Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 21E

Defective work

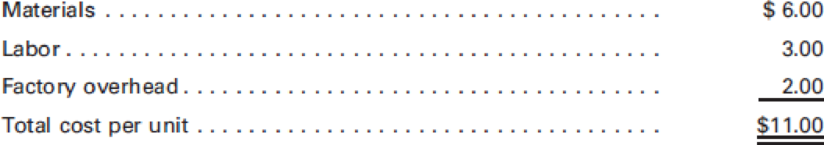

Herbert Electronics manufactures an integrated transistor circuit board for repeat customers but also accepts special orders for the same product. Job No. JM4 incurred the following unit costs for 1,000 circuit boards manufactured:

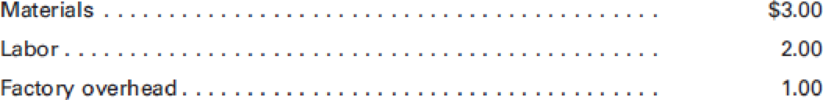

When the completed products were tested, 50 circuit boards were found to be defective. The costs per unit of correcting the defects follow:

Record the

- a. If the cost of the defective work is charged to factory overhead.

- b. If the cost of the defective work is charged to the specific job.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Journal entries to correct defective work. Columbus Fabricators manufacture golf carts and other recreational equipment. One order from Wisconsin Wholesale Company for 1000 carts showed the following costs per unit: direct materials, $40, direct labor, $20, and factory overhead applied at 140% of direct labor cost if defective work is charged to a specific job and 150% if it is not.

Final inspection revealed that wheels were assembled with improper bearings. The wheels were disassembled and the proper bearings inserted. The cost of correcting each defective cart consists of $2 added cost for bearings, $4 for labor, and factory overhead at the predetermined rate.

Required: Prepare journal entries to record correction of the defective units and transfer of the work in process to finished goods if:

(1) The Wisconsin Wholesale Company order is to be charged with the cost of defective units.

(2) The cost of correcting the defective work is not charged to Wisconsin Wholesale Company order.

GYM Machine Shop manufactures jacks equipment. One order comes from Muscle, Inc. for 2,000 jacks, which showed the following costs per unit:

Materials

$40.00

Labor

$17.50

FOH is 160% of direct labor cost (with 10% allowance for reworking defective units)

Final inspection revealed that 150 of the jacks were not properly produced. Correction of each unit requires 2.00 for materials, 3.00 for labor and factory overhead at an appropriate rate.

1. If defect is the result of internal failure, what is the cost of each unit of jacks produced?

a. $78.27b. $85.50c. $80.39d. $84.46

2. If defect is the result of change in specifications imposed by the customers, what is the cost of each unit of jacks produced?

a. $78.27b. $85.50c. $80.39d. $84.46

Pharoah Corp. received an order for 25 automatic mixing machines. Because of the order's exacting specifications, it is anticipated that defective and spoiled work will exceed the normal rate. The materials cost per unit is P80; labor cost, P194; and manufacturing overhead for this order is to be applied at 100% of the labor cost. During production, 5 units were found to be defective and required the following total additional costs: materials, P97, labor, P125, and manufacturing overhead at the 100% rate. On final inspection, 2 units were classified as seconds and sold for P400 each, the proceeds being credited to the order. The purchaser has agreed to accept the 23 machines, although the acceptable units are fewer than the number ordered. What is the unit cost of the completed units?

Chapter 2 Solutions

Principles of Cost Accounting

Ch. 2 - What are the two major objectives of materials...Ch. 2 - Prob. 2QCh. 2 - What factors should management consider when...Ch. 2 - Prob. 4QCh. 2 - What kind of information and data are needed to...Ch. 2 - How would you define the term economic order...Ch. 2 - What kind of information and data are needed to...Ch. 2 - What factors should be considered when determining...Ch. 2 - Prob. 9QCh. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Proper authorization is required before orders for...Ch. 2 - Prob. 13QCh. 2 - Prob. 14QCh. 2 - Prob. 15QCh. 2 - Prob. 16QCh. 2 - Prob. 17QCh. 2 - Normally, a manufacturer maintains an accounting...Ch. 2 - Prob. 19QCh. 2 - Why do companies adopt the LIFO method of...Ch. 2 - Prob. 21QCh. 2 - Prob. 22QCh. 2 - Prob. 23QCh. 2 - Prob. 24QCh. 2 - Prob. 25QCh. 2 - Prob. 26QCh. 2 - Prob. 27QCh. 2 - Prob. 28QCh. 2 - A manufacturing process may produce a considerable...Ch. 2 - After a product is inspected, some units may be...Ch. 2 - Order Point Pershing, Inc. expects daily usage of...Ch. 2 - Economic order quantity; order cost; carrying cost...Ch. 2 - Economic order quantity; order cost; carrying cost...Ch. 2 - Journalizing materials requisitions Penrose...Ch. 2 - Recording materials transactions Prepare a journal...Ch. 2 - PurrChems raw materials records contained the...Ch. 2 - Using first-in, first-out perpetual inventory...Ch. 2 - LIFO costing Using last-in, first-out perpetual...Ch. 2 - Using the weighted average method of perpetual...Ch. 2 - Prob. 10ECh. 2 - Renfro, Inc. was franchised on January 1, 2016. At...Ch. 2 - Recording materials transactions Craig Products...Ch. 2 - Recording materials transactions Broadwell...Ch. 2 - JIT and cost control Matsui Industries produces...Ch. 2 - Kenkel, Ltd. uses backflush costing to account for...Ch. 2 - For E2-15, prepare any journal entries that would...Ch. 2 - Davis Co. uses backflush costing to account for...Ch. 2 - For E2-17, prepare any journal entries that would...Ch. 2 - A machine shop manufactures a stainless steel part...Ch. 2 - Spoiled work Roger Company manufactures tennis...Ch. 2 - Defective work Herbert Electronics manufactures an...Ch. 2 - Perry Co. predicts it will use 25,000 units of...Ch. 2 - Prob. 2PCh. 2 - Economic order quantity; tabular computation Lopez...Ch. 2 - In P2-3, assume that the company desires a safety...Ch. 2 - Inventory costing methods The purchases and issues...Ch. 2 - Inventory costing methods The following...Ch. 2 - Terrills Transmissions uses a job order cost...Ch. 2 - Prob. 8PCh. 2 - Tuscany Products, Inc. uses a job order cost...Ch. 2 - Prob. 10PCh. 2 - JIT and cost control Langray, Ltd. produces 50,000...Ch. 2 - Backflush costing Russell Corp. uses backflush...Ch. 2 - Webster Company uses backflush costing to account...Ch. 2 - An examination of Buckhorn Fabricators records...Ch. 2 - One of the tennis rackets that Ace Sporting Goods...Ch. 2 - Lloyd Industries manufactures electrical equipment...Ch. 2 - Review Problem for Chapters 1 and 2 UltraLift...Ch. 2 - Financial and Nonfinancial Aspects of Changing to...Ch. 2 - Prob. 2MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lloyd Industries manufactures electrical equipment from specifications received from customers. Job X10 was for 1,000 motors to be used in a specially designed electrical complex. The followingcosts were determined for each motor: At final inspection, Lloyd discovered that 33 motors did not meet the exacting specifications established by the customer. Anexamination indicated that 18 motors were beyond repair andshould be sold as spoiled goods for 75 each. The remaining15 motors, though defective, could be reconditioned as first-qualityunits by the addition of 1,650 for materials, 1,500 for labor, and1,200 for factory overhead. Required: Prepare the journal entries to record the following: 1. The scrapping of the 18 motors, with the income from spoiledgoods treated as a reduction in the manufacturing cost of thespecific job. 2. The correction of the 15 defective motors, with the additionalcost charged to the specific job. 3. The additional cost of replacing the 18 spoiled motors with newmotors. 4. The sale of the spoiled motors for 75 each. 5. If the reconditioned motors sell for 400 each, is Lloyd betteroff reconditioning the defective motors or selling them as isfor 75 as spoiled goods?arrow_forwardA machine shop manufactures a stainless steel part that is used in an assembled product. Materials charged to a particular jobamounted to 600. At the point of final inspection, it was discoveredthat the material used was inferior to the specifications required bythe engineering department; therefore, all units had to be scrapped. Record the entries required for scrap under each of the following conditions: a. The revenue received for scrap is to be treated as a reductionin manufacturing cost but cannot be identified with a specificjob. The value of stainless steel scrap is stable and estimatedto be 125 for this job. The scrap is sold two months later forcash at the estimated value of 125. b. Revenue received for scrap is to be treated as a reduction inmanufacturing cost but cannot be identified with a specificjob. A firm price is not determinable for the scrap until it issold. It is sold eventually for 75 cash. c. The production job is a special job, and the 85 received onaccount for the scrap is to be treated as a reduction inmanufacturing cost. (A firm price is not determinable for thescrap until it is sold.) d. Only 40 cash was received for the scrap when it was sold inthe following fiscal period. (A firm price is not determinablefor the scrap until it is sold, and the amount to be received forthe scrap is to be treated as other income.)arrow_forwardMt. Palomar Manufacturing Co. uses a process cost system. Its manufacturing operation is carried on in two departments: Machining and Finishing. The Machining Department uses the weighted average cost method, and the Finishing Department uses the FIFO cost method. Materials are added in both departments at the beginning of operations, but the added materials do not increase the number of units being processed. Units are lost in the Machining Department throughout the production process, and inspection occurs at the end of the process. The lost units have no scrap value and are considered to be a normal loss. Production statistics for July show the following data: Required: Prepare a cost of production summary for each department. (Round unit costs to three decimal places.) Which department will have an easier time determining how its unit costs compare from month to month? Why?arrow_forward

- CleanCom Company specializes in cleaning commercial buildings and construction sites. Each building and site is different, requiring amounts and types of supplies and labor for each job. CleanCom estimated the following for the year: During the year, the following actual amounts were experienced: If CleanCom uses a normal costing system and overhead is applied on the basis of direct labor hours, what is the cost of cleaning a construction site that takes 140 of direct materials and 21 direct labor hours? a. 455 b. 508 c. 648 d. 644arrow_forwardHepworth Communications produces cell phones. One of the four major electronic components is produced internally. The other three components are purchased from external suppliers. The electronic components and other parts are assembled (by the Assembly Department) and then tested (by the Testing Department). Any units that fail the test are sent to the Rework Department where the unit is taken apart and the failed component is replaced. Data from the Testing Department reveal that the internally produced component (made by the Component Department) is the most frequent cause of product failure. One out of every 50 phones fails because of a faulty internally produced component. Barry Norton is the manager of the Component Department. In a recent performance evaluation, the plant manager told Barry that he needed to be more sensitive to the needs of the departments customers. This charge puzzled Barry somewhatafter all, the component is not sold to anyone but is used in producing the plants cell phones. Required: 1. Who are Barrys customers? 2. Explain the plant managers charge to Barry to be more sensitive to his customers. Explain also how this increased sensitivity could improve the companys time-based competitive ability. 3. What role would cost management play in helping Barry be more sensitive to his customers?arrow_forwardOne of the tennis rackets that Ace Sporting Goods manufactures is a titanium model (Slam) that sells for 149. The cost of each Slam consists of: Job 100 produced 100 Slams, of which six were spoiled and classified as seconds. Seconds are sold to discount stores for 50 each. Required: 1. Under the assumption that the loss from spoilage will be distributed to all jobs produced during the current period, use general journal entries to (a) record the costs of production, (b) put spoiled goods into inventory, and (c) record the cash sale of spoiled units. 2. Under the assumption that the loss due to spoilage will be charged to Job 100, use general journal entries to (a) record the costs of production, (b) put spoiled goods into inventory, and (c) record the cash sale of spoiled units.arrow_forward

- During the week of June 12, Harrison Manufacturing produced and shipped 15,000 units of its aluminum wheels: 3,000 units of Model A and 12,000 units of Model B. The following costs were incurred: Required: 1. Assume initially that the value-stream costs and total units shipped apply only to one model (a single-product value stream). Calculate the unit cost, and comment on its accuracy. 2. Calculate the unit cost for Models A and B, and comment on its accuracy. Explain the rationale for using units shipped instead of units produced in the calculation. 3. What if Model A is responsible for 40 percent of the materials cost? Show how the unit cost would be adjusted for this condition.arrow_forwardActive Frame, Inc., manufactures clear and tinted sport glasses. The manufacturing of clear glasses takes 45,000 direct labor hours and involves 1,700 parts and 115 inspections. The manufacturing of tinted glasses takes 115,000 direct labor hours and involves 1,400 parts and 450 inspections. The traditional method applies $560,000 of overhead on the basis of direct labor hours. What is the amount of overhead per direct labor hour applied to the clear glass products? A. $933.33 B. $157,500 C. $322.500 D. $402,500arrow_forwardSpoiled work Roger Company manufactures tennis clothing. During the month, the company cut and assembled 8,000 skirts. One hundred of the skirts did not meet specifications and were considered seconds. Seconds are sold for 9.95 per skirt, whereas first-quality skirts sell for 39.95. During the month, Work in Process was charged 108,000: 36,000 for materials, 48,000 for labor, and 24,000 for factory overhead. Record the entries to first charge production costs for the period and to then record the loss due to spoiled work, under each of the following conditions: a. The loss due to spoiled work is spread over all jobs in the department. b. The loss due to spoiled work is charged to the specific job because it is a special order.arrow_forward

- Walloon Company produced 150 defective units last month at a unit manufacturing cost of 30. The defective units were discovered before leaving the plant. Walloon can sell them as is for 20 or can rework them at a cost of 15 and sell them at the regular price of 50. What is the total relevant cost of reworking the defective units? a. 2,250 b. 3,000 c. 4,500 d. 6,750arrow_forwardLife Force Fitness, Inc., assembles and sells treadmills. Activity-based product information for each treadmill is as follows: All of the activity costs are related to labor. Management must remove 2.00 of activity cost from the product in order to remain competitive. Rework involves disassembling and repairing a unit that fails testing. Not all units require rework, but the average is 0.40 hour per unit. Presently, the testing is done on the completed assembly; but much of the rework has been related to motors, which can be tested independently prior to adding the motor to the treadmill during final assembly. Thus, motor issues can be diagnosed and solved without having to disassemble the complete treadmill. This change will reduce the average rework per unit by one-quarter. a.Determine the new activity cost per unit under the rework improvement scenario. b.If management had the choice of doing the rework improvement in (a) or cutting the moving activity in half by improving the product flow, which decision should be implemented? Why?arrow_forwardMartin Company received an order for 25 automatic mixing machines. Because ofthe order's exacting specifications, it is anticipated that defective and spoiled work willexceed the normal rate. The materials cost per unit is P80; labor cost, P194; andmanufacturing overhead for this order is to be applied at 100% of the labor cost.During production, 5 units were found to be defective and required the following totaladditional costs: materials, P97, labor, P125, and manufacturing overhead at the 100%rate. On final inspection, 2 units were classified as seconds and sold for P400 each,the proceeds being credited to the order. The purchaser has agreed to accept the 23machines, although the acceptable units are fewer than the number ordered. What isthe unit cost of the completed units?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Job Costing and Spoilage | Topic 2 | Spoilage, Re-work, and Scrap; Author: Samantha Taylor;https://www.youtube.com/watch?v=VP55_W2oXic;License: CC-BY