CUSTOM COST ACCOUNTING 15E

15th Edition

ISBN: 9781269831338

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.32E

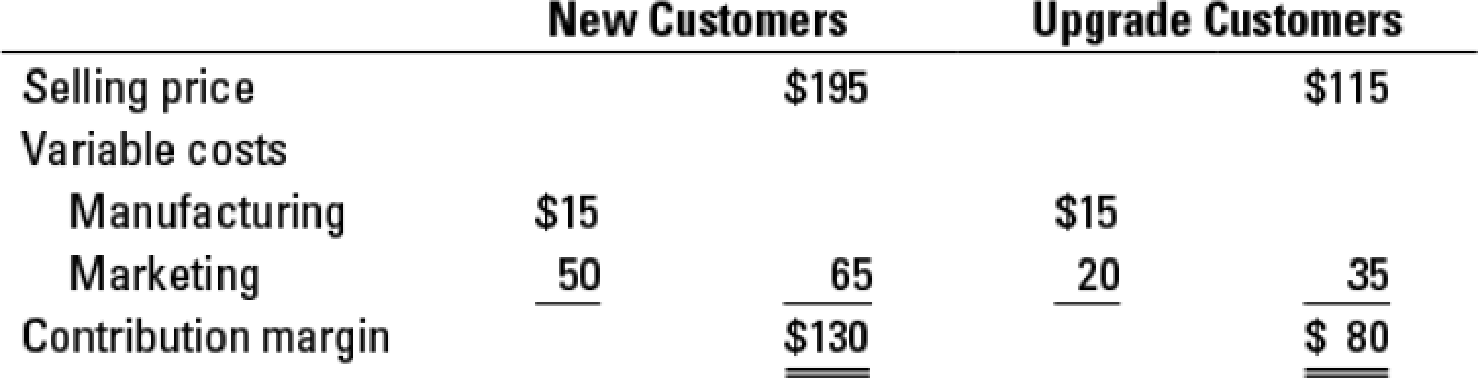

Sales mix, new and upgrade customers. Chartz 1-2-3 is a top-selling electronic spreadsheet product. Chartz is about to release version 5.0. It divides its customers into two groups: new customers and upgrade customers (those who previously purchased Chartz 1-2-3 4.0 or earlier versions). Although the same physical product is provided to each customer group, sizable differences exist in selling prices and variable marketing costs:

The fixed costs of Chartz 1-2-3 5.0 are $16,500,000. The planned sales mix in units is 60% new customers and 40% upgrade customers.

- 1. What is the Chartz 1-2-3 5.0 breakeven point in units, assuming that the planned 60%/40% sales mix is attained?

Required

- 2. If the sales mix is attained, what is the operating income when 170,000 total units are sold?

- 3. Show how the breakeven point in units changes with the following customer mixes:

- a. New 40% and upgrade 60%

- b. New 80% and upgrade 20%

- c. Comment on the results.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Onawa Ltd manufactures a top-selling electronic spreadsheet product called Cell 123. Onawa is aboutto release version 8. It divides its customers into 2 groups: new customers and upgrade customers(those who previously purchased Cell 123, version 7 or earlier versions). Although the same physicalproduct is provided to each customer group, sizeable differences exist in selling prices and variablemarketing costs

New customers

Upgrade customers

N$

N$

Selling price

210

120

Variable costs:

Manufacturing

(25)

(25)

Marketing

(65)

(15)

The fixed costs of Cell 8 are N514 000 000. The planned ratio of new customers to upgrade customers isexpected to be 6:4 respectively

requirement:a) Calculate Onawa Ltd individual break-even point both in units and sales revenue, assuming thatthe customers will come as planned.b) Ifthe planned sales mix is attained, calculate the operating income when 200 000 units are sold.c) The CVP analysis as any management tool has some limitations.…

AcerWare Inc. manufactures external hard disks for $32 per unit, and the maximum price customers are willing to pay is $47 per unit. Data Driver Inc. is a competitor of AcerWare Inc. that produces external hard disks for $37 per unit, and customers are willing to pay a maximum price of $50 per unit. What does this imply?

Multiple Choice

AcerWare and Data Driver share differentiation parity.

Data Driver has a competitive advantage over AcerWare in terms of perceived value.

AcerWare creates a greater economic value than Data Driver.

Data Driver is a cost-leader when compared to AcerWare.

Media Mogul Inc. is a marketing company that offers a variety of marketing offerings to its customers.

Specifically:

•Media will create a TV commercial for $1M, build an app for $500K, and build a Facebook page for $250K. These amounts represent Media’s charges for these items when Media sells them separately to customers. The TV commercial, the app, and the Facebook page are not interrelated; that is, each functions independently of the other offerings.

•If a customer purchases all aforementioned items together, the total cost is $1.5M. Payment terms are 50 percent consideration due at contract signing, with the remaining 50 percent due over the rest of the development period (25 percent at mid-point, 25 percent at completion).

•If the app is downloaded 500K times or more in the first month, there is a one-time bonus of $250K payable to Media.

Stone, a customer, approaches Media with the hopes of reinventing its image to a younger customer base. Stone has a verbal agreement with Media…

Chapter 3 Solutions

CUSTOM COST ACCOUNTING 15E

Ch. 3 - Define costvolumeprofit analysis.Ch. 3 - Describe the assumptions underlying CVP analysis.Ch. 3 - Distinguish between operating income and net...Ch. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Why is it more accurate to describe the subject...Ch. 3 - CVP analysis is both simple and simplistic. If you...Ch. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Give an example of how a manager can decrease...

Ch. 3 - Give an example of how a manager can increase...Ch. 3 - What is operating leverage? How is knowing the...Ch. 3 - There is no such thing as a fixed cost. All costs...Ch. 3 - Prob. 3.14QCh. 3 - In CVP analysis, gross margin is a less-useful...Ch. 3 - Jacks Jax has total fixed costs of 25,000. If the...Ch. 3 - During the current year, XYZ Company increased its...Ch. 3 - Under the contribution income statement, a...Ch. 3 - A company needs to sell 10,000 units of its only...Ch. 3 - Once a company exceeds its breakeven level,...Ch. 3 - Prob. 3.21ECh. 3 - CVP computations. Garrett Manufacturing sold...Ch. 3 - CVP analysis, changing revenues and costs. Sunset...Ch. 3 - CVP exercises. The Deli-Sub Shop owns and operates...Ch. 3 - CVP exercises. The Doral Company manufactures and...Ch. 3 - CVP analysis, income taxes. Westover Motors is a...Ch. 3 - CVP analysis, income taxes. The Home Style Eats...Ch. 3 - CVP analysis, sensitivity analysis. Perfect Fit...Ch. 3 - CVP analysis, margin of safety. Suppose Morrison...Ch. 3 - Operating leverage. Cover Rugs is holding a 2-week...Ch. 3 - CVP analysis, international cost structure...Ch. 3 - Sales mix, new and upgrade customers. Chartz 1-2-3...Ch. 3 - Prob. 3.33ECh. 3 - Prob. 3.34ECh. 3 - Contribution margin, decision making. Welch Mens...Ch. 3 - Contribution margin, gross margin, and margin of...Ch. 3 - Uncertainty and expected costs. Kindmart is an...Ch. 3 - CVP analysis, service firm. Lifetime Escapes...Ch. 3 - CVP, target operating income, service firm....Ch. 3 - CVP analysis, margin of safety. Marketing Docs...Ch. 3 - CVP analysis, income taxes. (CMA, adapted) J.T....Ch. 3 - CVP, sensitivity analysis. The Derby Shoe Company...Ch. 3 - CVP analysis, shoe stores. The HighStep Shoe...Ch. 3 - CVP analysis, shoe stores (continuation of 3-43)....Ch. 3 - Prob. 3.45PCh. 3 - Prob. 3.46PCh. 3 - CVP analysis, income taxes, sensitivity. (CMA,...Ch. 3 - Choosing between compensation plans, operating...Ch. 3 - Prob. 3.49PCh. 3 - Multiproduct CVP and decision making. Crystal...Ch. 3 - Sales mix, two products. The Stackpole Company...Ch. 3 - Prob. 3.52PCh. 3 - Ethics, CVP analysis. Megaphone Corporation...Ch. 3 - Deciding where to produce. (CMA, adapted) Portal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Media Mogul Inc. is a marketing company that offers a variety of marketing offerings to its customers. Specifically: •Media will create a TV commercial for $1M, build an app for $500K, and build a Facebook page for $250K. These amounts represent Media’s charges for these items when Media sells them separately to customers. The TV commercial, the app, and the Facebook page are not interrelated; that is, each functions independently of the other offerings. •If a customer purchases all aforementioned items together, the total cost is $1.5M. Payment terms are 50 percent consideration due at contract signing, with the remaining 50 percent due over the rest of the development period (25 percent at mid-point, 25 percent at completion). •If the app is downloaded 500K times or more in the first month, there is a one-time bonus of $250K payable to Media. Stone, a customer, approaches Media with the hopes of reinventing its image to a younger customer base. Stone has a verbal agreement with Media…arrow_forwardMedia Mogul Inc. is a marketing company that offers a variety of marketing offerings to its customers. Specifically: •Media will create a TV commercial for $1M, build an app for $500K, and build a Facebook page for $250K. These amounts represent Media’s charges for these items when Media sells them separately to customers. The TV commercial, the app, and the Facebook page are not interrelated; that is, each functions independently of the other offerings. •If a customer purchases all aforementioned items together, the total cost is $1.5M. Payment terms are 50 percent consideration due at contract signing, with the remaining 50 percent due over the rest of the development period (25 percent at mid-point, 25 percent at completion). •If the app is downloaded 500K times or more in the first month, there is a one-time bonus of $250K payable to Media. Stone, a customer, approaches Media with the hopes of reinventing its image to a younger customer base. Stone has a verbal agreement with Media…arrow_forwardA company is providing its product to the consumer through the wholesalers. The managing director of the company thinks that if the company starts selling through retailers or to the consumers directly, it can increase its sales, charge higher prices and make more profit. On the basis of the following information and consider variable cost is rial 2.50 per unit and fixed cost is rial 50000. (a) Advise the managing director whether the company should change its channel of distribution or not (with calculation and Justification). (b) Provide suggestions and recommendations on the basis of analysis.arrow_forward

- Activity-Based Customer-Driven Costs Suppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and the non-JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product. Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter: JITDistributors Non-JITDistributors Sales orders 1,000 100 Sales calls 70 70 Service calls 350 175 Average order size 550 5,500 Manufacturing cost/unit $125 $125 Customer costs: Processing sales orders $3,430,000 Selling goods 1,120,000 Servicing goods 1,050,000 Total $5,600,000 Required: 1. Calculate the total revenues per distributor category, and assign the customer costs to each distributor type by using revenues as the allocation base. Selling price for one unit is $150. Round…arrow_forwardActivity-Based Customer-Driven Costs Suppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and the non-JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product. Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter: JITDistributors Non-JITDistributors Sales orders 1,100 110 Sales calls 70 70 Service calls 350 175 Average order size 750 7,500 Manufacturing cost/unit $125 $125 Customer costs: Processing sales orders $3,330,000 Selling goods 1,120,000 Servicing goods 1,050,000 Total $5,500,000 Required: 1. Calculate the total revenues per distributor category, and assign the customer costs to each distributor type by using revenues as the allocation base. Selling price for one unit is $150. Round…arrow_forwardActivity-Based Customer-Driven Costs Suppose that Stillwater Designs has two classes of distributors: JITdistributors and non -JIT distributors. The JIT distributor places small,frequent orders, and the non -JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product.Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter: Required:1. Calculate the total revenues per distributor category, and assignthe customer costs to each distributor type by using revenues asthe allocation base. Selling price for one unit is $150. 2. CONCEPTUAL CONNECTION Calculate the customer cost perdistributor type using activity-based cost assignments. Discuss themerits of offering the non -JIT distributors a $2 price decrease(assume that they are agitating for a price concession). 3. CONCEPTUAL CONNECTION Assume that the JIT distributors are simply imposing the frequent orders on…arrow_forward

- Customer Value, Strategic PositioningAdriana Alvarado has decided to purchase a personal computer. She hasnarrowed the choices to two: Drantex (ad Confiar. Both brands have thesame processing speed, 6.4 gigabytes of hard-disk capacity, two USBports, and a DVDRW drive, and each comes with the same basic softwaresupport package. Both come from mail-order companies with goodreputations. The selling price for each is identical. After some review,Adriana discovers that the cost of operating and maintaining Drantexover a 3-year period is estimated to be $300. For Confiar, the operatingand maintenance cost is $600. The sales agent for Drantex emphasizedthe lower operating and maintenance costs. The agent for Confiar,however, emphasized the service reputation of the product and thefaster delivery time (Confiar can be purchased and delivered 1 weeksooner than Drantex). Based on all the information, Adriana has decidedto bur Confiar. Required:1. What is the total product purchased by Adriana?2.…arrow_forwardSuppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and the non-JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product. Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter: JITDistributors Non-JITDistributors Sales orders 1,000 100 Sales calls 70 70 Service calls 350 175 Average order size 650 6,500 Manufacturing cost/unit $125 $125 Customer costs: Processing sales orders $3,380,000 Selling goods 1,120,000 Servicing goods 1,050,000 Total $5,550,000 Required: 1. Calculate the total revenues per distributor category, and assign the customer costs to each distributor type by using revenues as the allocation base. Selling price for one unit is $150. Round calculations to the nearest dollar. JIT…arrow_forwardData 1-2-3 is a top-selling electronic spreadsheet product. is about to release version 5.0. It divides its customers into two groups: new customers and upgrades customers (those who previously purchased Data 1-2-3, 4.0, or earlier versions). Although the same physical product is provided to each customer group, sizable differences exist in selling prices and variable marketing costs: New Customers Upgrade Customers Selling price $225 $125 Variable costs Manufacturing $30 $30 Marketing 65 95 15 45 Contribution margin $130 $80 The fixed costs of Data 1-2-3 5.0 are $16,500,000. The planned sales mix in units is 60% new customers and 40% upgrade customers.…arrow_forward

- The Camera Shop sells two popular models of digital SLR cameras (Camera A Price: 230, Camera B Price: 310). The sales of these products are not independent of each other, but rather if the price of one increase, the sales of the other will increase. In economics, these two camera models are called substitutable products. The store wishes to establish a pricing policy to maximize revenue from these products. A study of price and sales data shows the following relationships between the quantity sold (N) and prices (P) of each model: NA = 192 - 0.5PA + 0.25PB NB = 305 + 0.08PA - 0.6PB Construct a model for the total revenue and implement it on a spreadsheet. Develop a two-way data table to estimate the optimal prices for each product in order to maximize the total revenue. Vary each price from $250 to $500 in increments of $10. Max profit occurs at Camera A price of $ . Max profit occurs at Camera B price of $ .arrow_forwardRizzo Goal Inc. produces and sells hockey equipment, often custom made for online orders. The company has the following performance metrics on its balanced scorecard: days from ordered to delivered, number of shipping errors, customer retention rate, and market share. A measure map illustrates that the days from ordered to delivered and the number of shipping errors are both expected to directly affect the customer retention rate, which affects market share. Additional internal analysis finds that: Every shipping error over three shipping errors per month reduces the customer retention rate by 1.5%. On average, each day above three days from ordered to delivered yields a reduction in the customer retention rate of 1%. Each day before three days from order to delivery yields an increase in the customer retention rate of 1%, on average. Rizzo Goal Inc.s current customer retention rate is 60%. The company estimates that for every 1% increase or decrease in the customer retention rate, market share changes 0.5% in the same direction. Rizzo Goal Inc.s current market share is 21.4%. Ignoring any other factors, if the company has six shipping errors this month and an average of 3.5 days from ordered to delivered, determine (a) the new customer retention rate and (b) the new market share that Rizzo Goal Inc. expects to have.arrow_forwardEvaluating selling and administrative cost allocations Gordon Gecco Furniture Company has two major product lines with the following characteristics: Commercial office furniture: Few large orders, little advertising support, shipments in full truckloads, and low handling complexity Home office furniture: Many small orders, large advertising support, shipments in partial truckloads, and high handling complexity The company produced the following profitability report for management: The selling and administrative expenses are allocated to the products on the basis of relative sales dollars. Evaluate the accuracy of this report and recommend an alternative approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Pricing Decisions; Author: Rutgers Accounting Web;https://www.youtube.com/watch?v=rQHbIVEAOvM;License: Standard Youtube License