Concept explainers

Akron Manufacturing Co. manufactures a cement-sealing compound called Seal-Rite. The process requires that the product pass through three departments. In Dept. 1, all materials are put into production at the beginning of the process; in Dept. 2, materials are put into production evenly throughout the process; and in Dept. 3, all materials are put into production at the end of the process. In each department, it is assumed that the labor and factory overhead are applied evenly throughout the process.

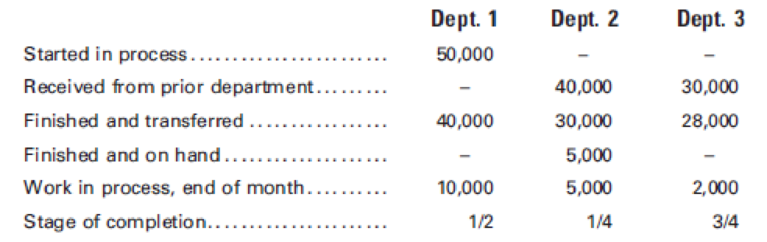

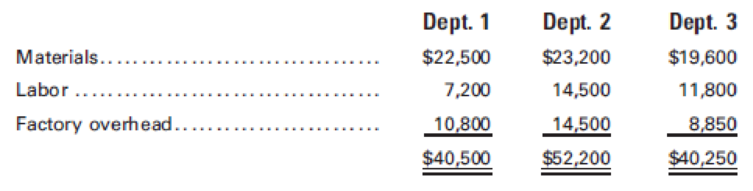

At the end of January, the production reports for the month show the following:

Required:

- 1. Prepare a cost of production summary for each department for January, using the weighted average cost method.

- 2. Prepare the

journal entries to record the January transactions. - 3. Prepare a statement of cost of goods manufactured for the month ended January 31.

1.

Prepare a cost of production summary for each department for the month January by using the weighted average method.

Explanation of Solution

Prepare a cost of production summary for Department 1.

| A M Co. | ||

| Cost of production summary | ||

| Department 1 | ||

| For the month ended January 31 | ||

| Particulars | Amount($) | Amount($) |

| Cost of production for month: | ||

| Materials | $22,500 | |

| Labor | 7,200 | |

| Factory overhead | 10,800 | |

| Total costs accounted for | $40,500 | |

| Unit output for month: | ||

| Materials: | ||

| Finished and transferred to Department 2 during month | 40,000 | |

| Equivalent units of work-in process, end of month | 10,000 | |

| Total equivalent production | 50,000 | |

| Labor and factory overhead | ||

| Finished and transferred to Department 2 during month | 40,000 | |

| Equivalent units of work-in process, end of month | 5,000 | |

| Total equivalent production | 45,000 | |

| Unit cost for month: | ||

| Materials | $0.45 | |

| Labor | 0.16 | |

| Factory overhead | 0.24 | |

| Total | $0.85 | |

| Inventory cost: | ||

| Cost of goods finished and transferred to department 2 during month | $34,000 | |

| Cost of work-in process, end of month: | ||

| Materials | $4,500 | |

| Labor | 800 | |

| Factory overhead | 1,200 | 6,500 |

| Total production costs accounted for | $40,500 | |

Table (1)

Prepare a cost of production summary for Department 2.

| A M Co. | |||

| Cost of production summary | |||

| Department 2 | |||

| For the month ended January 31 | |||

| Particulars | Amount($) | Amount($) | Amount($) |

| Cost of goods received from dept. 1. during month | $34,000 | ||

| Cost of production for month: | |||

| Materials | $23,200 | ||

| Labor | 14,500 | ||

| Factory overhead | 14,500 | 52,200 | |

| Total costs accounted for | $86,200 | ||

| Unit output for month: | |||

| Materials, labor, and factory overhead | |||

| Finished and transferred to Department 3 during month | 30,000 | ||

| Finished and on hand | 5,000 | 35,000 | |

| Equivalent units of work-in process, end of month | 1,250 | ||

| Total equivalent production | 36,250 | ||

| Unit cost for month: | |||

| Materials | $0.64 | ||

| Labor | 0.4 | ||

| Factory overhead | 0.4 | ||

| Total | $1.44 | ||

| Inventory cost: | |||

| Cost of goods finished and transferred to department 3 during month | |||

| Cost in department 1 | $25,500 | ||

| Cost in department 2 | 43,200 | $68,700 | |

| Cost of goods finished and on hand: | |||

| Cost in Dept. 1 | $4,250 | ||

| Cost in Dept. 2 | 7,200 | 11,450 | |

| Cost of work-in process, end of month: | |||

| Cost in dept. 1. | $4,250 | ||

| Cost in dept. 2: | |||

| Materials | $800 | ||

| Labor | 500 | ||

| Factory overhead | 500 | 1,800 | 6,050 |

| Total production costs accounted for | $86,200 | ||

Table (2)

Prepare a cost of production summary for Department 3.

| A M Co. | |||

| Cost of production summary | |||

| Department 3 | |||

| For the month ended January 31 | |||

| Particulars | Amount($) | Amount($) | Amount($) |

| Cost of goods received from dept. 2. during month | $68,700 | ||

| Cost of production for month: | |||

| Materials | $19,600 | ||

| Labor | 11,800 | ||

| Factory overhead | 8,850 | 40,250 | |

| Total costs accounted for | $108,950 | ||

| Unit output for month: | |||

| Materials: | |||

| Finished and transferred to finished goods during the month | 28,000 | ||

| Equivalent units of work-in process, end of month | 0 | ||

| Total equivalent production | 28,000 | ||

| Labor and factory overhead: | |||

| Finished and transferred to finished goods during the month | 28,000 | ||

| Equivalent units of work-in process, end of month | 1,500 | ||

| Total equivalent production | 29,500 | ||

| Unit cost for month: | |||

| Materials | $0.70 | ||

| Labor | 0.4 | ||

| Factory overhead | 0.3 | ||

| Total | $1.40 | ||

| Inventory cost: | |||

| Cost of goods finished and transferred to finished during month | |||

| Cost in department 1 | $23,800 | ||

| Cost in department 2 | 40,320 | ||

| Cost in department 3 | 39,200 | $103,320 | |

| Cost of work-in process, end of month: | |||

| Cost in dept. 1. | $1,700 | ||

| Cost in dept. 2: | 2,880 | ||

| Cost in dept. 3: | |||

| Materials | 0 | ||

| Labor | $600 | ||

| Factory overhead | 450 | 1,050 | 5,630 |

| Total production costs accounted for | $108,950 | ||

Table (3)

Summary from cost of production reports:

| Particulars | Amount($) | Amount($) |

| Materials: | ||

| Dept. 1 | $22,500 | |

| Dept. 2 | 23,200 | |

| Dept. 3 | 19,600 | $65,300 |

| Labor: | ||

| Dept. 1 | $7,200 | |

| Dept. 2 | 14,500 | |

| Dept. 3 | 11,800 | 33,500 |

| Factory overhead: | ||

| Dept. 1 | $10,800 | |

| Dept. 2 | 14,500 | |

| Dept. 3 | 8,850 | 34,150 |

| Total production costs for January | $ 132,950 | |

| Deduct work in process, end of month: | ||

| Dept. 1 | $6,500 | |

| Dept. 2 | 17,500 | |

| Dept. 3 | 5,630 | 29,630 |

| Cost of production, goods fully manufactured during January | $103,320 |

Table (4)

2.

Prepare the journal entry to record the transaction.

Explanation of Solution

Prepare the journal entry to record the transaction.

| Particulars | Post ref. | Debit($) | Credit($) |

| Work in process Dept. 1 | 22,500 | ||

| Work in process Dept. 2 | 23,200 | ||

| Work in process Dept. 3 | 19,600 | ||

| Materials | 65,300 | ||

| (To record the materials transaction) | |||

| Work in process Dept. 1 | 7,200 | ||

| Work in process Dept. 2 | 14,500 | ||

| Work in process Dept. 3 | 11,800 | ||

| Payroll | 33,500 | ||

| (To record the payroll transaction) | |||

| Work in process Dept. 1 | 10,800 | ||

| Work in process Dept. 2 | 14,500 | ||

| Work in process Dept. 3 | 8,850 | ||

| Factory overhead | 34,150 | ||

| (To record the factory overhead) | |||

| Work in process Dept. 2 | 34,000 | ||

| Work in process Dept. 1 | 34,000 | ||

| (To record the goods transferred to department 2) | |||

| Work in process Dept. 3 | 68,700 | ||

| Work in process Dept. 2 | 68,700 | ||

| (To record the goods transferred to department 3) | |||

| Finished goods | 1,03,320 | ||

| Work in process Dept. 3 | 1,03,320 | ||

| (To record the goods transferred to finished goods) |

Table (5)

3.

Prepare a statement of cost of goods manufactured for the January month.

Explanation of Solution

Prepare a statement of cost of goods manufactured.

| A M Co. | |

| Statement of cost of goods manufactured | |

| For the month end January | |

| Particulars | Amount($) |

| Materials | $65,300 |

| Labor | 33,500 |

| Factory overhead | 34,150 |

| Total manufacturing cost | $132,950 |

| Add: Work in process inventory, January 1 | 0 |

| $132,950 | |

| Less: Work in process inventory, January 31 | 29,630 |

| Cost of goods manufactured during the month | $103,320 |

Table (6)

Want to see more full solutions like this?

Chapter 6 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Managerial Accounting

Accounting for Governmental & Nonprofit Entities

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Managerial Accounting (5th Edition)

- Lacy, Inc., produces a subassembly used in the production of hydraulic cylinders. The subassemblies are produced in three departments: Plate Cutting, Rod Cutting, and Welding. Materials are added at the beginning of the process. Overhead is applied using the following drivers and activity rates: Other data for the Plate Cutting Department are as follows: Required: 1. Prepare a physical flow schedule. 2. Calculate equivalent units of production for: a. Direct materials b. Conversion costs 3. Calculate unit costs for: a. Direct materials b. Conversion costs c. Total manufacturing 4. Provide the following information: a. The total cost of units transferred out b. The journal entry for transferring costs from Plate Cutting to Welding c. The cost assigned to units in ending inventoryarrow_forwardReducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the subassembly are then assembled in the Assembly Department. The activities, expected costs, and drivers associated with these two manufacturing processes are given below. Note: In the assembly process, the materials-handling activity is a function of product characteristics rather than batch activity. Other overhead activities, their costs, and drivers are listed below. Other production information concerning the two hydraulic cylinders is also provided: Required: 1. Using a plantwide rate based on machine hours, calculate the total overhead cost assigned to each product and the unit overhead cost. 2. Using activity rates, calculate the total overhead cost assigned to each product and the unit overhead cost. Comment on the accuracy of the plantwide rate. 3. Calculate the global consumption ratios. 4. Calculate the consumption ratios for welding and materials handling (Assembly) and show that two drivers, welding hours and number of parts, can be used to achieve the same ABC product costs calculated in Requirement 2. Explain the value of this simplification. 5. Calculate the consumption ratios for inspection and engineering, and show that the drivers for these two activities also duplicate the ABC product costs calculated in Requirement 2.arrow_forwardGolding Manufacturing, a division of Farnsworth Sporting Inc., produces two different models of bows and eight models of knives. The bow-manufacturing process involves the production of two major subassemblies: the limbs and the handles. The limbs pass through four sequential processes before reaching final assembly: layup, molding, fabricating, and finishing. In the layup department, limbs are created by laminating layers of wood. In the molding department, the limbs are heat-treated, under pressure, to form strong resilient limbs. In the fabricating department, any protruding glue or other processing residue is removed. Finally, in the finishing department, the limbs are cleaned with acetone, dried, and sprayed with the final finishes. The handles pass through two processes before reaching final assembly: pattern and finishing. In the pattern department, blocks of wood are fed into a machine that is set to shape the handles. Different patterns are possible, depending on the machines setting. After coming out of the machine, the handles are cleaned and smoothed. They then pass to the finishing department, where they are sprayed with the final finishes. In final assembly, the limbs and handles are assembled into different models using purchased parts such as pulley assemblies, weight-adjustment bolts, side plates, and string. Golding, since its inception, has been using process costing to assign product costs. A predetermined overhead rate is used based on direct labor dollars (80% of direct labor dollars). Recently, Golding has hired a new controller, Karen Jenkins. After reviewing the product-costing procedures, Karen requested a meeting with the divisional manager, Aaron Suhr. The following is a transcript of their conversation: Karen: Aaron, I have some concerns about our cost accounting system. We make two different models of bows and are treating them as if they were the same product. Now I know that the only real difference between the models is the handle. The processing of the handles is the same, but the handles differ significantly in the amount and quality of wood used. Our current costing does not reflect this difference in material input. Aaron: Your predecessor is responsible. He believed that tracking the difference in material cost wasnt worth the effort. He simply didnt believe that it would make much difference in the unit cost of either model. Karen: Well, he may have been right, but I have my doubts. If there is a significant difference, it could affect our views of which model is more important to the company. The additional bookkeeping isnt very stringent. All we have to worry about is the pattern department. The other departments fit what I view as a process-costing pattern. Aaron: Why dont you look into it? If there is a significant difference, go ahead and adjust the costing system. After the meeting, Karen decided to collect cost data on the two models: the Deluxe model and the Econo model. She decided to track the costs for one week. At the end of the week, she had collected the following data from the pattern department: a. There were a total of 2,500 bows completed: 1,000 Deluxe models and 1,500 Econo models. b. There was no BWIP; however, there were 300 units in EWIP: 200 Deluxe and 100 Econo models. Both models were 80% complete with respect to conversion costs and 100% complete with respect to materials. c. The pattern department experienced the following costs: d. On an experimental basis, the requisition forms for materials were modified to identify the dollar value of the materials used by the Econo and Deluxe models: Required: 1. Compute the unit cost for the handles produced by the pattern department, assuming that process costing is totally appropriate. Round unit cost to two decimal places. 2. Compute the unit cost of each handle, using the separate cost information provided on materials. Round unit cost to two decimal places. 3. Compare the unit costs computed in Requirements 1 and 2. Is Karen justified in her belief that a pure process-costing relationship is not appropriate? Describe the costing system that you would recommend. 4. In the past, the marketing manager has requested more money for advertising the Econo line. Aaron has repeatedly refused to grant any increase in this products advertising budget because its per-unit profit (selling price minus manufacturing cost) is so low. Given the results in Requirements 1 through 3, was Aaron justified in his position?arrow_forward

- Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three departments: Mixing, Tableting, and Bottling. In Mixing, at the beginning of the process all materials are added and the ingredients for the minerals are measured, sifted, and blended together. The mix is transferred out in gallon containers. The Tableting Department takes the powdered mix and places it in capsules. One gallon of powdered mix converts to 1,600 capsules. After the capsules are filled and polished, they are transferred to Bottling where they are placed in bottles, which are then affixed with a safety seal and a lid and labeled. Each bottle receives 50 capsules. During July, the following results are available for the first two departments (direct materials are added at the beginning in both departments): Overhead in both departments is applied as a percentage of direct labor costs. In the Mixing Department, overhead is 200 percent of direct labor. In the Tableting Department, the overhead rate is 150 percent of direct labor. Required: 1. Prepare a production report for the Mixing Department using the weighted average method. Follow the five steps outlined in the chapter. Round unit cost to three decimal places. 2. Prepare a production report for the Tableting Department. Materials are added at the beginning of the process. Follow the five steps outlined in the chapter. Round unit cost to four decimal places.arrow_forwardK-Briggs Company uses the FIFO method to account for the costs of production. For Crushing, the first processing department, the following equivalent units schedule has been prepared: The cost per equivalent unit for the period was as follows: The cost of beginning work in process was direct materials, 40,000; conversion costs, 30,000. Required: 1. Determine the cost of ending work in process and the cost of goods transferred out. 2. Prepare a physical flow schedule.arrow_forwardGolding Manufacturing, a division of Farnsworth Sporting, Inc., produces two different models of bows and eight models of knives. The bow-manufacturing process involves the production of two major subassemblies: the limbs and the handle. The limbs pass through four sequential processes before reaching final assembly: lay-up, molding, fabricating, and finishing. In the Lay-Up Department, limbs are created by laminating layers of wood. In Molding, the limbs are heat treated, under pressure, to form a strong resilient limb. In the Fabricating Department, any protruding glue or other processing residue is removed. Finally, in Finishing, the limbs are cleaned with acetone, dried, and sprayed with the final finishes. The handles pass through two processes before reaching final assembly: pattern and finishing. In the Pattern Department, blocks of wood are fed into a machine that is set to shape the handles. Different patterns are possible, depending on the machines setting. After coming out of the machine, the handles are cleaned and smoothed. They then pass to the Finishing Department where they are sprayed with the final finishes. In Final Assembly, the limbs and handles are assembled into different models using purchased parts such as pulley assemblies, weight adjustment bolts, side plates, and string. Golding, since its inception, has been using process costing to assign product costs. A predetermined overhead rate is used based on direct labor dollars (80 percent of direct labor dollars). Recently, Golding has hired a new controller, Karen Jenkins. After reviewing the product costing procedures, Karen requested a meeting with the divisional manager, Aaron Suhr. The following is a transcript of their conversation: KAREN: Aaron, I have some concerns about our cost accounting system. We make two different models of bows and are treating them as if they were the same product. Now I know that the only real difference between the models is the handle. The processing of the handles is the same, but the handles differ significantly in the amount and quality of wood used. Our current costing does not reflect this difference in direct material input. AARON: Your predecessor is responsible. He believed that tracking the difference in direct material cost wasnt worth the effort. He simply didnt believe that it would make much difference in the unit cost of either model. KAREN: Well, he may have been right, but I have my doubts. If there is a significant difference, it could affect our views of which model is more important to the company. The additional bookkeeping isnt very stringent. All we have to worry about is the Pattern Department. The other departments fit what I view as a process-costing pattern. AARON: Why dont you look into it? If there is a significant difference, go ahead and adjust the costing system. After the meeting, Karen decided to collect cost data on the two models: the Deluxe model and the Econo model. She decided to track the costs for one week. At the end of the week, she had collected the following data from the Pattern Department: a. There were a total of 2,500 bows completed: 1,000 Deluxe models and 1,500 Econo models. b. There was no beginning work in process; however, there were 300 units in ending work in process: 200 Deluxe and 100 Econo models. Both models were 80 percent complete with respect to conversion costs and 100 percent complete with respect to direct materials. c. The Pattern Department experienced the following costs: d. On an experimental basis, the requisition forms for direct materials were modified to identify the dollar value of the direct materials used by the Econo and Deluxe models: Required: 1. Compute the unit cost for the handles produced by the Pattern Department, assuming that process costing is totally appropriate. 2. Compute the unit cost of each handle, using the separate cost information provided on materials. 3. Compare the unit costs computed in Requirements 1 and 2. Is Karen justified in her belief that a pure process-costing relationship is not appropriate? Describe the costing system that you would recommend. 4. In the past, the marketing manager has requested more money for advertising the Econo line. Aaron has repeatedly refused to grant any increase in this products advertising budget because its per-unit profit (selling price less manufacturing cost) is so low. Given the results in Requirements 1 through 3, was Aaron justified in his position?arrow_forward

- Benson Pharmaceuticals uses a process-costing system to compute the unit costs of the over-the-counter cold remedies that it produces. It has three departments: mixing, encapsulating, and bottling. In mixing, the ingredients for the cold capsules are measured, sifted, and blended (with materials assumed to be uniformly added throughout the process). The mix is transferred out in gallon containers. The encapsulating department takes the powdered mix and places it in capsules (which are necessarily added at the beginning of the process). One gallon of powdered mix converts into 1,500 capsules. After the capsules are filled and polished, they are transferred to bottling, where they are placed in bottles that are then affixed with a safety seal, lid, and label. Each bottle receives 50 capsules. During March, the following results are available for the first two departments: Overhead in both departments is applied as a percentage of direct labor costs. In the mixing department, overhead is 200% of direct labor. In the encapsulating department, the overhead rate is 150% of direct labor. Required: 1. Prepare a production report for the mixing department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to two decimal places for the unit cost.) 2. Prepare a production report for the encapsulating department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to four decimal places for the unit cost.) 3. CONCEPTUAL CONNECTION Explain why the weighted average method is easier to use than FIFO. Explain when weighted average will give about the same results as FIFO.arrow_forwardHercules Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: The activity-base usage quantities and units produced for each product were as follows: Use the activity rate and usage information to determine the total activity cost and activity cost per unit for each product.arrow_forwardHandy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stencilled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Handy Leather uses the multiple production department factory overhead rate method of allocating factory overhead costs. Its factory overhead costs were budgeted as follows: The direct labor estimated for each production department was as follows: Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows: a. Determine the two production department factory overhead rates. b. Use the two production department factory overhead rates to determine the factory overhead per unit for each product.arrow_forward

- Sonoma Products Inc. manufactures a liquid product in one department. Due to the nature of the product and the process, units are regularly lost during production. Materials and conversion costs are added evenly throughout the process. The following summaries were prepared for March: Calculate the unit cost for materials, labor, and factory overhead for March and show the costs of units transferred to finished goods and to ending work in process inventory.arrow_forwardRadford Inc. manufactures a sugar product by a continuous process, involving three production departmentsRefining, Sifting, and Packing. Assume that records indicate that direct materials, direct labor, and applied factory overhead for the first department, Refining, were 1,250,000, 660,000, and 975,000, respectively. Also, work in process in the Refining Department at the beginning of the period totaled 328,000, and work in process at the end of the period totaled 295,000. Journalize the entries to record (a) the flow of costs into the Refining Department during the period for (1) direct materials, (2) direct labor, and (3) factory overhead, and (b) the transfer of production costs to the second department, Sifting.arrow_forwardHeap Company manufactures a product that passes through two processes: Fabrication and Assembly. The following information was obtained for the Fabrication Department for September: a. All materials are added at the beginning of the process. b. Beginning work in process had 80,000 units, 30 percent complete with respect to conversion costs. c. Ending work in process had 17,000 units, 25 percent complete with respect to conversion costs. d. Started in process, 95,000 units. Required: 1. Prepare a physical flow schedule. 2. Compute equivalent units using the weighted average method. 3. Compute equivalent units using the FIFO method.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning