Concept explainers

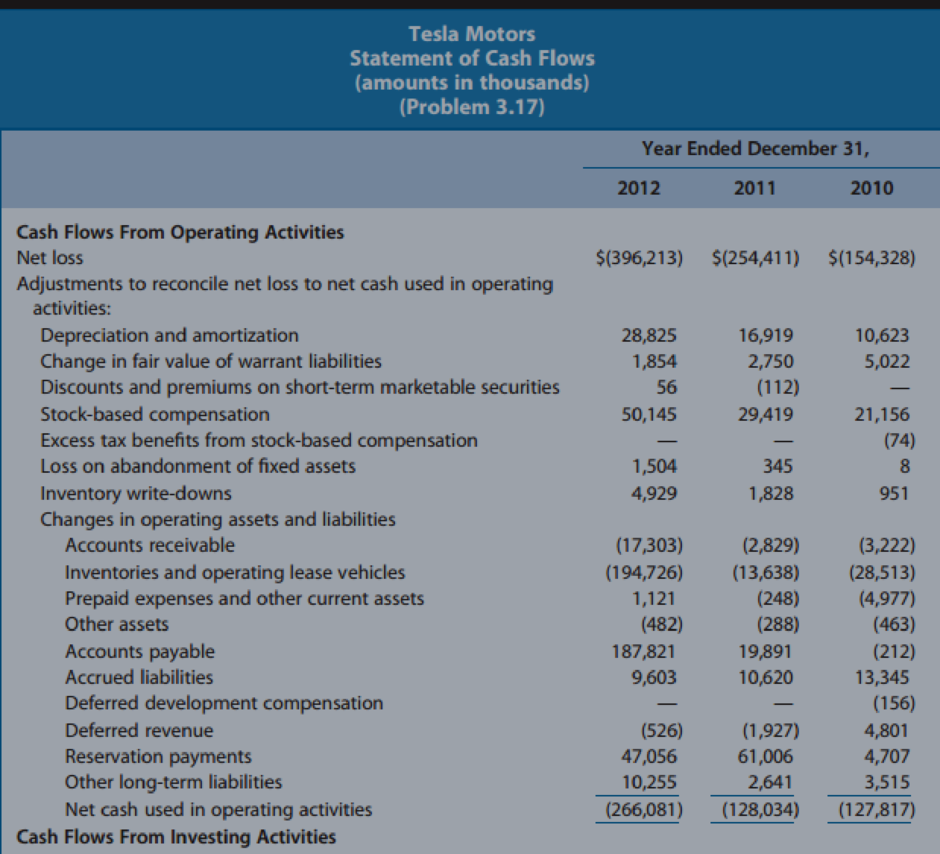

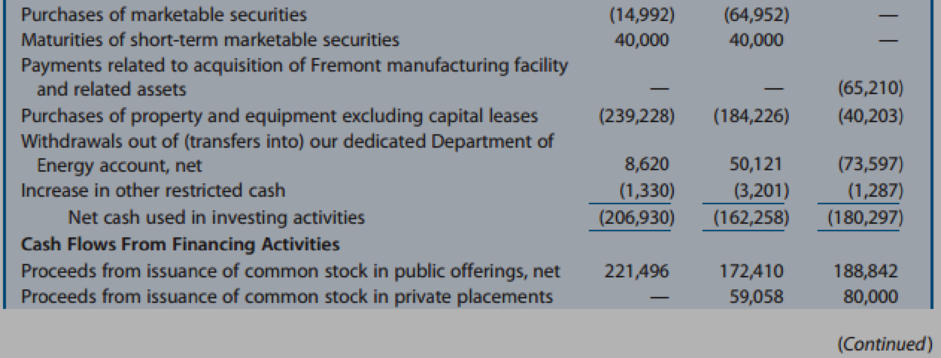

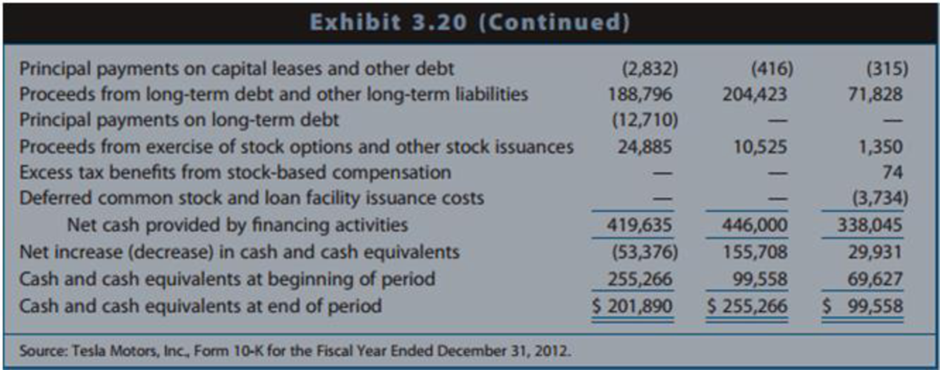

Interpreting the Statement of Cash Flows. Tesla Motors manufactures high performance electric vehicles that are extremely slick looking. Exhibit 3.20 presents the statement of cash flows for Tesla Motors for 2010–2012.

REQUIRED

Discuss the relations among net income, cash flows from operations, cash flows from investing activities, and cash flows from financing activities for the firm over the three-year period.

Describe what stage of life cycle these relations suggest for Tesla Motors. Why are negative operating cash flows less than the net losses? Where is Tesla obtaining cash, and what are they doing with it? What do you think will happen with cash flows in 2013?

Trending nowThis is a popular solution!

Chapter 3 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

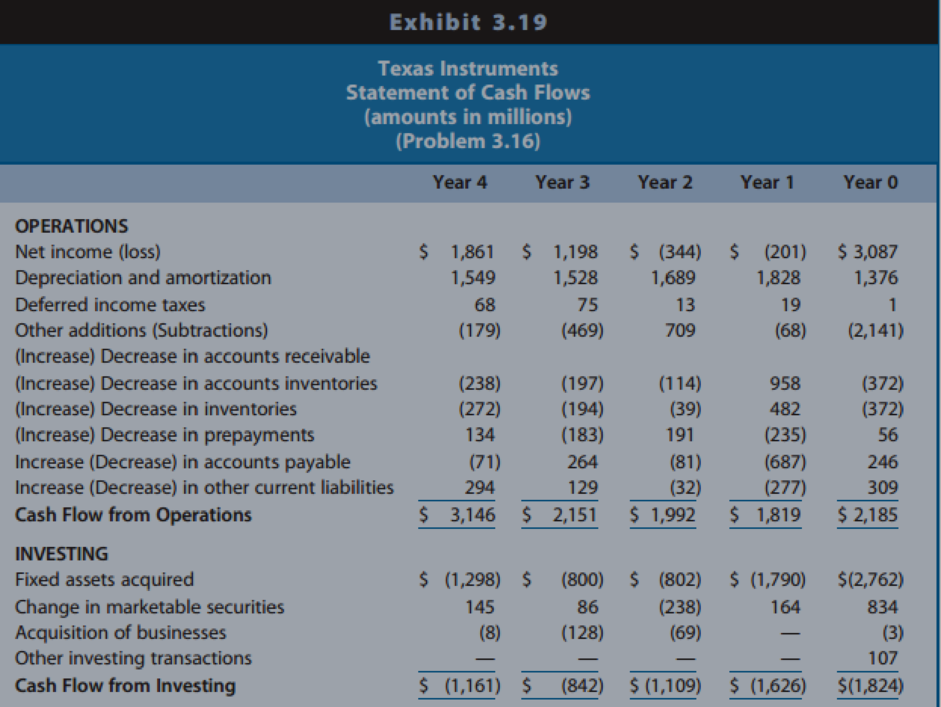

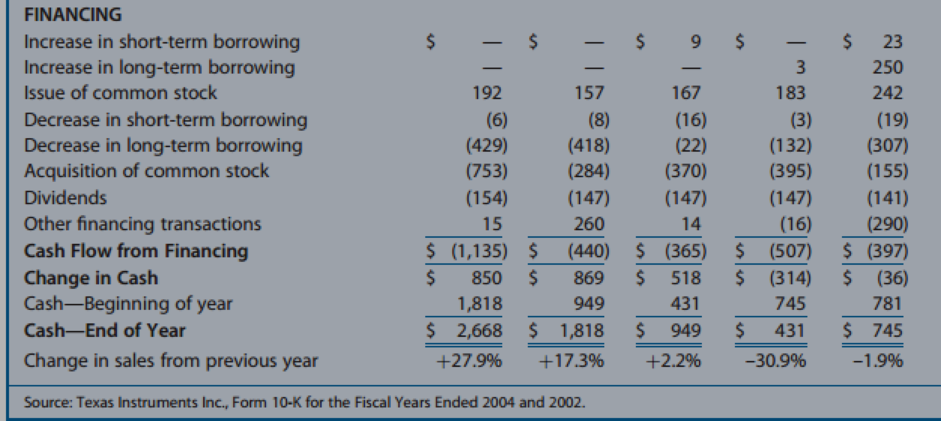

- Interpreting the Statement of Cash Flows. Texas Instruments primarily develops and manufactures semiconductors for use in technology-based products for various industries. The manufacturing process is capital-intensive and subject to cyclical swings in the economy. Because of overcapacity in the industry and a cutback on spending for technologyproducts due to a recession, semiconductor prices collapsed in Year 1 and commenced a steadycomeback during Years 2 through 4. Exhibit 3.19 presents a statement of cash flows for Texas Instruments for Year 0 to Year 4. REQUIRED Discuss the relations between net income and cash flows from operations and among cash flows from operating, investing, and financing activities for the firm over the five-year period.arrow_forwardMattel, Inc., designs, manufactures, and markets toy products worldwide. Mattels toys include Barbie fashion dolls and accessories, Hot Wheels, and Fisher-Price brands. For a recent year, Mattel reported the following net cash flows from operating activities (in thousands): Explain why Mattel reported negative net cash flows from operating activities during the first and second quarters and a large positive cash flow for the fourth quarter, with overall net positive cash flow for the year.arrow_forwardMattel, Inc., designs, manufactures, and markets toy products worldwide. Mattels toys include Barbie fashion dolls and accessories, Hot Wheels, and Fisher-Price brands. For a recent year, Mattel reported the following net cash flows from operating activities (in thousands): Explain why Mattel reported negative net cash flows from operating activities during the second and third quarters and a large positive cash flow for the fourth quarter, with overall net positive cash flow for the year.arrow_forward

- Preparing a Statement of Cash Flows from Balance Sheets and Income Statements. BTB Electronics Inc. manufactures parts, components, and processing equipment for electronics and semiconductor applications in the communications, computer, automotive, and appliance industries. Its sales tend to vary with changes in the business cycle because the sales of most of its customers are cyclical. Exhibit 3.32 presents balance sheets for BTB as of December 31, Year 7 through Year 9, and Exhibit 3.33 presents income statements for Year 8 and Year 9. REQUIRED a. Prepare a worksheet for the preparation of a statement of cash flows for BTB Electronics Inc for Years 8 and 9. Follow the format of Exhibit 3.14 in the text. Notes to the firms financial statements reveal the following (amounts in thousands): (1) Depreciation expense was 641 in Year 8 and 625 in Year 9. No fixed assets were sold during these years. (2) Other Assets represents patents. Patent amortization was 25 in Year 8 and 40 in Year 9. BTB sold a patent during Year 9 at no gain or loss. (3) Changes in Deferred Income Taxes are operating activities. b. Discuss the relations among net income and cash flow from operations and the pattern of cash flows from operating, investing, and financing activities.arrow_forwardExtracting Performance Trends from the Statement of Cash Flows. The Apollo Group is one of the largest providers of private education, and runs numerous programs and services, including the University of Phoenix. Exhibit 3.25 provides the statement of cash flows for 2012. REQUIRED Discuss the relations between net income and cash flow from operations and among cash flows from operating, investing, and financing activities for the firm, especially for 2012. Identify signals that might raise concerns for an analyst.arrow_forwardObserve the following statement: STATEMENT OF CASH FLOW FOR “COUCH POTATO TECHNOLOGIES P/L” For the year ending June 30 2011 2010 $000 2011 $000 Receipts from customers (sales) 350 180 Payments for purchases 50 60 Payments to employees 80 80 Purchase of assets 10 20 Payments for operating expenses 10 15 Additional Information: • Industry Average Efficiency : 20% • Net profit in 2010 : $21 000 a) Define the term working capital. b) Comment on the cash flow of Couch Potato Technologies P/L in 2010. c) Calculate and comment on the efficiency of Couch Potato Technologies P/L d) Calculate and comment on the net profit of Couch Potato Technologies P/L. e) Recommend TWO strategies that can be used to manage the working capital of Couch Potato Technologies P/L.arrow_forward

- For the past two years, Monroe Corporation’s statement of cash flows has shown net cash provided by financing activities. Which of the following choices could explain this result? a. Collection of accounts receivable balances. b. Sales of factory equipment. c. Issuance of long-term debt. d. Receipt of cash dividends from investments in other company’s stock.arrow_forwardYou can determine a company’s cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing new debt or selling its assets. Which of the following is true for the statement of cash flows? It reflects cash generated and used during the reporting period. It reflects revenues when earned. Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement. Operating Activity Investing Activity Financing Activity A company reports a 10% increase in its accounts payable from the last month. D and W Co. sells its last season’s inventory to a discount store. Yum Brands distributes dividends to its…arrow_forwardRefer to the financial statements and related disclosure notes of The Kroger Company for the fiscal year endingJanuary 30, 2016. You can locate the report online from “investor relations” at www.kroger.com.Notice that Kroger’s net income has increased over the three years reported. To supplement their analysis ofprofitability, many analysts like to look at “free cash flow.” A popular way to measure this metric is “structuralfree cash flow” (or as Warren Buffett calls it, “owner’s earnings”), which is calculated as net income from operations, plus depreciation and amortization, minus capital expenditures.Required:Determine free cash flows for Kroger in each of the three years reported. Compare that amount with net incomeeach year. What pattern do you detect?arrow_forward

- “Cash Is King” for all businesses You can determine a company’s cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing new debt or selling its assets. Which of the following is true for the statement of cash flows? It reflects cash generated and used during the reporting period. It reflects revenues when earned. Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement. Operating Activity Investing Activity Financing Activity Yum Co. uses cash to repurchase 10% of its common stock. A pharmaceutical company buys marketing rights to sell a drug exclusively in East Asian markets.…arrow_forwardAndrew Potter is comparing the cash- flow- generating ability of Microsoft with that of Apple Inc. He collects information from the companies’ annual reports and prepares the following table. Cash Flow from Operating Activities as a Percentage of Total Net Revenue 2017 (%) 2016 (%) 2015 (%) Microsoft 43.9 39.1 31.7 Apple Inc. 27.7 30.5 34.8 As a Percentage of Average Total Assets 2017 (%) 2016 (%) 2015 (%) Microsoft 18.2 18.1 17.1 Apple Inc. 18.2 21.5 31.1 What is Potter likely to conclude about the relative cash- flow- generating ability of these two companies?arrow_forward(AACSB) AnalysisYou review a company’s statement of cash flows and find that cash inflows from operations are $150,000,net outflows from investing are $80,000, and net inflows from financing are $60,000. Did the company’scash balance increase or decrease for the year? By what amount? What types of activities would you findunder the category investing activities? Under financing activities? If you had access to the company’sincome statement and balance sheet, why would you be interested in reviewing its statement of cash flows?What additional information can you gather from the statement of cash flows?arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning