EBK EXCEL APPLICATIONS FOR ACCOUNTING P

4th Edition

ISBN: 8220100456848

Author: SMITH

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 1R

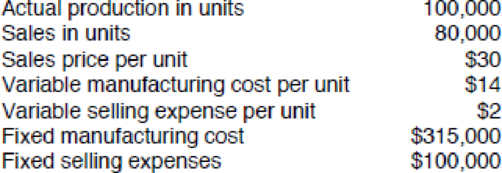

The records of Anderjak Corporation contain the following information for the month of January:

The company has no beginning inventory.

REQUIREMENT

You have been asked to prepare a variable costing (direct costing) income statement and an absorption costing income statement for the month of January. Review the worksheet VARCOST that follows these requirements.

Expert Solution & Answer

To determine

Prepare a income statement for january by using variable costing and absorption costing method.

Explanation of Solution

Prepare a income statement using absorption costing:

| Income statement | ||

| Absorption costing | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | $ 2,400,000 | |

| Cost of goods sold: | ||

| Beginning inventory cost | $ 266,875 | |

| Variable manufacturing costs | 980,000 | |

| Fixed manufacturing costs | 315,000 | |

| Total goods available for sale | $ 1,561,875 | |

| Less: ending inventory | 91,875 | |

| Cost of goods sold | 1,470,000 | |

| Gross profit | $ 930,000 | |

| Selling expenses: | ||

| Fixed selling expenses | $ 100,000 | |

| Variable selling expenses | 160,000 | |

| Total selling expenses | 260,000 | |

| Operating income | $ 670,000 | |

Table (1)

Prepare a income statement using variable costing:

| Income statement | ||

| Variable costing | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | $ 2,400,000 | |

| Cost of goods sold: | ||

| Beginning inventory cost | $ 210,000 | |

| Variable manufacturing costs | 980,000 | |

| Total goods available for sale | $ 1,190,000 | |

| Less: ending inventory | 70,000 | |

| Variable cost of goods sold | 1,120,000 | |

| Manufacturing margin | $ 1,280,000 | |

| Variable selling expenses | 160,000 | |

| Contribution margin | $ 1,120,000 | |

| Fixed costs: | ||

| Fixed manufacturing costs | $ 315,000 | |

| Fixed selling expenses | 100,000 | |

| Total fixed costs | $ 415,000 | |

| Operating income | $ 705,000 | |

Table (2)

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Gates Manufacturing reports based on an October 31 fiscal year. As a part of your interview for a cost analyst position, the interviewer provides you with the following information: Direct materials purchases Work-in-process inventory, November 1 Finished goods inventory, November 1 Finished goods inventory, October 31 Manufacturing overhead Cost of goods sold Direct labor Decrease in work-in-process inventory Average sales price per unit Gross margin percentage $ 96,000 53,000 30,800 31,800 57,600 Required: a. Find the cost of goods manufactured. b. Find the total manufacturing costs. c. Find the direct materials used. d. Find the sales revenue. e. Find the increase (decrease) in direct materials inventory. 221,000 30,400 28,000 20 ,35%

please please please solve all parts with all working if you can't solve all just skip/leave for other expert please do not waste my question with giving incomplete or incorrect answer thanks

The company uses a perpetual inventory system and has a highly labour-intensive production process, so it assigns manufacturing overhead based on direct labour cost. The predetermined overhead rate was computed from the following data:

Total estimated factory overhead $2,400,000

Total estimated direct labour cost $2,000,000

The WIP account given below relates to the activities for the month of June:

WIP Inventory A/C

June 1 Balance b/f $15,000

Direct Materials Used 123,000

Additional data:

▪ Total material requisitioned ………………………………… $153,000

▪ Manufacturing Labour Costs incurred …………………. $163,500 (75% represents direct labour)

▪ Other manufacturing overheads incurred …………... $94,275

▪ Two jobs were completed with total costs of $183,000 and $105,000 respectively. They were sold on account at a margin of 33 1/3% on sales.

Compute the predetermined manufacturing overhead rate.

The company uses a perpetual inventory system and has a highly labour-intensive production process, so it assigns manufacturing overhead based on direct labour cost. The predetermined overhead rate was computed from the following data:

Total estimated factory overhead $2,400,000

Total estimated direct labour cost $2,000,000

The WIP account given below relates to the activities for the month of June:

WIP Inventory A/C

June 1 Balance b/f $15,000

Direct Materials Used 123,000

Additional data:

▪ Total material requisitioned ………………………………… $153,000

▪ Manufacturing Labour Costs incurred …………………. $163,500 (75% represents direct labour)

▪ Other manufacturing overheads incurred …………... $94,275

▪ Two jobs were completed with total costs of $183,000 and $105,000 respectively. They were sold on account at a margin of 33 1/3% on sales.

State the journal entries necessary to record the following transactions in the general journal.

(i) Total materials issued to production

(ii)…

Chapter 19 Solutions

EBK EXCEL APPLICATIONS FOR ACCOUNTING P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On October 31, the end of the first month of operations, Maryville Equipment Company prepared the following income statement, based on the variable costing concept: Prepare an income statement under absorption costing.arrow_forwardClick the Chart sheet tab. On the screen is a column chart showing ending inventory costs. During a deflationary period, which bar (A, B, or C) represents FIFO costing, which represents LIFO costing, and which represents weighted average? Explain your reasoning. On January 4 following year-end, Rio Enterprises received a shipment of 60 units of product costing 580 each. These units had been ordered by Del in December and had been shipped to him on December 27. They were shipped FOB shipping point. Revise the FIFOLIFO3 worksheet to include this shipment. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as FIFOLIFOT. Using the FIFOLIFO3 file, prepare a 3-D bar (stacked) chart showing the cost of goods sold and ending inventory under each of the four inventory cost flow assumptions. No Chart Data Table is needed. Use the values in the Calculations Section of the worksheet for your chart. Enter your name somewhere on the chart. Save the file again as FIFOLIFO3. Print the chart.arrow_forwardGunnison Company had the following equivalent units schedule and cost information for its Sewing Department for the month of December: Required: 1. Calculate the unit cost for December, using the FIFO method. 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for. 3. What if you were asked for the unit cost from the month of November? Calculate Novembers unit cost and explain why this might be of interest to management.arrow_forward

- Statement of cost of goods manufactured; income statement; balance sheet The adjusted trial balance for Rochester Electronics, Inc. on November 30, the end of its first month of operation, is as follows: The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were 33,000. c. Direct labor cost was 18,500. d. Factory overhead costs were as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of November. 2. Prepare an income statement for the month of November. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.) 3. Prepare a balance sheet as of November 30. (Hint: Do not forget Retained Earnings.)arrow_forwardThe adjusted trial balance for Appleton Appliances, Ltd. on June 30, the end of its first month of operation, is as follows: The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were 23,000. c. Direct labor cost was 18,500. d. Factory overhead costs were as follows: Required: 1. Prepare a statement of cost of goods manufactured for June. 2. Prepare an income statement for June. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.) 3. Prepare a balance sheet as of June 30. (Hint: Do not forget Retained Earnings.)arrow_forwardWeighted Average Method, Unit Costs, Valuing Inventories Byford Inc. produces a product that passes through two processes. During November, equivalent units were calculated using the weighted average method: The costs that Byford had to account for during the month of November were as follows: Required: 1. Using the weighted average method, determine unit cost. 2. Under the weighted average method, what is the total cost of units transferred out? What is the cost assigned to units in ending inventory? 3. CONCEPTUAL CONNECTION Bill Johnson, the manager of Byford, is considering switching from weighted average to FIFO. Explain the key differences between the two approaches and make a recommendation to Bill about which method should be used.arrow_forward

- Cost flow relationships The following information is available for the first month of operations of Bahadir Company, a manufacturer of mechanical pencils: Using the information given, determine the following missing amounts: A. Cost of goods sold B. Finished goods inventory at the end of the month C. Direct materials cost D. Direct labor cost E. Work in process inventory at the end of the montharrow_forwardOReilly Manufacturing Co.s cost of goods sold for the month ended July 31 was 345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. No indirect materials were used during the period. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Start by using cost of goods sold to solve for the cost of goods manufactured.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July.arrow_forwardWebster Company uses backflush costing to account for its manufacturing costs. The trigger points for recording inventory transactions are the purchase of materials, the completion of products, and the sale of completed products. Required: 1. Prepare journal entries, if needed, to account for the followingtransactions. a. Purchased raw materials on account, 135,000. b. Requisitioned raw materials to production, 135,000. c. Distributed direct labor costs, 20,000. d. Incurred manufacturing overhead costs, 80,000. (Use Various Credits for the credit part of the entry.) e. Cost of products completed, 235,000. f. Completed products sold for 355,000, on account. 2. Prepare any journal entries that would be different from theabove, if the only trigger points were the purchase of materialsand the sale of finished goods.arrow_forward

- During the first month of operations ended May 31, Big Sky Creations Company produced 40,000 designer cowboy boots, of which 36,000 were sold. Operating data for the month are summarized as follows: During June, Big Sky Creations produced 32,000 designer cowboy boots and sold 36,000 cowboy boots. Operating data for June are summarized as follows: Instructions 1. Using the absorption costing concept, prepare income statements for (a) May and (b) June. 2. Using the variable costing concept, prepare income statements for (a) May and (b) June. 3. a. Explain the reason for the differences in operating income in (1) and (2) for May. b. Explain the reason for the differences in operating income in (1) and (2) for June. 4. Based on your answers to (1) and (2), did Big Sky Creations Company operate more profitably in May or in June? Explain.arrow_forwardMorrison Company had the equivalent units schedule and cost information for its Sewing Department for the month of December, as shown on the next page. Required: 1. Calculate the unit cost for December, using the weighted average method. 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for. 3. What if you were asked to show that the weighted average unit cost for materials is the blend of the November unit materials cost and the December unit materials cost? The November unit materials cost is 6.60 (66,000/10,000), and the December unit materials cost is 12.22 (550,000/45,000). The equivalent units in BWIP are 10,000, and the FIFO equivalent units are 45,000. Calculate the weighted average unit materials cost using weights defined as the proportion of total units completed from each source (BWIP output and current output).arrow_forwardYellowstone Fabricators uses a process cost system and applies actual factory overhead to work in process at the end of the month. The following data came from the records for March: There were no beginning inventories and no ending work in process inventory. From the information presented, compute the following: 1. Unit cost of production under absorption costing and variable costing. 2. Cost of the ending inventory under absorption costing and variable costing.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY