Concept explainers

Backflush, two trigger points, materials purchase and sale (continuation of 20-37). Assume the same facts for Acton Corporation as in Problem 20-37, except that now assume Acton uses a JIT production system and backflush costing with two trigger points for making entries in the accounting system:

- Purchase of direct materials

- Sale of finished goods

The inventory account is confined solely to direct materials, whether these materials are in a storeroom, in work in process, or in finished goods. No conversion costs are inventoried. They are allocated to the units sold at standard costs. Any under- or overallocated conversion costs are written off monthly to Cost of Goods Sold.

- 1. Prepare summary

journal entries for August, including the disposition of under- or overallocated conversion costs. Acton has no direct materials variances.

Required

- 2.

Post the entries in requirement 1 to T-accounts for Inventory Control, Conversion Costs Control, Conversion Costs Allocated, and Cost of Goods Sold.

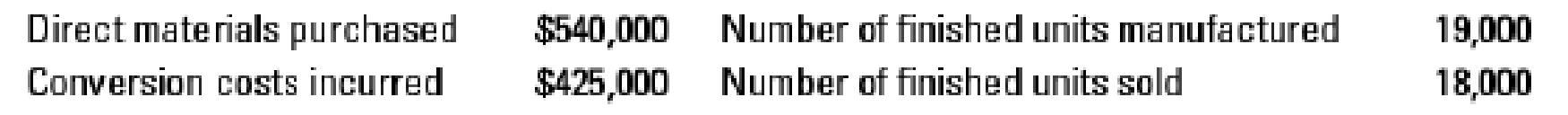

20-37 Backflush costing and JIT production. The Acton Corporation manufactures electrical meters. For August, there were no beginning inventories of direct materials and no beginning or ending work in process. Acton uses a JIT production system and backflush costing with three trigger points for making entries in the accounting system:

- Purchase of direct materials

- Completion of good finished units of product

- Sale of finished goods

Acton’s August

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

CUSTOM COST ACCT 2521 SWP W/ ACCESS

- Webster Company uses backflush costing to account for its manufacturing costs. The trigger points for recording inventory transactions are the purchase of materials, the completion of products, and the sale of completed products. Required: 1. Prepare journal entries, if needed, to account for the followingtransactions. a. Purchased raw materials on account, 135,000. b. Requisitioned raw materials to production, 135,000. c. Distributed direct labor costs, 20,000. d. Incurred manufacturing overhead costs, 80,000. (Use Various Credits for the credit part of the entry.) e. Cost of products completed, 235,000. f. Completed products sold for 355,000, on account. 2. Prepare any journal entries that would be different from theabove, if the only trigger points were the purchase of materialsand the sale of finished goods.arrow_forwardFor E2-17, prepare any journal entries that would have been different if the only trigger points had been the purchase of materials and the sale of finished goods. Davis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forwardDavis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forward

- Cicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price): Required: 1. Prepare a cost report for the year ending 20x1 that shows value-added costs, non-value-added costs, and total costs for each activity. 2. Explain why expediting products and storing goods are non-value-added activities. 3. What if receiving cost is a step-fixed cost with each step being 1,500 orders whereas assembly cost is a variable cost? What is the implication for reducing the cost of waste for each activity?arrow_forwardWeighted Average Method, Unit Costs, Valuing Inventories Byford Inc. produces a product that passes through two processes. During November, equivalent units were calculated using the weighted average method: The costs that Byford had to account for during the month of November were as follows: Required: 1. Using the weighted average method, determine unit cost. 2. Under the weighted average method, what is the total cost of units transferred out? What is the cost assigned to units in ending inventory? 3. CONCEPTUAL CONNECTION Bill Johnson, the manager of Byford, is considering switching from weighted average to FIFO. Explain the key differences between the two approaches and make a recommendation to Bill about which method should be used.arrow_forwardInventory Valuation under Absorption Costing Refer to the data for Judson Company above. Required: 1. How many units are in ending inventory? 2. Using absorption costing, calculate the per-unit product cost. 3. What is the value of ending inventory under absorption costing? Use the following information for Brief Exercises 3-21 and 3-22: During the most recent year, Judson Company had the following data associated with the product it makes:arrow_forward

- Assume you are the department B manager for Marleys Manufacturing. Marleys operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only o department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. (Hint: It may be helpful to perform a vertical analysis.)arrow_forwardSouthward Company has implemented a JIT flexible manufacturing system. John Richins, controller of the company, has decided to reduce the accounting requirements given the expectation of lower inventories. For one thing, he has decided to treat direct labor cost as a part of overhead and to discontinue the detailed direct labor accounting of the past. The company has created two manufacturing cells, each capable of producing a family of products: the radiator cell and the water pump cell. The output of both cells is sold to a sister division and to customers who use the radiators and water pumps for repair activity. Product-level overhead costs outside the cells are assigned to each cell using appropriate drivers. Facility-level costs are allocated to each cell on the basis of square footage. The budgeted direct labor and overhead costs are as follows: The predetermined conversion cost rate is based on available production hours in each cell. The radiator cell has 45,000 hours available for production, and the water pump cell has 27,000 hours. Conversion costs are applied to the units produced by multiplying the conversion rate by the actual time required to produce the units. The radiator cell produced 81,000 units, taking 0.5 hour to produce one unit of product (on average). The water pump cell produced 90,000 units, taking 0.25 hour to produce one unit of product (on average). Other actual results for the year are as follows: All units produced were sold. Any conversion cost variance is closed to Cost of Goods Sold. Required: 1. Calculate the predetermined conversion cost rates for each cell. 2. Prepare journal entries using backflush accounting. Assume two trigger points, with completion of goods as the second trigger point. 3. Repeat Requirement 2, assuming that the second trigger point is the sale of the goods. 4. Explain why there is no need to have a work-in-process inventory account. 5. Two variants of backflush costing were presented in which each used two trigger points, with the second trigger point differing. Suppose that the only trigger point for recognizing manufacturing costs occurs when the goods are sold. How would the entries be listed here? When would this backflush variant be considered appropriate?arrow_forwardDuring March, the following costs were charged to the manufacturing department: $14886 for materials; $14,656 for labor; and $13,820 for manufacturing overhead. The records show that 30,680 units were completed and transferred, while 2,400 remained in ending inventory. There were 33,080 equivalent units of material and 31,640 of conversion costs. Using the weighted-average method, what is the cost of inventory transferred and the balance in work in process inventory?arrow_forward

- Cassien Inc. manufactures products that pass through two or more processes. During June, equivalent units were computed using the weighted average method: Required: 1. Calculate the unit cost for June using the weighted average method. 2. Using the weighted average method, determine the cost of EWIP and the cost of the goods transferred out. 3. CONCEPTUAL CONNECTION Cassien had just finished implementing a series of measures designed to reduce the unit cost to 2.00 and was assured that this had been achieved and should be realized for Junes production. Yet, upon seeing the unit cost for June, the president of the company was disappointed. Can you explain why the full effect of the cost reductions may not show up in June? What can you suggest to overcome this problem?arrow_forwardAbsorption-Costing Income Statement Refer to the data for Osterman Company above. Required: 1. Calculate the cost of goods sold under absorption costing. 2. Prepare an income statement using absorption costing. Use the following information for Brief Exercises 3-23 and 3-24: During the most recent year, Osterman Company had the following data:arrow_forwardThe following information is available for the first year of operations of Creston Inc., a manufacturer of fabricating equipment: Determine the following amounts: a. Cost of goods sold b. Direct materials cost c. Direct labor costarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,