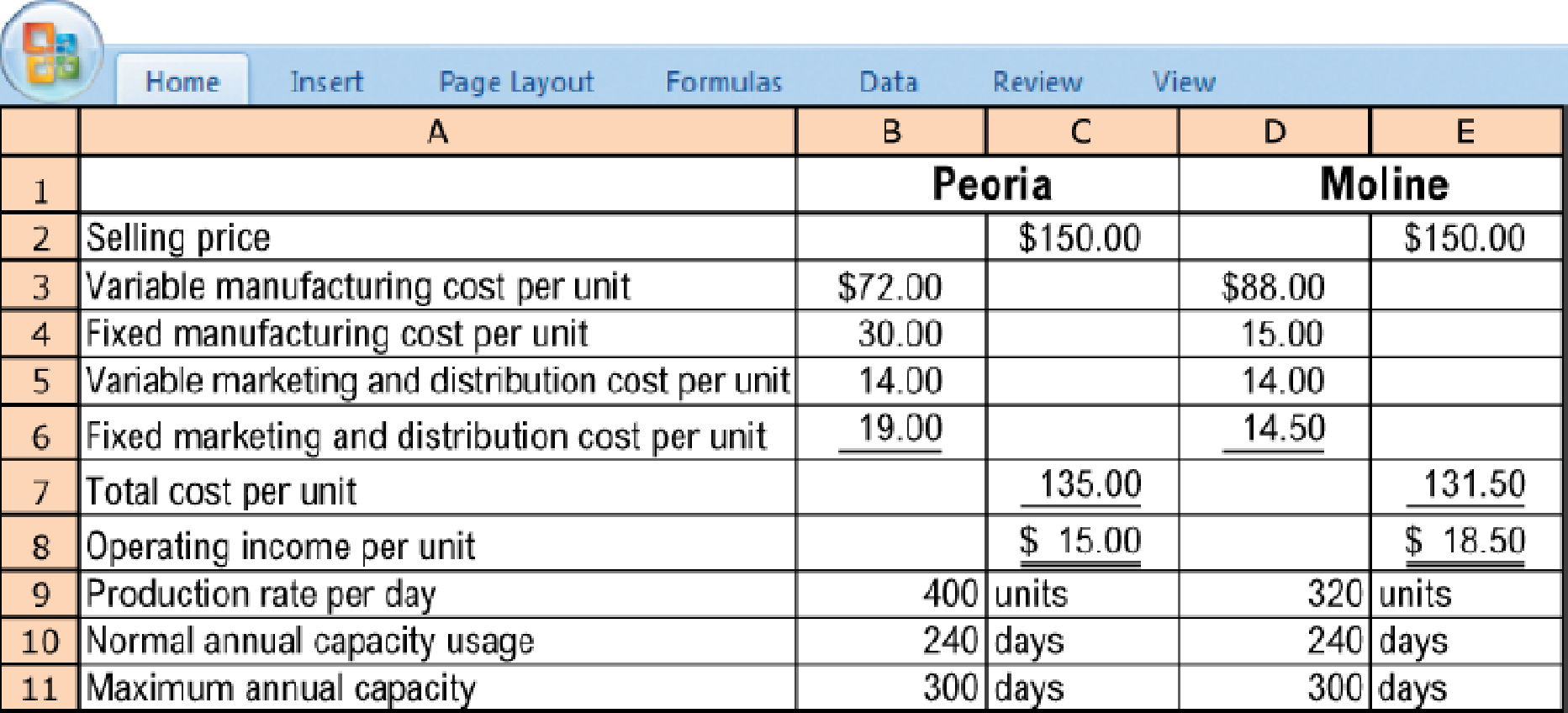

Deciding where to produce. (CMA, adapted) Portal Corporation produces the same power generator in two Illinois plants, a new plant in Peoria and an older plant in Moline. The following data are available for the two plants:

All fixed costs per unit are calculated based on a normal capacity usage consisting of 240 working days. When the number of working days exceeds 240, overtime charges raise the variable

Portal Corporation is expected to produce and sell 192,000 power generators during the coming year.

Wanting to take advantage of the higher operating income per unit at Moline, the company’s production manager has decided to manufacture 96,000 units at each plant, resulting in a plan in which Moline operates at maximum capacity (320 units per day × 300 days) and Peoria operates at its normal volume (400 units per day × 240 days).

- 1. Calculate the breakeven point in units for the Peoria plant and for the Moline plant. Required

- 2. Calculate the operating income that would result from the production manager’s plan to produce 96.000 units at each plant.

- 3. Determine how the production of 192,000 units should be allocated between the Peoria and Moline plants to maximize operating income for Portal Corporation. Show your calculations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

CUSTOM COST ACCOUNTING 15E

- Regal Executive, Inc., produces executive motor coaches and currently manufactures the cent awnings that accompany them at these costs: The company received an offer from Saied Tents to produce the awnings for $3,200 per unit and supply 1,000 awnings for the coming years estimated production. If the company accepts this offer and shuts down production of this part of the business, production workers and supervisors will be reassigned to other areas. Assume that for the short-term decision-making process demonstrated in this problem, the companys total labor costs (direct labor and supervisor salaries) will remain the same if the bar inserts are purchased. The specialized equipment cannot be used and has no market value. However, the space occupied by the awning production can be used by a different production group that will lease it for $60,000 per year. Should the company make or buy the awnings?arrow_forwardBoston Executive. Inc., produces executive limousines and currently manufactures the mini-bar inset at these costs: The company received an offer from Elite Mini-Bars to produce the insets for $2,100 per Unit and supply 1,000 mini-bars for the coming years estimated production. If the company accepts this offer and shuts down production of this part of the business, production workers and supervisors will be reassigned to other areas. Assume that for the short-term decision-making process demonstrated in this problem, the companys total labor costs (direct labor and supervisor salaries) will remain the same if the bar inserts are purchased. The specialized equipment cannot be used and has no market value. However, the space occupied by the mini bar production can be used by a different production group that will lease it for $55,000 per year. Should the company make or buy the mini-bar insert?arrow_forwardA company is considering a special order for 1,000 units to be priced at 8.90 (the normal price would be 11.50). The order would require specialized materials costing 4.00 per unit. Direct labor and variable factory overhead would cost 2.15 per unit. Fixed factory overhead is 1.20 per unit. However, the company has excess capacity, and acceptance of the order would not raise total fixed factory overhead. The warehouse, however, would have to add capacity costing 1,300. Which of the following is relevant to the special order? a. 11.50 b. 1.20 c. 7.35 d. 8.90arrow_forward

- Remarkable Enterprises requires four units of part A for every unit of Al that it produces. Currently, part A is made by Remarkable, with these per-unit costs in a month when 4,000 units were produced: Variable manufacturing overhead is applied at $1.60 per unit. The other $0.50 of overhead consists of allocated fixed costs. Remarkable will need 8,000 units of part A for the next years production. Altoona Corporation has offered to supply 8,000 units of part A at a price of $8.00 per unit. If Remarkable accepts the offer, all of the variable costs and $2,000 of the fixed costs will be avoided. Should Remarkable accept the offer from Altoona Corporation?arrow_forwardPinter Company had the following environmental activities and product information: 1. Environmental activity costs 2. Driver data 3. Other production data Required: 1. Calculate the activity rates that will be used to assign environmental costs to products. 2. Determine the unit environmental and unit costs of each product using ABC. 3. What if the design costs increased to 360,000 and the cost of toxic waste decreased to 750,000? Assume that Solvent Y uses 6,000 out of 12,000 design hours. Also assume that waste is cut by 50 percent and that Solvent Y is responsible for 14,250 of 15,000 pounds of toxic waste. What is the new environmental cost for Solvent Y?arrow_forwardSage Company is operating at 90% of capacity and is currently purchasing a part used in its manufacturing operations for $13.00 per unit. The unit cost for the business to make the part is $21.00, including fixed costs, and $11.00, not including fixed costs. If 39,927 units of the part are normally purchased during the year but could be manufactured using unused capacity, the amount of differential cost increase or decrease from making the part rather than purchasing it would be a a.$79,854 cost decrease b.$319,416 cost increase c.$79,854 cost increase d.$519,051 cost decreasearrow_forward

- Cullumber Water Co. is a leading producer of greenhouse irrigation systems. Currently, the company manufactures the timer unit used in each of its systems. Based on an annual production of 52,000 timers, the company has calculated the following unit costs. Direct fixed costs include supervisory and clerical salaries and equipment depreciation. Direct materials Direct labor Variable manufacturing overhead Direct fixed manufacturing overhead Allocated fixed manufacturing overhead Total unit cost $12 7 4 9 541 10 (30% salaries, 70% depreciation) Clifton Clocks has offered to provide the timer units to Cullumbet at a price of $36 per unit. If Cullumber accepts the offer, the current timer unit supervisory and clerical staff will be laid offarrow_forwardOffice Expert Inc. produces a component which is required for manufacturing many of its appliances. The monthly production data for the component are as follows: Monthly Production Data for Component Production Data Amounts Number of units produced 2,500 units Variable costs per unit $10 per unit Total monthly fixed costs (allocated) $18,000 The company received an offer from a foreign supplier to purchase the component for $15 per unit. The monthly fixed costs are unavoidable. However, if Office Expert decides to purchase the component, they can use the freed manufacturing space to earn an additional revenue of $20,000 per month. If Office Expert decides to purchase from the foreign supplier, monthly operating income would – Group of answer choices Decrease by $24,000 Increase by $7,500 Increase by $25,500 Decrease by $12,500arrow_forwardMountainburg Industries has developed two new products but has only enough plant capacity to introduce one product during the current year. The following data will assist management in deciding which product should be selected.Mountainburg's fixed overhead includes rent and utilities, equipment depreciation, and supervisory salaries. Selling and administrative expenses are not allocated to individual products. The difference between the $100 estimated selling price for Mountainburg's Product W and its total manufacturing cost of $88 representsarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning