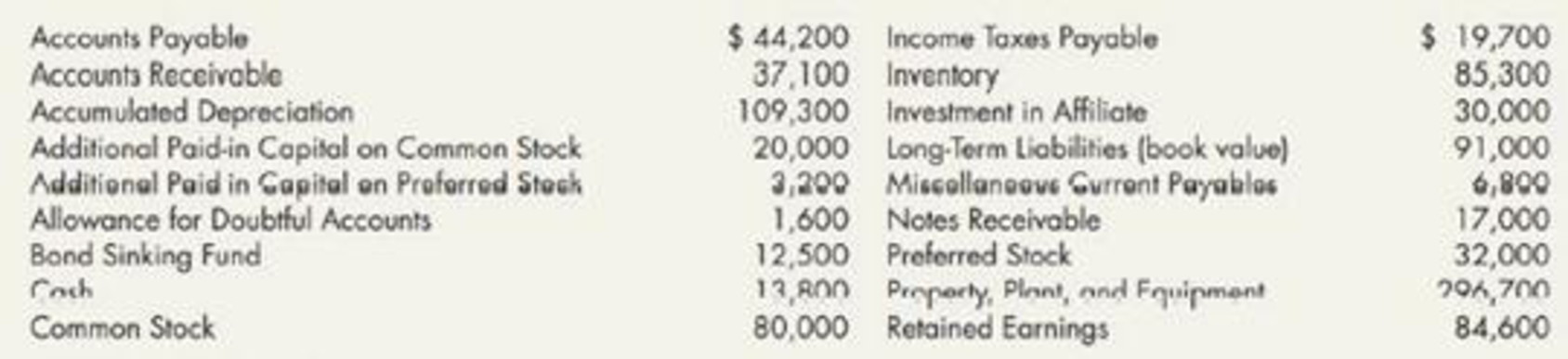

Comprehensive: Balance Sheet, Schedules, and Notes The following is an alphabetical listing of Stone Boat Company’s balances sheet accounts and account balances on December 31, 2019:

Additional information:

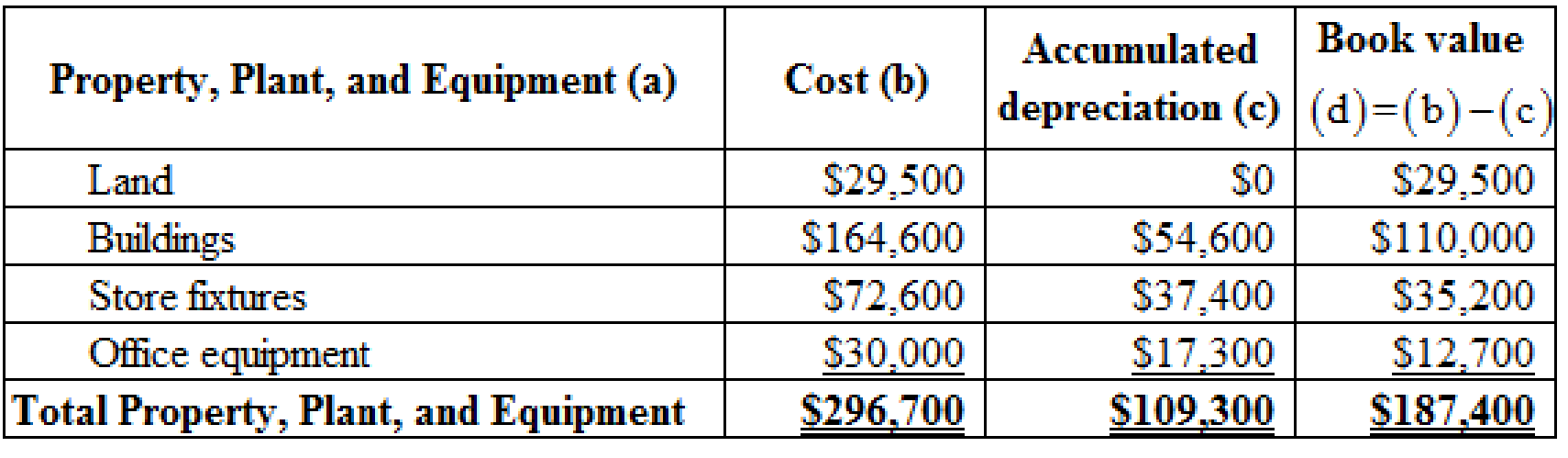

- 1. The company reports on the balance sheet the net book value of property and equipment and long-term liabilities (known as control accounts). The related details are disclosed in the notes.

- 2. The straight-line method is used to depreciate property and equipment based upon cost, estimated residual value, and estimated life. The costs of the assets in this account are: land, $29,500; buildings, $164,600; store fixtures, $72,600; and office equipment, $30,000.

- 3. The accumulated

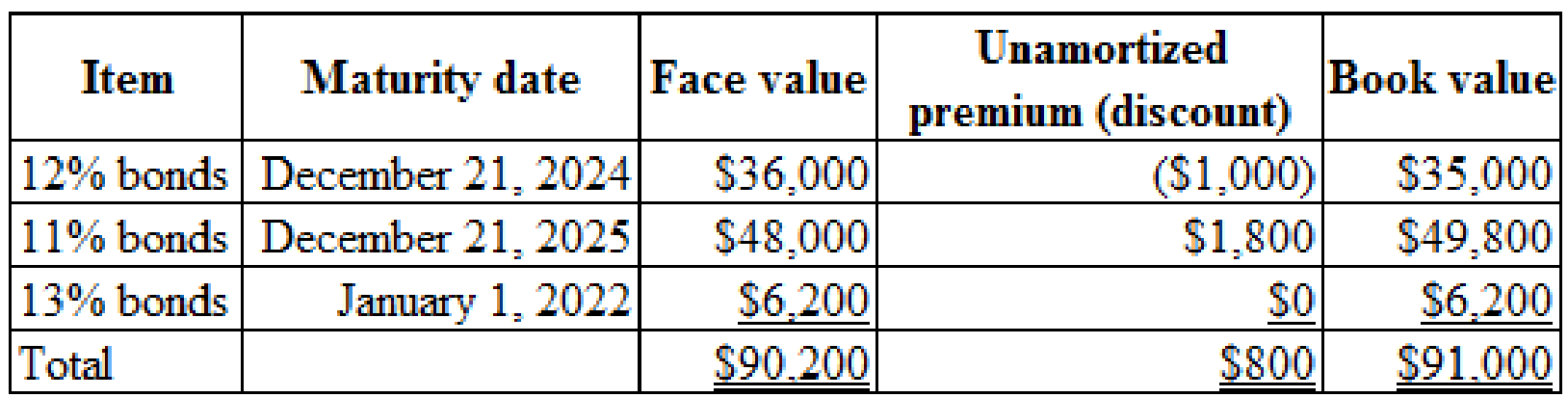

depreciation breakdown is as follows: buildings, $54,600; store fixtures, $37,400; and office equipment, $17,300. - 4. The long term debt includes 12%, $36,000 face

value bonds that mature on December 31, 2024, and have an unamortized bond discount of $1,000; 11%, $48,000 face value bonds that mature on December 31, 2025, have a premium on bonds payable of $1,800, and whose retirement is being funded by a bond sinking fund; and a 13% note payable that has a face value of $6,200 and matures on January 1, 2022. - 5. The non-interest-bearing note receivable matures on June 1, 2023.

- 6. Inventory is listed at lower of cost or market; cost is determined on the basis of average cost.

- 7. The investment in affiliate is carried at cost. The company has guaranteed the interest on 12%, $50,000, 15-year bonds issued by this affiliate, Jay Company.

- 8. Common stock has a $10 par value per share, 10,000 shares are authorized, and 1,000 shares were issued during 2019 at a price of $13 per share, resulting in 8,000 shares issued at year-end.

- 9.

Preferred stock has a $50 par value per share, 2,000 shares are authorized, and 140 shares were issued during 2019 at a price of $55 per share, resulting in 640 shares issued at year-end. - 10. On January 15, 2020, before the December 31, 2019, balance sheet was issued, a building with a cost of $20,000 and a book value of $7,000 was totally destroyed. Insurance proceeds will amount to only $5,000.

- 11. Net income and dividends declared and paid during the year were $50,500 and $21,000, respectively.

Required:

1. Prepare Stone Boat’s December 31, 2019, balance sheet (including appropriate parenthetical notations).

2. Prepare a statement of shareholders’ equity for 2019. (Hint: Work back from the ending account balances.)

3. Prepare notes that itemize the balance sheet control accounts and those necessary to disclose any company accounting policies,

4. Next Level Compute the debt-to-assets ratio at the cud of 2019. What is your evaluation of this ratio if it was 39% at the end of 2018?

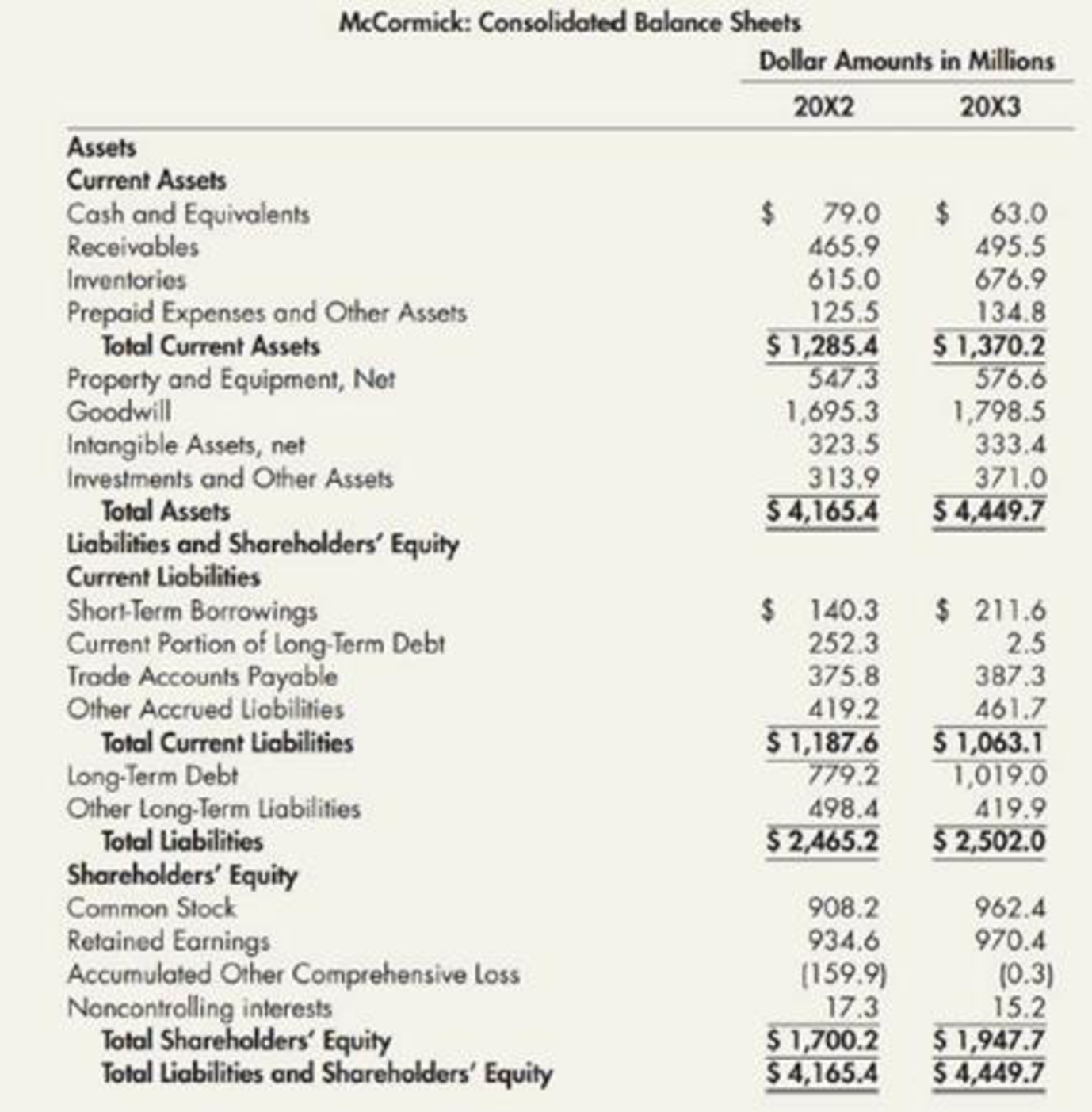

Use the following information for P4–15 and P4–16:

McCormick & Company, Inc. is one of the world’s leading producers of spices, herbs, seasonings, condiments, and other flavorings for foods. Its products are sold to consumers, with sonic of the leading brands of spices and seasonings, as well as to industrial producers of foods. McCormick’s consolidated balance sheets for 20X2 and 20X3 follow.

1.

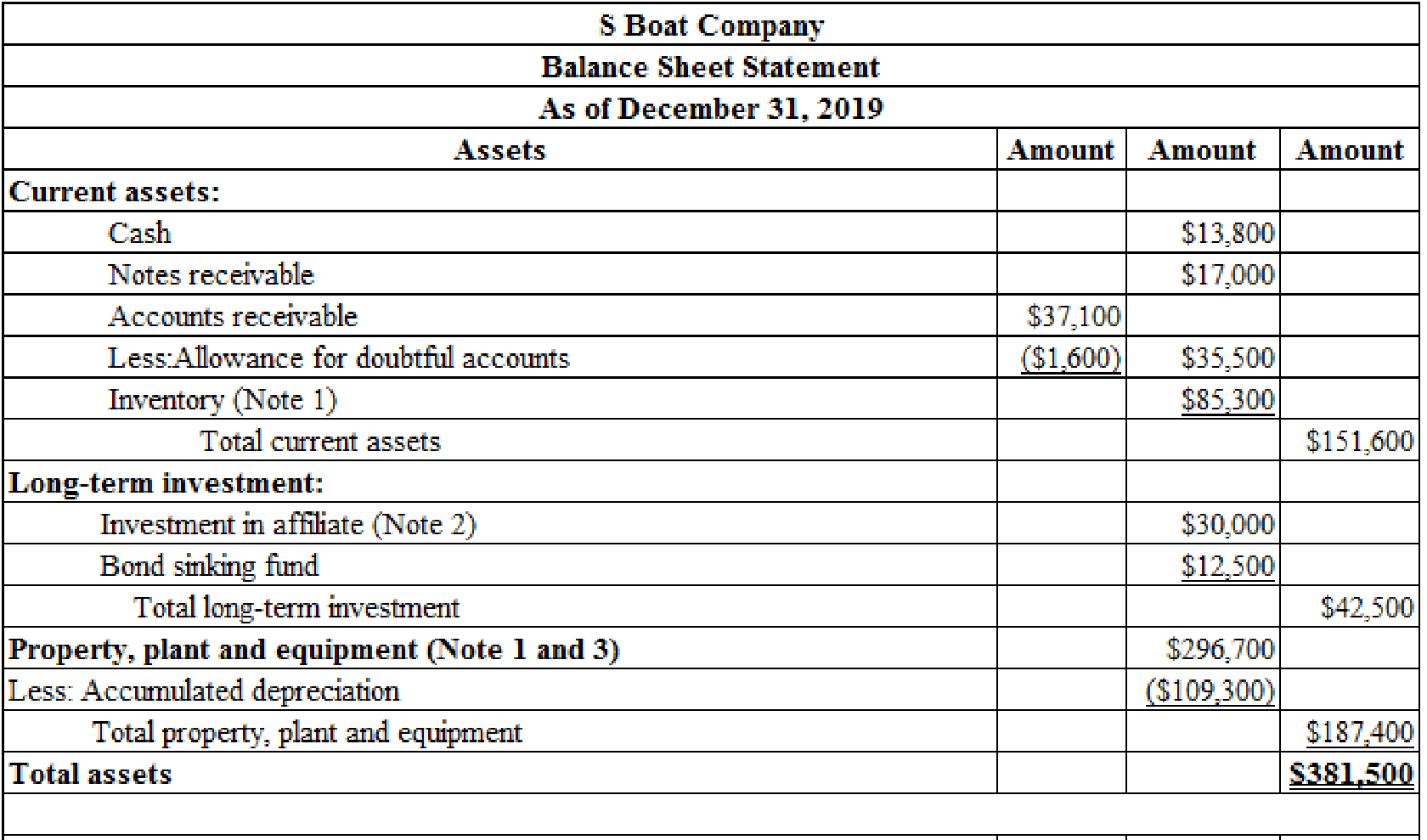

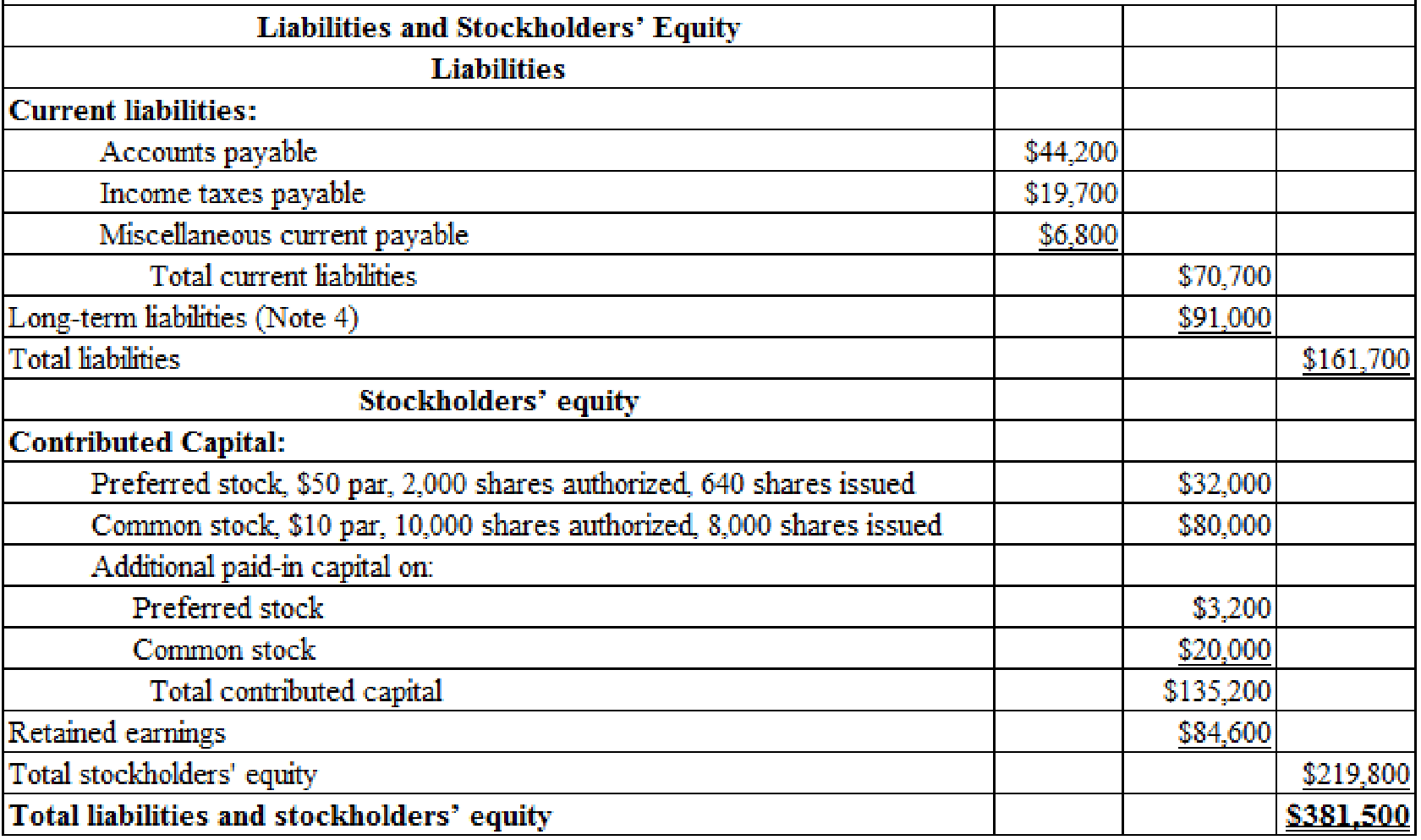

Prepare a balance sheet for S Boat Company as of December 31, 2019.

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare a balance sheet for S Boat Company as of December 31, 2019:

Table (1)

2

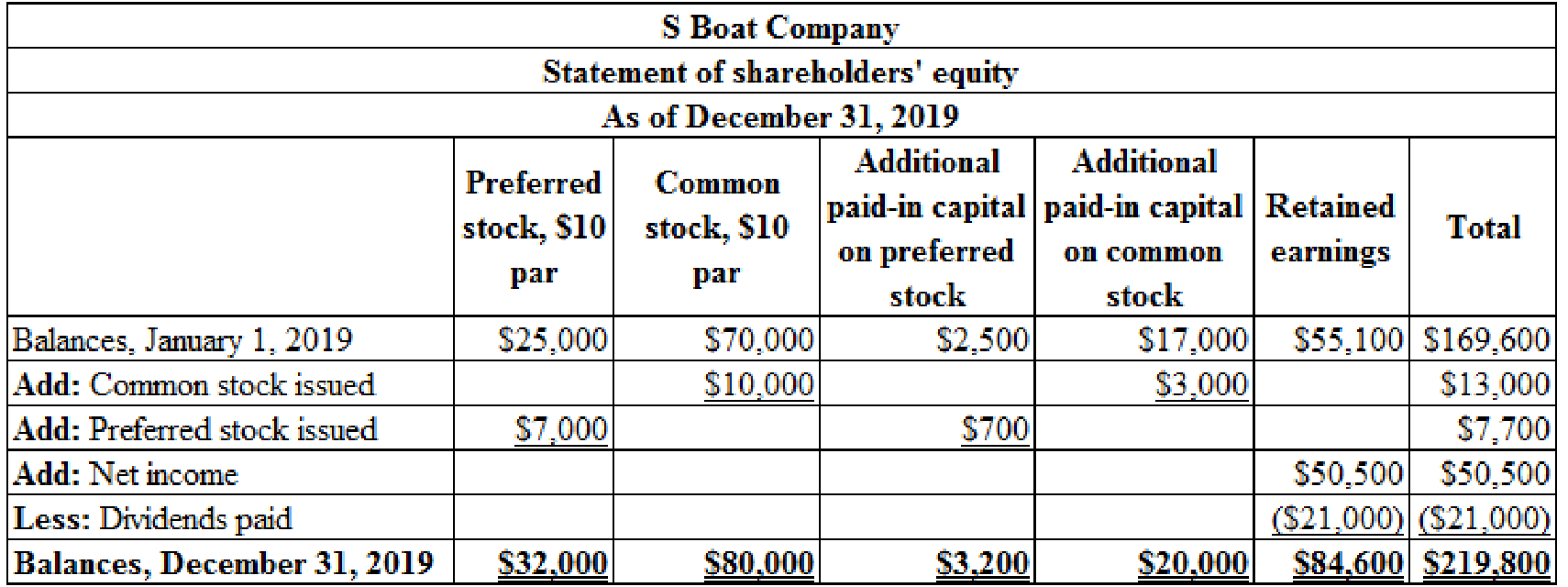

Prepare a statement of shareholders’ equity for the year 2019.

Explanation of Solution

Statement of Stockholders’ Equity:

Statement of Stockholders’ Equity is prepared to find out the changes and ending balance of contributed capital, treasury stock, retained earnings, and other comprehensive income in the business. The amount of stockholders’ equity is increased by issuance of stock and net income of the company and decreased by the payment of dividends and repurchase of treasury stock.

Prepare a statement of shareholders’ equity for the year 2019:

Table (2)

Working notes:

Determine the amount of common stock issued at par, during 2019:

Determine the amount of preference stock issued at par, during 2019:

Determine the amount of additional paid-in common stock, during 2019:

Determine the amount of additional paid-in preferred stock, during 2019:

Note: Statement of retained earnings is prepared back from ending accounts balances.

3.

Prepare notes that itemize the balance sheet control accounts and explain how it will helps to disclose any company accounting policies, contingent liabilities and subsequent events.

Explanation of Solution

Note 1:

Summary of significant accounting policies:

- Inventories are recorded at market price or cost price whichever is less.

- Straight line method is followed for depreciation of property, plant, and equipment based upon cost, estimated residual value, and useful life.

Note 2:

Guarantee to affiliate:

The company has been guaranteed by the affiliate Company J that it will be paid 12% interest on $50,000, 15-year bond.

Note 3:

Components of inventories:

The amount of inventories reported in the balance sheet is made up of the following components:

Table (3)

Note 4:

Components of long-term liabilities:

The amount of long-term liabilities reported in the balance sheet is made up of the following components:

Table (4)

Note 5:

Subsequent event:

On January 15, 2020, a building was totally destroyed. Its cost and book value are $20,000 and $7,000 respectively. However, insurance proceeds will amount to $5,000. This event has not been recorded in the balance sheet, as this event has been occurred after the balance sheet date.

4.

Determine debt-to-assets ratio of S Boat Company at the end of the year 2019.

Explanation of Solution

Debt-to-assets ratio:

Debt to assets ratio provides the relationship between the total liabilities and total assets. It helps the company to determine the amount of debt used to finance the assets.

The following formula is used to calculate debt-to-assets ratio:

Determine debt-to-assets ratio of S Boat Company at the end of the year 2019:

Hence, the debt-to-assets ratio of S Boat Company at the end of the year 2019 is 42.4%.

Evaluation:

If the debt-to-assets ratio is 39% at the end of 2018, then it has been increased by over 3% in 2019. An increase in this ratio indicates that the investors and creditors risk is increased, because of higher payment of interest has to be made by the company. The shareholder gets benefited, if the company generates a higher return on the additional debt equity than the interest paid.

Want to see more full solutions like this?

Chapter 4 Solutions

Interm.acct.:reporting.(ll)-w/access

- Balance Sheet and Notes Listed here in random order are Wicks Construction Limiteds balance sheet accounts and related ending balances as of December 31, 2019: Additional information: 1. The company reports on the balance sheet the total amount for inventories and the net book value of property, plant, and equipment, with the related details for each account disclosed in notes. 2. The straight line method is used to depreciate buildings, machinery, and equipment, based upon their cost and estimated residual values and lives. A breakdown of property, plant, and equipment shows the following: land at a cost of 32,000, buildings at a cost of 182,400 and a net book value of 120,200, machinery at a cost of 63,900, and related accumulated depreciation of 18,600, and equipment (40% depreciated) at a cost of 53,000. 3. Patents are amortized on a straight line basis directly to the Patent account. 4. Inventories are listed at the lower of cost or market value using an average cost. The inventories include raw-materials, 22,200; work in process, 34,700; and finished goods, 41,600. 5. Common stock has a 10 par value per share, 12,000 shares are authorized, and 6,280 shares have been issued. 6. Preferred stock has a 100 par value per share, 1,000 shares are authorized, and 400 shares have been issued. 7. The investment in bonds is carried at the original cost, which is the face value, and is being held to maturity. 8. Short-term investments in marketable securities were purchased at year-end. 9. The bonds payable mature on December 31, 2024. 10. The company attaches a 1-year warranty on all the products it sells. Required: 1. Prepare Wicks Constructions December 31, 2019, balance sheet (including appropriate parenthetical notations). 2. Prepare notes to accompany the balance sheet that itemize company accounting policies; inventories; and property, plant, and equipment. 3. Next Level Compute the current ratio and the quick ratio. How do these two ratios provide different information about the companys liquidity? Why are these ratios useful?arrow_forwardOn December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and amortization expense to the nearest whole year. During 2020, Vail engaged in the following transactions: Required: 1. Check the accuracy of the accumulated depreciation balances at December 31, 2019. Round to the nearest whole dollar in all requirements. 2. Prepare journal entries to record the preceding events in 2020, as well as the year-end recording of depreciation expense. 3. Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance, post the journal entries from Requirement 2, and compute the ending balance.arrow_forwardBalance Sheet Presentation The following information relates to the assets of Westfield Semiconductors as of December 31, 2019. Westfield uses the straight-line method for depreciation and amortization. Required: Use the information above to prepare the property, plant, and equipment and intangible assets portions of a classified balance sheet for Westfield.arrow_forward

- Soon after December 31, 2019, the auditor requested a depreciation schedule for trucks of Jarrett Trucking Company, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2016 to 2019, inclusive. The following data were in the Trucks account as of January 1, 2016: The Accumulated DepreciationTrucks account, previously adjusted to January 1,2016, and duly entered in the ledger, had a balance on that date of 16,460. This amount represented the straight-line depreciation on the four trucks from the respective dates of purchase, based on a 5-year life and no residual value. No debits had been made to this account prior to January 1, 2016. Transactions between January 1,2017, and December 31, 2019, and their record in the ledger were as follows: 1. July 1, 2016: Truck no. 1 was sold for 1,000 cash. The entry was a debit to Cash and a credit to Trucks, 1,000. 2. January 1, 2017: Truck no. 3 was traded for a larger one (no. 5) with a 5-year life. The agreed purchase price was 12,000. Jarrett paid the other company 1,780 cash on the transaction. The entry was a debit to Trucks, 1,780, and a credit to Cash, 1,780. 3. July 1, 2018: Truck no. 4 was damaged in a wreck to such an extent that it was sold as junk for 50 cash. Jarrett received 950 from the insurance company. The entry made by the bookkeeper was a debit to Cash, 1,000, and credits to Miscellaneous Revenue, 50, and Trucks, 950, 4. July 1, 2018: A new truck (no. 6) was acquired for 20,000 cash and debited at that amount to the Trucks account. The truck has a 5-year life. Entries for depreciation had been made at the close of each year as follows: 2016, 8,840; 2017, 5,436; 2018, 4,896; 2019, 4,356. Required: 1. Next Level For each of the 4 years, calculate separately the increase or decrease in earnings arising from the companys errors in determining or entering depreciation or in recording transactions affecting trucks. 2. Prove your work by one compound journal entry as of December 31, 2019; the adjustment of the Trucks account is to reflect the correct balances, assuming that the books have not been closed for 2019.arrow_forwardInvesting Activities and Depreciable Assets Verlando Company had the following account balances and information available for 2019: During 2019, Verlando recorded the following transactions affecting these accounts: a. Land with a carrying value of 35,000 was sold at a loss of 6,000. b. Land and equipment were purchased with cash during the period. c. Equipment with an original cost of 20,000 that had a book value of 4,000 was written off as obsolete. d. A building with an original cost of 60,000 and accumulated depreciation of 25,000 was sold at a 23,000 gain. e. Depreciation expense and amortization expense were recorded. f. Net income for the year was 60,000. g. A patent was acquired during the year in exchange for 1,200 shares of common stock with a par value of 1 per share and a market value of 26 per share. h. Additional marketable securities wefe purchased during the year. i. Verlando Company has no notes payable in the liabilities section of its balance sheet. Required: 1. Next Level Assuming that Verlando uses the indirect method to determine operating cash flows, what is the amount of depreciation expense and amortization expense that would be added back to net income: 2. Prepare the investing activities section of the statement of cash flows for the year ended December 31, 2019. 3. Prepare the disclosure for significant noncash transactions for the statement of cash flows for the year ended December 31, 2019.arrow_forwardSpreadsheet The following 2019 information is available for Payne Company: Partial additional information: The net income for 2019 totaled 1,600. During 2019, the company sold, for 390, equipment that cost 390 and had a book value of 300. The company sold land for 200, resulting in a loss of 40. The remaining change in the Land account resulted from the purchase of land through the issuance of common stock. Required: Making whatever additional assumptions that are necessary, prepare a spreadsheet to support the 2019 statement of cash flows for Payne.arrow_forward

- Financial Statement Presentation of Operating Assets Olympic Acquisitions Inc. prepared the following post-closing trial balance at December 31, 2019: Â Required: Prepare a classified balance sheet for Olympic at December 31, 2019. ( Note: Olympic reports the three categories of operating assets in separate subsections of assets.)arrow_forwardWorksheet Devlin Company has prepared the following partially completed worksheet for the year ended December 31, 2019: The following additional information is available: (a) salaries accrued but unpaid total 250; (b) the 80 heat and light bill for December has not been recorded or paid; (c) depreciation expense totals 810 on the buildings and equipment; (d) interest accrued on the note payable totals 380 (this will be paid when the note is repaid); (e) the company leases a portion of its floor space to KT Daniel Specialty Company for 50 per month, and KT Daniel has not yet paid its December rent; (f) interest accrued on the note receivable totals 80; (g) bad debts expense is 70; and (h) the income tax rate is 30% on current income and is payable in the first quarter of 2017. Required: 1. Complete the worksheet. (Round to the nearest dollar.) 2. Prepare the companys financial statements. 3. Prepare (a) adjusting and (b) closing entries in the general journal.arrow_forwardKoolman Construction Company began work on a contract in 2019. The contract price is 3,000,000, and the company determined that its performance obligation was satisfied over time. Other information relating to the contract is as follows: Required: 1. Compute the gross profit or loss recognized in 2019 and 2020. 2. Prepare the appropriate sections of the income statement and ending balance sheet for each year.arrow_forward

- Using the following information, A. Make the December 31 adjusting journal entry for depreciation. B. Determine the net book value (NBV) of the asset on December 31. Cost of asset, $195,000 Accumulated depreciation, beginning of year, $26,000 Current year depreciation, $13,000arrow_forwardComprehensive At December 31, 2018, certain accounts included in the property, plant, and equipment section of Townsand Company’s balance sheet had the following balances:arrow_forwardHello, Please assist with below accounting question, requesting note for financial statements???? Prepare the following note to the financial statements as at 28 February 2020: Property, plant and equipment Information as per belowThe following balances appeared in the general ledger of Umzinto Traders on 01 March 2019, the beginning of the financial year: Vehicles 300 000 Accumulated depreciation on vehicles 140 000 Equipment 130 000 Accumulated depreciation on equipment 75 000 Additional information 1) A new vehicle, cost price R160 000, was purchased on credit on 01 December 2019. 2) Equipment with a cost price of R10 000, was sold for cash on 31 August 2019 for R2 000. The accumulated depreciation on the equipment sold amounted to R7 000 on 01 March 2019. 3) Depreciation is calculated on equipment at 10% per annum on cost. 4) Depreciation is calculated on vehicles at 20% per annum on the diminishing balance.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College