The effect of tax on economic efficiency.

Explanation of Solution

Tax is a unilateral payment made to the government from the public for various purposes. There are many types of taxes, such as income tax, wealth tax, and so forth, which constitute a major portion of the revenue of the government that can be used for making public expenditures. Economic efficiency is a situation where no one can be in a better position without hurting the other. In the case, economic efficiency is the situation where the marginal benefit (of the consumer) from the last unit produced is equal to the marginal cost of the production of the unit. This means that both of them will be the same and neither the consumer nor the producer can be in a better position. The sum of the

Here, the tax imposed on the ride is 20%, which is equal to 6 pounds. This is because the

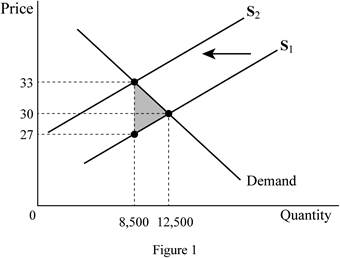

Thus, the supply vertically shifts by the tax amount of 6 pounds, and as a result, the quantity demanded decreases to 8,500 rides. The owner of the vehicles receives only 27 pounds, which is the reason for the decrease in the supply of the rides in the market. Thus, the consumer has to pay 33 pounds more than the equilibrium price, whereas the owner receives 3 pounds less than the equilibrium price received by him before the tax. Thus, the tax is equally shared among the consumer and the owner (by 3 pounds each). The economic efficiency is reduced by the tax because there will be

The new quantity demanded after the introduction of the tax is 8,500 rides and the new price after the introduction of the tax is 33 pounds. The price actually received by the owner of the vehicle also reduces to 27 pounds; this means that both the owner and the consumer are paying 3 pounds each as tax. This shows that the tax burden is evenly distributed between the seller and the buyer. There is deadweight loss in the economy because of the tax and it can be denoted by the area shaded in grey colour on the graph.

Concept introduction:

Tax: It is the unilateral payment made by the public towards the government. There are many different types of taxes in the economy, which includes income tax, property tax, professional tax, and so forth.

Economic efficiency: It is the situation where the economy is efficient. This means that the marginal benefit from the last unit produced is equal to the marginal cost of production and the economic surplus will be at is maximum.

Want to see more full solutions like this?

Chapter 4 Solutions

MyLab Economics with Pearson eText -- Access Card -- for Microeconomics

- Suppose the price elasticity of demand for smartphones is 0.5 (absolute value), while the price elasticity of supply is 1.9. If the government imposes a per-unit tax of $100 on the sellers of smartphones, how will the price and quantity transacted of smartphones change? Will the sellers or the buyers bear a larger tax burden? Will the market be able to achieve economic efficiency after the tax is imposed? Explain with a diagram.arrow_forwardSuppose the price of gasoline that drivers pay at the pump is $4 and stations pay a tax of $1 to the government and keep $3. Draw a diagram to show this. Then there is a tax switch: The tax on stations is ended, and drivers are required to keep receipts and pay the government a $1 tax for each gallon they consume. On the same diagram, show what happens to the pump price. What is the impact of the switch on drivers? On stations?arrow_forwardSuppose government imposes a tax on buyers of $30 per hotel room. After the tax is in effect: What is the Quantity exchanged in the market after tax? What is the buyers & sellers' price? Also, what is the incidence of tax? Show the deadweight loss on your graph.arrow_forward

- The mayor of the city decides to impose a $2 tax on each bottle of apple juice, then the total surplus is?arrow_forwardhow is the price of Fertilizer determined? we know that the price of a good is formed from the interaction of supply and demand. Producers will not sell a good below the cost of production. Demand changes the price due to competition; more demand drives the price up, less demand brings the price down. when you discuss how the price is determined: Taxes: is the good taxed? (e.g. cigarettes have a high tax) Costs of production: (resources, labor, etc.) Transportation Competition: is the good in high demand? Give a summary of the factors that go into the price of the good.arrow_forwardDuring the COVID-19 pandemic, alcohol consumption increased dramatically. In response, the government is considering increasing the tax rate on alcohol. It's known that the demand for alcohol is inelastic, and the supply of alcohol is perfectly elastic. Which of the following statements are true? (Select all that apply.) Question 5Answer a. A tax on alcohol is one way to make consumer internalize the cost of the externalities associated with drinking, such as long-term health implications. b. Regardless of how the tax is implemented, consumers will pay the full amount of the tax. c. It doesn't matter how the tax is implemented. d. Consumers and suppliers will split the burden of the tax. e. The government will collect more revenue if the tax is on the suppliers. f. Alcohol consumption will decrease more in the short-run than in the long-run. g. Alcohol consumption will decrease more in the long-run than in the short-run. h. There are positive…arrow_forward

- In the past, some counties and countries have imposed taxes on sugar, saturated fats, and food made with those ingredients as a way to reduce consumption of those foods. Assume the government imposes a unit tax on all chocolate. Answer the following questions: Will consumers be able to shift this tax to sellers? If yes explain why/how. If no explain why not. Based on your answer to c, who will bear the incidence of this tax?arrow_forwardIdentify at least one positive externality from running a donut shop. Identify at least one negative externality from running a donut shop. Explain how these positive and negative externalities could impact the donut shop’s profits. (Hint: think subsidy for positive externality and tax for negative externality.) Draw two graphs that show the price of donuts before and after the positive and negative externality impacted the price of your donuts.arrow_forward3. The market equilibrium is said to achieve allocative efficiency. What does this statement mean? Explain using a graph. Indicate the following on the graph: Consumer and producer surplus, market price, and quantity bought and sold. When a tax is introduced, explain how the market changes. In another graph indicate the Consumer and producer surpluses, tax revenue, and deadweight loss from taxationarrow_forward

- e. What happens when government imposes a tax of 60 cents per gallon on buyers?arrow_forwardMyra buys an iPhone for $280 and gets consumer surplus of $120. (a) What is her willingness to pay? (b) If she had bought the iPhone on sale for $180, what would her consumer surplus have been? (c) If the price of an iPhone were $500, what would her consumer surplus have been?arrow_forwardSuppose government impose a tax of 1 dollar per bottle on sellers of industrial detergent. Explain 3 dimensions in which you can explain the effect of this tax.arrow_forward

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning