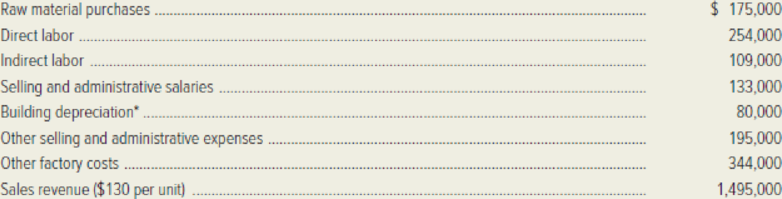

The following selected information was extracted from the 20x1 accounting records of Lone Oak Products:

*Seventy-five percent of the company’s building was devoted to production activities; the remaining 25 percent was used for selling and administrative functions.

Inventory data:

*The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1,190 units, respectively.

Required:

- 1. Calculate Lone Oak’s manufacturing overhead for the year.

- 2. Calculate Lone Oak’s cost of goods manufactured.

- 3. Compute the company’s cost of goods sold.

- 4. Determine net income for 20x1, assuming a 30% income tax rate.

- 5. Determine the number of completed units manufactured during the year.

- 6. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following data change: indirect labor is $115,000 and other

factory costs amount to $516,000.

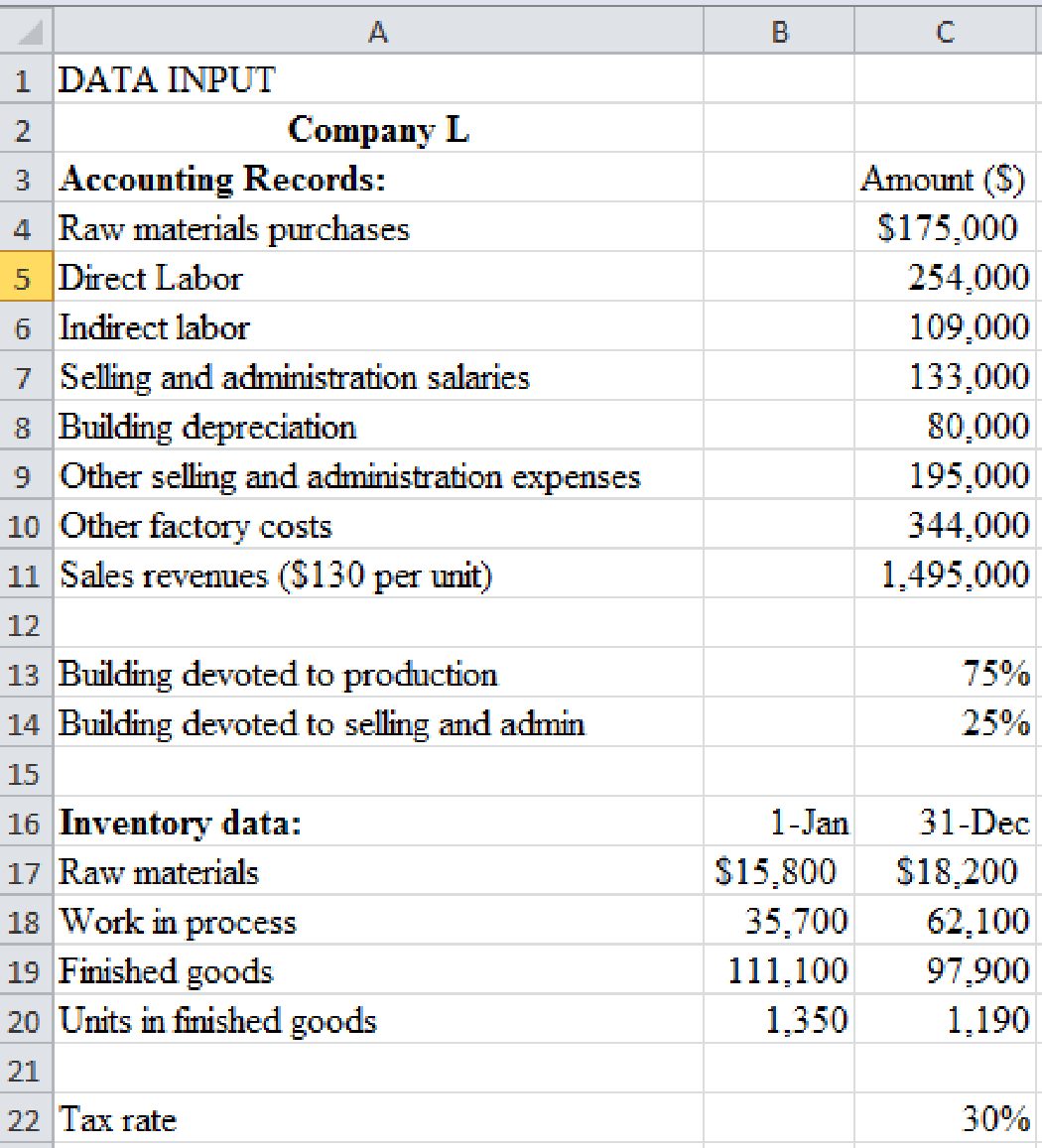

1.

Calculate the manufacturing overhead for L company.

Explanation of Solution

Manufacturing overhead: Manufacturing overhead includes all manufacturing cost except direct material and direct labor costs.

Calculate the manufacturing overhead.

2.

Calculate the cost of goods manufactured by L Company.

Explanation of Solution

Cost of goods manufactured: cost of good manufactured is the total cost of direct material, direct labor, and manufacturing overhead transferred from Work-in-Process to Finished-Goods during an accounting period.

Calculate the cost of goods manufactured.

| Cost of goods manufactured by L company | ||

| Particulars | Amount ($) | Amount ($) |

| Direct material: | ||

| Raw-material inventory, January 1 | $15,800 | |

| Add: Purchases of raw material | 175,000 | |

| Raw material available for use | $190,800 | |

| Deduct: Raw material inventory, December 31 | (18,200) | |

| Raw material used | $172,600 | |

| Direct labor | 254,000 | |

| Manufacturing overhead | 513,000 | |

| Total manufacturing costs | $939,600 | |

| Add: Work in process inventory, January 1 | 35,700 | |

| Sub total | $975,300 | |

| Deduct: Work in progress inventory, December 31 | (62,100) | |

| Cost of goods manufactured | $913,200 | |

Table (1)

3.

Calculate the Cost of goods sold by L Company.

Explanation of Solution

Cost of goods sold: Cost of goods sold is the total of all the expenses incurred by a company to sell the goods during the given period.

Calculate the cost of goods sold.

| Cost of goods sold | |

| Particulars | Amount ($) |

| Finished goods inventory, January 1 | $111,100 |

| Add: Cost of goods manufactured | 913,200 |

| Cost of goods available for sale | $1,024,000 |

| Deduct: Finished goods inventory, December 31 | 97,900 |

| Cost of goods sold | $926,400 |

Table (2)

4.

Calculate the net income for L Company and assume income tax rate as 30%.

Explanation of Solution

Net income: The bottom line of income statement which is the result of excess of earnings from operations (revenues) over the costs incurred for earning revenues (expenses) is referred to as net income.

Calculate the net income for L Company

| Net income for L Company | ||

| Particulars | Amount ($) | Amount ($) |

| Sales revenue | $1,495,000 | |

| Less: Cost of goods sold | 926,400 | |

| Gross margin | $568,600 | |

| Selling and administration expenses: | ||

| Salaries | $133,000 | |

| Building depreciation ($80,000*25%) | 20,000 | |

| Other | 195,000 | 348,000 |

| Income before taxes | $220,000 | |

| Income tax expense ($220,600*30%) | 66,180 | |

| Net income | $154,420 | |

Table (3)

5.

Calculate the number of finished units manufactured during the year.

Explanation of Solution

Calculate the number of finished units manufactured during the year.

Calculate the total units sold during the year.

Calculate the units came from finished goods inventory.

6.

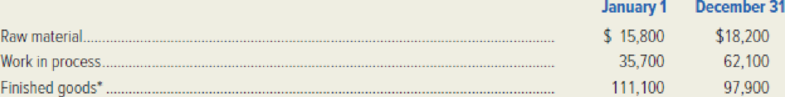

Prepare the excel spread sheet to solve the preceding requirements.

Explanation of Solution

Table (4)

Want to see more full solutions like this?

Chapter 2 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- At the end of the first year of operations, 21,500 units remained in the finished goods inventory. The unit manufacturing costs during the year were as follows: Determine the cost of the finished goods inventory reported on the balance sheet under (a) the absorption costing concept and (b) the variable costing concept.arrow_forwardDuring March, the following costs were charged to the manufacturing department: $22,500 for materials; $45,625 for labor; and $50,000 for manufacturing overhead. The records show that 40,000 units were completed and transferred, while 10,000 remained in ending inventory. There were 45,000 equivalent units of material and 42,500 units of conversion costs. Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forwardDuring the year, a company purchased raw materials of $77,321, and incurred direct labor costs of $125,900. Overhead is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forward

- During March, the following costs were charged to the manufacturing department: $14886 for materials; $14,656 for labor; and $13,820 for manufacturing overhead. The records show that 30,680 units were completed and transferred, while 2,400 remained in ending inventory. There were 33,080 equivalent units of material and 31,640 of conversion costs. Using the weighted-average method, what is the cost of inventory transferred and the balance in work in process inventory?arrow_forwardRexar had 1,000 units in beginning inventory before starting 9.500 units and completing 8,000 units. The beginning work in process inventory consisted of $5,000 in materials and $8,500 in conversion costs before $16,000 of materials and $18,500 of conversion costs were added during the month. The ending WIP inventory was 100% complete with regard to materials and 40% complete with regard to conversion costs. Prepare the journal entry to record the transfer of inventory from the manufacturing department to the finished goods department.arrow_forwardWyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forward

- Loanstar had 100 units in beginning inventory before starting 950 units and completing 800 units. The beginning work in process inventory consisted of $2,000 in materials and $500O in conversion costs before $8.500 of materials and $11,200 of conversion costs were added during the month. The ending WIP inventory was 100% complete with regard to materials and 40% complete with regard to conversion costs. Prepare the journal entry to record the transfer of inventory from the manufacturing department to the finished goods department.arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardAn examination of Buckhorn Fabricators records reveals the following transactions: a. On December 31, the physical inventory of raw material was 9,950 gallons. The book quantity, using the weighted average method, was 10,000 gal @ .52 per gal. b. Production returned to the storeroom materials that cost 775. c. Materials valued at 770 were charged to Factory Overhead (Repairs and Maintenance), but should have been charged to Work in Process. d. Defective material, purchased on account, was returned to the vendor. The material returned cost 234. e. Goods sold to a customer, on account, for 5,000 (cost 2,500) were returned because of a misunderstanding of the quantity ordered. The customer stated that the goods returned were in excess of the quantity needed. f. Materials requisitioned totaled 22,300, of which 2,100 represented supplies used. g. Materials purchased on account totaled 25,500. Freight on the materials purchased was 185. h. Direct materials returned to the storeroom amounted to 950. i. Scrap materials sent to the storeroom were valued at an estimated selling price of 685 and treated as a reduction in the cost of all jobs worked on during the period. j. Spoiled work sent to the storeroom valued at a sales price of 60 had production costs of 200 already charged to it. The cost of the spoilage is to be charged to the specific job worked on during the period. k. The scrap materials in (i) were sold for 685 cash. Required: Record the entries for each transaction.arrow_forward

- OReilly Manufacturing Co.s cost of goods sold for the month ended July 31 was 345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. No indirect materials were used during the period. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Start by using cost of goods sold to solve for the cost of goods manufactured.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July.arrow_forwardGlasson Manufacturing Co. produces only one product. You have obtained the following information from the corporations books and records for the current year ended December 31, 2016: a. Total manufacturing cost during the year was 1,000,000, including direct materials, direct labor, and factory overhead. b. Cost of goods manufactured during the year was 970,000. c. Factory Overhead charged to Work in Process was 75% of direct labor cost and 27% of the total manufacturing cost. d. The beginning Work in Process inventory, on January 1, was 40% of the ending Work in Process inventory, on December 31. e. Material purchases were 400,000 and the ending balance in Materials inventory was 60,000. No indirect materials were used in production. Required: Prepare a statement of cost of goods manufactured for the year ended December 31 for Glasson Manufacturing. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information.)arrow_forwardThe following data are taken from the general ledger and other records of Coral Park Production Co. on January 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,