Concept explainers

Forecasting Food and Beverage Sales

The Vintage Restaurant, on Captiva Island near Fort Myers, Florida, is owned and operated by Karen Payne. The restaurant just completed its third year of operation. Since opening her restaurant, Karen has sought to establish a reputation for the Vintage as a high-quality dining establishment that specializes in fresh seafood. Through the efforts of Karen and her staff, her restaurant has become one of the best and fastest growing restaurants on the island.

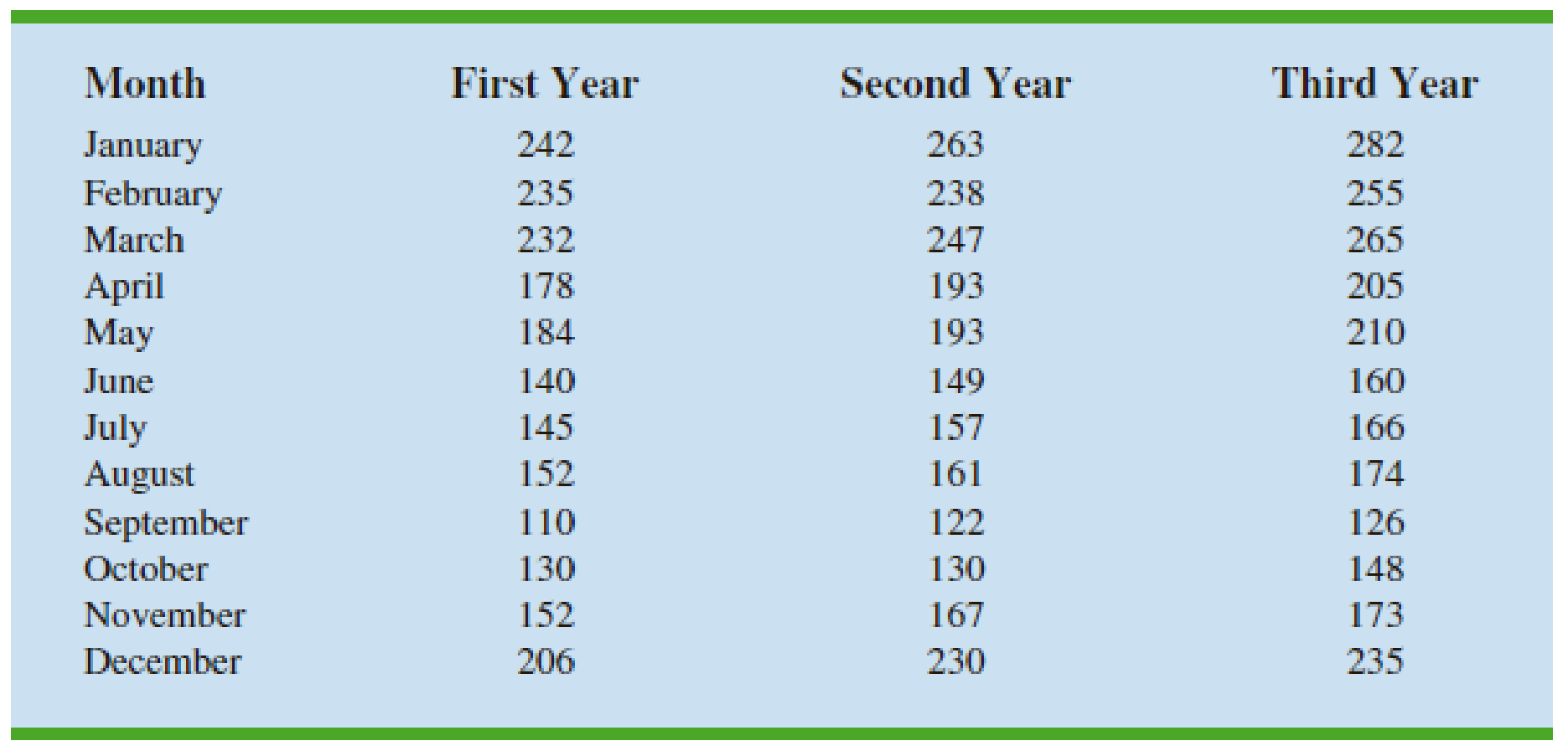

To better plan for future growth of the restaurant, Karen needs to develop a system that will enable her to forecast food and beverage sales by month for up to one year in advance. Table 17.25 shows the value of food and beverage sales ($1000s) for the first three years of operation.

Managerial Report

Perform an analysis of the sales data for the Vintage Restaurant. Prepare a report for Karen that summarizes your findings, forecasts, and recommendations. Include the following:

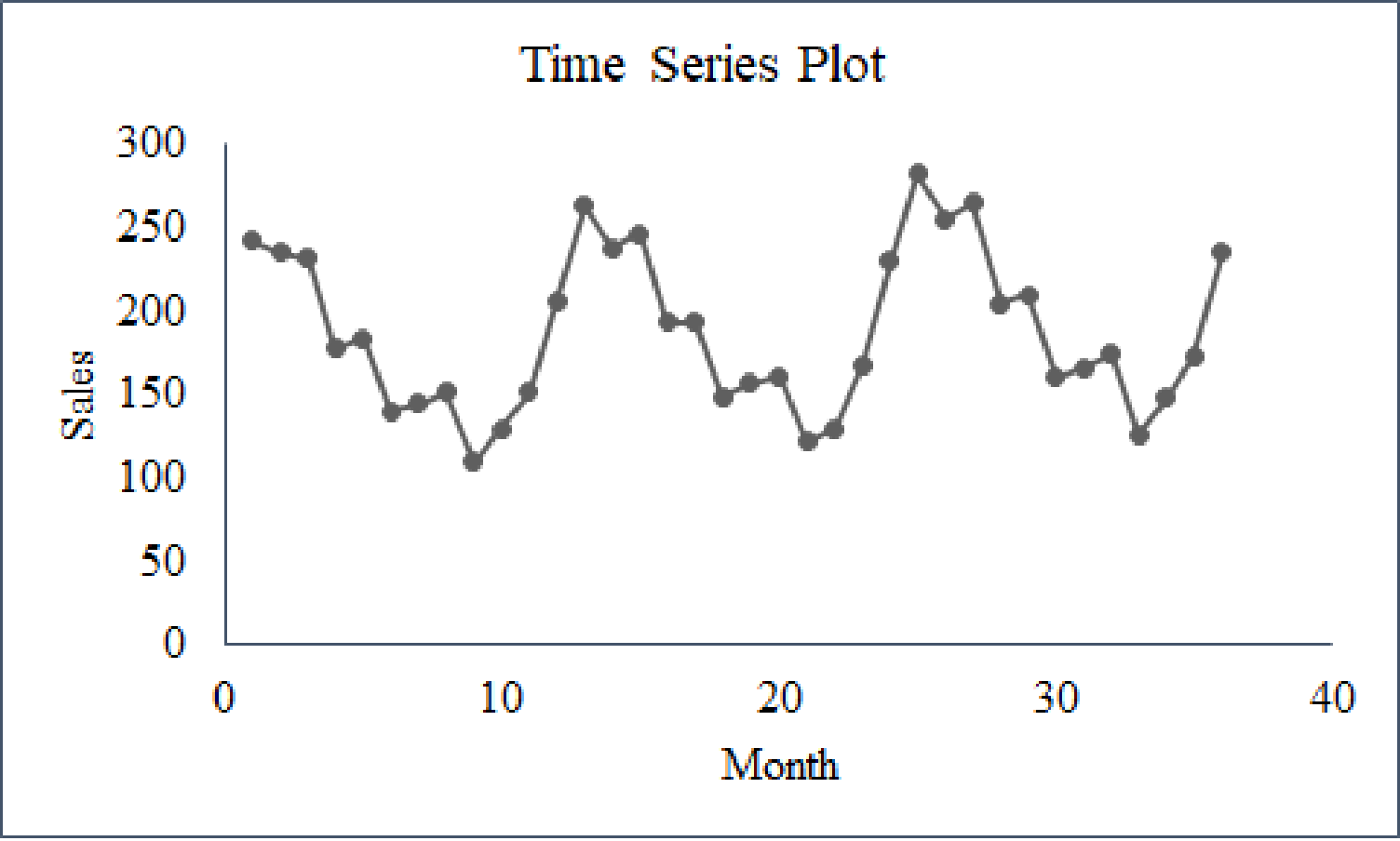

- 1. A time series plot. Comment on the underlying pattern in the time series.

- 2. An analysis of the seasonality of the data. Indicate the seasonal indexes for each month, and comment on the high and low seasonal sales months. Do the seasonal indexes make intuitive sense? Discuss.

TABLE 17.25 Food and beverage sales for the vintage restaurant ($1000s)

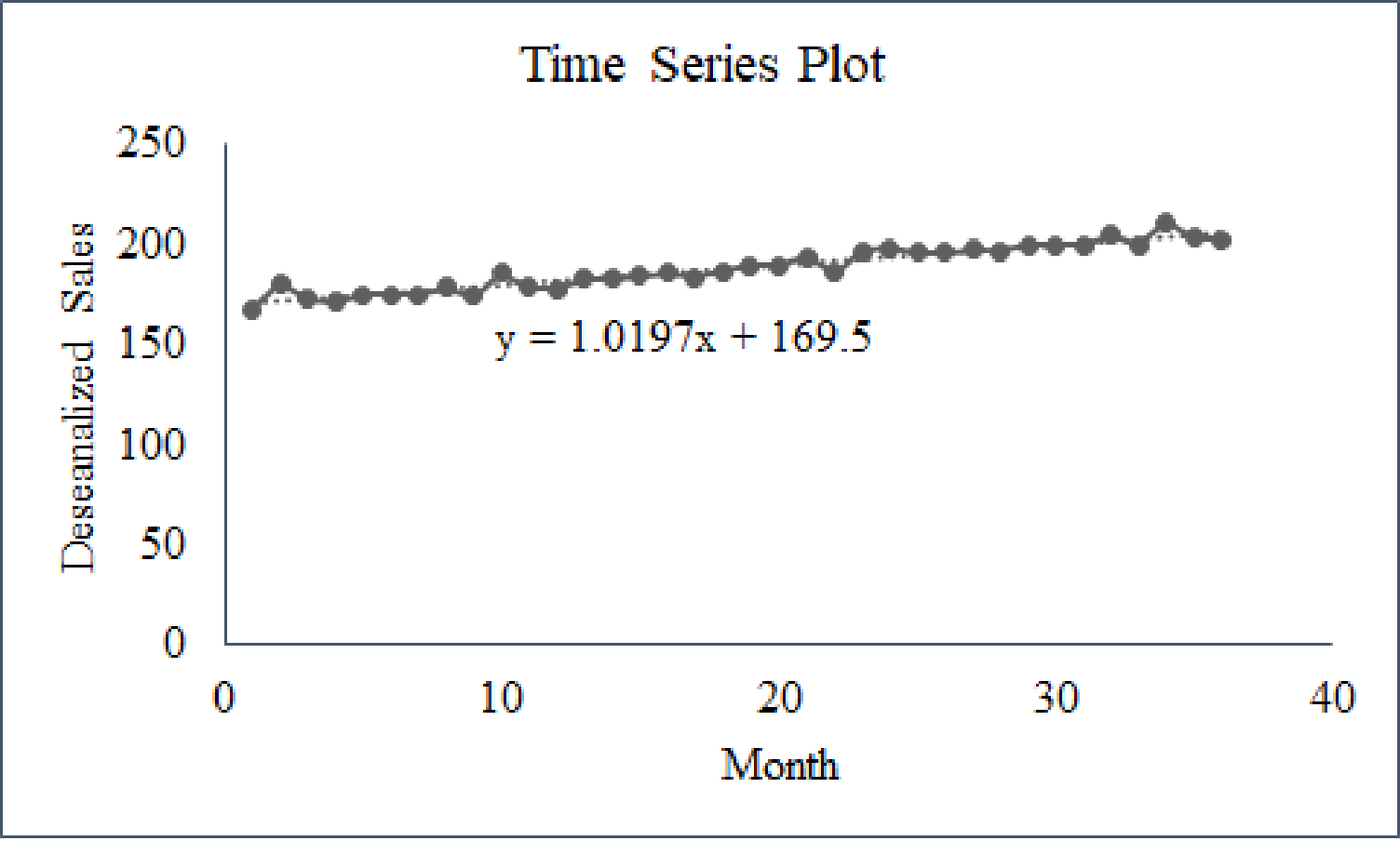

- 3. Deseasonalize the time series. Does there appear to be any trend in the deseasonalized time series?

- 4. Using the time series decomposition method, forecast sales for January through December of the fourth year.

- 5. Using the dummy variable regression approach, forecast sales for January through December of the fourth year.

- 6. Provide summary tables of your calculations and any graphs in the appendix of your report.

Assume that January sales for the fourth year turn out to be $295,000. What was your forecast error? If this error is large, Karen may be puzzled about the difference between your forecast and the actual sales value. What can you do to resolve her uncertainty in the forecasting procedure?

1.

Construct a time series plot and explain the type of pattern.

Answer to Problem 1CP

The time series plot is given below:

The pattern that appears in the graph is linear in trend with a seasonal pattern.

Explanation of Solution

Calculation:

It is given that Person KP started Restaurant V. Restaurant V is one of the best and fastest growing restaurants on the island. Person KP needs to develop a system that will forecast the food and beverage sales by month for up to one year in advance.

Software procedure:

Step-by-step software procedure to draw the time series plot using EXCEL:

- Open an EXCEL file.

- In column A, enter the data of Month and in column B, enter the data of Sales.

- Select the data that are to be displayed.

- Click on the Insert Tab > select Scatter icon.

- Choose a Scatter with Straight Lines and Markers.

- Click on the chart > select Layout from the Chart Tools.

- Select Chart Title > Above Chart and enter Time Series Plot.

- Select Axis Title > Primary Horizontal Axis Title > Title Below Axis.

- Enter Month in the dialog box.

- Select Axis Title > Primary Vertical Axis Title > Rotated Title.

- Enter Sales in the dialog box.

From the output, the time series plot represents the seasonality of the data. From the three years of the data, it is observed that the month of September has the lowest sales and the month of January has the highest sales every year.

Thus, the pattern that appears in the graph is linear in trend with a seasonal pattern.

2.

Calculate the seasonal indexes.

Find the high and low seasonal indexes and check whether the seasonal indexes are reasonable or not.

Answer to Problem 1CP

The monthly seasonal indexes are tabulated below:

| Month | Seasonal Index |

| 1 | 1.44 |

| 2 | 1.30 |

| 3 | 1.34 |

| 4 | 1.04 |

| 5 | 1.05 |

| 6 | 0.80 |

| 7 | 0.83 |

| 8 | 0.85 |

| 9 | 0.63 |

| 10 | 0.70 |

| 11 | 0.85 |

| 12 | 1.16 |

Explanation of Solution

Calculation:

The formula for moving the average forecast of order k is as follows:

For the first moving average:

For the second moving average:

For the first centered moving average:

Similarly, the remaining moving averages and centered moving averages are obtained as follows:

| Month | Sales | Moving Average |

Centered Moving Average | |

| 1 | 242 | – | – | |

| 2 | 235 | – | – | |

| 3 | 232 | – | – | |

| 4 | 178 | – | – | |

| 5 | 184 | – | – | |

| 6 | 140 | – | – | |

| 175.500 | ||||

| 7 | 145 | 176.375 | 0.822 | |

| 177.250 | ||||

| 8 | 152 | 177.375 | 0.857 | |

| 177.500 | ||||

| 9 | 110 | 178.125 | 0.618 | |

| 178.750 | ||||

| 10 | 130 | 179.375 | 0.725 | |

| 180.000 | ||||

| 11 | 152 | 180.375 | 0.843 | |

| 180.750 | ||||

| 12 | 206 | 181.125 | 1.137 | |

| 181.500 | ||||

| 13 | 263 | 182.000 | 1.445 | |

| 182.500 | ||||

| 14 | 238 | 182.875 | 1.301 | |

| 183.250 | ||||

| 15 | 247 | 183.750 | 1.344 | |

| 184.250 | ||||

| 16 | 193 | 184.250 | 1.047 | |

| 184.250 | ||||

| 17 | 193 | 184.875 | 1.044 | |

| 185.500 | ||||

| 18 | 149 | 186.500 | 0.799 | |

| 187.500 | ||||

| 19 | 157 | 188.292 | 0.834 | |

| 189.083 | ||||

| 20 | 161 | 189.792 | 0.848 | |

| 190.500 | ||||

| 21 | 122 | 191.250 | 0.638 | |

| 192.000 | ||||

| 22 | 130 | 192.500 | 0.675 | |

| 193.000 | ||||

| 23 | 167 | 193.708 | 0.862 | |

| 194.417 | ||||

| 24 | 230 | 194.875 | 1.180 | |

| 195.333 | ||||

| 25 | 282 | 195.708 | 1.441 | |

| 196.083 | ||||

| 26 | 255 | 196.625 | 1.297 | |

| 197.167 | ||||

| 27 | 265 | 197.333 | 1.343 | |

| 197.500 | ||||

| 28 | 205 | 198.250 | 1.034 | |

| 199.000 | ||||

| 29 | 210 | 199.250 | 1.054 | |

| 199.500 | ||||

| 30 | 160 | 199.708 | 0.801 | |

| 199.917 | ||||

| 31 | 166 | – | – | |

| 32 | 174 | – | – | |

| 33 | 126 | – | – | |

| 34 | 148 | – | – | |

| 35 | 173 | – | – | |

| 36 | 235 | – | – |

Use the above table to calculate the following:

| Months | Seasonal Irregular Values | Seasonal Index | |

| 1 | 1.445 | 1.441 | |

| 2 | 1.301 | 1.297 | |

| 3 | 1.344 | 1.343 | |

| 4 | 1.047 | 1.034 | |

| 5 | 1.044 | 1.054 | |

| 6 | 0.799 | 0.801 | |

| 7 | 0.822 | 0.834 | |

| 8 | 0.857 | 0.848 | |

| 9 | 0.618 | 0.638 | |

| 10 | 0.725 | 0.675 | |

| 11 | 0.843 | 0.862 | |

| 12 | 1.137 | 1.180 | |

3.

Compute the deseasonalized time-series.

Check whether the deseasonalized data appear to be of any trend.

Answer to Problem 1CP

Deseasonalized expenses are given below:

|

Month (Year 1) |

Deseasonalized Readings |

Month (Year 2) |

Deseasonalized Readings |

Month (Year 3) |

Deseasonalized Readings |

| 1 | 168.06 | 1 | 182.64 | 1 | 195.83 |

| 2 | 180.77 | 2 | 183.08 | 2 | 196.15 |

| 3 | 173.13 | 3 | 184.33 | 3 | 197.76 |

| 4 | 171.15 | 4 | 185.58 | 4 | 197.12 |

| 5 | 175.24 | 5 | 183.81 | 5 | 200.00 |

| 6 | 175.00 | 6 | 186.25 | 6 | 200.00 |

| 7 | 174.70 | 7 | 189.16 | 7 | 200.00 |

| 8 | 178.82 | 8 | 189.41 | 8 | 204.71 |

| 9 | 174.60 | 9 | 193.65 | 9 | 200.00 |

| 10 | 185.71 | 10 | 185.71 | 10 | 211.43 |

| 11 | 178.82 | 11 | 196.47 | 11 | 203.53 |

| 12 | 177.59 | 12 | 198.28 | 12 | 202.59 |

The linear trend equation is

Explanation of Solution

Calculation:

Deseasonalized data are obtained below:

| Month | Sales |

Adjusted Seasonal Index | |

| 1 | 242 | 1.44 | 168.06 |

| 2 | 235 | 1.30 | 180.77 |

| 3 | 232 | 1.34 | 173.13 |

| 4 | 178 | 1.04 | 171.15 |

| 5 | 184 | 1.05 | 175.24 |

| 6 | 140 | 0.80 | 175.00 |

| 7 | 145 | 0.83 | 174.70 |

| 8 | 152 | 0.85 | 178.82 |

| 9 | 110 | 0.63 | 174.60 |

| 10 | 130 | 0.70 | 185.71 |

| 11 | 152 | 0.85 | 178.82 |

| 12 | 206 | 1.16 | 177.59 |

| 13 | 263 | 1.44 | 182.64 |

| 14 | 238 | 1.30 | 183.08 |

| 15 | 247 | 1.34 | 184.33 |

| 16 | 193 | 1.04 | 185.58 |

| 17 | 193 | 1.05 | 183.81 |

| 18 | 149 | 0.80 | 186.25 |

| 19 | 157 | 0.83 | 189.16 |

| 20 | 161 | 0.85 | 189.41 |

| 21 | 122 | 0.63 | 193.65 |

| 22 | 130 | 0.70 | 185.71 |

| 23 | 167 | 0.85 | 196.47 |

| 24 | 230 | 1.16 | 198.28 |

| 25 | 282 | 1.44 | 195.83 |

| 26 | 255 | 1.30 | 196.15 |

| 27 | 265 | 1.34 | 197.76 |

| 28 | 205 | 1.04 | 197.12 |

| 29 | 210 | 1.05 | 200.00 |

| 30 | 160 | 0.80 | 200.00 |

| 31 | 166 | 0.83 | 200.00 |

| 32 | 174 | 0.85 | 204.71 |

| 33 | 126 | 0.63 | 200.00 |

| 34 | 148 | 0.70 | 211.43 |

| 35 | 173 | 0.85 | 203.53 |

| 36 | 235 | 1.16 | 202.59 |

Trend:

Software procedure:

Step-by-step software procedure to find the linear trend equation using EXCEL:

- Open an EXCEL file.

- In column A, enter the data of Month and in column B, enter the data of Deseasonalized Sales.

- Select the data that are to be displayed.

- Click on the Insert Tab > select Scatter icon.

- Choose a Scatter with Straight Lines and Markers.

- Click on the chart > select Layout from the Chart Tools.

- Select Chart Title > Above Chart and enter Time Series Plot.

- Select Axis Title > Primary Horizontal Axis Title > Title Below Axis.

- Enter Month in the dialog box.

- Select Axis Title > Primary Vertical Axis Title > Rotated Title.

- Enter Deseasonalized Sales in the dialog box.

- Right Click at any point in the time series plot and select Add Trendline.

- Select Linear under TrendLine Options.

- Choose Display Equation on Chart.

Output obtained using EXCEL is given below:

From the output, the linear trend equation is

4.

Compute the adjusted deseasonalized trend forecasts for 12 months of the fourth year.

Answer to Problem 1CP

The adjusted forecast is tabulated below:

| Month |

Adjusted Forecast |

| 1 | 298.41 |

| 2 | 27072 |

| 3 | 280.42 |

| 4 | 218.70 |

| 5 | 221.87 |

| 6 | 169.86 |

| 7 | 177.08 |

| 8 | 182.21 |

| 9 | 135.70 |

| 10 | 151.48 |

| 11 | 184.81 |

| 12 | 253.40 |

Explanation of Solution

Calculation:

The linear trend equation using Part (3) is as follows:

The periods for fourth year are 37 to 48.

For the period 37:

Similarly, the remaining forecasts for year 4 are obtained as follows:

| Period | Year 4 | Forecast |

| 37 | January | 207.229 |

| 38 | February | 208.249 |

| 39 | March | 209.268 |

| 40 | April | 210.288 |

| 41 | May | 211.308 |

| 42 | June | 212.327 |

| 43 | July | 213.347 |

| 44 | August | 214.367 |

| 45 | September | 215.387 |

| 46 | October | 216.406 |

| 47 | November | 217.426 |

| 48 | December | 218.446 |

Use the seasonal indexes to adjust the forecasts developed in Part (3).

The adjusted forecast is obtained as follows:

For January:

| Year 4 | Period | Forecast | Seasonal Index | Adjusted Forecast |

| January | 37 | 207.229 | 1.44 | 298.410 |

| February | 38 | 208.249 | 1.30 | 270.724 |

| March | 39 | 209.268 | 1.34 | 280.419 |

| April | 40 | 210.288 | 1.04 | 218.700 |

| May | 41 | 211.308 | 1.05 | 221.873 |

| June | 42 | 212.327 | 0.80 | 169.862 |

| July | 43 | 213.347 | 0.83 | 177.078 |

| August | 44 | 214.367 | 0.85 | 182.212 |

| September | 45 | 215.387 | 0.63 | 135.694 |

| October | 46 | 216.406 | 0.70 | 151.484 |

| November | 47 | 217.426 | 0.85 | 184.812 |

| December | 48 | 218.446 | 1.16 | 253.397 |

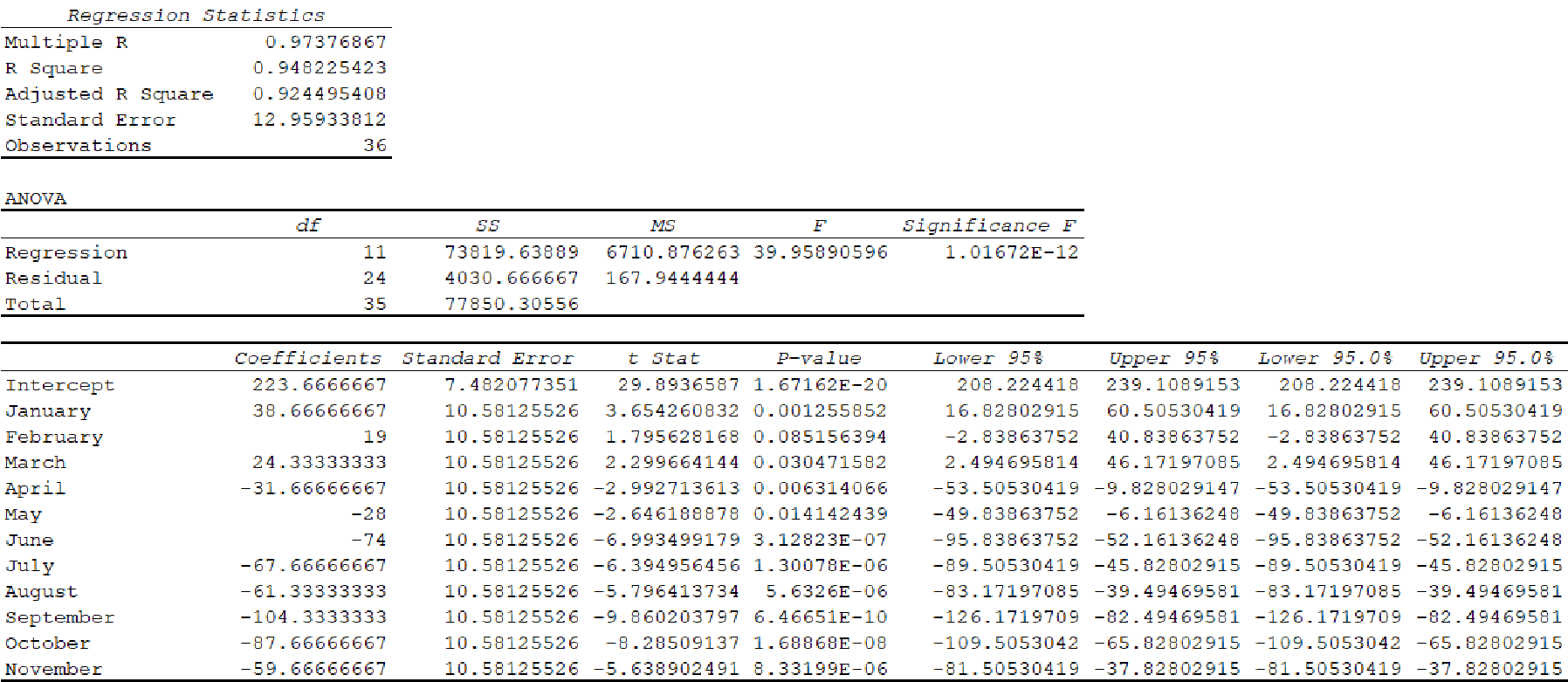

5.

Estimate the forecast sales for January through December of the fourth year using dummy variable.

Answer to Problem 1CP

The forecast sales are tabulated below:

| Month | Forecast Sales |

| 1 | 262.7 |

| 2 | 243 |

| 3 | 248.3 |

| 4 | 192.3 |

| 5 | 196 |

| 6 | 150 |

| 7 | 156.3 |

| 8 | 162.7 |

| 9 | 120 |

| 10 | 136.3 |

| 11 | 164.3 |

| 12 | 224 |

Explanation of Solution

Calculation:

The regression equation is given below:

Here

…

Software procedure:

Step-by-step procedure to obtain the estimated regression equation using EXCEL:

- In EXCEL sheet, enter January, February, March, April, May, June, July, September, October, November, Time period and Sales in different columns.

- In Data, select Data Analysis and choose Regression.

- In Input Y Range, select S.

- In Input X Range, select January, February, March, April, May, June, July, September, October, November.

- Select Labels.

- Click OK.

Output obtained using EXCEL is given below:

From the results, the regression equation is given below:

The next year monthly forecasts are as follows:

6.

Give summary tables.

Find the forecast error between the forecast sales and the actual sales.

Explain the solution for the uncertainty in the forecasting procedure.

Explanation of Solution

Calculation:

The summary table of the data is given below:

| Month | Seasonal Index |

Forecast Sales By deseasonalize data |

Forecast Sales By dummy variable |

| 1 | 1.44 | 298.410 | 262.7 |

| 2 | 1.30 | 270.724 | 243 |

| 3 | 1.34 | 280.419 | 248.3 |

| 4 | 1.04 | 218.700 | 192.3 |

| 5 | 1.05 | 221.873 | 196 |

| 6 | 0.80 | 169.862 | 150 |

| 7 | 0.83 | 177.078 | 156.3 |

| 8 | 0.85 | 182.212 | 162.7 |

| 9 | 0.63 | 135.694 | 120 |

| 10 | 0.70 | 151.484 | 136.3 |

| 11 | 0.85 | 184.812 | 164.3 |

| 12 | 1.16 | 253.397 | 224 |

It is assumed that the January sales for the fourth year is $295,000.

The forecast January sales using deseasonalized data is $298,410.

The forecast error is calculated as follows:

The forecast value is overpredicted and the difference is –$3,410.

The error is very small, while the sales are of large amount.

The uncertainty in the forecast procedure can be resolved using the monthly forecast.

Want to see more full solutions like this?

Chapter 17 Solutions

Modern Business Statistics With Microsoft Office Excel - Text Only

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman