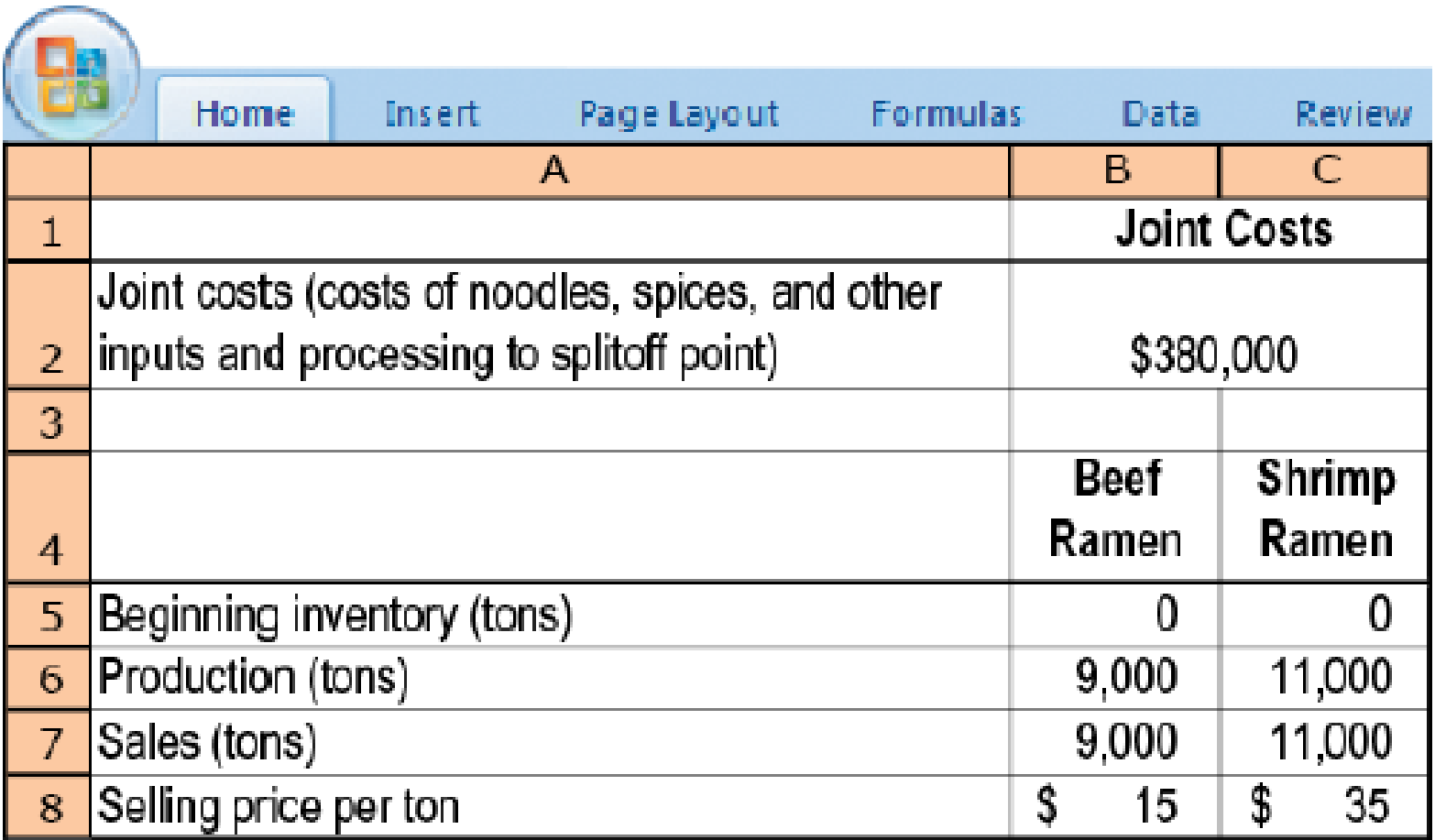

Joint-cost allocation, sales value, physical measure, NRV methods. Tasty Foods produces two types of microwavable products: beef-flavored ramen and shrimp-flavored ramen. The two products share common inputs such as noodle and spices. The production of ramen results in a waste product referred to as stock, which Tasty dumps at negligible costs in a local drainage area. In June 2017, the following data were reported for the production and sales of beef-flavored and shrimp-flavored ramen:

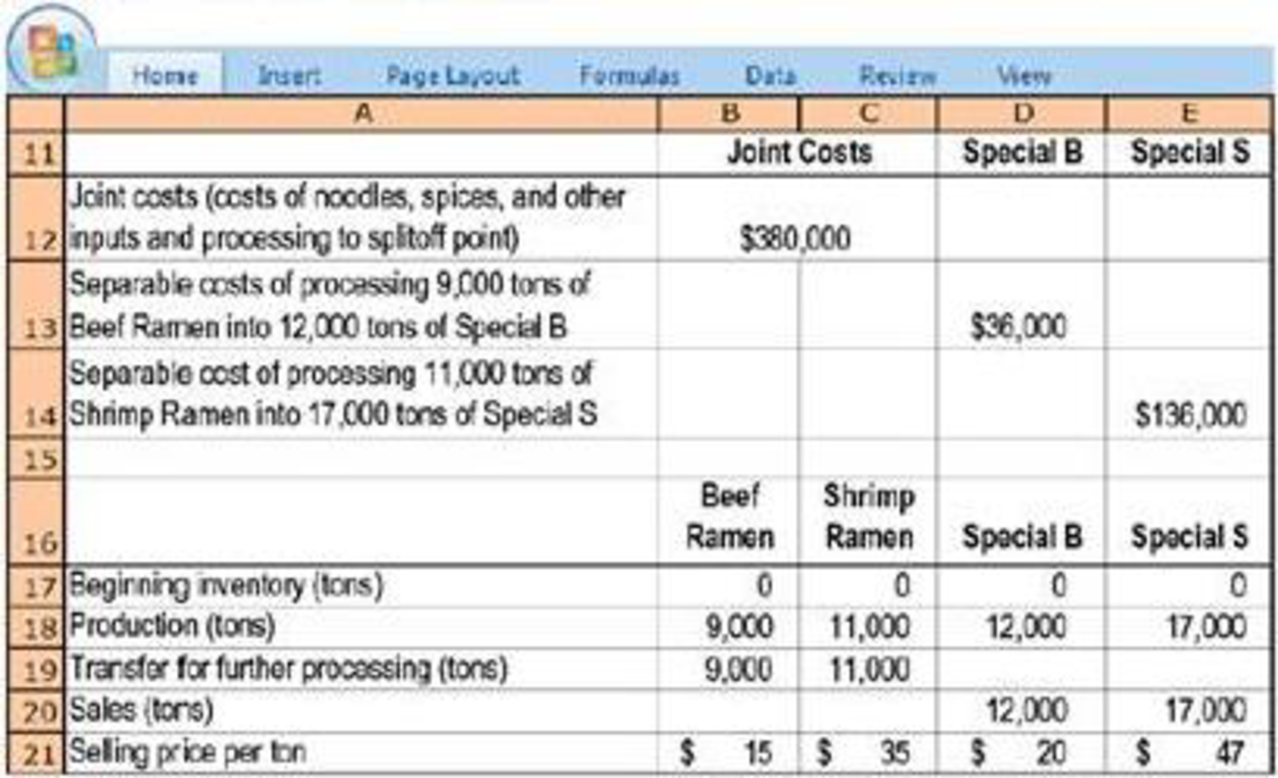

Due to the popularity of its microwavable products, Tasty decides to add a new line of products that targets dieters. These new products are produced by adding a special ingredient to dilute the original ramen and are to be sold under the names Special B and Special S, respectively. Following are the monthly data for all the products:

- 1. Calculate Tasty’s gross-margin percentage for Special B and Special S when joint costs are allocated using the following:

Required

- a. Sales value at splitoff method

- b. Physical-measure method

- c. Net realizable value method

Trending nowThis is a popular solution!

Chapter 16 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

- Joint cost allocation and performance evaluation Gigabody, Inc., a nutritional supplement manufacturer, produces five lines of protein supplements. Each product line is managed separately by a senior-level product engineer who is evaluated, in part, based on his or her ability to keep costs low. The five product lines are produced in a joint production process. After splitting off from the joint production process, all five lines are processed further before resale. Traditionally, joint product costs have been allocated to the five product lines using the physical units method. Recently, however, one of the line managers has complained that the supplement she oversees, the Turbo Capsule, is subsidizing the production of the Power Shake. As she puts it, The powder for the Power Shake requires a higher temperature in the early refining process than the powder in my capsules, so it should carry more of the joint costs! However, the line manager does not point out that in terms of the powder used, the Power Shakes sell for a fraction of the Turbo Capsules, such that Turbo Capsules have much higher margins than Power Shakes. This provides a reasonable argument for Turbo Capsules to carry even more of the joint costs than they currently carry. a. Did the line manager behave ethically by not disclosing the facts that go against her argument? b. What factors should be considered when determining the allocation of joint costs?arrow_forwardCicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price): Required: 1. Prepare a cost report for the year ending 20x1 that shows value-added costs, non-value-added costs, and total costs for each activity. 2. Explain why expediting products and storing goods are non-value-added activities. 3. What if receiving cost is a step-fixed cost with each step being 1,500 orders whereas assembly cost is a variable cost? What is the implication for reducing the cost of waste for each activity?arrow_forwardThe Chocolate Baker specializes in chocolate baked goods. The firm has long assessed the profitability of a product line by comparing revenues to the cost of goods sold. However, Barry White, the firms new accountant, wants to use an activity-based costing system that takes into consideration the cost of the delivery person. Following are activity and cost information relating to two of Chocolate Bakers major products: Using activity-based costing, which of the following statements is correct? a. The muffins are 2,000 more profitable. b. The cheesecakes are 75 more profitable. c. The muffins are 1,925 more profitable. d. The muffins have a higher profitability as a percentage of sales and, therefore, are more advantageous.arrow_forward

- Sell-or-Process-Further Decision; Product Mix Cantel Company produces cleaning compounds for both commercial and household customers. Some of these products are producedas part of a joint manufacturing process. For example, GR37, a coarse cleaning powder meantfor commercial sale, costs $1.60 a pound to make and sells for $2.00 per pound. A portion ofthe annual production of GR37 is retained for further processing in a separate department whereit is combined with several other ingredients to form SilPol, which is sold as a silver polish,at $4.00 per unit. The additional processing requires ¼ pound of GR37 per unit; additionalprocessing costs amount to $2.50 per unit of SilPol produced. Variable selling costs forSilPol average $0.30 per unit. If production of SilPol were discontinued, $5,600 of costs inthe processing department would be avoided. Cantel has, at this point, unlimited demand for,but limited capacity to produce, product GR37.Required1. Calculate the minimum number of units…arrow_forwardAccounting for a main product and a byproduct. (Cheatham and Green, adapted) Crispy, Inc., is a producer of potato chips. A single production process at Crispy, Inc., yields potato chips as the main product, as well as a byproduct that can be sold as a snack. Both products are fully processed by the splitoff point, and there are no separable costs. For September 2017, the cost of operations is $520,000. Production and sales data are as follows: Production (lbs) Sales (lbs) Sell price per lb Potato Chips 46,000 34,960 $26 Byproducts 8200 5000 $5 There were no beginning inventories on September 1, 2017. What is the gross margin for Crispy, Inc., under the production method and the sales method of byproduct accounting? What are the inventory…arrow_forwardCONSO Inc. manufactures joint products ALT and TAB, and a by-product DEL. Costs are assigned to the joint products by the net realizable value or final market value method which considers further processing costs in subsequent operations. It is the policy of CONSO Inc. to account for its by-product by market value or reversal cost method or deduction of net realizable value of by-product from the joint manufacturing costs of main products. The total manufacturing costs for 100,000 units were Php 1,520,000.00 during the year. Production and costs data follow: (a)Product Name: ALT, units produced:60,000, sales price per unit: Php 70.00, Further processing cost per unit Php 20.00 (b)Product Name: TAB, units produced:30,000, sales price per unit: Php 25.00, Further processing cost per unit Php 5.00 (C)Product Name: DEL, units produced:10,000, sales price per unit: Php 10.00, Further processing cost per unit Php 30.00, Selling and admin expense per unit, Php 5.00. 1.What is the value of DEL…arrow_forward

- Accounting for a main product and a byproduct (Cheatham and green, adapted)Crispy,Inc., is a producer of potato chips. A single production process at crispy, Inc., yields potato chips as the main product, as well as byproduct that can be sold as a snack. Both products are fully processed by the splitoff point, and there are no separable costs. For September 2017, the cost of operations is $520,000. Production and sales data are as follows:arrow_forwardGigabody, Inc., a nutritional supplement manufacturer, produces five lines of protein supplements. Each product line is managed separately by a senior-level product engineer who is evaluated, in part, based on his or her ability to keep costs low. The five product lines are produced in a joint production process. After splitting off from the joint production process, all five lines are processed further before resale. Traditionally, joint product costs have been allocated to the five product lines using the physical units method. Recently, however, one of the line managers has complained that the supplement she oversees, the Turbo Capsule, is subsidizing the production of the Power Shake. As she puts it, "The powder for the Power Shake requires a higher temperature in the early refining process than the powder in my capsules, so it should carry more of the joint costs!" However, the line manager does not point out that in terms of the powder used, the Power Shakes sell for a fraction…arrow_forwardGigabody, Inc., a nutritional supplement manufacturer, produces five lines of protein supplements. Each product line is managed separately by a senior-level product engineer who is evaluated, in part, based on his or her ability to keep costs low. The five product lines are produced in a joint production process. After splitting off from the joint production process, all five lines are processed further before resale. Traditionally, joint product costs have been allocated to the five product lines using the physical units method. Recently, however, one of the line managers has complained that the supplement she oversees, the Turbo Capsule, is subsidizing the production of the Power Shake. As she puts it, “The powder for the Power Shake requires a higher temperature in the early refining process than the powder in my capsules, so it should carry more of the joint costs!” However, the line manager does not point out that in terms of the powder used, the Power Shakes sell for a fraction…arrow_forward

- Gigabody, Inc., a nutritional supplement manufacturer, produces five lines of protein supplements. Each product line is managed separately by a senior-level product engineer who is evaluated, in part, based on his or her ability to keep costs low. The five product lines are produced in a joint production process. After splitting off from the joint production process, all five lines are processed further before resale. Traditionally, joint product costs have been allocated to the five product lines using the physical units method. Recently, however, one of the line managers has complained that the supplement she oversees, the Turbo Capsule, is subsidizing the production of the Power Shake. As she puts it, “The powder for the Power Shake requires a higher temperature in the early refining process than the powder in my capsules, so it should carry more of the joint costs!” However, the line manager does not point out that in terms of the powder used, the Power Shakes sell for a fraction…arrow_forwardMethods of joint-cost allocation, comprehensive. Kardash Cosmetics purchases flowers in bulk and processes them into perfume. From a certain mix of petals, the firm uses Process A to generate Seduction, its high-grade perfume, as well as a certain residue. The residue is then further treated, using Process B, to yield Romance, a medium-grade perfume. An ounce of residue typically yields an ounce of Romance. In July, the company used 25,000 pounds of petals. Costs involved in Process A, i.e., reducing the petals to Seduction and the residue, were: Direct Materials - $440,000; Direct Labor - $220,000; Overhead Costs - $110,000. The additional costs of producing Romance in Process B were: Direct Materials - $22,000; Direct Labor - $50,000; Overhead Costs - $40,000. During July, Process A yielded 7,000 ounces of Seduction and 49,000 ounces of residue. From this, 5,000 ounces of Seduction were packaged and sold for $109.50 an ounce. Also, 28,000 ounces of Romance were processed in Process B…arrow_forwardYalland Manufacturing Company makes two different products, M and N. The company’s two departments are named after the products; for example, Product M is made in Department M. Yalland’s accountant has identified the following annual costs associated with these two products. Identify the costs that are (1) direct costs of Department M, (2) direct costs of Department N, and (3) indirect costs. Select the appropriate cost drivers for the indirect costs and allocate these costs to Departments M and N. Determine the total estimated cost of the products made in Departments M and N. Assume that Yalland produced 2,000 units of Product M and 4,000 units of Product N during the year. If Yalland prices its products at cost plus 40 percent of cost, what price per unit must it charge for Product M and for Product N?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,