Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 32AP

Mighty Stars produces stars for elementary teachers to reward their students. Mighty Stars’

June 1 balances in the subsidiary ledgers were as follows:

- Raw Materials Inventory subsidiary ledger: Paper, $4,000; indirect materials, $2,000

- Work-in-Process Inventory subsidiary ledger: Job 120, $40,000; Job 121, $0

- Finished Goods Inventory subsidiary ledger: Large Stars, $9,900; Small Stars, $10,500

June transactions are summarized as follows:

- a. Collections on account, $145,000.

- b. Selling and administrative expenses incurred and paid, $32,000.

- c. Payments on account, $39,000.

- d. Materials purchases on account: Paper, $24,000; indirect materials, $4,200.

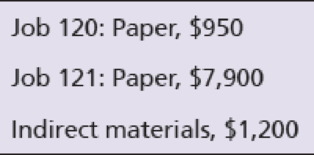

- e. Materials requisitioned and used in production:

- f. Wages incurred during June, $39,000. Labor time records for the month: Job 120, $3,600; Job 121, $17,000; indirect labor, $18,400.

- g. Wages paid in June include the balance in Wages Payable at May 31 plus $36,100 of wages incurred during June.

- h.

Depreciation on plant and equipment, $2,500. - i. Manufacturing

overhead allocated at the predetermined overhead allocation rate of 80% of direct labor costs. - j. Jobs completed during the month: Job 120 with 700,000 Large Stars at a total cost of $47,430.

- k. Sales on account: all of Job 120 for $104,000.

- l. Adjusted for overallocated or underallocated manufacturing overhead.

Requirements

- 1. Journalize the transactions for the company.

- 2. Open T-accounts for the general ledger, the Raw Materials Inventory subsidiary ledger, the Work-in-Process Inventory subsidiary ledger, and the Finished Goods Inventory subsidiary ledger. Insert each account balance as given, and use the reference Bal.

Post the journal entries to the T-accounts using the transaction letters as a reference. - 3. Prepare a trial balance at June 30, 2018.

- 4. Use the Work-in-Process Inventory T-account to prepare a schedule of cost of goods manufactured for the month of June.

- 5. Prepare an income statement for the month of June.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Preparing comprehensive accounting for manufacturing transactions

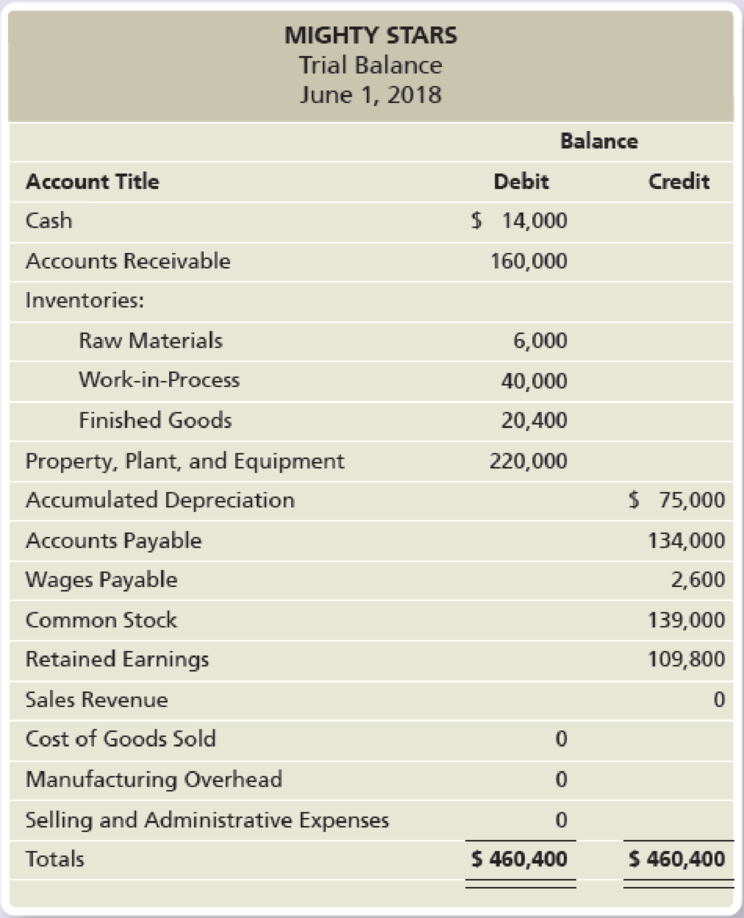

Mighty Stars produces stars for elementary teachers to reward their students Mighty Stars’ trial balance on June 1 follows:

June 1 balances in the subsidiary ledgers were as follows:

• Raw Materials Inventory subsidiary ledger: Paper, $4,000; indirect materials, $2,000

• Work-in-Process Inventory subsidiary ledger: Job 120, $40,000; Job 121, $0

June transactions are summarized as follows:

a. Collections on account, $145,000.

b. Selling and administrative expenses incurred and paid, $32,000.

c. Payments on account, $39,000.

d. Materials purchases on account: Paper, $24,000; indirect materials, $4,200.

e. Materials requisitioned and used in production:

f. Wages incurred during June, $39,000. Labor time records for the month: Job 120, $3,600; Job 121, $17,000; indirect labor, $18,400.

g. Wages paid in June include the balance in Wages Payable at May 31 plus $36,100 of wages incurred during June.

h. Depreciation on plant and…

Zoe Corporation has the following information for the month of March:

Purchases

$92,000

Materials inventory, March 1

6,000

Materials inventory, March 31

8,000

Direct labor

25,000

Factory overhead

37,000

Work in process, March 1

22,000

Work in process, March 31

23,500

Finished goods inventory, March 1

21,000

Finished goods inventory, March 31

30,000

Sales

257,000

Sales and administrative expenses

79,000

a. Prepare a schedule of cost of goods manufactured.

Zoe Corporation

Statement of Cost of Goods Manufactured

For Month Ended March 31

$

Direct Materials:

$

$

Cost of direct materials used

$

Total manufacturing costs incurred

Total manufacturing costs

$

Cost of goods manufactured

$

b. Prepare an income statement for the month ended March 31.

Zoe Corporation

Income Statement

For Month Ended March 31

$

Cost of…

Zoe Corporation has the following information for the month of March:

Purchases

$92,000

Materials inventory, March 1

6,000

Materials inventory, March 31

8,000

Direct labor

25,000

Factory overhead

37,000

Work in process, March 1

22,000

Work in process, March 31

23,500

Finished goods inventory, March 1

21,000

Finished goods inventory, March 31

30,000

Sales

257,000

Sales and administrative expenses

79,000

a. Prepare a schedule of cost of goods manufactured.

Zoe Corporation

Statement of Cost of Goods Manufactured

For Month Ended March 31

Beginning work in process inventory, March 1

$fill in the blank 857f0a0ad075ffa_2

Direct Materials:

Beginning materials inventory

$fill in the blank 857f0a0ad075ffa_4

Purchases

fill in the blank 857f0a0ad075ffa_6

Cost of materials available for use

$fill in the blank 857f0a0ad075ffa_8

Less ending materials inventory

fill in the blank 857f0a0ad075ffa_10

Cost of direct…

Chapter 17 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Prob. 6TICh. 17 - Record the following journal entries for Smith...Ch. 17 - Prob. 8TICh. 17 - Prob. 9TICh. 17 - Prob. 10TI

Ch. 17 - Prob. 11TICh. 17 - Prob. 12TICh. 17 - The following information pertains to Smith...Ch. 17 - Prob. 14TICh. 17 - Prob. 15TICh. 17 - Prob. 16TICh. 17 - Wesson Company is a consulting firm. The firm...Ch. 17 - Prob. 18TICh. 17 - Would an advertising agency use job order or...Ch. 17 - Prob. 2QCCh. 17 - When a manufacturing company uses indirect...Ch. 17 - When a manufacturing company uses direct labor, it...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - A manufacturing company completed work on a job....Ch. 17 - For which of the following reasons would David...Ch. 17 - Why do managers need to know the cost of their...Ch. 17 - What types of companies use job order costing...Ch. 17 - What types of companies use process costing...Ch. 17 - What is the purpose of a job cost record?Ch. 17 - Explain the difference between cost of goods...Ch. 17 - A job was started on May 15, completed on June 27,...Ch. 17 - Give the journal entry for raw materials purchased...Ch. 17 - What is the purpose of the raw materials...Ch. 17 - How does the use of direct and indirect materials...Ch. 17 - Prob. 10RQCh. 17 - Give five examples of manufacturing overhead...Ch. 17 - What is the predetermined overhead allocation...Ch. 17 - What is an allocation base? Give some examples.Ch. 17 - How is manufacturing overhead allocated to jobs?Ch. 17 - A completed job cost record shows the unit cost of...Ch. 17 - Prob. 16RQCh. 17 - Give the journal entry for the completion of a...Ch. 17 - Prob. 18RQCh. 17 - Explain the difference between underallocated...Ch. 17 - If a company incurred 5,250 in actual overhead...Ch. 17 - Prob. 21RQCh. 17 - Explain the terms accumulate, assign, allocate,...Ch. 17 - Prob. 23RQCh. 17 - Prob. 24RQCh. 17 - Would the following companies most likely use job...Ch. 17 - Prob. 2SECh. 17 - Analyze the following T-accounts to determine the...Ch. 17 - Prob. 4SECh. 17 - Oak Outdoor Furniture manufactures wood patio...Ch. 17 - Job 303 includes direct materials costs of 550 and...Ch. 17 - Calculating predetermined overhead allocation...Ch. 17 - Lincoln Company completed jobs that cost 38,000 to...Ch. 17 - Columbus Enterprises reports the following...Ch. 17 - The T-account showing the manufacturing overhead...Ch. 17 - Adjusting Manufacturing Overhead Justice Companys...Ch. 17 - Prob. 12SECh. 17 - Prob. 13SECh. 17 - Prob. 14SECh. 17 - Prob. 15ECh. 17 - Defining terminology Match the following terms to...Ch. 17 - Prob. 17ECh. 17 - Goldenrod Company makes artificial flowers and...Ch. 17 - Selected cost data for Classic Print Co. are as...Ch. 17 - Prob. 20ECh. 17 - Prob. 21ECh. 17 - Prob. 22ECh. 17 - Jordan Company has the following information for...Ch. 17 - Journalize the following transactions for Marges...Ch. 17 - Prob. 25ECh. 17 - Analyze the following T-accounts, and determine...Ch. 17 - Prob. 27ECh. 17 - Clement Manufacturing makes carrying cases for...Ch. 17 - Ki Technology Co. manufactures DVDs for computer...Ch. 17 - Superior Construction, Inc. is a home builder in...Ch. 17 - Accounting for manufacturing overhead Prestige...Ch. 17 - Mighty Stars produces stars for elementary...Ch. 17 - Bluebird Design, Inc. is a Web site design and...Ch. 17 - Sutherland Manufacturing makes carrying cases for...Ch. 17 - Ye Technology Co. manufactures DVDs for computer...Ch. 17 - Meadow Construction, Inc. is a home builder in...Ch. 17 - Accounting for manufacturing overhead Elegant...Ch. 17 - Hero Stars produces stars for elementary teachers...Ch. 17 - Skylark Design, Inc. is a Web site design and...Ch. 17 - Accounting for manufacturing overhead This problem...Ch. 17 - Granite Construction Incorporated is a major...Ch. 17 - Hiebert Chocolate, Ltd. is located in Memphis. The...Ch. 17 - Prob. 1FC

Additional Business Textbook Solutions

Find more solutions based on key concepts

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Ravenna Candles recently purchased candleholders for resale in its shops. Which of the following costs would be...

Financial Accounting (12th Edition) (What's New in Accounting)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

What are assets limited as to use and how do they differ from restricted assets?

Accounting for Governmental & Nonprofit Entities

Calculating certain information using the direct method (Learning Objective 4) 20-25 min. Trudeaus Marine, Inc....

Financial Accounting, Student Value Edition (5th Edition)

Disposal of assets. Answer the following questions. 1. A company has an inventory of 1,300 assorted parts for a...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rexar had 1,000 units in beginning inventory before starting 9.500 units and completing 8,000 units. The beginning work in process inventory consisted of $5,000 in materials and $8,500 in conversion costs before $16,000 of materials and $18,500 of conversion costs were added during the month. The ending WIP inventory was 100% complete with regard to materials and 40% complete with regard to conversion costs. Prepare the journal entry to record the transfer of inventory from the manufacturing department to the finished goods department.arrow_forwardSCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Sanchez Welding and Manufacturing Company. Prepare a schedule of cost of goods manufactured for the year ended December 31, 20--. Assume that all materials inventory items are direct materials. Work in process, January 1 20,500 Materials inventory, January 1 11,000 Materials purchases 12,000 Materials inventory, December 31 13,000 Direct labor 9,500 Overhead 5,500 Work in process, December 31 10,500arrow_forwardDuring March, the following costs were charged to the manufacturing department: $14886 for materials; $14,656 for labor; and $13,820 for manufacturing overhead. The records show that 30,680 units were completed and transferred, while 2,400 remained in ending inventory. There were 33,080 equivalent units of material and 31,640 of conversion costs. Using the weighted-average method, what is the cost of inventory transferred and the balance in work in process inventory?arrow_forward

- SCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Maupin Manufacturing Company. Prepare a schedule of cost of goods manufactured for the year ended December 31, 20--. Assume that all materials inventory items are direct materials. Work in process, January 1 77,000 Materials inventory, January 1 31,000 Materials purchases 35,000 Materials inventory, December 31 26,000 Direct labor 48,000 Overhead 20,000 Work in process, December 31 62,000arrow_forwardLeMans Company produces specialty papers at its Fox Run plant. At the beginning of June, the following information was supplied by its accountant: During June, direct labor cost was 143,000, direct materials purchases were 346,000, and the total overhead cost was 375,800. The inventories at the end of June were: Required: 1. Prepare a cost of goods manufactured statement for June. 2. Prepare a cost of goods sold schedule for June.arrow_forwardOReilly Manufacturing Co.s cost of goods sold for the month ended July 31 was 345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. No indirect materials were used during the period. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Start by using cost of goods sold to solve for the cost of goods manufactured.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July.arrow_forward

- High-End Products Inc. uses a standard cost system in accounting for the cost of production of its only product, Swank. The standards for the production of one unit of Swank follow: Direct materials: 10 feet of Class at $.75 per foot and 3 feet of Chic at $1.00 per foot. Direct labor: 4 hours at $12.00 per hour. Factory overhead: applied at 150% of standard direct labor costs. There was no beginning inventory on hand at July 1. Following is a summary of costs and related data for the production of Swank during the following year ended June 30: 100,000 feet of Class were purchased at $.72 per foot. 30,000 feet of Chic were purchased at $1.05 per foot. 8,000 units of Swank were produced that required 78,000 feet of Class, 26,000 feet of Chic, and 31,000 hours of direct labor at $11.80 per hour. 6,000 units of product Swank were sold. On June 30, there are 22,000 feet of Class, 4,000 feet of Chic, and 2,000 completed units of Swank on hand. All purchases and transfers are “charged in” at standard. Required: Calculate the following, using the formulas on pages 421–422 and 424 and compute the materials variances for both Class and Chic: Materials quantity variance. Materials purchase price variance. Labor efficiency variance. Labor rate variance.arrow_forwardDavis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forwardGlasson Manufacturing Co. produces only one product. You have obtained the following information from the corporations books and records for the current year ended December 31, 2016: a. Total manufacturing cost during the year was 1,000,000, including direct materials, direct labor, and factory overhead. b. Cost of goods manufactured during the year was 970,000. c. Factory Overhead charged to Work in Process was 75% of direct labor cost and 27% of the total manufacturing cost. d. The beginning Work in Process inventory, on January 1, was 40% of the ending Work in Process inventory, on December 31. e. Material purchases were 400,000 and the ending balance in Materials inventory was 60,000. No indirect materials were used in production. Required: Prepare a statement of cost of goods manufactured for the year ended December 31 for Glasson Manufacturing. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information.)arrow_forward

- On December 1, Carmel Valley Production Inc. had a work in process inventory of 1,200 units that were complete as to materials and 50% complete as to labor and overhead. December 1 costs follow: During December the following transactions occurred: a. Purchased materials costing 50,000 on account. b. Placed direct materials costing 49,000 into production. c. Incurred production wages totaling 50,500. d. Incurred overhead costs for December: e. Applied overhead to work in process at a predetermined rate of 125% of direct labor cost. f. Completed and transferred 10,000 units to finished goods. (Hint: You should first compute equivalent units and unit costs. The unit cost should include applied, not actual, factory overhead.) Carmel Valley uses the weighted average cost method. The ending inventory of work in process consisted of 1,000 units that were completed as to materials and 25% complete as to labor and overhead. Required: Prepare the journal entries to record the above December transactions.arrow_forwardKenkel, Ltd. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 80,000. b. Requisitioned raw materials to production, 80,000. c. Distributed direct labor costs, 10,000. d. Factory overhead costs incurred, 60,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 225,000, on account.arrow_forwardSelected information concerning the operations of a company for the year ended December 31 is as follows: Work in process inventories at the beginning and end of the year were zero. Beginning inventory of finished goods was 9,650 (for 1,000 units). Cost of goods sold was 174,600. What was the companys finished goods inventory cost at December 31? a. 98,050 b. 29,100 c. 29,050 d. 40,600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY