COST ACCOUNTING

16th Edition

ISBN: 9781323694008

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 16.23E

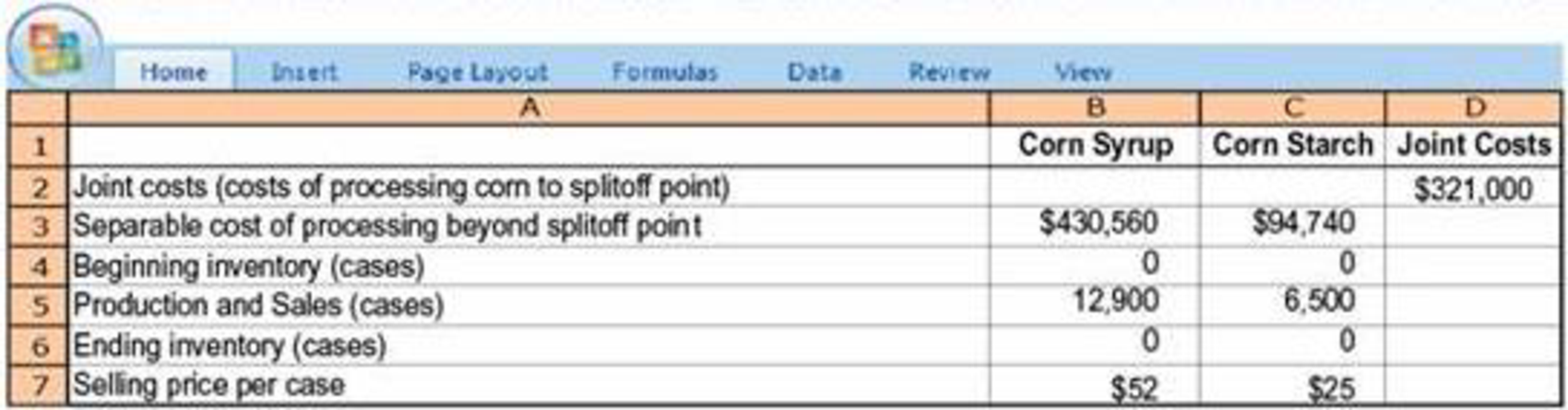

Net realizable value method. Sweeney Company is one of the world’s leading corn refiners. It produces two joint products—corn syrup and corn starch—using a common production process. In July 2017, Sweeney reported the following production and selling-price information:

Allocate the $321,000 joint costs using the NRV method.

Required

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Net realizable value method. Sweeney Comapny is one of the world’s leading corn refiners. It produces two joint products –corn syrup and corn starch- using a common production process. In July 2017, Sweeney reported the following production and selling-price information:

The XYZ Corp. manufactures pots, pans, and bowls from a joint process. May production is 4,000 pots, 7,000 pans, and 8,000 bowls. Respective per unit selling prices at split-off are $15, $10, $5. Joint costs up to the split-off point are $75,000. If joint costs are allocated based upon the sales (market) value at split-off, what amount of joint costs will be allocated to the pots?

I need answers to the following questions:

Fritz Co. Produces 2 Products "Maria and Rose" , and 1 by-product "Sina" Total Joint Cost is P3,840,000. The by product however would need an additional cost of P180,000 to fully utilize Sina. The Cost is allocated based on Net Realizable Value method, while the by Product will be accounted for using the Cost Reduction Method. How much is the Adjusted Joint Cost? This will pertain to #12 to #15

(IMAGE)

Using the NRV Method, How much cost would be allocated to Maria?

Using the NRV Method, How much cost would be allocated to Rose?

How much is the total Gain in the by product if the Company opted for the Sales Method?

Chapter 16 Solutions

COST ACCOUNTING

Ch. 16 - Give two examples of industries in which joint...Ch. 16 - What is a joint cost? What is a separable cost?Ch. 16 - Distinguish between a joint product and a...Ch. 16 - Why might the number of products in a joint-cost...Ch. 16 - Provide three reasons for allocating joint costs...Ch. 16 - Why does the sales value at splitoff method use...Ch. 16 - Prob. 16.7QCh. 16 - Distinguish between the sales value at splitoff...Ch. 16 - Give two limitations of the physical-measure...Ch. 16 - How might a company simplify its use of the NRV...

Ch. 16 - Why is the constant gross-margin percentage NRV...Ch. 16 - Managers must decide whether a product should be...Ch. 16 - Prob. 16.13QCh. 16 - Describe two major methods to account for...Ch. 16 - Why might managers seeking a monthly bonus based...Ch. 16 - Prob. 16.16MCQCh. 16 - Joint costs of 8,000 are incurred to process X and...Ch. 16 - Houston Corporation has two products, Astros and...Ch. 16 - Dallas Company produces joint products, TomL and...Ch. 16 - Earls Hurricane Lamp Oil Company produces both A-1...Ch. 16 - Joint-cost allocation, insurance settlement....Ch. 16 - Joint products and byproducts (continuation of...Ch. 16 - Net realizable value method. Sweeney Company is...Ch. 16 - Alternative joint-cost-allocation methods,...Ch. 16 - Alternative methods of joint-cost allocation,...Ch. 16 - Prob. 16.26ECh. 16 - Joint-cost allocation, sales value, physical...Ch. 16 - Joint-cost allocation: Sell immediately or process...Ch. 16 - Accounting for a main product and a byproduct....Ch. 16 - Joint costs and decision making. Jack Bibby is a...Ch. 16 - Joint costs and byproducts. (W. Crum adapted)...Ch. 16 - Methods of joint-cost allocation, ending...Ch. 16 - Alternative methods of joint-cost allocation,...Ch. 16 - Comparison of alternative joint-cost-allocation...Ch. 16 - Joint-cost allocation, process further or sell....Ch. 16 - Joint-cost allocation. SW Flour Company buys 1...Ch. 16 - Further processing decision (continuation of...Ch. 16 - Joint-cost allocation with a byproduct. The...Ch. 16 - Byproduct-costing journal entries (continuation of...Ch. 16 - Joint-cost allocation, process further or sell....Ch. 16 - Prob. 16.41PCh. 16 - Prob. 16.42PCh. 16 - Methods of joint-cost allocation, comprehensive....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Camp Corporation manufactures two products out of a joint process— Coma and Ultra. The joint costs incurred are Php250,000 for a standard production that generates 120,000 gallons of Coma and 80,000 gallons of Ultra. Coma sells for Php2.00 per gallon, while Ultra sells for Php3.25 per gallon. If there are no additional processing costs incurred after the split-off point, the amount of joint cost of each production allocated to Coma by the quantitative unit method is?arrow_forwardOakes Inc. manufactured 40,000 gallons of Mononate and 60,000 gallons of Beracyl in a joint production process, incurring 250,000 of joint costs. Oakes allocates joint costs based on the physical volume of each product produced. Mononate and Beracyl can each be sold at the split-off point in a semifinished state or, alternatively, processed further. Additional data about the two products are as follows: An assistant in the companys cost accounting department was overheard saying ...that when both joint and separable costs are considered, the firm has no business processing either product beyond the split-off point. The extra revenue is simply not worth the effort. Which of the following strategies should be recommended for Oakes?arrow_forwardMorrill Company produces two different types of gauges: a density gauge and a thickness gauge. The segmented income statement for a typical quarter follows. Includes depreciation. The density gauge uses a subassembly that is purchased from an external supplier for 25 per unit. Each quarter, 2,000 subassemblies are purchased. All units produced are sold, and there are no ending inventories of subassemblies. Morrill is considering making the subassembly rather than buying it. Unit-level variable manufacturing costs are as follows: No significant non-unit-level costs are incurred. Morrill is considering two alternatives to supply the productive capacity for the subassembly. 1. Lease the needed space and equipment at a cost of 27,000 per quarter for the space and 10,000 per quarter for a supervisor. There are no other fixed expenses. 2. Drop the thickness gauge. The equipment could be adapted with virtually no cost and the existing space utilized to produce the subassembly. The direct fixed expenses, including supervision, would be 38,000, 8,000 of which is depreciation on equipment. If the thickness gauge is dropped, sales of the density gauge will not be affected. Required: 1. Should Morrill Company make or buy the subassembly? If it makes the subassembly, which alternative should be chosen? Explain and provide supporting computations. 2. Suppose that dropping the thickness gauge will decrease sales of the density gauge by 10 percent. What effect does this have on the decision? 3. Assume that dropping the thickness gauge decreases sales of the density gauge by 10 percent and that 2,800 subassemblies are required per quarter. As before, assume that there are no ending inventories of subassemblies and that all units produced are sold. Assume also that the per-unit sales price and variable costs are the same as in Requirement 1. Include the leasing alternative in your consideration. Now, what is the correct decision?arrow_forward

- Oat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently. The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. Should Oat Treats make or buy the oat bars?arrow_forwardSell or Process Further, Basic Analysis Shenista Inc. produces four products (Alpha, Beta, Gamma, and Delta) from a common input. The joint costs for a typical quarter follow: The revenues from each product are as follows: Alpha, 100,000; Beta, 93,000; Gamma, 30,000; and Delta, 40,000. Management is considering processing Delta beyond the split-off point, which would increase the sales value of Delta to 75,000. However, to process Delta further means that the company must rent some special equipment that costs 15,400 per quarter. Additional materials and labor also needed will cost 8,500 per quarter. Required: 1. What is the operating profit earned by the four products for one quarter? 2. CONCEPTUAL CONNECTION Should the division process Delta further or sell it at split-off? What is the effect of the decision on quarterly operating profit?arrow_forwardGalaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: In addition, the following sales unit volume information for the period is as follows: a. Prepare a contribution margin by product report. Compute the contribution margin ratio for each. b. What advice would you give to the management of Galaxy Sports Inc. regarding the profitability of the two products?arrow_forward

- Product Mix Decision, Single Constraint Sealing Company manufactures three types of DVD storage units. Each of the three types requires the use of a special machine that has a total operating capacity of 15,000 hours per year. Information on the three types of storage units is as follows: Sealings marketing director has assessed demand for the three types of storage units and believes that the firm can sell as many units as it can produce. Required: 1. How many of each type of unit should be produced and sold to maximize the companys contribution margin? What is the total contribution margin for your selection? 2. Now suppose that Sealing Company believes that it can sell no more than 12,000 of the deluxe model but up to 50,000 each of the basic and standard models at the selling prices estimated. What product mix would you recommend, and what would be the total contribution margin?arrow_forwardActivity-Based Supplier Costing Levy Inc. manufactures tractors for agricultural usage. Levy purchases the engines needed for its tractors from two sources: Johnson Engines and Watson Company. The Johnson engine has a price of 1,000. The Watson engine is 900 per unit. Levy produces and sells 22,000 tractors. Of the 22,000 engines needed for the tractors, 4,000 are purchased from Johnson Engines, and 18,000 are purchased from Watson Company. The production manager, Jamie Murray, prefers the Johnson engine. However, Jan Booth, purchasing manager, maintains that the price difference is too great to buy more than the 4,000 units currently purchased. Booth also wants to maintain a significant connection with the Johnson source just in case the less expensive source cannot supply the needed quantities. Jamie, however, is convinced that the quality of the Johnson engine is worth the price difference. Frank Wallace, the controller, has decided to use activity costing to resolve the issue. The following activity cost and supplier data have been collected: Required: 1. CONCEPTUAL CONNECTION Calculate the activity-based supplier cost per engine (acquisition cost plus supplier-related activity costs). (Round to the nearest cent.) Which of the two suppliers is the low-cost supplier? Explain why this is a better measure of engine cost than the usual purchase costs assigned to the engines. 2. CONCEPTUAL CONNECTION Consider the supplier cost information obtained in Requirement 1. Suppose further that Johnson can only supply a total of 20,000 units. What actions would you advise Levy to undertake with its suppliers?arrow_forwardJoint-cost allocation. SW Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May 2017, SW bought 12,000 inputs of flour for $89,000. SW spent another $47,800 on the special sifting process. The baking flour can be sold for $3.60 per cup and the bread flour for $4.80 per cup. SW puts the baking flour through a second process so it is super fine. This costs an additional $1.00 per cup of baking flour and the process yields ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. Q. Some claim that the sales value at splitoff method is the best method to use. Discuss the logic behind this claimarrow_forward

- Joint-cost allocation. SW Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May 2017, SW bought 12,000 inputs of flour for $89,000. SW spent another $47,800 on the special sifting process. The baking flour can be sold for $3.60 per cup and the bread flour for $4.80 per cup. SW puts the baking flour through a second process so it is super fine. This costs an additional $1.00 per cup of baking flour and the process yields ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. Q. Allocate the $136,800 joint cost to the super-fine baking flour and the bread flour using the following: a. Physical-measure method (using cups) of joint-cost allocation b. Sales value at splitoff method of joint-cost allocation c. NRV method of joint-cost allocation d. Constant gross-margin percentage NRV method of joint-cost allocationarrow_forwardJoint-cost allocation. SW Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May 2017, SW bought 12,000 inputs of flour for $89,000. SW spent another $47,800 on the special sifting process. The baking flour can be sold for $3.60 per cup and the bread flour for $4.80 per cup. SW puts the baking flour through a second process so it is super fine. This costs an additional $1.00 per cup of baking flour and the process yields ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. SW Flour Company has decided that their bread flour may sell better if it was marketed for gourmet baking and sold with infused spices. This would involve additional cost for the spices of $0.80 per cup. Each cup could be sold for $5.50. Q.Explain the effect that the different cost-allocation methods have on the decision to sell the products at…arrow_forwardJoint-cost allocation. SW Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May 2017, SW bought 12,000 inputs of flour for $89,000. SW spent another $47,800 on the special sifting process. The baking flour can be sold for $3.60 per cup and the bread flour for $4.80 per cup. SW puts the baking flour through a second process so it is super fine. This costs an additional $1.00 per cup of baking flour and the process yields ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. SW Flour Company has decided that their bread flour may sell better if it was marketed for gourmet baking and sold with infused spices. This would involve additional cost for the spices of $0.80 per cup. Each cup could be sold for $5.50. Q.If SW uses the physical-measure method, what combination of products should SW sell to maximize profits?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License