Operations Management: Processes and Supply Chains, Student Value Edition Plus MyLab Operations Management with Pearson eText -- Access Card Package (12th Edition)

12th Edition

ISBN: 9780134855424

Author: Lee J. Krajewski, Manoj K. Malhotra, Larry P. Ritzman

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

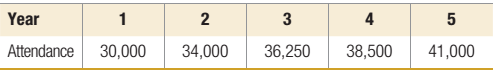

Chapter 4, Problem 12P

The Astro World amusement park has the opportunity to expand its size now (the end of year 0) by purchasing adjacent property for $250,000 and adding attractions at a cost of $550,000. This expansion is expected to increase attendance by 30 percent over projected attendance without expansion. The price of admission is $30, with a $5 increase planned for the beginning of year 3. Additional operating costs are expected to be $100,000 per year. Estimated attendance for the next five years, without expansion, is as follows:

- What are the pretax combined cash flows for years 0 through 5 that are attributable to the park’s expansion?

- Ignoring tax,

depreciation , and the Lime value of money, determine how long it will take to recover (pay back) the investment.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The Astro World amusement park has the opportunityto expand its size now (the end of year 0) by purchasingadjacent property for $250,000 and adding attractions ata cost of $550,000. This expansion is expected to increaseattendance by 30 percent over projected attendance with-out expansion. The price of admission is $30, with a $5increase planned for the beginning of year 3. Additionaloperating costs are expected to be $100,000 per year.Estimated attendance for the next five years, withoutexpansion, is as follows:

a. What are the pretax combined cash flows for years 0through 5 that are attributable to the park’s expansion?b. Ignoring tax, depreciation, and the time value of money,determine how long it will take to recover (pay back) theinvestment.

What is the future worth (in Year 10) of $23,000 deposited at the end of Year 3 plus $28,000 deposited at the end of Year 5, and $20,000 deposited at the end of Year 8 at an interest rate of 5% per year?

Kabelo and Hendrik are joint owners of Fitness Gym. They are currently investigating the option of investing in cryotherapy, a cold therapy that may reduce inflammation in tendons or joints. Their investment would provide Fitness Gym members with equipment which may be used to reduce post-exercise recovery times, at an additional cost. The addition of cryotherapy to the gym represents a strategic service for Fitness Gym. Which one of the following statements reflect the importance of capital-investment projects such as the example above.

a.

The relative magnitude of the amounts involved.

b.

The short-term nature of capital-investment decisions.

c.

The operational nature of capital-investment projects.

d.

The direct effect of the time value of money on capital-investment projects.

Chapter 4 Solutions

Operations Management: Processes and Supply Chains, Student Value Edition Plus MyLab Operations Management with Pearson eText -- Access Card Package (12th Edition)

Ch. 4 - Prob. 1DQCh. 4 - Prob. 2DQCh. 4 - The Dahlia Medical Center has 30 labor rooms, 15...Ch. 4 - A process currently services an average of 50...Ch. 4 - An airline company must plan its fleet capacity...Ch. 4 - Food Goblin Supermarkets use both cashiers and...Ch. 4 - Returning to Problem 4, under both assumption of...Ch. 4 - Purple Swift manufactures birdhouses in lots of...Ch. 4 - Macon Controls produces three different types of...Ch. 4 - Up, Up, and Away is a producer of kites and wind...

Ch. 4 - Tuff-Rider, Inc. manufactures touring bikes and...Ch. 4 - Arabelle is considering expanding the floor area...Ch. 4 - The Astro World amusement park has the opportunity...Ch. 4 - Kim Epson operates a full-service car wash, which...Ch. 4 - MKM International is seeking to purchase a new CNC...Ch. 4 - Prob. 17PCh. 4 - Prob. 18PCh. 4 - Prob. 19PCh. 4 - Dawson Electronics is a manufacturer of high-tech...Ch. 4 - A manager is trying to decide whether to buy one...Ch. 4 - Acme Steel Fabricators experienced booming...Ch. 4 - Referring to Problem 7, the operations manager at...Ch. 4 - Darren Mack owns the Gas n’ Go convenience store...Ch. 4 - Prob. 25PCh. 4 - Prob. 1VCCh. 4 - Prob. 2VCCh. 4 - How does Southwest Airlines know they are...Ch. 4 - Prob. 4VCCh. 4 - Prob. 1CCh. 4 - Prob. 2CCh. 4 - Prob. 3C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- The Tinkan Company produces one-pound cans for the Canadian salmon industry. Each year the salmon spawn during a 24-hour period and must be canned immediately. Tinkan has the following agreement with the salmon industry. The company can deliver as many cans as it chooses. Then the salmon are caught. For each can by which Tinkan falls short of the salmon industrys needs, the company pays the industry a 2 penalty. Cans cost Tinkan 1 to produce and are sold by Tinkan for 2 per can. If any cans are left over, they are returned to Tinkan and the company reimburses the industry 2 for each extra can. These extra cans are put in storage for next year. Each year a can is held in storage, a carrying cost equal to 20% of the cans production cost is incurred. It is well known that the number of salmon harvested during a year is strongly related to the number of salmon harvested the previous year. In fact, using past data, Tinkan estimates that the harvest size in year t, Ht (measured in the number of cans required), is related to the harvest size in the previous year, Ht1, by the equation Ht = Ht1et where et is normally distributed with mean 1.02 and standard deviation 0.10. Tinkan plans to use the following production strategy. For some value of x, it produces enough cans at the beginning of year t to bring its inventory up to x+Ht, where Ht is the predicted harvest size in year t. Then it delivers these cans to the salmon industry. For example, if it uses x = 100,000, the predicted harvest size is 500,000 cans, and 80,000 cans are already in inventory, then Tinkan produces and delivers 520,000 cans. Given that the harvest size for the previous year was 550,000 cans, use simulation to help Tinkan develop a production strategy that maximizes its expected profit over the next 20 years. Assume that the company begins year 1 with an initial inventory of 300,000 cans.arrow_forwardThe lease cost for a specialized highway design software package is estimated to be $13,000 for each of years 1, 2, and 3 (future dollars). (a) Calculate the CV amount today (year 0) of each future cost estimate at the inflation rate of 6% per year. (b) Develop a spreadsheet and graph for inflation rates of 3%, 6%, and 8% per year that show the CV today.arrow_forwardGeorge Zegoyan and Amir Gupta face a difficult decision. Their private auto parts manufacturing company has been a great success - too quickly. They cannon keep up with the demand for their product. They must expand their facilities, but have not had time to accumulate sufficient working capital, nor do they want to acquire long-term debt to finance the expansion. Discussions with there accountants, lawyers, and stockbrokers have confronted them with the necessity of going public to raise the required capital. Zegoyan and Gupta are concerned about maintaining control if they become a public company. They are also worried about loss of privacy because of the required reporting to various regulatory bodies and their their shareholders. Naturally, they are also pleased that the process will enable them to sell some of their shareholdings to the public and realize a faiir profit from their past and expected future successes. They will be able to sell 40 percent of the shares for…arrow_forward

- Problem 1: A government committee is considering the economic benefits of a program of preventative flu vaccinations. We will assume that the flu vaccine is completely effective so if the vaccine is implemented, there will be no flu cases. It is estimated that a vaccination program will cost $9 million and that the probability of flu striking in the next year is 0.70. If vaccinations are not introduced then the estimated cost to the government if flu strikes in the next year is $7 million with probability 0.15, $10 million with probability 0.25 and $15 million with probability 0.6. One alternative open to the committee is to institute an "early-warning" monitoring scheme (costing $3 million) which will enable it to detect an outbreak of flu early and therefore decide whether or not to institute a rush vaccination program (costing $12 million because of the need to vaccinate quickly before the outbreak spreads, again with the vaccine being completely effective) or to do nothing with…arrow_forwardJasmine owns 12 apartment buildings in a college town, which it rents exclusively to students. Each apartment building contains 120 rental units, but the owner is having cash flow problems due to an average vacancy rate of nearly 50 percent. The apartments in each building have comparable floor plans, but some buildings are closer to campus than others. Jasmine’s accumulated data from last year on the number of apartments rented, the rental price (in dollars), and the amount spent on advertising (in hundreds of dollars) at each of the 12 apartments are available below. These data, along with the distance (in miles) from each apartment building to campus, are presented below. Jasmine is looking for expert advice on the available data to inform administrative and business policy. By applying this scenario, help her regress the quantity demanded of her apartments on price, advertising, and distance datasets by using Excel or SPSS. Observation or (Number of Apartments) Quantity…arrow_forwardProblems LU - 2 Wally Beaver won a lottery and will receive a check for $2,500 at the beginning of each 6 months for the next 6 years. If Wally deposits each check into an account that pays 6%, how much will he have at the end of the 6 years?arrow_forward

- Mono Industries has a project with the following projected cash flows: Initial Cost, Year 0: P200,000 Cash flow year one: P25,000 Cash flow year two: P75,000 Cash flow year three: P150,000 Cash flow year four: P150,000 Using a 10% discount rate for this project and the NPV model, should this project be accepted or rejected?arrow_forwardHarley, an ice-cream vendor, purchases each pint of ice-cream for $7 and sells for $20 each. At the end of the week, the unsold ice-cream can be salvaged for $2 each. From past experience, Harley has estimated the sales probabilities as below. What is the optimal number of pints Harley should purchase? Number of Ice-creams Sold, Probability 1 = 0.05, 2 = 0.1, 3 = 0.2 , 4 = 0.25, 5 = 0.15, 6 = 0.1, 7 = 0.08, 8 = 0.07arrow_forwardGlobal Logistics needs to rent space for storing product for the next three years. The following information regarding the demand and spot price is available. Current demand for the product is 150,000. Historically, Global Logistics has required 1500 square feet to store 1500 units of the product. Demand for the product can go up by 20% with a probability of 0.7 or down by 20% with a probability of 0.3. Global Logistics can sign a three-year fixed lease to rent 150,000 square feet of space at $1.00 per square foot per year. The firm may also choose to obtain warehousing space on the spot market. The current spot market price is $1.20 per square foot per year. The spot price can go up by 10% with a probability of 0.8 and can decrease by 10% with a probability of 0.2. The firm receives a revenue of $1.22 for each unit of demand. a) Create a decision tree showing period 0, 1 and 2 for the scenario described above. b) Calculate the NPV for the option when the firm decides to sign a…arrow_forward

- The Star Youth Soccer Club helps to support its 20 boys' and girls' teams financially, primarily through the payment of coaches. The club puts on a tournament each fall to help pay its expenses. The cost of putting on the tournament is $8,000, mainly for development, printing, and mailing of the tournament brochures. The tournament entry fee is $400 per team. For every team that enters, it costs the club about $75 to pay referees for the three-game minimum each team is guaranteed. If the club needs to clear $60,000 from the tournament, how many teams should it invite?arrow_forwardBased on Exhibit 9-9, or using a financial calculator, what would be the monthly mortgage payments for each of the following situations? Note: Round time value factor and final answers to 2 decimal places. What relationship exists between the length of the loan and the monthly payment? How does the mortgage rate affect the monthly payment? Monthly Mortgage Payment a. $123,000, 15-year loan at 6.00 percent. b. $165,000, 30-year loan at 7.50 percent. c. $68,000, 20-year loan at 7.50 percent. d-1. Longer mortgage terms mean a monthly payment. d-2. For increase in mortgage rate monthly payment is required.arrow_forwardGrand Garden is a hotel with 140 suites. Its regular suite price is $210 per night per suite. The hotel’s total cost per night is $150 per suite and consists of the following. Variable cost $ 110 Fixed cost 40 Total cost per night per suite $ 150 The hotel manager receives an offer to hold the local Bikers’ Club meeting at the hotel in March, which is the hotel’s slow season with a low occupancy rate per night. The Bikers’ Club would reserve 120 suites for one night if the hotel accepts a price of $118 per night.(a) What is the contribution margin from this special offer?(b) Should the Bikers’ Club offer be accepted or rejected?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Inventory Management | Concepts, Examples and Solved Problems; Author: Dr. Bharatendra Rai;https://www.youtube.com/watch?v=2n9NLZTIlz8;License: Standard YouTube License, CC-BY