Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 25PC

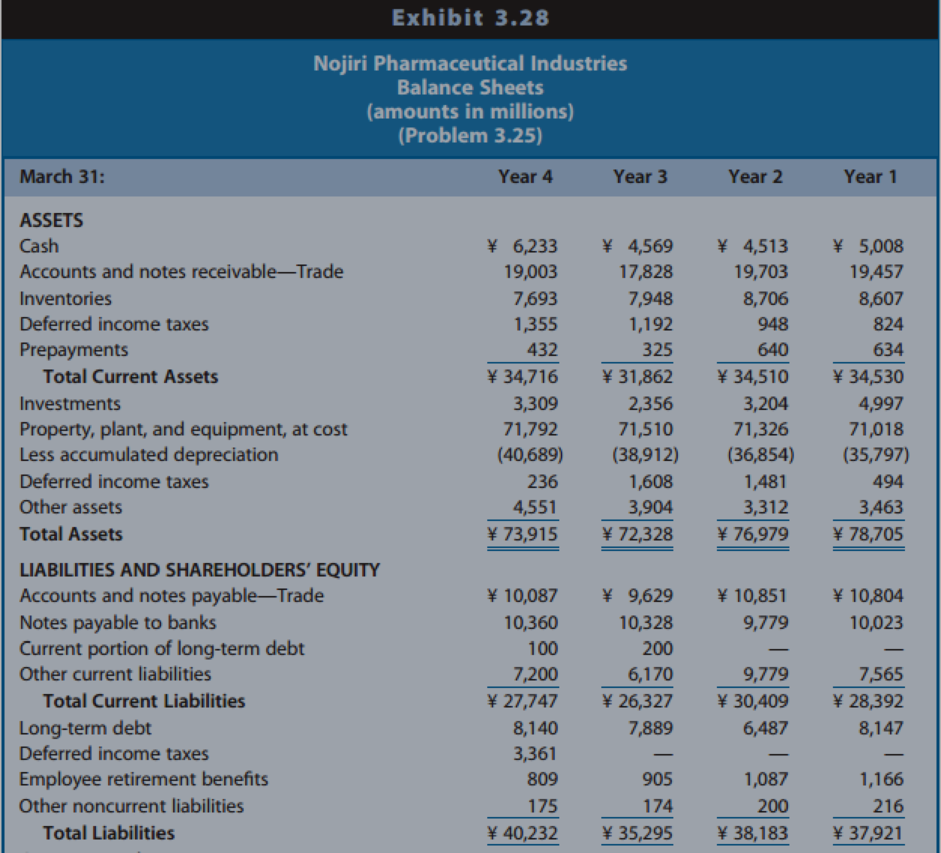

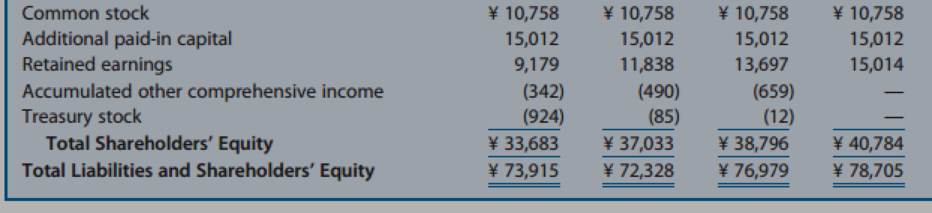

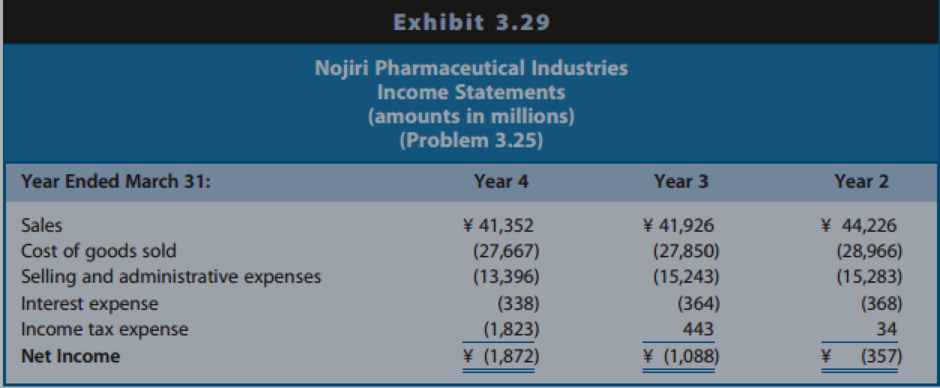

Preparing a Statement of Cash Flows from Balance Sheets and Income Statements. Nojiri Pharmaceutical Industries develops, manufactures, and markets pharmaceutical products in Japan. The Japanese economy experienced recessionary conditions in recent years. In response to these conditions, the Japanese government increased the proportion of medical costs that is the patient’s responsibility and lowered the prices for prescription drugs. Exhibits 3.28 and 3.29 present the firm’s balance sheets and income statements for Years 1 through 4.

REQUIRED

- a. Prepare a worksheet for the preparation of a statement of cash flows for Nojiri Pharmaceutical Industries for each of the years ending March 31, Year 2 to Year 4. Follow the format of Exhibit 3.14 in the text. Notes to the financial statements indicate the following:

- (1) The changes in Accumulated Other Comprehensive Income relate to revaluations of Investments in Securities to market value. The remaining changes in Investments in Securities result from purchases and sales. Assume that the sales occurred at no gain or loss.

- (2) No sales of property, plant, and equipment took place during the three-year period.

- (3) The changes in Other Noncurrent Assets are investing activities.

- (4) The changes in Employee Retirement Benefits relate to provisions made for retirement benefits net of payments made to retired employees, both of which the statement of cash flows classifies as operating activities.

- (5) The changes in Other Noncurrent Liabilities are financing activities.

- b. Prepare a comparative statement of cash flows for Year 2, Year 3, and Year 4.

- c. Discuss the relations among net income and cash flow from operations and the pattern of cash flows from operating, investing, and financing transactions for Year 2, Year 3, and Year 4.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Indicate how you would expect the following strategies to affect the company’s net cash flows

from operating activities (1) in the near future and (2) in later periods (after the strategy’s long-term effects have “taken hold”). Fully explain your reasoning.

a. A successful pharmaceutical company substantially reduces its expenditures for research anddevelopment.b. A restaurant that previously sold only for cash adopts a policy of accepting bank credit cards,such as Visa and MasterCard.c. A manufacturing company reduces by 50 percent the size of its inventories of raw materials(assume no change in inventory storage costs).d. Through tax planning, a rapidly growing real estate developer is able to defer significantamounts of income taxes.e. A rapidly growing software company announces that it will stop paying cash dividends for theforeseeable future and will instead distribute stock dividends.

Accounting

Bluepanda Inc. sales electronics parts, which finds application in various equipment used mainly in construction industry. The company has faced some issues in managing its working capital and has lost some key suppliers in the recent past due to mismanagement of cash and delay in vendor payments. Bluepanda has hired you as a financial consultant to look into this matter and provide a comprehensive perspective. The management also desired to maintain a cash balance of more than $15,000 each month as financial prudence.

After considering all the information provided to you, you decided that having a cash budget would be the first step to understand the shortfall/surplus of cash and will aid in working capital management. You arranged a meeting with the marketing team and gathered the following information:

Sales Forecast

Month- year

Sales

Nov. 2022

$50,000

Dec 2022

$60,000

Jan 2023

$60,000

Feb 2023

$70,000

March 2023

$75,000

April 2023…

Capstone Turbine Corporation produces and sells turbine generators for such applications as charging electric, hybrid vehicles. Capstone Turbine reported the following financial data for a recent year (in thousands):

Net cash flows from operating activities $(23,018) Cash and cash equivalents 32,221

a. Determine the monthly cash expenses. Round to one decimal place.b. Determine the ratio of cash to monthly cash expenses. Round to one decimal place.c. Based on your analysis, do you believe that Capstone Turbine will remainin business?

Chapter 3 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 3 - Need for a Statement of Cash Flows. The accrual...Ch. 3 - Articulation of the Statement of Cash Flows with...Ch. 3 - Classification of Interest Expense. Under U.S....Ch. 3 - Prob. 4QECh. 3 - Classification of Changes in Short-Term Financing....Ch. 3 - Classification of Cash Flows Related to...Ch. 3 - Treatment of Non-Cash Exchanges. The acquisition...Ch. 3 - Computing Cash Collections from Customers....Ch. 3 - Computing Cash Payments to Suppliers. Lowes...Ch. 3 - Computing Cash Payments for Income Taxes. Visa...

Ch. 3 - Interpreting the Relation between Net Income and...Ch. 3 - Interpreting the Relation between Net Income and...Ch. 3 - Interpreting Relations among Cash Flows from...Ch. 3 - Interpreting Relations among Cash Flows from...Ch. 3 - Interpreting the Statement of Cash Flows. The...Ch. 3 - Interpreting the Statement of Cash Flows. Texas...Ch. 3 - Interpreting the Statement of Cash Flows. Tesla...Ch. 3 - Interpreting the Statement of Cash Flows. Gap Inc....Ch. 3 - Prob. 19PCCh. 3 - Prob. 20PCCh. 3 - Interpreting the Statement of Cash Flows....Ch. 3 - Extracting Performance Trends from the Statement...Ch. 3 - Interpreting a Direct Method Statement of Cash...Ch. 3 - Prob. 24PCCh. 3 - Preparing a Statement of Cash Flows from Balance...Ch. 3 - Prob. 26PCCh. 3 - Preparing a Statement of Cash Flows from Balance...Ch. 3 - Prob. 1AICCh. 3 - Prob. 1BICCh. 3 - Prob. 1CICCh. 3 - Prob. 1DICCh. 3 - Prob. 1EICCh. 3 - Prob. 1FICCh. 3 - Prob. 1GICCh. 3 - Prob. 1HICCh. 3 - Prob. 2AICCh. 3 - Prob. 2BICCh. 3 - Prob. 2CICCh. 3 - Prob. 2DICCh. 3 - Prob. 2EICCh. 3 - Prob. 2FICCh. 3 - Prob. 3IC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Mattel, Inc., designs, manufactures, and markets toy products worldwide. Mattels toys include Barbie fashion dolls and accessories, Hot Wheels, and Fisher-Price brands. For a recent year, Mattel reported the following net cash flows from operating activities (in thousands): Explain why Mattel reported negative net cash flows from operating activities during the second and third quarters and a large positive cash flow for the fourth quarter, with overall net positive cash flow for the year.arrow_forwardInterpreting a Direct Method Statement of Cash Flows. Aer Lingus is an international airline based in Ireland. Exhibit 3.26 provides the statement of cash flows for Year 1 and Year 2, which includes a footnote from the financial statements. Year 2 was characterized by weakening consumer demand for air travel due to a recession and record high fuel prices. In addition, Year 2 includes exceptional items totaling 141 million, which reflect a staff restructuring program for early retirement (118 million), takeover defense costs due to a bid by Ryanair (18 million), and other costs (5 million). REQUIRED a. Based on information in the statement of cash flows, compare and contrast the cash flows for Years 1 and 2. Explain significant differences in individual reconciling items and direct cash flows. b. The format of Aer Lingus statement of cash flows is the direct method, as evidenced by the straightforward titles used in the operating section. How is this statement different from the presentation that Aer Lingus would report using the indirect method?arrow_forwardEthical Issue: Moss Exports is having a bad year. Net Income is only $60,000. Also, two important overseas customers are falling behind in their payments to Moss, and Moss's Accounts Receivable are ballooning (these two customers owe Moss $80,000 combined). The company desperately needs a loan. The Moss Exports Board of Directors is considering ways to put the best face on the company's financial statements. Moss's bank closely examines cash flow from operating activities. Daniel Peavey, Moss's Controller, suggests reclassifying the receivables from the two overseas customers as long-term assets. He explains to the Board that removing the $80,000 increase in Accounts Receivable from current assets will increase the net cash provided by operations.This approach may help get Moss the loan. 1. Using only the amounts given, compute net cash provided by operations, both without and with the reclassification of the receivables. Which reporting makes Moss look better? In showing your math,…arrow_forward

- Consider the following data for this company (image) True or False and why: This company raised cash in 2020 by increasing borrowing from suppliers. True or False and why: Despite having lower operating cash flow in 2020, this company managed to maintain its investments in the business during 2020 by reducing cash holdings True or False and why: This company raised cash from investors to manage the crisis in 2020 and suspended any payments to investors during 2020arrow_forwardPlease assist by providing the correct answer for 1.1,1.2 and 1.3 1.1 Which one of the following would reduce the cash balances of a business and not reduce the profit for the year? Select one: a. Interest paid b. Distribution costs c. Remuneration to directors d. Dividends paid 1.2 Goods costing R180 000 sent out to consignee to show a profit of 20% on Invoice Price. Invoice price of the goods will be______. Select one: a. R216 000 b. R225 000 c. R210 000 d. R281 250 1.3 Goods sent on consignment Invoice value R200 000, at cost + 331/3 %. 1/5th of the goods were lost in transit. Insurance claim received R10 000. The amount of abnormal loss to be transferred to General P/L is___. Select one: a. R30 000 b. R20 000 c. R35 000 d. R25 000arrow_forwardAssume the following:• A company is importing and selling Mercedes cars.• An Islamic bank invests US$7 million for an 70% profit share.• An investor invests US$3 million for a 30% profit share.• The investor is to be paid a 15% management fee as percentage of profit after expenses. Assume: Sale proceeds = US$12, 400, 000Expenses = US$200, 000 Requirement:Calculate total return to the bank and total return to the investor.arrow_forward

- Required: (a) Prepare a cash flow statement for Chamber Corp for the year ended 31 December 2021. (b) Reply to the following questions put to you by one of the directors of the company: 'Can you please explain to me how we have a healthy profit yet our bank overdraft has reached a record level? Surely there must be something wrong with the profit calculations.'arrow_forwardSelected information for a recent year follows for Bank of Montreal and Scotiabank (in millions): Bank of Montreal Scotiabank Profit $3,990 $8,243 Cash provided (used) by operating activities 2,908 16,584 Cash provided (used) by investing activities (3,155 ) (12,540 ) Cash provided (used) by financing activities 1,996 (2,932 ) Calculate the increase or decrease in cash for each company. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Enter your answers in millions.) Bank of Montreal Scotiabank $ $ eTextbook and Media Calculate the free cash flow for each company. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Enter your answers in millions.) Bank of…arrow_forwarda) CIA provided the following data from its accounting system: Sales (including GST) $103 400 Stock purchases (including GST) $59 400 Equipment purchased (including GST) $7 700 PAYG Withheld $9 475 Fruit purchased for staff room $39 a) Calculate the GST Collected, the GST Paid and the amount payable or refundable to or from the Australian Taxation Office. b) Cash and profit can be very different figures. List three causes or reasons why cash and profit will be different.arrow_forward

- Your managers showed you the income statement for your company. The income statement shows a net income of 5.4%, yet your manager says the company will need to borrow money to meet their financial obligations. How is this possible? Please address the following issues in your discussion this week: How can a company make a profit and still be short of cash? In accrual accounting, we record sales when they occur, not when the cash is collected. How does this affect cash flow? How does the purchase of fixed assets or additional inventory adversely affect cash flow?arrow_forward(A) Explain how Unilever Pakistan, Inc. achieved positive cash flows from operating activities despite incurring a net loss for the year. (B) Does the company's financial position appear to be improving or deteriorating? Explain.arrow_forwardMusharaka with Profits Assume the following:_ A company is importing and selling Mercedes cars. An Islamic bank invests US$8 million for an 80% profit share. An investor invests US$2 million for a 20% profit share. The investor is to be paid a 10% management fee as a percentage of profit after expenses. Assume: Sale proceeds = US$12,400,000 Expenses = US$200,000 Calculate: 1. The total return to the bank: 2. The total return to the investor: please provide an accurate and step by step answer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License