Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 17, Problem 16EP

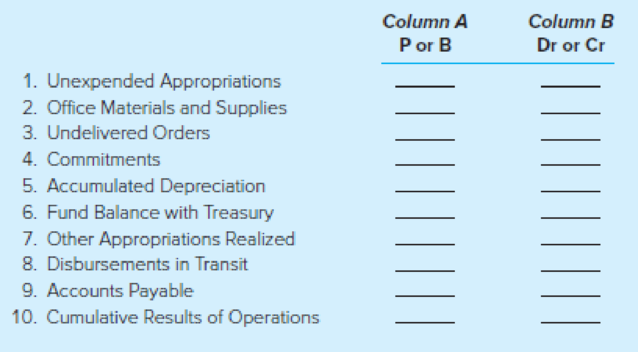

Following is a list of a number of accounts used by federal agencies.

Required

For each of the accounts listed, indicate in Column A whether the account is a proprietary account (P) or a budgetary account (B). In Column B indicate whether the account has a normal debit (Dr) or credit (Cr) balance.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Identify the types of financial statements issued annually by federal agencies.

Compare and contrast them against the financial statements issued by a state government and a for-profit business.

Discuss why there is a difference between the three.

Which of the following groups sets standards for audits of federal financial assistance recipients? a. U.S. General Accounting Office b. U.S. Office of Management and Budget c. Governmental Accounting Standards Board d. Financial Accounting Standards Board

Define the branches of accounting of the following:

1.preparation of general purpose financial statement.

Answer:____________

2.evaluation of the performance of a sales department.

Answer:___________

3.develop standards to address a new business set up.

Answer:____________

4.review tax compliance of the business.

Answer:_________

5.evaluate whether a branch of the business complies with the collection and deposit policy of the company.

Answer:_________

6.review whether the financial statement are presented fairly and in compliance with accounting standards.

Answer:_________

7.report on the spending of government funds.

Answer:__________

8.report on the total cost of materials and labor used in the production.

Answer:________

9.conducting lectures on accounting topics.

Answer:___________

Chapter 17 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 17 - Prob. 1QCh. 17 - Prob. 2QCh. 17 - Prob. 3QCh. 17 - Prob. 4QCh. 17 - Prob. 5QCh. 17 - Prob. 6QCh. 17 - The federal government uses two groups of funds....Ch. 17 - Prob. 8QCh. 17 - Prob. 9QCh. 17 - Prob. 10Q

Ch. 17 - Prob. 12CCh. 17 - Prob. 13CCh. 17 - Access the most recent Financial Report of the...Ch. 17 - Prob. 15.1EPCh. 17 - Prob. 15.2EPCh. 17 - Prob. 15.3EPCh. 17 - Prob. 15.4EPCh. 17 - Prob. 15.5EPCh. 17 - Prob. 15.6EPCh. 17 - Which of the following is a correct mathematical...Ch. 17 - Which of the following is not a component of a...Ch. 17 - Fund Balance with the Treasury would be considered...Ch. 17 - Prob. 15.10EPCh. 17 - Which of the following federal funds is most...Ch. 17 - Following is a list of a number of accounts used...Ch. 17 - One amount is missing in the following trial...Ch. 17 - Use the data from Problem 1717 for this...Ch. 17 - Prob. 19EPCh. 17 - Prob. 20EPCh. 17 - Congress authorized the Flood Control Commission...Ch. 17 - Prob. 22EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A government entity makes payment through Advice to Debit Account (ADA). The entry is most likely to be used in recording the payment is a. Accounts Payable Advances to Officers and Employees b. Accounts Payable Subsidy from National Government c. Accounts Payable Cash- ADA d. Nonearrow_forwardWhich of the following is true regarding the organization of the comprehensive annual financial report?a. The three major sections are introductory, financial, and statistical.b. The management’s discussion and analysis is considered to be part of the introductory section.c. The auditor’s report is considered to be part of the statistical section.d. Basic financial statements include the government-wide statements, the budgetary statement, and the notes to the financial statements.arrow_forwardThe Summary of Significant Accounting Policies : not required in the CAFR Describes the methods used in the financial accounting system . a summary of the financial results of the operations of the governmental unit . usally the last note found in the CAFR .arrow_forward

- Which among the following is an external user of accounting information? a. Government authorities b. Operations Manager c. Finance Manager d. Accountantarrow_forwardWhich of the following would typically not be included in the introductory section of a comprehensive annual financial report? Multiple Choice Title and contents page. Letter of transmittal. A description of the government. Summary of the government's current financial position and results of financial activities.arrow_forward1. What are the components that are included in the minimum requirements for general purpose external financial reporting?a. Introductory section, financial section, and statistical section.b. MD&A, government-wide financial statements, fund financial statements, notes to the financial statements, and RSI.c. Letter from the chief financial officer, government financial statements, notes to the financial statements, and RSI.d. MD&A, government-wide financial statements, notes to the financial statements, and RSI 2. Which of the following is not a required section of a federal agency or department’s performance and accountability report (PAR)?a. A performance section, which includes an annual performance report (APR).b. An MD&A.c. A basic financial statements section.d. A statement of nonparticipation in political matters. 3. The basic financial statements of a not-for-profit include all of the following excepta. Statement of financial position.b. Statement of activities.c.…arrow_forward

- A financial plan which serves as a framework of accounts A. Appropriation act B. Budget C. Obligational authority D. Allotment request E. Cash disbursement ceilingarrow_forwardWhat objectives does the Statement of Federal Financial Accounting Concepts (SFFAC) No. 1 for federal financial reporting identify?arrow_forwardStatement 1: Control is the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities. Statement 2: Consolidated financial statements shall be prepared using uniform accounting policies for like transactions and other events in similar circumstances. Statement 3: An expense item allocated by the home office to a branch is recorded by the branch by a debit to an expense ledger account and a credit cash-home office. Statement 4: A debit to Home Office ledger account and a credit to the Trade Accounts Receivable account in the accounting records of a branch indicate that the home office collected accounts receivable of the branch. Statement 5: Under the acquisition method, if the fair values of identifiable net assets exceed the value implied by the purchase price of the acquired company, the excess should be accounted for goodwill. Statement 6: With an acquisition, direct and indirect expenses are considered a par of the total cost of…arrow_forward

- All of them Compare and contrast the following terms as used in public sector accounting 1. Cash Basis of Accounting and Accrual Basis of Accounting 2. Appropriation Accounting and Commitment Accountingarrow_forwardV6. What is the entity in charge of creating and ensuring accounting standards for government organizations? Do you understand that government accounting standards offer some benefit to users of financial statements? Explain Distingue entre fondos gubernamentales y fondos de propietario Name and explain the two types of owner funds.arrow_forward1. Explain the purpose of operational accountability and the purpose of fiscal accountability. Which category of financial statements is most useful in reporting on each of these accountability concepts? 2. Under GASB guidance, when should an item be recognized on the face of the financial statements? Under what conditions would the GASB indicate that a note disclosure should accompany an item that has been recognized on the financial statements?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License