Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 17, Problem 17EP

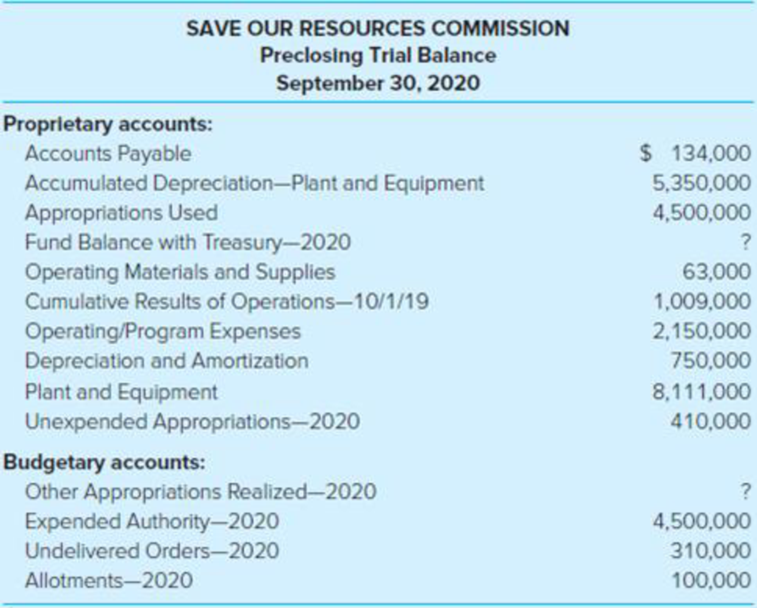

One amount is missing in the following

Required

- a. Compute each missing amount in the preclosing trial balance.

- b. Compute the net additions (or reductions) to assets other than Fund Balance with Treasury during fiscal year 2020. Clearly label your computations and show all work in good form.

- c. In general journal form, prepare entries to close the budgetary accounts as needed and to close the operating statement proprietary accounts.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Revenues that are legally restricted to expenditures for specified purposes should be accounted for in special revenue funds, includinga. accumulation of resources for payment of general long-term debt principal and interest.b. pension trust fund revenues.c. gasoline taxes to finance road repairs.d. proprietary fund revenues.

Which of the following adjustments would likely be made when moving from governmental funds financial statements to government-wide financial statements? a. Record an additional expense for compensated absences b. Record an additional expense related to salaries earned at year-end c. Both of the above d. Neither of the above

When a government orders equipment which is to be used by an activity accounted within the General Fund, it should be recorded in the General Fund as a(an):

Multiple Choice

Encumbrance.

Capital asset.

Expenditure.

None of the choices are correct, the General Fund does not record capital assets purchases..

Chapter 17 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 17 - Prob. 1QCh. 17 - Prob. 2QCh. 17 - Prob. 3QCh. 17 - Prob. 4QCh. 17 - Prob. 5QCh. 17 - Prob. 6QCh. 17 - The federal government uses two groups of funds....Ch. 17 - Prob. 8QCh. 17 - Prob. 9QCh. 17 - Prob. 10Q

Ch. 17 - Prob. 12CCh. 17 - Prob. 13CCh. 17 - Access the most recent Financial Report of the...Ch. 17 - Prob. 15.1EPCh. 17 - Prob. 15.2EPCh. 17 - Prob. 15.3EPCh. 17 - Prob. 15.4EPCh. 17 - Prob. 15.5EPCh. 17 - Prob. 15.6EPCh. 17 - Which of the following is a correct mathematical...Ch. 17 - Which of the following is not a component of a...Ch. 17 - Fund Balance with the Treasury would be considered...Ch. 17 - Prob. 15.10EPCh. 17 - Which of the following federal funds is most...Ch. 17 - Following is a list of a number of accounts used...Ch. 17 - One amount is missing in the following trial...Ch. 17 - Use the data from Problem 1717 for this...Ch. 17 - Prob. 19EPCh. 17 - Prob. 20EPCh. 17 - Congress authorized the Flood Control Commission...Ch. 17 - Prob. 22EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following adjustments is necessary to move from governmental fund financial statements to government-wide financial statements? a. Eliminate expenditures for debt principal b. Eliminate expenditures for capital outlay and add depreciation expense c. Both of the above d. Neither of the abovearrow_forwardWhat are the purpose and financial reporting requirements for the General and Special Revenue Funds? Please include the way the modified basis of accounting is used to account for revenues and expenditures along with the use of budgetary accountsarrow_forward________________ is the action by which OMB distributes amounts available for obligation, including budgetary reserves established pursuant to law, in an appropriation of and account. An apportionment divide amounts available for obligation by specific time periods. (usually quarters), activities, projects, objects or a combination incurred. In apportioning any account, some funds may be reserved to provide for contingencies or to effect savings, pursuant to the Anti-deficiency Act. Funds, including Anti-deficiency Act reserves, may also be proposed for deferred or recession, pursuant to the impoundment Control Acts of 1974arrow_forward

- Which of the following is incorrect with respect to fund balances? Multiple Choice Restricted fund balance are net resources of a government fund that are subject to constraints imposed by external parties or by law. Assigned fund balances are resources that the governing body has specified for a particular use through ordinance or resolution by the government’s highest level of authority. Only unassigned fund balances may have a negative balance. Inventory and prepaid items are classified as nonspendable fund balances..arrow_forwardA statement of revenues, expenditures, and changes in fund balances is used to report the inflows and outflows of current financial resources of governmental funds. True Falsearrow_forwardWhich of the following statements best describes the accounting for inventories in the General Fund? Select one: A. Inventories on hand at the end of the accounting period are not reflected on the balance sheet. B. Inventories used during the period are reflected as an expense in the statement of revenues, expenditures, and changes in fund balances. C. There is generally no recognition in the fund accounts of any remaining balance of inventories at the end of the accounting period. D. None of the abovearrow_forward

- Which of the following funds provides goods and services only to other departments or agencies of the government on a cost-reimbursement basis? Group of answer choices a.) Internal service funds b.) Enterprise funds c.) Special revenue fundsarrow_forwardWhich of the following is true regarding government-wide financial statements? a. All capital assets, including infrastructure, are required to be reported. b. Internal service funds are not included. c. Both of the above d. Neither of the abovearrow_forwardWhich of the following statements is false? Unmatured principal installments and accrued interest which is due shortly after year end are required to be reported as liabilities in the debt service fund at year end. An encumbrance in a capital project fund is created when the contract for the work is signed or issued. Premiums generated from the issuance of bonds for a capital projects fund are generally transferred to the Debt Service Fund. If taxes are levied specifically for payment of interest and principal on long-term debt, those taxes are recognized as revenues of the Debt Service Fund.arrow_forward

- custodial fund assets and liabilities are to be recognized: When the earnings process is complete and collection is reasonably assured At the time the government becomes responsible for assets. When they are available and measurable Only in the government wide financial statements.arrow_forwardWhat is the primary difference between revenue grants and capital grants in accounting for government grants? A. Revenue grants are recognized in the income statement immediately, while capital grants are recognized as deferred income. B. Revenue grants are used for long-term asset acquisition, while capital grants support day-to-day operating activities. C. Both revenue and capital grants are recognized in the income statement immediately. D. Capital grants are not accounted for in financial statements.arrow_forwardIn addition to the government-wide statements, governments are required to prepare fund financial statements for governmental funds only. true or falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License