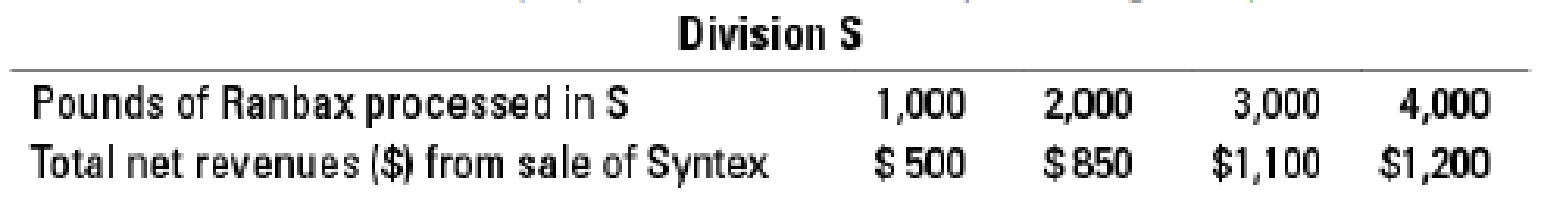

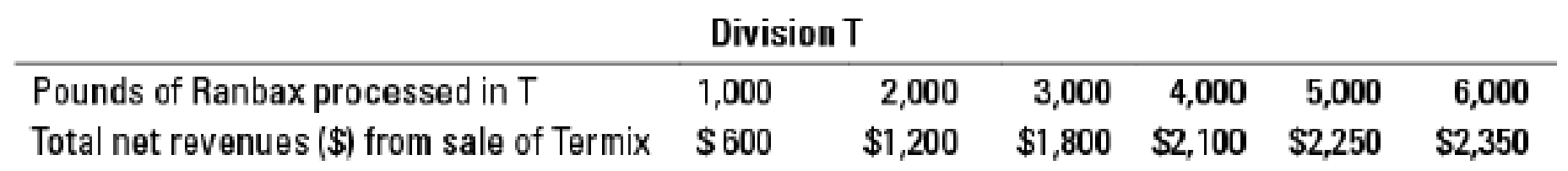

Transfer pricing, perfect and imperfect markets. Letang Company has three divisions (R, S, and T), organized as decentralized profit centers. Division R produces the basic chemical Ranbax, in multiples of 1,000 pounds, and transfers it to divisions S and T. Division S processes Ranbax into the final product Syntex, and division T processes Ranbax into the final product Termix. No material is lost during processing.

Division R has no fixed costs. The variable cost per pound of Ranbax is $0.18. Division R has a capacity limit of 10,000 pounds. Divisions S and T have capacity limits of 4,000 and 6,000 pounds, respectively. Divisions S and T sell their final product in separate markets. The company keeps no inventories of any kind.

The cumulative net revenues (i.e., total revenues – total

- A. Suppose there is no external market for Ranbax. What quantity of Ranbax should the Letang Company produce to maximize overall income? How should this quantity be allocated between the two processing divisions?

- B. What range of transfer prices will motivate divisions S and T to demand the quantities that maximize overall income (as determined in requirement 1), as well as motivate division R to produce the sum of those quantities?

- C. Suppose that division R can sell any quantity of Ranbax in a

perfectly competitive market for $0.33 a pound. To maximize Letang’s income, how many pounds of Ranbax should division R transfer to divisions S and T, and how much should it sell in the external market? - D. What range of transfer prices will result in divisions R, S, and T taking the actions determined as optimal in requirement 3? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

COST ACCOUNTING

- Illinois Metallurgy Corporation has two divisions. The Fabrication Division transfers partially completed components to the Assembly Division at a predetermined transfer price. The Fabrication Division’s standard variable production cost per unit is $300. The division has no excess capacity, and it could sell all of its components to outside buyers at $380 per unit in a perfectly competitive market. Required: Determine a transfer price using the general rule.arrow_forwardSpark Ltd has two divisions, assembly and electrical. The assembly division transfers partially completed components to the electrical division at a predetermined transfer price. The assembly division’s standard variable production cost per unit is $550. This division has spare capacity, and it could sell all its components to outside buyers at $680 per unit in a perfectly competitive market. a) Determine a transfer price using the general rule.b) How would the transfer price change if the assembly division had no spare capacity? c) What transfer price would you recommend if there was no outside market for the transferredcomponent and the assembly division had spare capacity? d) Explain how negotiation between the supplying and buying units may be used to set transferprices. How does this relate to the general transfer pricing rule?arrow_forwardSpark Ltd has two divisions, assembly and electrical. The assembly division transfers partially completed components to the electrical division at a predetermined transfer price. The assembly division’s standard variable production cost per unit is $550. This division has spare capacity, and it could sell all its components to outside buyers at $680 per unit in a perfectly competitive market. Required: a) How would the transfer price change if the assembly division had no spare capacity? b) What transfer price would you recommend if there was no outside market for the transferred component and the assembly division had spare capacity? c) Explain how negotiation between the supplying and buying units may be used to set transfer prices. How does this relate to the general transfer pricing rule? (explain)arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning