Concept explainers

Change in inventory methods

• LO20–2

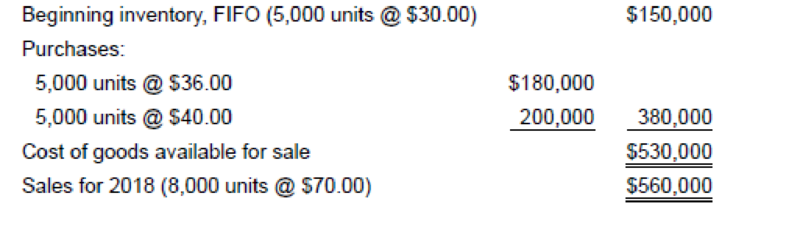

The Rockwell Corporation uses a periodic inventory system and has used the FIFO cost method since inception of the company in 1979. In 2018, the company decided to change to the average cost method. Data for 2018 are as follows:

Additional Information:

1. The company’s effective income tax rate is 40% for all years.

2. If the company had used the average cost method prior to 2018, ending inventory for 2017 would have been $130,000.

3. 7,000 units remained in inventory at the end of 2018.

Required:

1. Prepare the

2. In the 2018–2016 comparative financial statements, what will be the amounts of cost of goods sold and inventory reported for 2018?

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Intermediate Accounting

- Exhibit7.5 Sullivan Produce Co. switched from FIFO to LIFO on January1,2018, for external reporting and income tax purposes, while retaining FIFO for internal reports. On that date, the FIFO inventory equaled $360,000. The ensuing three-year period resulted in the following: December31,2018 Year-End Costs $438,000 Cost Index 1.05 December 31,2019 Year-End Costs $460,000 Cost Index 1.15 December 31, 2020 Year-End Costs $520,000 Cost Index 1.25 Refer to Exhibit 7-5, The ending inventory at December 31,2020, using the dollar-value LIFO method would be a. $422,000 b. $402,000 c $426,000 d. $420,400 Refer to Exhibit7-5, the ending inventory at December 31,2019, at base-year price is: a.$400,000 b. $402,000 c.$406,000 d.$424,000arrow_forwardPROBLEM 6: XXX Company is preparing its 2021 financial statements. Prior to any adjustments, inventory is valued at P1,605,000. The following information has been found relating to certaininventory transactions from your cut-off test: A. Goods valued at P110,000 are on consignment with a customer. These goods werenot included in the ending inventory figure. B.Goods costing P87,000 were received from a vendor on January 5, 2022. The relatedinvoice was received and recorded on January 12, 2022. The goods were shippedonDecember 31, 2021, terms FOB shipping point. C. Goods costing P85,000, sold for P102,000, were shipped on December 31, 2021, andwere delivered to the customer on January 2, 2022. The terms of the invoice wereFOBshipping point. The goods were included in the ending inventory for 2021 and thesalewas recorded in 2022. D. A P35,000 shipment of goods to a customer on December 31, terms FOB destinationwas not included in the year-end inventory. The goods cost P26,000…arrow_forwardQuestion 54 On December 31, 2021 Dean Company changed its method of accounting for inventory from weighted average cost method to the FIFO method. This change caused the 2021 beginning inventory to increase by $960,000. The cumulative effect of this accounting change to be reported for the year ended 12/31/21, assuming a 20% tax rate, is $192,000. $960,000. $0. $768,000.arrow_forward

- TF 4 part b Sharon Lee, CEO of Carla Vista Industries, is concerned about the recent volatility in the company’s operating income. She believes that since the number of units sold has been fairly stable over the past three years that operating income also should have been stable. Sharon asked Brian Walker, Carla Vista's inventory manager, to help her understand the issue.Brian reviewed the company’s records and compiled the following changes to Finished Goods Inventory (in units) for the years 2019, 2020, and 2021. Year 2019 2020 2021 Beginning inventory 1,000 2,000 500 Production 40,000 38,000 40,000 Sales (39,000) (39,500) (39,500) Ending inventory 2,000 500 1,000 Brian also gathered the 2019 income statements prepared using absorption costing and variable costing, which follow. Income Statement—Absorption Costing Sales $ 4,875,000 Cost of goods sold…arrow_forwardP6.11 (LO 6), AP Rayre Books uses the retail inventory method to estimate its monthly ending invento- ries. The following information is available for two of its departments at October 31, 2022. Hardcovers Paperbacks Cost Retail Cost Retail Beginning inventory $ 420,000 $ 640,000 $ 280,000 $ 360,000 Purchases 2,135,000 3,200,000 1,155,000 1,540,000 Freight-in 24,000 12,000 Purchase discounts 44,000 22,000 Net sales 3,100,000 1,570,000 At December 31, Rayre Books takes a physical inventory at retail. The actual retail values of the inven- tories in each department are Hardcovers $744,000 and Paperbacks $335,000. Instructions a. Determine the estimated cost ofthe ending inventory for each department at October 31, 2022, using the retail inventory method. b. Compute the ending inventory at cost for each department atDecember 31, assuming the cost-to- retail ratios for the year are 65% for Hardcovers and 75% for Paperbacks.arrow_forward13 Mactan Company’s statements for 2018 and 2019 included the following errors: 12/31/18 inventory understated P2,000,000 12/31/19 inventory overstated 1,000,000 Depreciation for 2018 understated 400,000 Depreciation for 2019 overstated 800,000 How much should retained earnings be retroactively adjusted on January 1, 2020? Group of answer choices 1,400,000 decrease 600,000 increase 600,000 decrease 1,400,000 increasearrow_forward

- 3. Question: What is the cost of HIBISCUS Company's inventory at December 31, 2020, under the average method? a. ₱ 289,150 b. ₱ 281,250 c. ₱ 266,560 d. ₱ 291,060 At December 31, 2020, the following information was available from HIBISCUS Company's accounting records:arrow_forward55.XXX Company uses the average cost retail method to estimate its inventory. Data relating to the inventory at December 31, 2020 are: Cost Retail Inventory, January 1 P 2,000,000 P3,000,000 Purchases 10,600,000 14,000,000 Net markups 1,600,000 Net markdowns 600,000 Sales 12,000,000 Estimated normal shoplifting losses 400,000 Estimated normal shrinkage is 5% of sales Trinidad’s cost of goods sold for the year ended December 31, 2019 isarrow_forwardTF 4 of 4 Sharon Lee, CEO of Carla Vista Industries, is concerned about the recent volatility in the company’s operating income. She believes that since the number of units sold has been fairly stable over the past three years that operating income also should have been stable. Sharon asked Brian Walker, Carla Vista's inventory manager, to help her understand the issue.Brian reviewed the company’s records and compiled the following changes to Finished Goods Inventory (in units) for the years 2019, 2020, and 2021. Year 2019 2020 2021 Beginning inventory 1,000 2,000 500 Production 40,000 38,000 40,000 Sales (39,000) (39,500) (39,500) Ending inventory 2,000 500 1,000 Brian also gathered the 2019 income statements prepared using absorption costing and variable costing, which follow. Income Statement—Absorption Costing Sales $ 4,875,000 Cost of goods sold…arrow_forward

- 8–6 Various inventory costing methods; gross profit ratio ● LO8–1, LO8–4, LO8–7 Topanga Group began operations early in 2024. Inventory purchase information for the quarter ended March 31, 2024, for Topanga’s only product is provided below. The unit costs include the cost of freight. The company uses a periodic inventory system to report inventory and cost of goods sold. Date of Purchase Units Unit Cost Total Cost Jan. 7 5,000 $4.00 $20,000 Feb. 16 12,000 4.50 54,000 March 22 17,000 5.00 85,000 Total purchases 34,000 $159,000 Sales for the quarter, all at $7.00 per unit, totaled 20,000 units leaving 14,000 units on hand at the end of the quarter. Required: Calculate Topanga’s gross profit ratio for the first quarter using: FIFO LIFO Average cost Comment on the relative effect of each of the three inventory methods on the gross profit ratio.arrow_forwardMay I ask for an explanation and solution to the question for a better understanding. Thank you! 5. Pierce Corporation has the following gross profits for 2018 and 2019: Sales = 2019 - P810,000; 2018 - P792,000. Cost of sales = 2019 - 480,000; 2018 - 464,000. Gross profit = 2019 - P330,000; 2018 - P328,000. Sales price was 10% lower during 2019. The increase (decrease) in quantity sold must be: a. (7.95%) b. 12.00% c. 13.33% d. 13.64%arrow_forwardQuestion 2 The following information is available for Headlands Industries for three recent fiscal years. 2022 2021 2020 Inventory $568,000 $578,000 $345,000 Net sales 1,910,000 1,775,000 1,355,000 Cost of goods sold 1,375,200 1,153,750 934,000 (a)Calculate the inventory turnover, days in inventory, and gross profit rate for 2022 and 2021. (Round inventory turnover to 1 decimal place, e.g. 5.2, days in inventory to 0 decimal places, e.g. 125 and gross profit rate to 1 decimal place, e.g. 5.2%.) 2022 2021 Inventory Turnover enter an inventory turnover times enter an inventory turnover times Days in Inventory enter a number of days days enter a number of days days Gross Profit Rate enter percentages % enter percentages %arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning