Concept explainers

Chrome Solutions Company manufactures special chromed parts made to the order and specifications of the customer. It has two production departments, Stamping and Plating, and two service departments, Power and Maintenance. In any production department, the job in process is wholly completed before the next job is started.

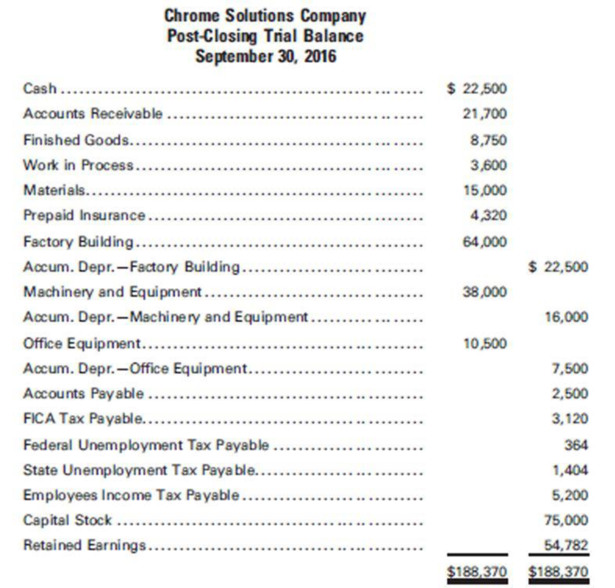

The company operates on a fiscal year, which ends September 30. Following is the post-closing

Additional information:

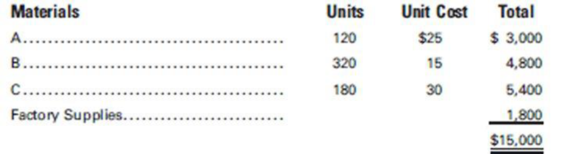

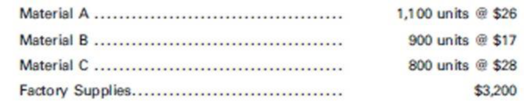

1. The balance of the materials account represents the following:

The company uses the FIFO method of accounting for all inventories. Material A is used in the Stamping Department, and materials B and C are used in the Plating Department.

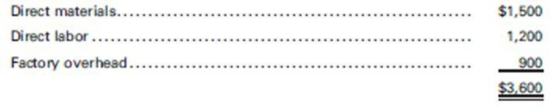

2. The balance of the work in process account represents the following costs that are applicable to Job 905. (The customer’s order is for 1,000 units of the finished product.)

3. The finished goods account reflects the cost of Job 803, which was finished at the end of the preceding month and is awaiting delivery orders from the customer.

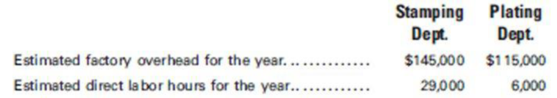

4. At the beginning of the year, factory overhead application rates were based on the following data:

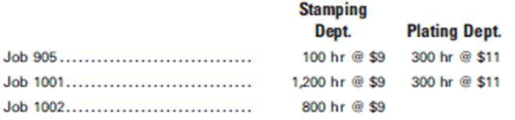

In October, the following transactions were recorded:

a. Purchased the following materials and supplies on account:

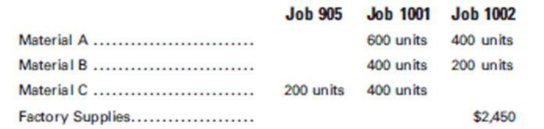

b. The following materials were issued to the factory:

Customers’ orders covered by Jobs 1001 and 1002 are for 1,000 and 500 units of finished product, respectively.

c. Factory wages and office, sales, and administrative salaries are paid at the end of each month. (Assume FICA and federal income tax rates of 8% and 10%, respectively.) Record the company’s liability for state and federal

Wages of the supervisors, custodial personnel, etc., totaled $9,500; administrative salaries were $18,300.

d. Miscellaneous factory overhead incurred during October totaled $4,230. Miscellaneous selling and administrative expenses were $1,500. These items as well as the FICA tax and federal income tax withheld for September were paid. (See account balances on the post-closing trial balance for September 30.)

e. Annual

Factory buildings–5%

Machinery and equipment–20%

Office equipment–20%

f. The balance of the prepaid insurance account represents a three-year premium for a fire insurance policy covering the factory building and machinery. It was paid on the last day of the preceding month and became effective on October 1.

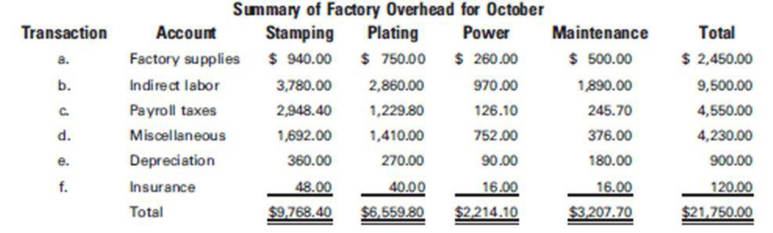

g. The summary of factory overhead prepared from the factory overhead ledger is reproduced here:

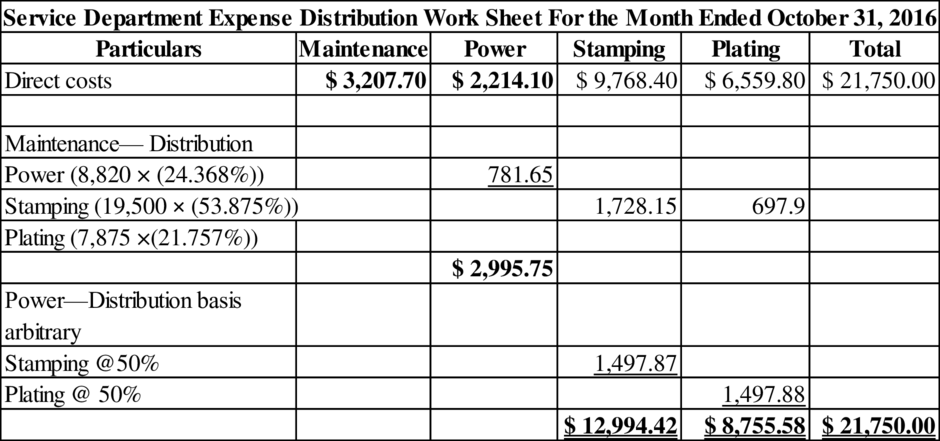

h. The total expenses of the Maintenance Department are distributed on the basis of floor space occupied by the Power Department (8,820 sq ft), Stamping Department (19,500 sq ft), and Plating Department (7,875 sq ft). The power department expenses are then allocated equally to the Stamping and Plating departments.

i. After the actual factory overhead expenses have been distributed to the departmental accounts and the applied factory overhead has been recorded and posted, any balances in the departmental accounts are transferred to Under- and Overapplied Overhead.

j. Jobs 905 and 1001 were finished during the month. Job 1002 is still in process at the end of the month.

k. During the month, Jobs 803 and 905 were sold with a mark-on percentage of 50% on cost.

l. Received $55,500 from customers in payment of their accounts.

m. Checks were issued in the amount of $43,706 for payment of the payroll.

Required

- 1. Set up the beginning trial balance in T-accounts.

- 2. Prepare materials inventory ledger cards and enter October 1 balances.

- 3. Prepare a Payroll Summary and Schedule of Earnings and Payroll Taxes for the month of October.

- 4. Set up

job cost sheets as needed. - 5. Record all transactions and related entries for October and post to T-accounts.

- 6. Prepare a service department expense distribution worksheet for October.

- 7. At the end of the month:

- a. Analyze the balance in the materials account, the work in process account, and the finished goods account.

- b. Prepare the statement of cost of goods manufactured for the month ended October 31.

1.

Prepare T-accounts for company C.

Explanation of Solution

Prepare T-accounts for company C:

| Cash | ||||||

| October.1 | 22,500 | October.31 | d. | 14,050 | ||

| 31 | l. | 55,500 | m. | 43,706 | ||

| Total | 78,000 | 57,756 | ||||

| 20,244 | ||||||

| Accounts receivable | ||||||

| October.1 | 21,700 | October.31 | l. | 55,500 | ||

| 31 | k. | 43,140 | ||||

| Total | 64,840 | |||||

| 9,340 | ||||||

| Finished Goods | ||||||

| October.1 | 8,750 | October.31 | k. | 28,760 | ||

| 31 | j. | 78,700 | ||||

| Total | 87,450 | |||||

| 58,690 | ||||||

| Work in Process | ||||||

| October.1 | 3,600 | October.31 | j. | 78,700 | ||

| 31 | b. | 52,600 | ||||

| c. | 25,500 | |||||

| i. | 22,000 | |||||

| Total | 103,700 | |||||

| 25,000 | ||||||

| Materials | ||||||

| October.1 | 15,000 | October.31 | b. | 55,050 | ||

| 31 | a. | 69,500 | ||||

| Total | 84,500 | |||||

| 29,450 | ||||||

| Prepaid Insurance | ||||||

| October.1 | 4,320 | October.31 | f. | 120 | ||

| Total | 4,320 | |||||

| 4,200 | ||||||

| Factory Building | ||||||

| October.1 | 64,000 | |||||

| Accumulated Depreciation—Factory Building | ||||||

| October.1 | 22,500 | |||||

| 31 | e. | 267 | ||||

| 22,767 | ||||||

| Machinery & Equipment | ||||||

| October.1 | 38,000 | |||||

| Accumulated Depreciation—Factory Building | ||||||

| October.1 | 16,000 | |||||

| 31 | e. | 633 | ||||

| 16,633 | ||||||

| Office Equipment | ||||||

| October.1 | 10,500 | |||||

| Accumulated Depreciation—Office Equipment | ||||||

| October.1 | 7,500 | |||||

| 31 | 175 | |||||

| 7,675 | ||||||

| Accounts Payable | ||||||

| October.1 | 2,500 | |||||

| 31 | a. | 69,500 | ||||

| 72,000 | ||||||

| FICA Tax Payable | ||||||

| October.31 | d. | 3,120 | October.1 | 3,120 | ||

| c. | 4,264 | |||||

| 31 | c. | 4,264 | ||||

| 11,648 | ||||||

| 8,528 | ||||||

| Federal Unemployment Tax Payable | ||||||

| October.1 | 364 | |||||

| 31 | c. | 533 | ||||

| 897 | ||||||

| State Unemployment Tax Payable | ||||||

| October.1 | 1,404 | |||||

| 31 | c. | 2,132 | ||||

| 3,536 | ||||||

| Employees Income Tax Payable | ||||||

| October.31 | d. | 5,200 | October.1 | 5,200 | ||

| 31 | c. | 5,330 | ||||

| 10,530 | ||||||

| 5,330 | ||||||

| Wages Payable | ||||||

| October.31 | m. | 43,706 | October.31 | 43,706 | ||

| Wages Payable | ||||||

| October.31 | m. | 43,706 | October.31 | 43,706 | ||

| Capital Stock | ||||||

| October.1 | 75,000 | |||||

| Retained Earnings | ||||||

| October.1 | 54,782 | |||||

| Factory Overhead | ||||||

| October.31 | b. | 2,450 | October.31 | g. | 21,750 | |

| c. | 9,500 | |||||

| c. | 4,550 | |||||

| d. | 4,230 | |||||

| e. | 900 | |||||

| f. | 120 | |||||

| 21,750 | 21,750 | |||||

| Factory Overhead—Stamping | ||||||

| October.31 | g. | 9,768.40 | October.31 | i. | 10,500 | |

| h. | 1,728.15 | i. | 2,494.42 | |||

| h. | 1,497.87 | |||||

| 12,994.42 | 12,994.42 | |||||

| Factory Overhead—Plating | ||||||

| October.31 | g. | 6,559.80 | October.31 | i. | 11,500 | |

| h. | 697.90 | |||||

| h. | 1,497.88 | |||||

| i. | 2,744.42 | |||||

| 11,500 | 11,500 | |||||

| Applied Factory Overhead—Stamping | ||||||

| October.31 | i. | 10,500 | October.31 | i. | 10,500 | |

| 10,500 | 10,500 | |||||

| Applied Factory Overhead—Plating | ||||||

| October.31 | i. | 11,500 | October.31 | i. | 11,500 | |

| 11,500 | 11,500 | |||||

| Factory Overhead—Power | ||||||

| October.31 | g. | 2,214.10 | October.31 | h. | 2,995.75 | |

| h. | 781.65 | |||||

| 2,995.75 | 2,995.75 | |||||

| Factory Overhead—Maintenance | ||||||

| October.31 | g. | 3,207.70 | October.31 | h. | 3,207.70 | |

| 3,207.70 | 3,207.70 | |||||

| Under- and Over-applied Overhead | ||||||

| October.31 | i. | 250.00 | ||||

| 250.00 | ||||||

| Sales | ||||||

| October.31 | k. | 43,140 | ||||

| 43,140 | ||||||

| Cost of Goods Sold | ||||||

| October.31 | k. | 28,760 | ||||

| 28,760 | ||||||

| Payroll | ||||||

| October.31 | c. | 53,300 | October.31 | c. | 53,300 | |

| 53,300 | 53,300 | |||||

| Salaries | ||||||

| October.31 | c. | 18,300 | ||||

| 18,300 | ||||||

| Payroll Tax Expense—Salaries | ||||||

| October.31 | c. | 2,379 | ||||

| 2,379 | ||||||

| Miscellaneous Selling & Administrative Expense | ||||||

| October.31 | d. | 1,500 | ||||

| 1,500 | ||||||

| Depreciation Expense—Office Equipment | ||||||

| October.31 | e. | 175 | ||||

| 175 | ||||||

2.

Prepare materials inventory ledger cards and enter October 1 balances.

Explanation of Solution

Prepare materials inventory ledger cards and enter October 1 balances:

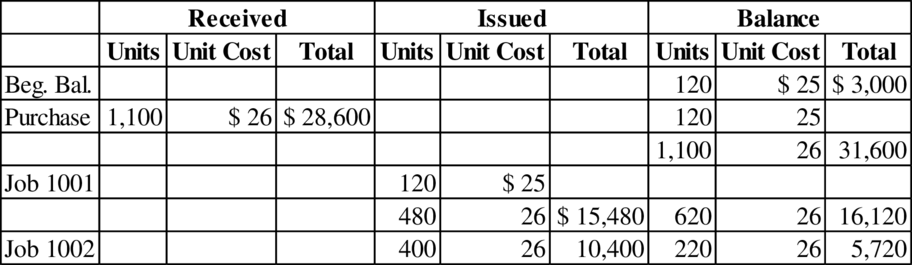

For Material A:

Table (1)

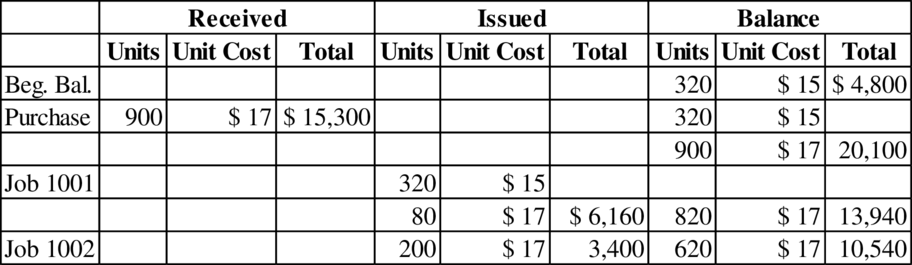

For Material B:

Table (2)

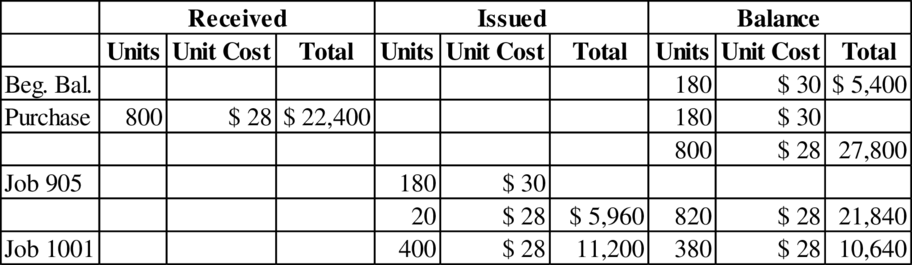

For Material C:

Table (3)

Factory supplies:

| Particulars | Amounts ($) |

| Beginning balance | $ 1,800 |

| Purchases | $ 3,200 |

| Issued | ($ 2,450) |

| Ending balance | $ 2,550 |

Table (4)

Total direct materials issued are $52,600

3.

Prepare a Payroll Summary and Schedule of Earnings and Payroll Taxes for the month of October.

Explanation of Solution

Prepare a Payroll Summary and Schedule of Earnings and Payroll Taxes for the month of October:

Payroll Summary:

| Particulars | Factory Employees | Sales and Administrative Employees | Total |

| Gross Earnings (A) | $ 35,000 | $ 18,300 | $ 53,300 |

| Withholdings and deductions: | |||

| FICA tax | $ 2,800 | $ 1,464 | $ 4,264 |

| Income tax | $ 3,500 | $ 1,830 | $ 5,330 |

| Total (B) | $ 6,300 | $ 3,294 | $ 9,594 |

| Net earnings (A+B) | $ 28,700 | $ 15,006 | $ 43,706 |

Table (5)

Compute the amount of total factory labor:

| Particulars | Factory Employees |

| Job 905 | $4,200 |

| Job 1001 | 14,100 |

| Job 1002 | 7,200 |

| Total direct labor | $25,500 |

| Indirect labor | 9,500 |

| Total factory labor | 35,000 |

Table (6)

Schedule of Earnings and Payroll Taxes:

| Particulars | Gross Earnings | FICA | State | FUTA | Total Payroll Taxes |

| 8% | 4% | 1% | |||

| Non factory employees | $ 18,300 | $ 1,464 | $ 732 | $ 183 | $ 2,379 |

| Factory employees | 35,000 | 2,800 | 1,400 | 350 | 4,550 |

| Total | $ 53,300 | $ 4,264 | $ 2,132 | $ 533 | $ 6,929 |

Table (7)

4.

Prepare a job cost sheets as needed.

Explanation of Solution

Prepare a job cost sheets as needed:

| Job Cost Sheet—Job 905 | ||||||

| Date | Material | Direct labor | Factory Overhead | |||

| October 1 | 1500 | 1200 | 900 | |||

| Material C | 5,960 | Stamping | 900 | 100 hr @5.00 | 500 | |

| Plating | 3,300 | 300 hr @19.167 | 5,750 | |||

| Totals | 7,460 | 5,400 | 7,150 | |||

| Job total | 20,010 | |||||

Table (8)

| Job Cost Sheet—Job 1001 | ||||||

| Date | Material | Direct labor | Factory Overhead | |||

| October 1 | Material A | 15,480 | ||||

| Material B | 6,160 | Stamping | 10,800 | 1,200 hr @5.00 | 6,000 | |

| Material C | 11,200 | Plating | 3,300 | 300 hr @19.167 | 5,750 | |

| Totals | 32,840 | 14,100 | 11,750 | |||

| Job total | 58,690 | |||||

Table (9)

| Job Cost Sheet—Job 1002 | ||||||

| Date | Material | Direct labor | Factory Overhead | |||

| October 1 | Material A | 10,400 | ||||

| Material B | 3,400 | Stamping | 7,200 | 800 hr @5.00 | 4,000 | |

| Totals | 13,800 | 7,200 | 4,000 | |||

| Job total | 25,000 | |||||

Table (10)

5.

Prepare journal entries for the given transactions for October.

Explanation of Solution

Prepare journal entries for the given transactions for October:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| October | ||||

| a. | Materials | 69,500 | ||

| Accounts Payable | 69,500 | |||

| (To record the materials purchased) | ||||

| b. | Work in Process | 52,600 | ||

| Factory Overhead | 2,450 | |||

| Materials | 55,050 | |||

| (To record the issuance of materials to the factory) | ||||

| c. | Payroll | 53,300 | ||

| FICA Tax Payable | 4,264 | |||

| Employees Income Tax Payable | 5,330 | |||

| Wages Payable | 43,706 | |||

| (To record the wages payable) | ||||

| Work in Process | 25,500 | |||

| Factory Overhead | 9,500 | |||

| Salaries | 18,300 | |||

| Payroll | 53,300 | |||

| (To record the distribution of payroll to work in process and overhead) | ||||

| Factory Overhead | 4,550 | |||

| Payroll Tax Expense—Salaries | 2,379 | |||

| FICA Tax Payable | 4,264 | |||

| Federal Unemployment Tax Payable | 533 | |||

| State Unemployment Tax Payable |

2,132 | |||

| (To record the employer payroll taxes) | ||||

| d. | Factory Overhead | 4,230 | ||

| Miscellaneous, Selling & Administration Expense | 1,500 | |||

| FICA Tax Payable | 3,120 | |||

| Employees Income Tax Payable | 5,200 | |||

| Cash | 14,050 | |||

| (To record the payment made for expenses) | ||||

| e. | Factory Overhead | 900 | ||

| Depreciation Expense—Office Equipment | 175 | |||

| Accumulated Depreciation—Factory Building | 267 | |||

| Accumulated Depreciation—Machinery & Equipment | 633 | |||

| Accumulated Depreciation—Office Equipment | 175 | |||

| (To record the depreciation) | ||||

| f. | Factory Overhead | 120 | ||

| Prepaid Insurance | 120 | |||

| (To record the insurance expired) | ||||

| g. | Factory Overhead—Stamping | 9,768.40 | ||

| Factory Overhead—Plating | 6,559.80 | |||

| Factory Overhead—Power | 2,214.10 | |||

| Factory Overhead—Maintenance | 3,207.70 | |||

| Factory Overhead | 21,750 | |||

| (To record the distribution of factory overhead to other departments) | ||||

| h. | Factory Overhead—Stamping | 1,728.15 | ||

| Factory Overhead—Plating | 697.90 | |||

| Factory Overhead—Power | 781.65 | |||

| Factory Overhead—Maintenance | 3,207.70 | |||

| (To record the distribution of maintenance overhead to other departments) | ||||

| Factory Overhead—Stamping | 1,497.87 | |||

| Factory Overhead—Plating | 1,497.88 | |||

| Factory Overhead—Power | 2,995.75 | |||

| (To record the distribution of power overhead to producing departments) | ||||

| i. | Work in Process | 22,000 | ||

| Applied Factory Overhead—Stamping | 10,500 | |||

| Applied Factory Overhead—Plating | 11,500 | |||

| (To record the work in process) | ||||

| Applied Factory Overhead---Stamping | 10,500 | |||

| Applied Factory Overhead---Plating | 11,500 | |||

| Factory Overhead—Stamping | 10,500 | |||

| Factory Overhead----Plating | 11,500 | |||

| (To record the transfer of applied overhead to actual overhead) | ||||

| Factory Overhead—Plating | 2,744.42 | |||

| Factory Overhead—Stamping | 2,494.42 | |||

| Under- and Over applied Overhead | 250 | |||

|

(To record the transfer under- and over applied overhead to under- and over applied account) | ||||

| j. | Finished Goods | 78,700 | ||

| Work in Process | 78,700 | |||

| (To record the finished goods during October) | ||||

| k. | Accounts Receivable | 43,140 | ||

| Sales | 43,140 | |||

| Cost of Goods Sold | 28,760 | |||

| Finished Goods | 28,760 | |||

| (To record sales made and cost of goods sold) | ||||

| l. | Cash | 55,500 | ||

| Accounts Receivable | 55,500 | |||

| (To record the cash receipts) | ||||

| m. | Wages Payable | 43,706 | ||

| Cash | 43,706 | |||

| (To record wages paid) |

Table (11)

6.

Prepare a service department expense distribution worksheet for October.

Explanation of Solution

Prepare a service department expense distribution worksheet for October:

Table (12)

7. a

Prepare a schedule to analyze the balance in the materials account, the work in process account, and the finished goods account.

Explanation of Solution

Prepare a schedule to analyze the balance in the materials account, the work in process account, and the finished goods account:

| Material Summary—October 31 | |||

| Particulars | Unit (a) | Unit Cost (b) | Total |

| Material | 220 | $ 26 | $ 5,720 |

| Material B | 620 | 17 | 10,540 |

| Material C | 380 | 26 | 10,640 |

| Factory Supplies | 2,550 | ||

| Total | $ 29,450 | ||

| Finished Goods Summary—October 31 | |||

| Job 1001 | $58,690 | ||

| Work in Process Summary—October 31 | |||

| Job 1002 | $25,000 | ||

Table (13)

7. b

Prepare the statement of cost of goods manufactured for the month ended October 31.

Explanation of Solution

Prepare the statement of cost of goods manufactured for the month ended October 31:

| Company C | |

| Statement of Cost of Goods Manufactured | |

| For the Month Ended October 31, 2016 | |

| Direct materials: | |

| Inventory, October 1 | $ 15,000 |

| Add: Purchases | 69,500 |

| Total cost of materials available | $ 84,500 |

| Less: Inventory, October 31 | 29,450 |

| Cost of materials used | $ 55,050 |

| Less: indirect materials used | 2,450 |

| Direct materials used | $ 52,600 |

| Direct labor | 25,500 |

| Applied factory overhead | 22,000 |

| Total manufacturing cost | $ 100,100 |

| Add: Work in process inventory, October 1 | 3,600 |

| Total | $ 103,700 |

| Less: work in process inventory, October 31 | 25,000 |

| Cost of goods manufactured | $ 78,700 |

Table (14)

Want to see more full solutions like this?

Chapter 4 Solutions

PRINCIPLES OF COST ACCOUNTING

- Kraus Steel Company has two departments, Casting and Rolling. In the Rolling Department, ingots From the Casting Department are rolled into steel sheet. The Rolling Department received 4,000 tons from the Casting Department in October. During October, the Rolling Department completed 3,900 tons, including 200 tons of work in process on October 1. The ending work in process inventory on October 31 was 300 tons. How many tons were started and completed during October?arrow_forwardRockford Company has four departmental accounts: Building Maintenance, General Factory Overhead, Machining, and Assembly. The direct labor hour method is used to apply factory overhead to the jobs being worked on in Machining and Assembly. The company expects each production department to use 30,000 direct labor hours during the year. The estimated overhead rates for the year include the following: During the year, both Machining and Assembly used 28,000 direct labor hours. Factory overhead costs incurred during the year follow: In determining application rates at the beginning of the year, cost allocations were made as follows, using the sequential distribution method: Building Maintenance to: General Factory Overhead, 10%; Machining, 50%; Assembly, 40%. General factory overhead was distributed according to direct labor hours. Required: Determine the under- or overapplied overhead for each production department. (Hint: First you must distribute the service department costs.)arrow_forwardThe post-closing trial balance of Custer Products, Inc. on April 30 is reproduced as follows: During May, the following transactions took place: a. Purchased raw materials at a cost of 45,000 and general factory supplies at a cost of 13,000 on account (recorded materials and supplies in the materials account). b. Issued raw materials to be used in production, costing 47,000, and miscellaneous factory supplies costing 15,000. c. Recorded the payroll and the payments to employees as follows: factory wages (including 12,000 indirect labor), 41,000; and selling and administrative salaries, 7,000. Additional account titles include Wages Payable and Payroll. (Ignore payroll withholdings and deductions.) d. Distributed the payroll in (c). e. Recognized depreciation for the month at an annual rate of 5% on the building, 10% on the factory equipment, and 20% on the office equipment. The sales and administrative staff uses approximately one-fifth of the building for its offices. f. Incurred other expenses totaling 11,000. One-fourth of this amount is allocable to the office function. g. Transferred total factory overhead costs to Work in Process. h. Completed and transferred goods with a total cost of 91,000 to the finished goods storeroom. i. Sold goods costing 188,000 for 362,000. (Assume that all sales were made on account.) j. Collected accounts receivable in the amount of 345,000. k. Paid accounts payable totaling 158,000. Required: 1. Prepare journal entries to record the transactions. 2. Set up T-accounts. Post the beginning trial balance and the journal entries prepared in (1) to the accounts and determine the balances in the accounts on May 31. 3. Prepare a statement of cost of goods manufactured, an income statement, and a balance sheet. (Round amounts to the nearest whole dollar.)arrow_forward

- Akron Manufacturing Co. manufactures a cement-sealing compound called Seal-Rite. The process requires that the product pass through three departments. In Dept. 1, all materials are put into production at the beginning of the process; in Dept. 2, materials are put into production evenly throughout the process; and in Dept. 3, all materials are put into production at the end of the process. In each department, it is assumed that the labor and factory overhead are applied evenly throughout the process. At the end of January, the production reports for the month show the following: Required: 1. Prepare a cost of production summary for each department for January, using the weighted average cost method. 2. Prepare the journal entries to record the January transactions. 3. Prepare a statement of cost of goods manufactured for the month ended January 31.arrow_forwardSpokane Production Co. obtained the following information from its records for July: Required: 1. Prepare, in summary form, the journal entries that would have been made during the month to record issuing materials to production, the distribution of labor, and overhead costs; the completion of the jobs; and the sale of the jobs. 2. Prepare schedules computing the following for July: a. The gross profit or loss for each job completed and sold, and for the business as a whole. b. For each job, the gross profit or loss per unit. (Round to the nearest cent.)arrow_forwardCollegiate Publishing Inc. began printing operations on March 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, 4,500 of indirect materials and 8,200 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: Journalize the summary entry to record each of the following operations for March (one entry for each operation): a. Direct and indirect materials used. b. Direct and indirect labor used. c. Factory overhead applied to all four jobs (a single overhead rate is used based on direct labor cost). d. Completion of Jobs 301 and 302.arrow_forward

- Bangor Products Co. obtained the following information from its records for April: Required: 1. Prepare, in summary form, the journal entries that would have been made during the month to record issuing materials to production, the distribution of labor, and overhead costs; the completion of the jobs; and the sale of the jobs. 2. Prepare schedules computing the following for April: a. The gross profit or loss for each job completed and for the business as a whole. b. For each job, the gross profit or loss per unit. (Round to the nearest cent.)arrow_forwardLuna Manufacturing Inc. completed Job 2525 on May 31, and there were no jobs in process in the plant. Prior to June 1, the predetermined overhead application rate for June was computed from the following data, based on an estimate of 5,000 direct labor hours: The factory has one production department and uses the direct labor hour method to apply factory overhead. Three jobs are started during the month, and postings are made daily to the job cost sheets from the materials requisitions and labor-time records. The following schedule shows the jobs and amounts posted to the job cost sheets: The factory overhead control account was debited during the month for actual factory overhead expenses of 27,000. On June 11, Job 2526 was completed and delivered to the customer using a mark-on percentage of 50% on manufacturing cost. On June 24, Job 2527 was completed and transferred to Finished Goods. On June 30, Job 2528 was still in process. Required: 1. Prepare job cost sheets for Jobs 2526, 2527, and 2528, including factory overhead applied when the job was completed or at the end of the month for partially completed jobs. 2. Prepare journal entries as of June 30 for the following: a. Applying factory overhead to production. b. Closing the applied factory overhead account. c. Closing the factory overhead account. d. Transferring the cost of the completed jobs to finished goods. e. Recording the cost of the sale and the sale of Job 2526.arrow_forwardDuring December, Krause Chemical Company had the following selected data concerning the manufacture of Xyzine, an industrial cleaner: All materials are added at the beginning of processing in this department, and conversion costs are added uniformly during the process. The beginning work in process inventory had 120 of raw materials and 180 of conversion costs incurred. Materials added during December were 540, and conversion costs of 1,484 were incurred. Krause uses the first-in, first-out (FIFO) process cost method. The equivalent units of production used to compute conversion costs for December were: a. 110 units. b. 104 units. c. 100 units. d. 92 units.arrow_forward

- LeMans Company produces specialty papers at its Fox Run plant. At the beginning of June, the following information was supplied by its accountant: During June, direct labor cost was 143,000, direct materials purchases were 346,000, and the total overhead cost was 375,800. The inventories at the end of June were: Required: 1. Prepare a cost of goods manufactured statement for June. 2. Prepare a cost of goods sold schedule for June.arrow_forwardHolmes Products, Inc., produces plastic cases used for video cameras. The product passes through three departments. For April, the following equivalent units schedule was prepared for the first department: Costs assigned to beginning work in process: direct materials, 90,000; conversion costs, 33,750. Manufacturing costs incurred during April: direct materials, 75,000; conversion costs, 220,000. Holmes uses the weighted average method. Required: 1. Compute the unit cost for April. 2. Determine the cost of ending work in process and the cost of goods transferred out.arrow_forwardPotomac Automotive Co. manufactures engines that are made only on customers orders and to their specifications. During January, the company worked on Jobs 007, 008, 009, and 010. The following figures summarize the cost records for the month: Jobs 007 and 008 have been completed and delivered to the customer at a total selling price of 426,000, on account. Job 009 is finished but has not yet been delivered. Job 010 is still in process. There were no materials or work in process inventories at the beginning of the month. Material purchases were 115,000, and there were no indirect materials used during the month. Required: 1. Prepare a summary showing the total cost of each job completed during the month or in process at the end of the month. 2. Prepare the summary journal entries for the month to record the distribution of materials, labor, and overhead costs. 3. Determine the cost of the inventories of completed engines and engines in process at the end of the month. 4. Prepare the journal entries to record the completion of the jobs and the sale of the jobs. 5. Prepare a statement of cost of goods manufactured.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning