FINANCIAL ACCT-CONNECT

8th Edition

ISBN: 9781266627903

Author: Wild

Publisher: INTER MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2BTN

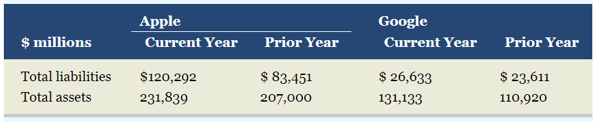

Key comparative figures for Apple and Google follow.

- What is the debt ratio for Apple in the current year and for the prior year?

- What is the debt ratio for Google in the current year and for the prior year?

- Which of the two companies has the higher degree of financial leverage? What does this imply?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Compare the general trends of current liabilities for both companies. Which company do you think is in a better position?

Compare the general trends of noncurrent liabilities for both companies. Which company do you think is in a better position?

Compare the general trends of equity for both companies. Which company do you think is in a better position?

Which company fared better using the horizontal analysis?

How much net income did H&M’s tool, incorporated, generate during 2021? What was the net profit margin?

Is the company financed primarily by liabilities or stock holders equity?

What is its current ratio?

Leverage Ratios

Provide a brief definition of what leverage ratios mean to the profitability of a company.

What are the differences between Samsung and Apple in relationship to each of the ratios?

Debt to Total Assets Apple 0.73 and Samsung 0.25

Debt to Equity Ratio Apple 2.74 and Samsung 0.34

3. What do the ratios mean to the company’s profitability? Is it good or bad?

Chapter 2 Solutions

FINANCIAL ACCT-CONNECT

Ch. 2 - Provide the names of two (a) asset accounts, (b)...Ch. 2 - What is the difference between a note payable and...Ch. 2 - Prob. 3DQCh. 2 - Prob. 4DQCh. 2 - Prob. 5DQCh. 2 - Should a transaction be recorded first in a...Ch. 2 - Prob. 7DQCh. 2 - Why does the recordkeeper prepare a trial balance?Ch. 2 - Prob. 9DQCh. 2 - Prob. 10DQ

Ch. 2 - Prob. 11DQCh. 2 - Prob. 12DQCh. 2 - Prob. 13DQCh. 2 - Prob. 14DQCh. 2 - Prob. 15DQCh. 2 - Review the Apple balance sheet in Appendix A....Ch. 2 - Prob. 17DQCh. 2 - Prob. 18DQCh. 2 - Identify the items from the following list that...Ch. 2 - Prob. 2QSCh. 2 - Prob. 3QSCh. 2 - Prob. 4QSCh. 2 - Prob. 5QSCh. 2 - Prob. 6QSCh. 2 - Prob. 7QSCh. 2 - Prob. 8QSCh. 2 - Prob. 9QSCh. 2 - Prob. 11QSCh. 2 - Prob. 1ECh. 2 - Prob. 2ECh. 2 - Prob. 3ECh. 2 - Prob. 4ECh. 2 - Prob. 5ECh. 2 - Prob. 6ECh. 2 - Prob. 7ECh. 2 - Prob. 9ECh. 2 - Prob. 11ECh. 2 - Prob. 12ECh. 2 - Prob. 13ECh. 2 - Prob. 14ECh. 2 - A corporation had the following assets and...Ch. 2 - Prob. 16ECh. 2 - Prob. 17ECh. 2 - Prob. 18ECh. 2 - Prob. 19ECh. 2 - Prob. 20ECh. 2 - Prob. 21ECh. 2 - Prob. 22ECh. 2 - Prob. 1PSACh. 2 - Prob. 2PSACh. 2 - Prob. 3PSACh. 2 - Prob. 4PSACh. 2 - Prob. 5PSACh. 2 - Prob. 1PSBCh. 2 - Prob. 2PSBCh. 2 - Prob. 3PSBCh. 2 - Nuncio Consulting complete the following...Ch. 2 - Prob. 5PSBCh. 2 - Prob. 2SPCh. 2 - Prob. 1BTNCh. 2 - Key comparative figures for Apple and Google...Ch. 2 - Assume that you are a cashier and your manager...Ch. 2 - Prob. 4BTNCh. 2 - Prob. 6BTNCh. 2 - Prob. 7BTNCh. 2 - Prob. 8BTNCh. 2 - Samsung (www.Samsung.com) is a market leader in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please see the attached graph for questions below. What is the difference between the two companies on this ratio? What is a plausible explanation as to why they would differ? Is one company clearly different than the other? Are there economic or end-market influences that explain why the ratios differ? What might they be? Over time, is each company’s overall financial performance improving, declining, or is something strange going on? Do you think evaluating financial statements is a good idea? What do you regard as some of the shortcomings of financial ratio analysis?arrow_forwardThese are the three long term solvency ratios for Facebook Inc. Based on these numbers, how well is the company doing? How are their levels of debt financing?arrow_forwardWhich of the following ratios helps in measuring the long term solvency of the company? Current ratio Debt equity ratio Net profit margin ratio Quick ratioarrow_forward

- What do the following ratios reveal about the financial health of a company? And how do I calculate them? Long-Term Debt-paying Ability Debt Ratio Debt-equity Ratio Times Interest Earnedarrow_forwardGiven the financial data in the popup window, , for Disney (DIS) and McDonald's (MCD), compare these two companies using the following financial ratios: debt ratio, current ratio, total asset turnover, financial leverage component (equity miltiplier), profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? The debt ratio for Disney is nothing. (Round to four decimal places.) Help Me Solve ThisView an Example Get More Help Clear All Check Answer Data Table Click on the following Icon in order to past this table's content into a spreadsheet. Disney McDonald's Sales $48,792 $28,023 EBIT $12,116 $8,123 Net Income $7,572 $5,507 Current Assets $15,187 $5,004 Total Assets $84,112 $36,637 Current Liabilities $13,105 $3,064…arrow_forwardUnder what situation will return on equity be higher than return on investment? a. When assets exceed liabilities. b. When the debt to equity ratio is greater than 1.0. c. When net income is higher than it was in the previous year. d. When a company earns more on borrowed money than the interest it must pay.arrow_forward

- Profitability Ratios Provide brief definition of what Profitability ratios mean to the company. What are the differences between Apple and Samsung in relationship to each of the ratios? See attached for ratios Net Profit Margin Samsung vs Apple Gross Profit Margin Samsung vs Apple Return on Equity (ROE) Samsung vs Apple Net Return on Assets Samsung vs Apple 3. What does it mean to the company’s profitability? Is it good or bad?arrow_forwardDuPont system of analysis Use the following financial information for AT&T and Verizon to conduct a DuPont system of analysis for each company. Sales Earnings available for common stockholders Total assets Stockholders' equity a. Which company has the higher net profit margin? Higher asset turnover? b. Which company has the higher ROA? The higher ROE? c. Which company has the higher financial leverage multiplier? a. Net profit margin (Round to three decimal places.) AT&T Net profit margin AT&T $164,000 13,333 403,921 201,934 Verizon Verizon $126,280 13,608 244,280 24,232arrow_forwardMarket Ratios Provide brief definition of what Market ratios mean to the profitability of a company. What are the differences between Apple and Samsung in relationship to the ratios? See attached for ratios What does it mean to the company’s profitability? Is it good or bad?arrow_forward

- The income statement of Small Town, Inc. is as shown below: Small Town, Inc. Comparative Income Statement Year Ended December 31, 2025 (In millions) Net Sales Cost of Goods Sold Gross Profit Operating Expenses: O A. 41.89% O B. 60.81% O C. 39.19% O D. 28.38% $ 7,400 2,900 4,500arrow_forwardSelected financial data for Surf City and Paradise Falls are as follows:Required:1. Calculate the debt to equity ratio for Surf City and Paradise Falls for the most recent year. Which company has the higher ratio?2. Calculate the return on assets for Surf City and Paradise Falls. Which company appears more profitable?3. Calculate the times interest earned ratio for Surf City and Paradise Falls. Which company is better able to meet interest payments as they become due?arrow_forwardSelected financial data for Bahama Bay and Caribbean Key are as follows:Required:1. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. Which company has the higher ratio?2. Calculate the return on assets for Bahama Bay and Caribbean Key. Which company appears more profitable?3. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key. Which company is better able to meet interest payments as they become due?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License