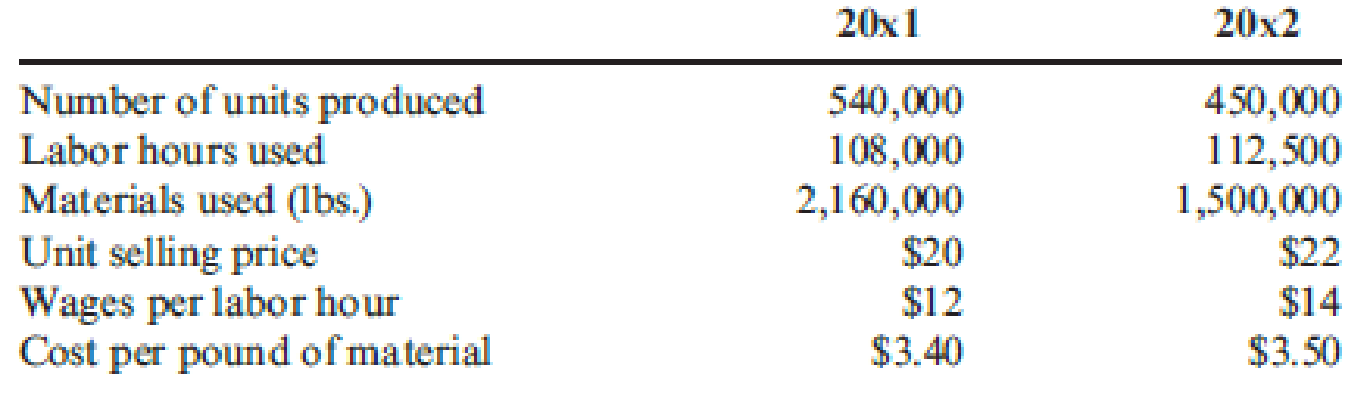

Refer to Cornerstone Exercise 15.3. Choctaw Company provides the following additional information so that total productivity can be valued:

Required:

- 1. Calculate the cost of inputs in 20x2, assuming no productivity change from 20x1 to 20x2.

- 2. Calculate the actual cost of inputs for 20x2. What is the net value of the productivity changes? How much profit change is attributable to each input’s productivity change?

- 3. What if a manager wants to know how much of the total profit change from 20x1 to 20x2 is attributable to price recovery? Calculate the price-recovery component, and comment on its meaning.

1.

Compute the cost of inputs for the profile 20x2, if there is no change from productivity profile 20x1 to 20x2.

Explanation of Solution

Productivity measurement: The productivity measurement refers to the quantitative assessment of the changes in the productivity.

Profile measurement and analysis: The profile measurement and analysis refers to the computation of a set of operational partial productivity measures and their comparison to the corresponding set of base period, for the assessment of the nature of changes in productivity.

Calculate the cost of inputs for the profile 20x2:

| Particulars | Amount ($) |

| Cost of labor (3) | $1,260,000 |

| Cost of materials (4) | $6,300,000 |

| Total PQ Cost | $7,560,000 |

Table (1)

Working Notes (1):

Compute the base period productivity ratios for profile 20x1:

Compute the Labor Productivity Profile for 20x1:

Working Notes (2):

Compute the Material Productivity Profile for 20x1:

The Labor Productivity Profile is 5.00 and Material Productivity Profile is 0.25 for 20x1.

Working Notes (3):

Calculate the cost of labor:

Working Notes 4):

Calculate the cost of materials:

2.

Compute the actual cost of inputs for the profile 20x2. Indicate the net value of productivity changes and identify the profit change attributable to productivity change of each unit.

Explanation of Solution

Profit-linked productivity measurement and analysis: The profit-linked productivity measurement and analysis is the ascertainment of the amount of change in profit, from the base period to the current period, due to the various changes in the productivity.

Calculate the current cost of inputs for the profile 20x2:

| Particulars | Amount ($) |

| Cost of labor (5) | $1,575,000 |

| Cost of materials (6) | $5,250,000 |

| Total Current Cost | $6,825,000 |

Table (2)

Working Notes (5):

Calculate the cost of labor:

Working Notes (6):

Calculate the cost of materials:

Compute the profit linked productivity measure:

| Input | A | C | E | ||||

| Labor | 5 | 90,000 | $14 | $1,260,000 | 112,500 | $1,575,000 | ($315,000) |

| Materials | 0.25 | 1,800,000 | $3.50 | $6,300,000 | 1,500,000 | $5,250,000 | $1,050,000 |

| Total | $7,560,000 | $6,825,000 | $735,000 |

Table (3)

The Net productivity change is $735,000.

The Labor productivity change is ($315,000).

The materials productivity change is $1,050,000.

3.

Compute and describe the price recovery component.

Explanation of Solution

Price-recovery component: The price-recovery component refers to the differences amongst the changes in the total profit with the changed in the productivity effects.

Compute the profit linked productivity measure:

| Particulars | Profile 20x1 | Profile 20x2 | Amount ($) |

| Revenues | (7) $10,800,000 | (8) $9,900,000 | (9) ($900,000) |

| Costs | (10) $8,640,000 | $6,825,000 | (11) $1,815,000 |

| Total Profit | $2,160,000 | $3,075,000 | $915,000 |

Table (4)

Working Notes (7):

Calculate the Revenues for Profile for 20x1:

Working Notes (8):

Calculate the Revenues for Profile for 20x2:

Working Notes (9):

Calculate the changes in revenues:

Working Notes (10):

Calculate the cost of inputs for Profile 20x1:

Working Notes (11):

Calculate the changes in cost of inputs:

Compute the Price-recovery component:

The Price-recovery component is $180,000.

Want to see more full solutions like this?

Chapter 15 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- In designing a bonus structure to reward your production managers, one of the options is to reward the managers based on reaching annual income targets. What are the differences between a reward system for a company that uses absorption costing and one for a company that uses variable costing?arrow_forwardThe following information is given for a manufacturing firm: Which of the following correctly describes the change in productive efficiency from Year 1 to Year 2? a. Material and labor productivity both increased. b. Material and labor productivity both decreased. c. Material productivity decreased and labor productivity increased. d. Material productivity increased and labor productivity decreased.arrow_forwardThe management of Hartman Company is trying to determine the amount of each of two products to produce over the coming planning period. The following information concerns labor availability, labor utilization, and product profitability: a. Develop a linear programming model of the Hartman Company problem. Solve the model to determine the optimal production quantities of products 1 and 2. b. In computing the profit contribution per unit, management does not deduct labor costs because they are considered fixed for the upcoming planning period. However, suppose that overtime can be scheduled in some of the departments. Which departments would you recommend scheduling for overtime? How much would you be willing to pay per hour of overtime in each department? c. Suppose that 10, 6, and 8 hours of overtime may be scheduled in departments A, B, and C, respectively. The cost per hour of overtime is 18 in department A, 22.50 in department B, and 12 in department C. Formulate a linear programming model that can be used to determine the optimal production quantities if overtime is made available. What are the optimal production quantities, and what is the revised total contribution to profit? How much overtime do you recommend using in each department? What is the increase in the total contribution to profit if overtime is used?arrow_forward

- The following series of statements or phrases are associated with product life-cycle viewpoints. Identify whether each one is associated with the marketing, production, or customer viewpoint. Where possible, identify the particular characteristic being described. If the statement or phrase fits more than one viewpoint, label it as interactive. Explain the interaction. a. Sales are increasing at an increasing rate. b. The cost of maintaining the product after it is purchased. c. The product is losing market acceptance and sales are beginning to decrease. d. A design is chosen to minimize post-purchase costs. e. Ninety percent or more of the costs are committed during the development stage. f. The length of time that the product serves the needs of a customer. g. All the costs associated with a product for its entire life cycle. h. The time in which a product generates revenue for a company. i. Profits tend to reach peak levels during this stage. j. Customers have the lowest price sensitivity during this stage. k. Describes the general sales pattern of a product as it passes through distinct life-cycle stages. l. The concern is with product performance and price. m. Actions taken so that life-cycle profits are maximized. n. Emphasizes internal activities that are needed to develop, produce, market, and service products.arrow_forwardSuppose you are analyzing a firm that is successfully executing a strategy that differentiates its products from those of its competitors. Because of this strategy, you project that next year the firm will generate 6.0% revenue growth from price increases and 3.0% revenue growth from sales volume increases. Assume that the firms production cost structure involves strictly variable costs. (That is, the cost to produce each unit of product remains the same.) Should you project that the firms gross profit will increase next year? If you project that the gross profit will increase, is the increase a result of volume growth, price growth, or both? Should you project that the firms gross profit margin (gross profit divided by sales) will increase next year? If you project that the gross profit margin will increase, is the increase a result of volume growth, price growth, or both?arrow_forwardTo determine the effect of different levels of production on the company’s income, move to cell B7 (Actual production). Change the number in B7 to the different production levels given in the table below. The first level, 100,000, is the current level. What happens to the operating income on both statements as production levels change? Enter the operating incomes in the following table. Does the level of production affect income under either costing method? Explain your findings.arrow_forward

- ____ 1.Which of the following is a responsibility center that incurs expenses, generates revenues, and is responsible for generating a return on assets? a. Cost center b. Revenue center c. Profit center d. Investment center ____ 2.Which one of the following is the most useful measure for evaluating a manager's performance in controlling revenues and costs in a profit center? a. Contribution margin b. Contribution net income c. Contribution gross profit d. Controllable margin ____ 3.Hanover Corporation desires to earn target net income of $42,000. The selling price per unit is $18, unit variable cost is $5.60, and total fixed costs are $123,912. How many units must the company sell to earn its target net income? a. 13,380 b. 9,993 c. 3,387 d. 9,217 ____ 4.Remark…arrow_forwardWartlow Electric Manufacturing Company introduced lean principles in 2018 and reported a successfulimplementation in 2021. Wartlow began with the implementation of lean principles and then adopted valuestream management (VSM) using the value-stream income statement. As expected, the use of VSM achievedbetter decision making (previously the firm had treated direct labour as a pure variable cost that varied withvolume; after VSM it was clear that the behavior of labour costs was far more complex), reduced inventory,reduced cycle times and improved communication and coordination among employees. It was this latter result,better communication, that surprised Wartlow management, as employees began to work as teams that focusedon the key success factors for the firm.The steps taken by Wartlow to implement lean included: Identify the main value streams of the company (Wartlow selected value streams consisting of 25-150 employees each; more than 90% of the company’s employees were assigned to…arrow_forwardIn attempting to achieve better results in the marketplace, management has been looking at changing the reward system for marketing, distribution and sales personnel. This would result in an increase in variable marketing and administrative costs by $2 per unit, and would reduce fixed marketing and distribution costs by $100,000: Calculate the number of units required to breakeven if management implemented the changes and Would you suggest that management pursue the changes? Explain By reference to the above data:How can a company effectively use CPV (Cost-Volume-Profit) analysis to make strategic decisions about its product pricing and production levels?arrow_forward

- “Benchmarking against other companies enables a company to identify the lowest-cost producer. This amount should become the performance measure for next year.” Do you agree?arrow_forward(1)Use the graph to answer the question that follows. Based on the chart above, if the product sells at a price of $3 per unit, what is the marginal revenue product of the second unit of labor? A-$30. B-$45. C-$90. D-$120. E-Indeterminate (2)The number of units of output that a machine will produce increases, ceteris paribus. How will this change in productivity affect demand for the machine? A-Demand for the machine will increase. B-Demand for the machine will decrease. C-There will be no change in demand for the machine. D-Demand will not change, but quantity demanded will decrease. E-Demand will not change, but quantity demanded will increase.arrow_forwardThe trend for cost of goods sold is it is decreasing as a percentage of sales and the trend for total marketing costs as a percentage of sales is increasing. What does this suggest to the company CEO? The CEO would want to analyze the company’s cost structure – particularly the contribution margin ratio, the relevant ranges for fixed expenses and the company’s marketing and production expenses The CEO would want to analyze whether operations has done something that reduces production costs, but that has also made the product less attractive in the customers’ eyes The CEO would want to analyze the company's margin % and asset utilization The CEO would want to analyze the company's cost of capitalarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,