Concept explainers

CVP Analysis—Sensitivity Analysis (spreadsheet recommended)

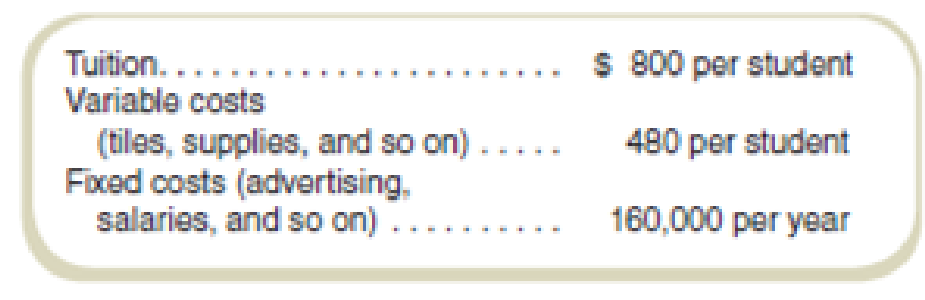

Alameda Tile sells products to many people remodeling their homes and thinks that it could profitably offer courses on tile installation, which might also increase the demand for its products. The basic installation course has the following (tentative) price and cost characteristics:

Required

- a. What enrollment will enable Alameda Tile to break even?

- b. How many students will enable Alameda Tile to make an operating profit of $80,000 for the year?

- c. Assume that the projected enrollment for the year is 800 students for each of the following (considered independently):

- 1. What will be the operating profit (for 800 students)?

- 2. What would be the operating profit if the tuition per student (that is, sales price) decreased by 10 percent? Increased by 20 percent?

- 3. What would be the operating profit if variable costs per student decreased by 10 percent? Increased by 20 percent?

- 4. Suppose that fixed costs for the year are 10 percent lower than projected, whereas variable costs per student are 10 percent higher than projected. What would be the operating profit for the year?

a.

Calculate the enrolment required to break-even for Company A.

Answer to Problem 53P

Company A requires 500 enrolments to break-even.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Contribution margin: The excess of sales price over the variable expenses is referred to as the contribution margin. It is computed by deducting the variable expenses from the sales revenue.

Compute the break-even point:

Thus, Company A requires 500 enrolments to break-even.

Working note 1:

Compute the contribution margin:

b.

Calculate the enrolment required to make the operating profit of $80,000 for the year.

Answer to Problem 53P

Company A requires 750 enrolments to make the operating profit of $80,000 for the year.

Explanation of Solution

Operating profit: The operating profit is the excess of total revenues over total expenses after adjusting for depreciation and taxes.

Compute the enrolments required to make the operating profit of $80,000 for the year:

Thus, Company A requires 750 enrolments to make the operating profit of $80,000 for the year.

c.

- 1. Calculate the operating profit of 800 students.

- 2. Calculate the operating profit when tuition fee per students decreases by 10%. Increases by 20%.

- 3. Calculate the operating profit when the variable cost per students decreases by 10%. Increases by 20%.

- 4. Calculate the operating profit when fixed cost decreases by 10% and variable cost increases by 10%.

Answer to Problem 53P

- 1. Operating profit for selling 800 units is $96,000.

- 2. Operating profit will be $32,000 if the tuition fee per student decreases by 10%.

Operating profit will be $224,000 if tuition fee per student increases by 20%.

- 3. Operating profit will be $134,400 if the variable cost per student decreases by 10%.

Operating profit will be $19,200 if the variable cost per student increases by 20%.

- 4. Operating profit will be $73,600 if fixed costs for the year are 10 per cent lower than projected, whereas variable costs per student are 10 per cent higher than projected.

Explanation of Solution

Target volume: the level of sales which need to be achieved during a particular period of time is termed as target volume.

Target profit: the amount of profit which needs to be achieved during a particular period of time on a particular level of sales is termed as target profit.

1.

Compute the operating profit for 800 units:

Thus, operating profit for selling 800 units is $96,000.

2.

(I)

Calculate the operating profit when tuition fee per students decreases by 10%.

Thus, operating profit will be 32,000 if tuition fee per student decreases by 10%.

Working note 2:

Revised sales price:

(II)

Calculate the operating profit when tuition fee per students increases by 20%:

Thus, operating profit will be 224,000 if tuition fee per student increases by 20%.

Working note 3:

Revised sales price:

3.

(I)

Calculate the operating profit when variable per students decreases by 10%.

Thus, operating profit will be 134,400 if the variable cost per student decreases by 10%.

Working note 4:

Revised variable cost:

(II)

Calculate the operating profit when the variable cost per students increases by 20%:

Thus, operating profit will be $19,200 if the variable cost per student increases by 20%.

Working note 5:

Revised variable price:

4.

Compute the operating profit if fixed costs for the year are 10 per cent lower than projected, whereas variable costs per student are 10 per cent higher than projected:

Thus, operating profit will be $73,600 if fixed costs for the year are 10 per cent lower than projected, whereas variable costs per student are 10 per cent higher than projected.

Working note 6:

Compute the revised variable cost:

Working note 7:

Compute the revised fixed cost:

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Ethical Behavior Consider the following scenario between Dave, a printer, and Steve, an assistant in the local universitys athletic department. Steve: Dave, our department needs to have 10,000 posters printed for the basketball team for next year. Heres the mock-up, and well need them in a month. How much will you charge? Dave: Well, given the costs I have for ink and paper, 1 can come in at around 5,000. Steve: Great, heres what I want you to do. Print me up an invoice for 7,500. Huts our budget. Then, when they pay you, you give me a check for 2,500. Ill make sure that you get the job. Required: CONCEPTUAL CONNECTION Is Steves proposal ethical? What should Dave do?arrow_forwardKeith Golding has decided to purchase a personal computer. He has narrowed his choices to two: Brand A and Brand B. Both brands have the same processing speed, hard disk capacity, RAM, graphics card memory, and basic software support package. Both come from companies with good reputations. The selling price for each is identical. After some review, Keith discovers that the cost of operating and maintaining Brand A over a three-year period is estimated to be 200. For Brand B, the operating and maintenance cost is 600. The sales agent for Brand A emphasized the lower operating and maintenance cost. She claimed that it was lower than any other PC brand. The sales agent for Brand B, however, emphasized the service reputation of the product. She provided Keith with a copy of an article appearing in a PC magazine that rated service performance of various PC brands. Brand B was rated number one. Based on all the information, Keith decided to buy Brand B. Required: 1. What is the total product purchased by Keith? 2. Is the Brand A company pursuing a cost leadership or differentiation strategy? The Brand B company? Explain. 3. When asked why he purchased Brand B, Keith replied, I think Brand B offered more value than Brand A. What are the possible sources of this greater value? If Keiths reaction represents the majority opinion, what suggestions could you offer to help improve the strategic position of Brand A?arrow_forwardFinancial and Nonfinancial Aspects of Changing to JIT IntelliTalk manufactures smart phones. It is considering the implementation of a JIT system. Costs to reconfigure the production line will amount to 200,000 annually. Estimated benefits from the change to JIT are as follows: The quality advantages of JIT should reduce current rework cost of 300,000 by 25%. Materials storage, handling, and insurance costs of 250,000 would be reduced by an estimated 40%. Average inventory is expected to decline by 300,000 units, and the carrying cost per unit is .35. Required: 1. What is the estimated financial advantage or disadvantage of changing to a JIT system? 2. Are there any nonfinancial advantages or disadvantages of changing to a JIT system?arrow_forward

- Shonda & Shonda is a company that does land surveys and engineering consulting. They have an opportunity to purchase new computer equipment that will allow them to render their drawings and surveys much more quickly. The new equipment will cost them an additional $1.200 per month, but they will be able to increase their sales by 10% per year. Their current annual cost and break-even figures are as follows: A. What will be the impact on the break-even point if Shonda & Shonda purchases the new computer? B. What will be the impact on net operating income if Shonda & Shonda purchases the new computer? C. What would be your recommendation to Shonda & Shonda regarding this purchase?arrow_forwardColin OShea has a carpentry shop that employs 4 carpenters. Colin received an order for 1,000 coffee tables. The coffee tables have a round table top and four decorative legs. An offer for $500 per table was received. Colin found an unfinished round table top that he could buy for $50 each. A. Using this quantitative cost data to make the table top, should Colin buy the table top or make it? B. What qualitative factors would be included in your decision. B. Can the vendor make it to the same quality standards? Can it be completed on time? Is there idle capacity in the factory that could be used?arrow_forwardAlameda Tile sells products to many people remodeling their homes and thinks that it could profitably offer courses on tile installation, which might also increase the demand for its products. The basic installation course has the following (tentative) price and cost characteristics. Need Assistance with Req C2, Req C3, Req C4arrow_forward

- You own a furniture manufacturing company. You are looking to expand into glass furniture and need to buy new manufacturing equipment to manufacture this type of furniture. You have researched many suppliers but have found that two machines will best suit your needs. The cost of machine 1 is $90,000, and the cost of machine 2 is $110,000. The estimated net profits the machines will generate are in the following table: Net Profit Machine 1 (cost $90,000) Machine 2 (cost $110,000) Year 1 $20,000 $10,000 Year 2 $30,000 $20,000 Year 3 $40,000 $40,000 Year 4 $20,000 $60,000 Year 5 $20,000 $50,000 Total $130,000 $180,000 Compare the ARR for both machines and decide which machine you should buy? 2.Critically evaluate the ARR technique in evaluating investment options?arrow_forwardYou own a furniture manufacturing company. You are looking to expand into glass furniture and need to buy new manufacturing equipment to manufacture this type of furniture. You have researched many suppliers but have found that two machines will best suit your needs. The cost of machine 1 is $90,000, and the cost of machine 2 is $110,000. The estimated net profits the machines will generate are in the attached image. a)Compare the ARR for both machines and decide which machine you should buy. b)Critically evaluate the ARR technique in evaluating investment options.arrow_forwardPart A A software company is considering launching a new product in the market. To record consumer behavior, the company participated in two domestic software fairs in Athens and Thessaloniki that costed €7,000. The results showed that there are two Scenarios (A and B) whose probabilities of occurrence are 60% and 40% respectively, based on consumers’ willingness to buy the new product. To start production, €100,000 is required for new machinery, plus another €2,000 for transport costs and €1,000 for installation costs. This is a state-of-the-art technology machinery, thus, its economic life is only two years. The new machinery will be fully depreciated at the end of its economic life and the company applies the straight-line depreciation method. Table 1 shows the estimated figures on sales, variable costs, selling price, management and distribution costs and working capital needs. At the end of the second year the working capital will be recovered. Table 1: Estimated financial data…arrow_forward

- Making pricing decisions Johnson Builders builds 1,500—square-foot starter tract homes in the fast-growing suburbs of Atlanta. Land and labor are cheap, and competition among developers is fierce. The homes are a standard model, with any upgrades added by the buyer after the sale. Johnson Builders’s costs per developed sublot are as follows: Johnson Builders would like to earn a profit of 14% of the variable cost of each home sold. Similar homes offered by competing builders sell for $207,000 each. Assume the company has no fixed costs. Requirements Which approach to pricing should Johnson Builders emphasize? Why? Will Johnson Builders be able to achieve its target profit levels? Bathrooms and kitchens are typically the most important selling features of a home. Johnson Builders could differentiate the homes by upgrading the bathrooms and kitchens. The upgrades would cost $16,000 per home but would enable Johnson Builders to increase the sales prices by $28,000 per home. (Kitchen and…arrow_forwardEthics and pricing. Instyle Interior Designs has been requested to prepare a bid to decorate four model homes for a new development. Winning the bid would be a big boost for sales representative Jim Doogan, who works entirely on commission. Sara Groom, the cost accountant for Instyle, prepares the bid based on the following cost information: Based on the company policy of pricing at 120% of full cost, Groom gives Doogan a figure of $165,600 to submit for the job. Doogan is very concerned. He tells Groom that at that price, Instyle has no chance of winning the job. He confides in her that he spent $600 of company funds to take the developer to a basketball playoff game where the developer disclosed that a bid of $156,000 would win the job. He hadn’t planned to tell Groom because he was confident that the bid she developed would be below that amount. Doogan reasons that the $600 he spent will be wasted if Instyle doesn’t capitalize on this valuable information. In any case, the company…arrow_forwardMaking pricing decisions Johnson Builders builds 1,500—square-foot starter tract homes in the fast-growing suburbs of Atlanta. Land and labor are cheap, and competition among developers is fierce. The homes are a standard model, with any upgrades added by the buyer after the sale. Johnson Builders’s costs per developed sub lot are as follows: Johnson Builders would like to earn a profit of 14% of the variable cost of each home sold. Similar homes offered by competing builders sell for $207,000 each. Assume the company has no fixed costs. Requirements Which approach to pricing should Johnson Builders emphasize? Why? Will Johnson Builders be able to achieve its target profit levels? Bathrooms and kitchens are typically the most important selling features of a home. Johnson Builders could differentiate the homes by upgrading the bathrooms and kitchens. The upgrades would cost $16,000 per home but would enable Johnson Builders to increase the sales prices by $28,000 per home. (Kitchen and…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning