COST ACCOUNTING

null Edition

ISBN: 9781323927397

Author: Pearson

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 22, Problem 22.30P

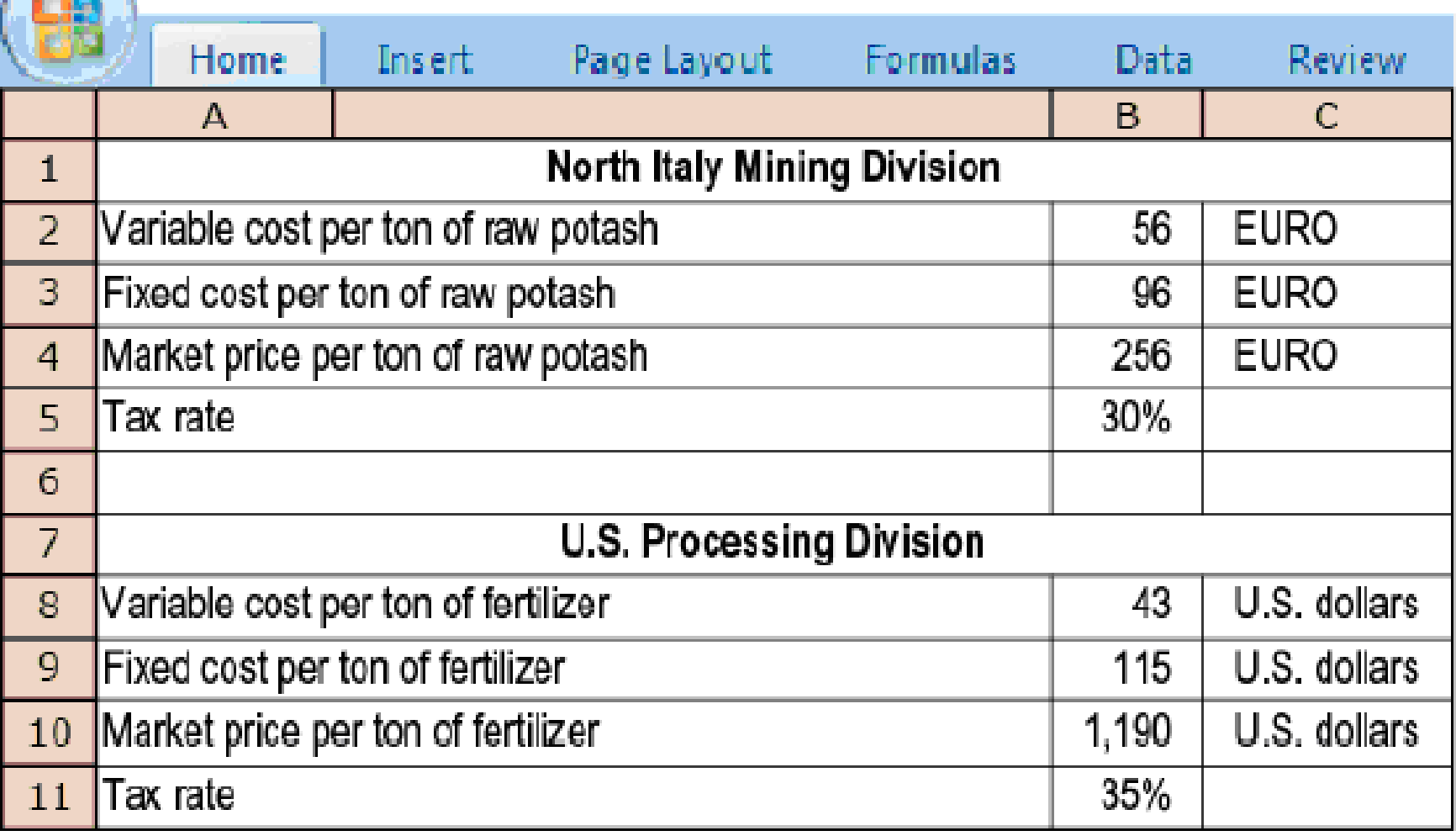

Multinational transfer pricing, global tax minimization. Express Grow Inc., based in Ankeny, lowa, sells high-end fertilizers. Express Grow has two divisions:

- North Italy mining division, which mines potash in northern Italy

- U.S. processing division, which uses potash in manufacturing top-grade fertilizer

The processing division’s yield is 50%: It takes 2 tons of raw potash to produce 1 ton of top-grade fertilizer. Although all of the mining division’s output of 8,000 tons of potash is sent for processing in the United States, there is also an active market for potash in Italy. The foreign exchange rate is 0.80 Euro = $1 U.S. The following information is known about the two divisions:

- A. Compute the annual pretax operating income, in U.S. dollars, of each division under the following transfer-pricing methods: (a) 150% of full cost and (b) market price.

- B. Compute the after-tax operating income, in U.S. dollars, for each division under the transfer-pricing methods in requirement 1. (Income taxes are not included in the computation of cost-based transfer price, and Express Grow does not pay U.S. income tax on income already taxed in Italy.)

- C. If the two division managers are compensated based on after-tax division operating income, which transfer-pricing method will each prefer? Which transfer-pricing method will maximize the total after-tax operating income of Express Grow?

- D. In addition to tax minimization, what other factors might Express Grow consider in choosing a transfer-pricing method?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assume the U.S. corporate income tax rate is 40 percentand the Mexican corporate income tax rate is 30 percent.Jacques International Apparel Company has subsidiaries inboth the U.S. and Mexico. Jacques is trying to decide whattransfer price to use for its famous French frock, whichis being transferred from the U.S. subsidiary to theMexican subsidiary. It could ship the frock at the marketprice of $75 or at cost plus 20 percent. The cost of the frockis $40. Which transfer price would minimize Jacques’s taxburden?a. $75.b. $48.c. $90.d. $75 $40 $35.

Quest Motors, Inc., operates as a decentralized multidivision company. The Vivo division of Quest Motors purchases most of its airbags from the airbag division. The airbag division’s incremental cost for manufacturing the airbags is $90 per unit. The airbag division is currently working at 80% of capacity. The current market price of the airbags is $125 per unit.

Q. If the two divisions were to negotiate a transfer price, what is the range of possible transfer prices? Evaluate this negotiated transfer-pricing policy using the criteria of goal congruence, evaluating division performance, motivating management effort, and preserving division autonomy.

Multinational rms, differing risk, comparison of prot, ROI, and RI. Newmann, Inc. has divisions in the United States, France, and Australia. The U.S. division is the oldest and most established of the three and has a cost of capital of 6%. The French division was started four years ago when the exchange rate for the Euro was 1 Euro = $1.34 USD. The French division has a cost of capital of 8%. The division in Australia was started this year, when the exchange rate was 1 Australian Dollar (AUD) = $0.87 USD. Its cost of capital is 11%. Average exchange rates for the current year are 1 euro = $1.07 and 1 AUD = $0.74 USD. Other information for the three divisions includes:

Chapter 22 Solutions

COST ACCOUNTING

Ch. 22 - Prob. 22.1QCh. 22 - Describe three criteria you would use to evaluate...Ch. 22 - What is the relationship among motivation, goal...Ch. 22 - Name three benefits and two costs of...Ch. 22 - Organizations typically adopt a consistent...Ch. 22 - Transfer pricing is confined to profit centers. Do...Ch. 22 - What are the three methods for determining...Ch. 22 - What properties should transfer-pricing systems...Ch. 22 - All transfer-pricing methods give the same...Ch. 22 - Prob. 22.10Q

Ch. 22 - Prob. 22.11QCh. 22 - Prob. 22.12QCh. 22 - Prob. 22.13QCh. 22 - Under the general guideline for transfer pricing,...Ch. 22 - How should managers consider income tax issues...Ch. 22 - Evaluating management control systems, balanced...Ch. 22 - Cost centers, profit centers, decentralization,...Ch. 22 - Prob. 22.18ECh. 22 - Prob. 22.19ECh. 22 - Multinational transfer pricing, effect of...Ch. 22 - Prob. 22.21ECh. 22 - Multinational transfer pricing, global tax...Ch. 22 - Prob. 22.23ECh. 22 - Prob. 22.24ECh. 22 - Transfer-pricing problem (continuation of 22-24)....Ch. 22 - Prob. 22.26PCh. 22 - Prob. 22.27PCh. 22 - Effect of alternative transfer-pricing methods on...Ch. 22 - Goal-congruence problems with cost-plus...Ch. 22 - Multinational transfer pricing, global tax...Ch. 22 - Transfer pricing, external market, goal...Ch. 22 - Prob. 22.32PCh. 22 - Transfer pricing, goal congruence, ethics. Cocoa...Ch. 22 - Prob. 22.34PCh. 22 - Transfer pricing, perfect and imperfect markets....Ch. 22 - Prob. 22.36PCh. 22 - Prob. 22.37P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Global Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell Moore, controller for Global Reach, has been reading about the advantages of foreign trade zones. He wonders if locating in one would be of benefit to his company, which imports about 90 percent of its merchandise (e.g., chess sets from the Philippines, jewelry from Thailand, pottery from Mexico, etc.). Darnell estimates that the new warehouse will store imported merchandise costing about 16.78 million per year. Inventory shrinkage at the warehouse (due to breakage and mishandling) is about 8 percent of the total. The average tariff rate on these imports is 5.5 percent. Required: 1. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in tariffs? Why? (Round your answer to the nearest dollar.) 2. Suppose that, on average, the merchandise stays in a Global Reach warehouse for nine months before shipment to retailers. Carrying cost for Global Reach is 6 percent per year. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.) 3. Suppose that the shifting economic situation leads to a new tariff rate of 13 percent, and a new carrying cost of 6.5 percent per year. To combat these increases, Global Reach has instituted a total quality program emphasizing reducing shrinkage. The new shrinkage rate is 7 percent. Given this new information, if Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)arrow_forwardBanana group is one of the largest MNC in the world, with more than 20 years of extensive experience in the exporting of bananas to Central Asia countries with the purpose of selling there. It wants to open a new subsidiary in Almaty which will sell exported bananas to the citizens of Almaty. They are evaluating a project (subsidiary) with the following characteristics: -Fixed capital investment includes the purchase of five refrigerators which cost 92,000 tenge each; two packaging machines 105,165 tenge per unit; two units of some equipment which is 25,000 tenge/unit; one truck 40,000 tenge; a factory of 1,000 meters square and 30,000 tenge per meter square, the factory seller will provide a ten percent discount from the total cost of factory; and some other fixed capital costs amount in 20,000 tenge. -The project has an expected five-year life. -The initial investment in net working capital is 1,500,000 tenge -The fixed capital is depreciated using straight line method -Sales are…arrow_forwardNashville Co. presently incurs costs of about 12 million Australian dollars (A$) per year for research and development expenses in Australia. It sells the products that are designed each year, and all of the products sold each year are invoiced in U.S. dollars. Nashville anticipates revenue of about $20 million per year, and about half of the revenue will be from sales to customers in Australia. The Australian dollar is presently valued at $1 (1 U.S. dollar), but it fluctuates a lot over time. Nashville Co. is planning a new project that will expand its sales to other regions within the United States, and the sales will be invoiced in dollars. Nashville can finance this project with a 5-year loan by (1) borrowing only Australian dollars, or (2) borrowing only U.S. dollars, or (3) borrowing one-half of the funds from each of these sources. The 5-year interest rates on an Australian dollar loan and a U.S. dollar loan are the same. If Nashville wants to use the form of financing that will…arrow_forward

- Creston Machine Works has two divisions: a machine tool division and robotic welding division. The machine tool division has a market value of $150 million; the welding division has a market value of $450 million. Creston Machine Works is a private company, but its welding division is very comparable to Path Robotics, which has a WACC of 8% per year. If the overall WACC for Creston Machine Works is 11% per year, what is the WACC for the machine tool division?arrow_forwardDavao has a potential foreign customer that has offered to buy 1,500 tons at P450 per ton. Assume that all of Davao’s costs would be at the same levels and rates as last year. What net income after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity? Without prejudice to your answers to previous questions, and assume that Davao plans to market its product in a new territory. Davao estimates that an advertising and promotion program costing P61,500 annually would need to be undertaken for the next two or three years. In addition, a P25 per ton sales commission over and above the current commission to the sales force in the new territory would be required. How many tons would have to be sold in the new territory to maintain Davao’s current after-tax income of P94,500? If the sales volume is estimated to be 2,100 tons in the next year, and if the prices and costs stay at the same levels and amounts next year, the…arrow_forwardThurmond, Inc., has two divisions, one located in New York and the other located in Arizona. New York sells a specialized circuit to Arizona and just recently raised the circuit’s transfer price. This price hike had no effect on the volume of circuits transferred nor on Arizona’s option of acquiring the circuit from either New York or from an external supplier. On the basis of this information, which of the following statements is most correct? a. The profit reported by New York will increase and the profit reported by Arizona will increase. b. The profit reported by New York will decrease, the profit reported by Arizona will increase, and Thurmond’s profit will be unaffected. c. The profit reported by New York will increase, the profit reported by Arizona will decrease, and Thurmond’s profit will be unaffected. d. The profit reported by New York will increase and the profit reported by Arizona will decrease.arrow_forward

- Banyan Industries has two divisions, a tax rate of 30%, and a minimum rate of return of 20%. Division A has a weighted average cost of Capital of 9.5% and is looking at a new project that will generate a profit of $1,200,000 from a machine that costs $4,000,000. Division B has a weighted average cost of capital of 9.5% and is looking at a new project that will generate a profit of $1,350,000 from a machine that costs $5,000.000. A. Calculate the EVA for each of Banyans divisions. B. Calculate the RI for each of Banyans division. C. If Banyan uses EVA to evaluate the projects, which division has the better project and by how much? D. If Banyan uses RI, which division has the better project and by how much? E. What are some of the reasons for the similarity or difference that you found in the use of EVA versus RI?arrow_forwardHyundai is considering opening a plant in two neighboring states. Option 1: One state has a corporate tax rate of 10 percent. If operated in this state, the plant is expected to generate $1,250,000 pretax profit. Option 2: The other state has a corporate tax rate of 2 percent. If operated in this state, the plant is expected to generate $1,180,000 of pretax profit. Required: What is the after-state-taxes profit in the state with the 10% tax rate? What is the after-state-taxes profit in the state with the 2% tax rate? Which state should Hyundai choose?arrow_forwardIn addition to its Australian business, Big Red Bicycle is considering manufacturing anew range of cheaper bicycles in Indonesia. The following information is available:● The Indonesian plant has capacity to manufacture 8,000 units.● Big Red Bicycle’s strategic goal is to generate a pretax profit of $1,000,000 forthe next financial year for Indonesian operations.● Clients will pay a maximum of $500 per bicycle● Possibility exists for move to Indian plant with capacity for 10,000 units.● Market for bicycles is growing rapidly and BRB will be able to sell allunitsproduced.● Limited ability to renegotiate costs with suppliers.● Pricing and cost information is as follows. Bicycle price per unit $500 (excl. GST)Current variable costs perunit $250 Fixed costs $1,280,000 Complete the following. 1. On your response document, work out:a. how many units at current variable cost would need to be produced toachieve profit target (show calculations)b. what the variable costs per unit would need to…arrow_forward

- All amounts are in $AUD. In order to satisfy the sharp increase in demand KGN is evaluatinginvesting in a “Mega Warehouse” project in Australia. KGN has already identified two existing warehouses. In order to mitigate the risk and assess the fit for purpose of these facilities KGN asked “Axiom Ltd.” to conduct a technical due diligence. “Axiom Ltd.” is asking $100,000 as a fixed fee for its consulting services. Project A has an initial outlay of dollars $150 million and Project B has an initial outlay of $85 million. Project A will generate additional revenues of 45 million starting at the end of year 1 until the end of year 10. It will also incur additional working capital expenses of $1million immediately, this working capital will be recovered at the end of the project. Project B will generate additional revenues of 25 million starting at the end of year 1 until the end of year 10. It will also incur additional working capital expenses of $2million immediately, this working capital…arrow_forwardAll amounts are in $AUD. In order to satisfy the sharp increase in demand KGN is evaluatinginvesting in a “Mega Warehouse” project in Australia. KGN has already identified two existing warehouses. In order to mitigate the risk and assess the fit for purpose of these facilities KGN asked “Axiom Ltd.” to conduct a technical due diligence. “Axiom Ltd.” is asking $100,000 as a fixed fee for its consulting services. Project A has an initial outlay of dollars $150 million and Project B has an initial outlay of $85 million. Project A will generate additional revenues of 45 million starting at the end of year 1 until the end of year 10. It will also incur additional working capital expenses of $1million immediately, this working capital will be recovered at the end of the project. Project B will generate additional revenues of 25 million starting at the end of year 1 until the end of year 10. It will also incur additional working capital expenses of $2million immediately, this working capital…arrow_forwardHemisphere Electric Coop (HEC) is planning to outsource its 51-person information technology (IT) department to Dyonyx. HEC believes this move will allow it to have access to cutting edge technologies and skill sets that would be cost prohibitive to build on its own. If it is assumed that the loaded cost of an IT employee is $100,000 per year, and that HEC will save 25% of this cost through outsourcing, what is the present worth of the savings to HEC for a 5-year contract at an interest rate of 0.5% per month? Assume the same number of contract employees is needed as are currently employed.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is Transfer Pricing for Small Businesses?; Author: Nomad Capitalist;https://www.youtube.com/watch?v=_Q6nN3s1Xjs;License: Standard Youtube License