Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 34BP

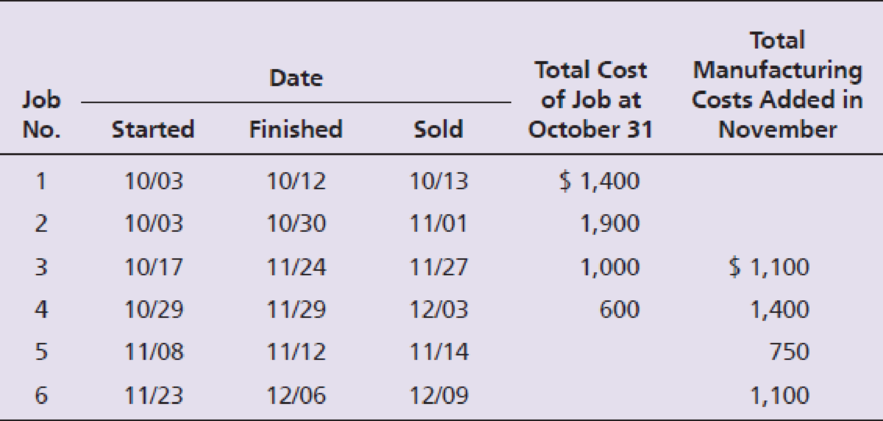

Sutherland Manufacturing makes carrying cases for portable electronic devices. Its costing records yield the following information:

Requirements

- 1. Which type of costing system is Sutherland using? What piece of data did you base your answer on?

- 2. Use the dates in the table to identify the status of each job at October 31 and November 30. Compute Sutherland’s account balances at October 31 for Work-in-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold. Compute, by job, account balances at November 30 for Work-in-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold.

- 3. Prepare

journal entries to record the transfer of completed jobs from Work-in-Process Inventory to Finished Goods Inventory for October and November. - 4. Record the sale of Job 3 for $2,200 on account.

- 5. What is the gross profit for Job 3?

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule08:50

Chapter 17 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Prob. 6TICh. 17 - Record the following journal entries for Smith...Ch. 17 - Prob. 8TICh. 17 - Prob. 9TICh. 17 - Prob. 10TI

Ch. 17 - Prob. 11TICh. 17 - Prob. 12TICh. 17 - The following information pertains to Smith...Ch. 17 - Prob. 14TICh. 17 - Prob. 15TICh. 17 - Prob. 16TICh. 17 - Wesson Company is a consulting firm. The firm...Ch. 17 - Prob. 18TICh. 17 - Would an advertising agency use job order or...Ch. 17 - Prob. 2QCCh. 17 - When a manufacturing company uses indirect...Ch. 17 - When a manufacturing company uses direct labor, it...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - A manufacturing company completed work on a job....Ch. 17 - For which of the following reasons would David...Ch. 17 - Why do managers need to know the cost of their...Ch. 17 - What types of companies use job order costing...Ch. 17 - What types of companies use process costing...Ch. 17 - What is the purpose of a job cost record?Ch. 17 - Explain the difference between cost of goods...Ch. 17 - A job was started on May 15, completed on June 27,...Ch. 17 - Give the journal entry for raw materials purchased...Ch. 17 - What is the purpose of the raw materials...Ch. 17 - How does the use of direct and indirect materials...Ch. 17 - Prob. 10RQCh. 17 - Give five examples of manufacturing overhead...Ch. 17 - What is the predetermined overhead allocation...Ch. 17 - What is an allocation base? Give some examples.Ch. 17 - How is manufacturing overhead allocated to jobs?Ch. 17 - A completed job cost record shows the unit cost of...Ch. 17 - Prob. 16RQCh. 17 - Give the journal entry for the completion of a...Ch. 17 - Prob. 18RQCh. 17 - Explain the difference between underallocated...Ch. 17 - If a company incurred 5,250 in actual overhead...Ch. 17 - Prob. 21RQCh. 17 - Explain the terms accumulate, assign, allocate,...Ch. 17 - Prob. 23RQCh. 17 - Prob. 24RQCh. 17 - Would the following companies most likely use job...Ch. 17 - Prob. 2SECh. 17 - Analyze the following T-accounts to determine the...Ch. 17 - Prob. 4SECh. 17 - Oak Outdoor Furniture manufactures wood patio...Ch. 17 - Job 303 includes direct materials costs of 550 and...Ch. 17 - Calculating predetermined overhead allocation...Ch. 17 - Lincoln Company completed jobs that cost 38,000 to...Ch. 17 - Columbus Enterprises reports the following...Ch. 17 - The T-account showing the manufacturing overhead...Ch. 17 - Adjusting Manufacturing Overhead Justice Companys...Ch. 17 - Prob. 12SECh. 17 - Prob. 13SECh. 17 - Prob. 14SECh. 17 - Prob. 15ECh. 17 - Defining terminology Match the following terms to...Ch. 17 - Prob. 17ECh. 17 - Goldenrod Company makes artificial flowers and...Ch. 17 - Selected cost data for Classic Print Co. are as...Ch. 17 - Prob. 20ECh. 17 - Prob. 21ECh. 17 - Prob. 22ECh. 17 - Jordan Company has the following information for...Ch. 17 - Journalize the following transactions for Marges...Ch. 17 - Prob. 25ECh. 17 - Analyze the following T-accounts, and determine...Ch. 17 - Prob. 27ECh. 17 - Clement Manufacturing makes carrying cases for...Ch. 17 - Ki Technology Co. manufactures DVDs for computer...Ch. 17 - Superior Construction, Inc. is a home builder in...Ch. 17 - Accounting for manufacturing overhead Prestige...Ch. 17 - Mighty Stars produces stars for elementary...Ch. 17 - Bluebird Design, Inc. is a Web site design and...Ch. 17 - Sutherland Manufacturing makes carrying cases for...Ch. 17 - Ye Technology Co. manufactures DVDs for computer...Ch. 17 - Meadow Construction, Inc. is a home builder in...Ch. 17 - Accounting for manufacturing overhead Elegant...Ch. 17 - Hero Stars produces stars for elementary teachers...Ch. 17 - Skylark Design, Inc. is a Web site design and...Ch. 17 - Accounting for manufacturing overhead This problem...Ch. 17 - Granite Construction Incorporated is a major...Ch. 17 - Hiebert Chocolate, Ltd. is located in Memphis. The...Ch. 17 - Prob. 1FC

Additional Business Textbook Solutions

Find more solutions based on key concepts

Communication Activity 9-1

In 150 words or fewer, explain the different methods that can be used to calculate d...

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

How can a management accountant help formulate strategy?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

What is broad averaging, and what consequences can it have on costs?

Cost Accounting (15th Edition)

Revenue recognition principle Revenue recognition principle states that every business organization should reco...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (4th Edition)

Basic accounting equation (Learning Objective 5) 10-15 min. Hanson Corp. ? 44,900 + 10,300 Tiny Tots Daycare In...

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gerken Fabrication Inc. uses the job order cost system of accounting. The following information was taken from the companys books after all posting had been completed at the end of March: a. Compute the total production cost of each job. b. Prepare the journal entries to charge the costs of materials, labor, and factory overhead to Work in Process. c. Prepare the journal entry to transfer the cost of jobs completed to Finished Goods. d. Compute the unit cost of each job. e. Compute the selling price per unit for each job, assuming a mark-on percentage of 50%.arrow_forwardYellowstone Fabricators uses a process cost system and applies actual factory overhead to work in process at the end of the month. The following data came from the records for March: There were no beginning inventories and no ending work in process inventory. From the information presented, compute the following: 1. Unit cost of production under absorption costing and variable costing. 2. Cost of the ending inventory under absorption costing and variable costing.arrow_forwardGeneva, Inc., makes two products, X and Y, that require allocation of indirect manufacturing costs. The following data were compiled by the accountants before making any allocations: The total cost of purchasing and receiving parts used in manufacturing is 60,000. The company uses a job-costing system with a single indirect cost rate. Under this system, allocated costs were 48,000 and 12,000 for X and Y, respectively. If an activity-based system is used, what would be the allocated costs for each product?arrow_forward

- Freeman Furnishings has summarized its data as shown. Direct labor hours will be used as the activity base to allocate overhead: Compute the cost of goods manufactured.arrow_forwardSan Mateo Optics, Inc., specializes in manufacturing lenses for large telescopes and cameras used in space exploration. As the specifications for the lenses are determined by the customer and vary considerably, the company uses a job-order costing system. Manufacturing overhead is applied to jobs on the basis of direct labor hours, utilizing the absorption- or full-costing method. San Mateos predetermined overhead rates for 20x1 and 20x2 were based on the following estimates. Jim Cimino, San Mateos controller, would like to use variable (direct) costing for internal reporting purposes as he believes statements prepared using variable costing are more appropriate for making product decisions. In order to explain the benefits of variable costing to the other members of San Mateos management team, Cimino plans to convert the companys income statement from absorption costing to variable costing. He has gathered the following information for this purpose, along with a copy of San Mateos 20x1 and 20x2 comparative income statement. San Mateo Optics, Inc. Comparative Income Statement For the Years 20x1 and 20x2 San Mateos actual manufacturing data for the two years are as follows: The companys actual inventory balances were as follows: For both years, all administrative expenses were fixed, while a portion of the selling expenses resulting from an 8 percent commission on net sales was variable. San Mateo reports any over-or underapplied overhead as an adjustment to the cost of goods sold. Required: 1. For the year ended December 31, 20x2, prepare the revised income statement for San Mateo Optics, Inc., utilizing the variable-costing method. Be sure to include the contribution margin on the revised income statement. 2. Describe two advantages of using variable costing rather than absorption costing. (CMA adapted)arrow_forwardSultan, Inc. manufactures goods to special order and uses a job order cost system. During its first month of operations, the following selected transactions took place: Required: 1. Prepare a schedule reflecting the cost of each of the four jobs. 2. Prepare journal entries to record the transactions. 3. Compute the ending balance in Work in Process. 4. Compute the ending balance in Finished Goods.arrow_forward

- Morrison Company had the equivalent units schedule and cost information for its Sewing Department for the month of December, as shown on the next page. Required: 1. Calculate the unit cost for December, using the weighted average method. 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for. 3. What if you were asked to show that the weighted average unit cost for materials is the blend of the November unit materials cost and the December unit materials cost? The November unit materials cost is 6.60 (66,000/10,000), and the December unit materials cost is 12.22 (550,000/45,000). The equivalent units in BWIP are 10,000, and the FIFO equivalent units are 45,000. Calculate the weighted average unit materials cost using weights defined as the proportion of total units completed from each source (BWIP output and current output).arrow_forwardTuscany Products, Inc. uses a job order cost system. The following accounts have been taken from the books of the company: Required: 1. Analyze the accounts and describe in narrative form what transactions took place. (Use the reference letters a. through f. in your explanations and note that some accounts needed in your explanation have been purposely omitted.) 2. List the supporting documents or forms required to record each transaction involving the receipt or issuance of materials. 3. Determine the ending balances for Materials, Work in Process, and Finished Goods.arrow_forwardDavis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forward

- Kenkel, Ltd. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 80,000. b. Requisitioned raw materials to production, 80,000. c. Distributed direct labor costs, 10,000. d. Factory overhead costs incurred, 60,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 225,000, on account.arrow_forwardRIRA Company makes attachments such as backhoes and grader and bulldozer blades for construction equipment. The company uses a job order cost system. Management is concerned about cost performance and evaluates the job cost sheets to learn more about the cost effectiveness of the operations. To facilitate a comparison, the job cost sheets for Job 206 (for 50 backhoe buckets completed in October) and Job 228 (for 75 backhoe buckets completed in December) were pulled and presented as follows: Management is concerned about the increase in unit costs over the months from October to December. To understand what has occurred, management interviewed the purchasing manager and quality manager. Purchasing Manager: Prices have been holding steady for our raw materials during the first half of the year. I found a new supplier for our bulk steel that was willing to offer a better price than we received in the past. I saw these lower steel prices and jumped on them, knowing that a reduction in steel prices would have a very favorable impact on our costs. Quality Manager: Something happened around mid-year. All of a sudden, we were experiencing problems with respect to the quality of our steel. As a result, weve been having all sorts of problems on the shop floor in our foundry and welding operation. a. Analyze the two job cost sheets and identify why the unit costs have changed for the backhoe buckets. Complete the following schedule to help in your analysis: b. How would you interpret what has happened in light of your analysis and the interviews?arrow_forwardFollowing is a list of manufactured products. For each product, would a job order or a process cost system be used to account for the costs of production? a. lumber b. buildings c. airplanes d. gasoline e. cereal f. textbooks g. paint h. jeansarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY