Concept explainers

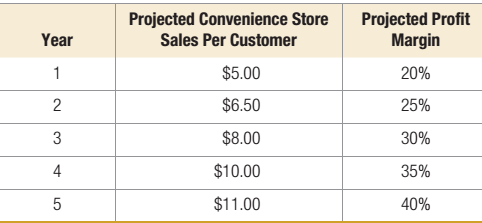

Darren Mack owns the Gas n’ Go convenience store and gas station. After hearing a marketing lecture, he realizes that it might be possible to draw more customers to his high-margin convenience store by selling his gasoline at a lower price. However, the Gas n’ Go is unable to qualify for volume discounts on its gasoline purchases, and therefore cannot sell gasoline for profit if the price is lowered. Each new pump will cost $95,000 to install, but will increase customer traffic in the store by 1,000 customers per year. Also, because the Gas n’ Go would be selling its gasoline at no profit, Darren plans on increasing the profit margin on convenience store items incrementally over the next 5 years. Assume a discount rate of 8 percent. The projected convenience store sales per customer and the projected profit margin for the next 5 years are as follows:

- What is the

NPV of the next 5 years of cash flows if Darren had four new pumps installed? - If Darren required a payback period of 4 years, should he go ahead with the installation of the new pumps?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Operations Management: Processes and Supply Chains, Student Value Edition Plus MyLab Operations Management with Pearson eText -- Access Card Package (12th Edition)

Additional Business Textbook Solutions

Principles Of Operations Management

Operations Management

Operations and Supply Chain Management 9th edition

OPERATIONS MANAGEMENT IN THE SUPPLY CHAIN: DECISIONS & CASES (Mcgraw-hill Series Operations and Decision Sciences)

Operations Management, Binder Ready Version: An Integrated Approach

Loose-leaf for Operations Management (The Mcgraw-hill Series in Operations and Decision Sciences)

- Seas Beginning sells clothing by mail order. An important question is when to strike a customer from the companys mailing list. At present, the company strikes a customer from its mailing list if a customer fails to order from six consecutive catalogs. The company wants to know whether striking a customer from its list after a customer fails to order from four consecutive catalogs results in a higher profit per customer. The following data are available: If a customer placed an order the last time she received a catalog, then there is a 20% chance she will order from the next catalog. If a customer last placed an order one catalog ago, there is a 16% chance she will order from the next catalog she receives. If a customer last placed an order two catalogs ago, there is a 12% chance she will order from the next catalog she receives. If a customer last placed an order three catalogs ago, there is an 8% chance she will order from the next catalog she receives. If a customer last placed an order four catalogs ago, there is a 4% chance she will order from the next catalog she receives. If a customer last placed an order five catalogs ago, there is a 2% chance she will order from the next catalog she receives. It costs 2 to send a catalog, and the average profit per order is 30. Assume a customer has just placed an order. To maximize expected profit per customer, would Seas Beginning make more money canceling such a customer after six nonorders or four nonorders?arrow_forwardLemingtons is trying to determine how many Jean Hudson dresses to order for the spring season. Demand for the dresses is assumed to follow a normal distribution with mean 400 and standard deviation 100. The contract between Jean Hudson and Lemingtons works as follows. At the beginning of the season, Lemingtons reserves x units of capacity. Lemingtons must take delivery for at least 0.8x dresses and can, if desired, take delivery on up to x dresses. Each dress sells for 160 and Hudson charges 50 per dress. If Lemingtons does not take delivery on all x dresses, it owes Hudson a 5 penalty for each unit of reserved capacity that is unused. For example, if Lemingtons orders 450 dresses and demand is for 400 dresses, Lemingtons will receive 400 dresses and owe Jean 400(50) + 50(5). How many units of capacity should Lemingtons reserve to maximize its expected profit?arrow_forwardThe Pigskin Company produces footballs. Pigskin must decide how many footballs to produce each month. The company has decided to use a six-month planning horizon. The forecasted monthly demands for the next six months are 10,000, 15,000, 30,000, 35,000, 25,000, and 10,000. Pigskin wants to meet these demands on time, knowing that it currently has 5000 footballs in inventory and that it can use a given months production to help meet the demand for that month. (For simplicity, we assume that production occurs during the month, and demand occurs at the end of the month.) During each month there is enough production capacity to produce up to 30,000 footballs, and there is enough storage capacity to store up to 10,000 footballs at the end of the month, after demand has occurred. The forecasted production costs per football for the next six months are 12.50, 12.55, 12.70, 12.80, 12.85, and 12.95, respectively. The holding cost incurred per football held in inventory at the end of any month is 5% of the production cost for that month. (This cost includes the cost of storage and also the cost of money tied up in inventory.) The selling price for footballs is not considered relevant to the production decision because Pigskin will satisfy all customer demand exactly when it occursat whatever the selling price is. Therefore. Pigskin wants to determine the production schedule that minimizes the total production and holding costs. Can you guess the results of a sensitivity analysis on the initial inventory in the Pigskin model? See if your guess is correct by using SolverTable and allowing the initial inventory to vary from 0 to 10,000 in increments of 1000. Keep track of the values in the decision variable cells and the objective cell.arrow_forward

- The Pigskin Company produces footballs. Pigskin must decide how many footballs to produce each month. The company has decided to use a six-month planning horizon. The forecasted monthly demands for the next six months are 10,000, 15,000, 30,000, 35,000, 25,000, and 10,000. Pigskin wants to meet these demands on time, knowing that it currently has 5000 footballs in inventory and that it can use a given months production to help meet the demand for that month. (For simplicity, we assume that production occurs during the month, and demand occurs at the end of the month.) During each month there is enough production capacity to produce up to 30,000 footballs, and there is enough storage capacity to store up to 10,000 footballs at the end of the month, after demand has occurred. The forecasted production costs per football for the next six months are 12.50, 12.55, 12.70, 12.80, 12.85, and 12.95, respectively. The holding cost incurred per football held in inventory at the end of any month is 5% of the production cost for that month. (This cost includes the cost of storage and also the cost of money tied up in inventory.) The selling price for footballs is not considered relevant to the production decision because Pigskin will satisfy all customer demand exactly when it occursat whatever the selling price is. Therefore. Pigskin wants to determine the production schedule that minimizes the total production and holding costs. As indicated by the algebraic formulation of the Pigskin model, there is no real need to calculate inventory on hand after production and constrain it to be greater than or equal to demand. An alternative is to calculate ending inventory directly and constrain it to be nonnegative. Modify the current spreadsheet model to do this. (Delete rows 16 and 17, and calculate ending inventory appropriately. Then add an explicit non-negativity constraint on ending inventory.)arrow_forwardThe Pigskin Company produces footballs. Pigskin must decide how many footballs to produce each month. The company has decided to use a six-month planning horizon. The forecasted monthly demands for the next six months are 10,000, 15,000, 30,000, 35,000, 25,000, and 10,000. Pigskin wants to meet these demands on time, knowing that it currently has 5000 footballs in inventory and that it can use a given months production to help meet the demand for that month. (For simplicity, we assume that production occurs during the month, and demand occurs at the end of the month.) During each month there is enough production capacity to produce up to 30,000 footballs, and there is enough storage capacity to store up to 10,000 footballs at the end of the month, after demand has occurred. The forecasted production costs per football for the next six months are 12.50, 12.55, 12.70, 12.80, 12.85, and 12.95, respectively. The holding cost incurred per football held in inventory at the end of any month is 5% of the production cost for that month. (This cost includes the cost of storage and also the cost of money tied up in inventory.) The selling price for footballs is not considered relevant to the production decision because Pigskin will satisfy all customer demand exactly when it occursat whatever the selling price is. Therefore. Pigskin wants to determine the production schedule that minimizes the total production and holding costs. Modify the Pigskin model so that there are eight months in the planning horizon. You can make up reasonable values for any extra required data. Dont forget to modify range names. Then modify the model again so that there are only four months in the planning horizon. Do either of these modifications change the optima] production quantity in month 1?arrow_forwardThe Tinkan Company produces one-pound cans for the Canadian salmon industry. Each year the salmon spawn during a 24-hour period and must be canned immediately. Tinkan has the following agreement with the salmon industry. The company can deliver as many cans as it chooses. Then the salmon are caught. For each can by which Tinkan falls short of the salmon industrys needs, the company pays the industry a 2 penalty. Cans cost Tinkan 1 to produce and are sold by Tinkan for 2 per can. If any cans are left over, they are returned to Tinkan and the company reimburses the industry 2 for each extra can. These extra cans are put in storage for next year. Each year a can is held in storage, a carrying cost equal to 20% of the cans production cost is incurred. It is well known that the number of salmon harvested during a year is strongly related to the number of salmon harvested the previous year. In fact, using past data, Tinkan estimates that the harvest size in year t, Ht (measured in the number of cans required), is related to the harvest size in the previous year, Ht1, by the equation Ht = Ht1et where et is normally distributed with mean 1.02 and standard deviation 0.10. Tinkan plans to use the following production strategy. For some value of x, it produces enough cans at the beginning of year t to bring its inventory up to x+Ht, where Ht is the predicted harvest size in year t. Then it delivers these cans to the salmon industry. For example, if it uses x = 100,000, the predicted harvest size is 500,000 cans, and 80,000 cans are already in inventory, then Tinkan produces and delivers 520,000 cans. Given that the harvest size for the previous year was 550,000 cans, use simulation to help Tinkan develop a production strategy that maximizes its expected profit over the next 20 years. Assume that the company begins year 1 with an initial inventory of 300,000 cans.arrow_forward

- The Excel file President’s Inn Guest Database provides a list of customers, rooms they occupied, arrival and departure dates, number of occupants, and daily rate for a small bed-and-breakfast inn during one month. Room rates include breakfast and are the same for one or two guests; however, any additional guests must pay an extra $20 per person per day for breakfast. Parties staying for seven days or more receive a 10% discount on the room rate as well as any additional breakfast fees. Modify the spreadsheet to calculate the number of days that each party stayed at the inn and the total revenue for the length of stay.arrow_forwardA steel production plant manufactures bands and coils which sell at a profit of $25 and $30 per ton,respectively. The production rate of the plant for bands is 200 tons/hr, and that for coils is 140 tons/hr.Based on the market analysis, it has been identified that the weekly demand is at most 6000 tons and4000 tons for bands and coils, respectively . The plant operates for a maximum of 40 hours per week. 1. In Microsoft Excel, formulate a linear programming model instance for this problem, then solve. 2. Assume that the products need to be painted after manufacturing, and the painting departmentcan paint at a rate of 600 tons per hour for bands and 400 tons per hour for coils. The paintingdepartment works only for 20 hours. Update the linear programming model instance to accom-modate this requirement, and re-solve the problem. 3. The plant is planning to introduce another product “rods” to its production mix with the followingparameters:•Profit/ton = $40•Production volume = 150…arrow_forwardThe Scottsville Textile Mill produces several different fabrics on eight dobby looms that operate 24 hours per day and are scheduled for 30 days in the coming month. The mill will produce only Fabric 1 and Fabric 2 during the coming month. Each dobby loom can turn out 4.62 yards of either fabric per hour. Assume that there is a monthly demand of 16,000 yards of Fabric 1 and 12,000 yards of Fabric 2. Profits are calculated as 33¢ per yard for each fabric produced on the dobby looms. (a) Will it be possible to satisfy total demand? (b) In the event that total demand is not satisfied, the Scottsville Textile Mill will need to purchase the fabrics from another mill to make up the shortfall. Its profits on resold fabrics ordered from another mill amount to 20¢ per yard for Fabric 1 and 16¢ per yard for Fabric 2. How many yards of each fabric should it produce to maximize profits? (Round your answers to one decimal place. If total demand is satisfied, enter NONE.)arrow_forward

- Round Tree Manor is a hotel that provides two types of rooms with three rental classes: Super Saver, Deluxe, and Business. The profit per night for each type of room and rental class is as follows: Rental Class Super Saver Deluxe Business Room Type I (Mountain View) $35 $40 - Type II (Street View) $15 $25 $35 Round Tree's management makes a forecast of the demand by rental class for each night in the future. A linear programming model developed to maximize profit is used to determine how many reservations to accept for each rental class. The demand forecast for a particular night is 140 rentals in the Super Saver class, 65 in the Deluxe class, and 40 in the Business class. Since these are the forecasted demands, Round Tree will take no more than these amounts of each reservation for each rental class. Round Tree has a limited number of each type of room. There are 100 Type I rooms and 120 Type II rooms. (a) Formulate and solve a linear program to determine…arrow_forwardRound Tree Manor is a hotel that provides two types of rooms with three rental classes: Super Saver, Deluxe, and Business. The profit per night for each type of room and rental class is as follows: Rental Class Super Saver Deluxe Business Room Type I (Mountain View) $35 $40 - Type II (Street View) $15 $25 $35 Round Tree's management makes a forecast of the demand by rental class for each night in the future. A linear programming model developed to maximize profit is used to determine how many reservations to accept for each rental class. The demand forecast for a particular night is 140 rentals in the Super Saver class, 65 in the Deluxe class, and 40 in the Business class. Since these are the forecasted demands, Round Tree will take no more than these amounts of each reservation for each rental class. Round Tree has a limited number of each type of room. There are 100 Type I rooms and 120 Type II rooms. (a) Formulate and solve a linear program to determine…arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,