Concept explainers

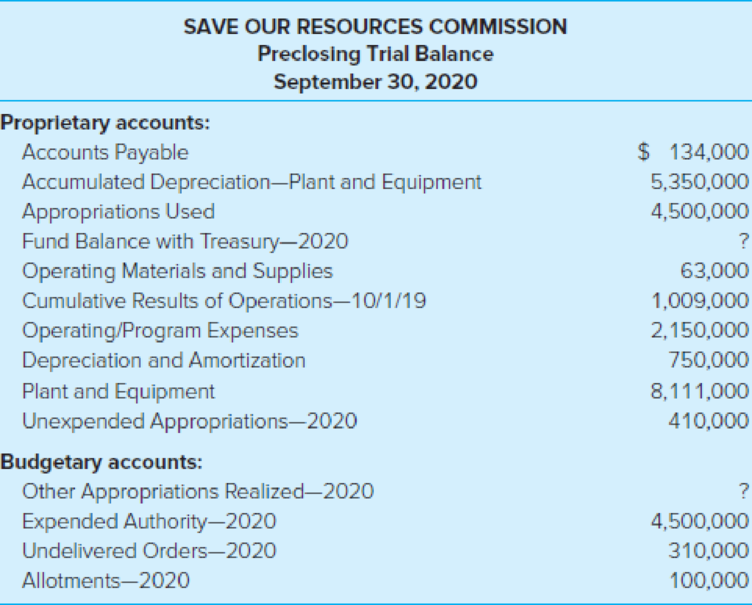

Use the data from Problem 17–17 for this assignment. In completing the assignment, assume that all assets are entity assets, Fund Balance with Treasury is an intragovernmental asset, and all other assets are governmental. Also, assume that Other Appropriations Realized—2019 were zero.

Required

In good form, prepare the following statements for the Save Our Resources Commission for 2020:

- a. A statement of budgetary resources using Illustration 17–17 as an example.

- b. A statement of changes in net position using Illustration 17–16 as an example.

- c. A

balance sheet using Illustration 17–15 as an example.

Problem 17-17:

One amount is missing in the following

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Accounting For Governmental & Nonprofit Entities

- The dual objectives of assessing interperiod equity and ensuring budgetary compliance may necessitate different accounting practices. A city engages in the transactions that follow. For each transaction, indicate the amount of revenue or expenditure that it should report in 2020. Assume first that the main objective of the financial statements is to enable users to assess budgetary compliance. Then calculate the amounts, assuming that the main objective is to assess interperiod equity. The city prepares its budget on a “modified” cash basis (that is, it expands the definition of cash to include short‐term marketable securities), and its fiscal year ends on December 31. Employees earned $128,000 in salaries and wages for the last five days in December 2020. They were paid on January 5, 2021. A consulting actuary calculated that per an accepted actuarial cost method, the city should contribute $225,000 to its firefighters' pension fund for benefits earned in 2020. However, the city…arrow_forwardPlease help with problem Preparation of fund financial statements and schedules Prepare a governmental funds balance sheet; a governmental funds statement of revenues, expenditures, and changes in fund balances; and a General Fund budgetary comparison schedule. In the budgetary comparison schedule, include a column for variances. To ease financial statement preparation, we supply you with the pre-closing trial balances for Croton City’s General Fund, Library Special Revenue Fund, Capital Projects Fund, and Debt Service Fund. Consider all funds as major funds for this exercise and classify the fund balance for the Debt Service Fund as Assigned fund balance. In addition, make calculations to determine which of the funds would be considered as nonmajor if Croton had not considered all of them to be major. Preclosing Trial Balance for Croton City General Fund December 31, 2019 Debits Credits Budgetary Accounts Estimated revenues – property taxes $9,000 Estimated…arrow_forwardOn December 23, 2022, a legislation approves the allocation of P10B funds to support the operations of a National Government Agency (NGA) for the whole CY 2023. At the start of 1st quarter of CY 2023, NGA receives authorization to incur obligations for a maximum amount of P2.4B for the said quarter and Notice of Cash Allocation amounting to P2.2B. At the end of the 1st quarter, total obligations incurred amounted to P2B while total disbursements amounted to P1.7B.Compute for the amount of unliquidated obligations for the 1st Quarter of CY 2023. Options: a. P400,000,000 b. P200,000,000 c. P300,000,000 d. P500,000,000 ------arrow_forward

- The board of commissioners of the City of Hartmoore adopted a General Fund budget for the year ending June 30, 2017, that included revenues of $1,292,500, bond proceeds of $575,000, appropriations of $1,060,000, and operating transfers out of $420,000. If this budget is formally integrated into the accounting records, what journal entry is required at the beginning of the year? If this budget is formally integrated into the accounting records, what later entry is required?arrow_forwardGovernmental funds report current financial resources. However, governmental funds may report some assets which are not current financial resources. Which of the assets below is acurrent financial resource at December 31, 2022? A. An advance to an enterprise fund that is scheduled to be repaid in February, 2024. B. Due from other funds. C.A and B. D.Neither A nor B.arrow_forward42. A certification on the availability of allotment is required before a disbursement of government funds is made. According to the GAM for NGAs, who shall issue this certification? Budget officer Chief accountant Head of the agency Requisitioning Individualarrow_forward

- The schedule of capital assets has a significant impact on the reconciliations between fund and government‐wide statements. The schedule that follows pertaining to governmental capital assets was excerpted from the annual report of Urbana, Illinois (with changed dates): A related schedule indicates the following: Capital outlays $ 3,358,611 Depreciation (2,268,579) $ 1,090,032 As required by GASB Statement No. 34, the annual report includes reconciliations between: (1) total fund balance, governmental funds (per the funds statements), and net position of governmental activities (per the government‐wide statements); and (2) net change in fund balance, governmental funds (per the funds statements), and change in net position of governmental activities (per the government‐wide statements). In what way would the data provided in the accompanying schedules be incorporated into the two reconciliations? Be specific. The amount deleted from the equipment account ($452,194) exactly…arrow_forwardChoose the correct.At the end of the current year, a government reports a fund balance—assigned balance of $9,000 in connection with an encumbrance. What information is being conveyed?a. A donor has given the government $9,000 that must be used in a specified fashion.b. The government has made $9,000 in commitments in one year that will be honored in the subsequent year. c. Encumbrances exceeded expenditures by $9,000 during the current year.d. The government spent $9,000 less than was appropriated.arrow_forwardA local government has the following transactions during the current fiscal period. Prepare journal entries without dollar amounts, first for fund financial statements and then for government-wide financial statements.a. The budget for the police department, ambulance service, and other ongoing activities is passed. Funding is from property taxes, transfers, and bond proceeds. All monetary outflows will be for expenses and fixed assets. A deficit is projected.b. A bond is issued at face value to fund the construction of a new municipal building. c. A computer is ordered for the tax department.d. The computer is received.e. The invoice for the computer is paid.f. The city council agrees to transfer money from the general fund as partial payment for a special assessments project but has not yet done so. The city will be secondarily liable for any money borrowed for this work.g. The city council creates a motor pool to service all government vehicles.…arrow_forward

- The following are the balances of accounts in the Statement of Operations of the Quezon Cooperative for the Year Ended December 31, 2020.*How much is to be the allocated for General Reserved fundarrow_forwardAssume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $646,000. Parks reports net expenses of $180,000. Art museum reports net revenues of $61,000. General government revenues for the year were $941,000 with an overall increase in the city's net position of $176,000. The fund financial statements provide the following for the entire year: The general fund reports a $51,500 increase in its fund balance. The capital projects fund reports a $52,250 increase in its fund balance. The enterprise fund reports a $69,500 increase in its net position. The city asks the…arrow_forwardAssume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $702,000. Parks reports net expenses of $144,000. Art museum reports net revenues of $50,250. General government revenues for the year were $966,750 with an overall increase in the city's net position of $171,000. The fund financial statements provide the following for the entire year: The general fund reports a $45,250 increase in its fund balance. The capital projects fund reports a $53,750 increase in its fund balance. The enterprise fund reports a $69,000 increase in its net position. The city asks the…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education