Special Order

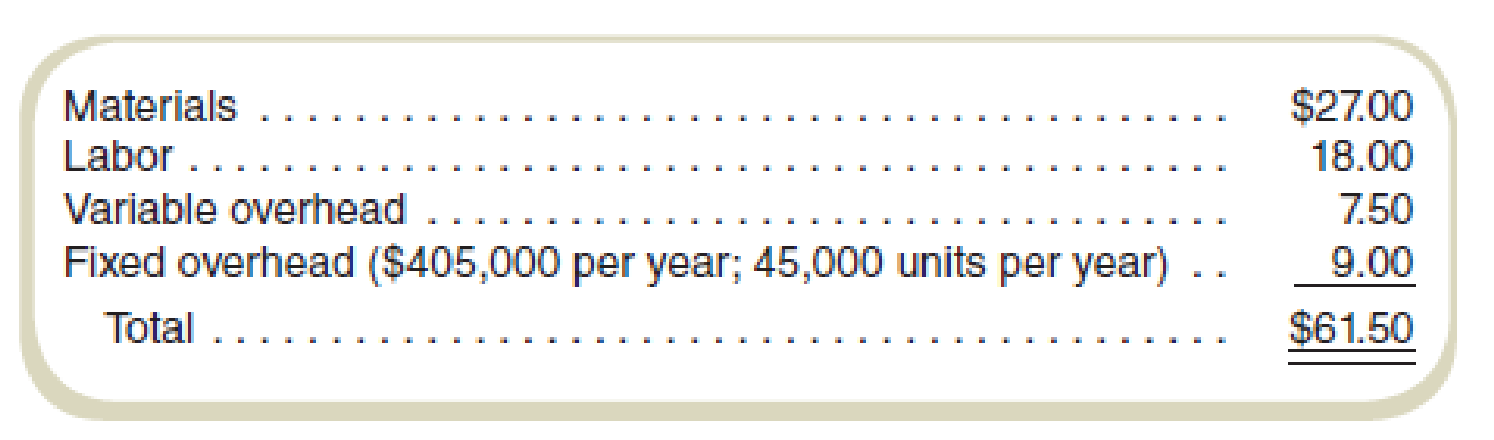

Fairmount Travel Gear produces backpacks and sells them to vendors who sell them under their own label. The cost of one of its backpacks follows:

Riverside Discount Mart, a chain of low-price stores, has asked Fairmount to supply it with 3,000 backpacks for a special promotion Riverside is planning. Riverside has offered to pay Fairmount a unit price of $63 per pack. The regular selling price is $90. The special order would require some modification to the basic model. These modifications would add $6.00 per unit in material cost, $2.50 per unit in labor cost, and $0.70 in variable overhead cost. Although Fairmount has the capacity to produce the 3,000 units without affecting its regular production of 45,000 units, a onetime rental of special testing equipment to meet Riverside’s requirements would be needed. The equipment rental would be $7,500 and would allow Fairmount to test up to 5,000 units.

Required

- a. Prepare a schedule to show the impact of filling the Riverside order on Fairmont’s profits for the year.

- b. Would you recommend that Fairmont accept the order?

- c. Considering only profit, determine the minimum quantity of backpacks in the special order that would make it profitable.

a.

Calculate the impact on operating profit because of the special order.

Answer to Problem 41E

The operating profit decreases by $3,600 because of the special order of 3,000 backpacks.

Explanation of Solution

Operating profit: The operating profit is the excess of total revenues over total expenses after adjusting for depreciation and taxes.

- • A special order has a price of $63 and 3,000 units (backpacks).

- • Fixed cost for special order will increase by $7,500 because of rental equipment.

- • Special order will require the additional material cost of $6, the labor cost of $2.5 and variable cost of$0.70.

Compute the impact on operating profit because of the special order:

| Particulars | Status Quo: 45,000 units | Alternative: 48,000 units | Difference |

| Sales revenue | $4,050,000 | $4,239,000(1) | $189,000 higher |

| Less: material | $1,215,000 | $1,314,000(2) | $99,000 higher |

| Labor | $810,000 | $871,500(3) | $61,500 higher |

| Variable cost | $337,500 | $362,100(4) | $24,600 higher |

| Total variable overhead | $2,362,500 | $2,547,600 | $185,100 higher |

| Contribution margin | $1,687,500 | $1,691,400 | $3,900 higher |

| Less: fixed overhead | $405,000 | $412,500(5) | $7,500 higher |

| Operating profit | $1,282,500 | $1,278,900 | $3,600 lower |

Table: (2)

Thus, the operating profit decreases by $3,600 because of the special order of 3,000 backpacks.

Working note 1:

Compute the sales revenue for an alternative:

Working note 2:

Compute the material cost for the alternative:

Working note 3:

Compute the labor cost for the alternative:

Working note 4:

Compute the variable cost for the alternative:

Working note 5:

Compute the fixed cost for the alternative:

Working note 6:

Compute the revised costs:

| Particulars | Amount | Additional cost | Total |

| Material cost | $27 | $6.0 | $33 |

| Labor | $18 | $2.5 | $20.5 |

| Variable overhead | $7.5 | $0.7 | $8.2 |

Table: (6)

b.

Recommend whether Company F should accept the offer or not.

Explanation of Solution

Company F should not accept the offer. The operating profit decreases by $3,600 because of the special order of 3,000 backpacks. Accepting the offer will decrease the operating profit by $3,600.

Thus, Company F should not accept the offer as per the loss of the operating profit.

c.

Considering only the profit, determine the minimum quantity of backpacks in the special order that would make it profitable, assuming capacity is available.

Answer to Problem 41E

Company F should sell 5,769 units in order to make the business profitable.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Contribution margin: The excess of sales price over the variable expenses is referred to as the contribution margin. It is computed by deducting the variable expenses from the sales revenue.

Company F should use the break-even analysis to find out the minimum quantity of backpacks in the special order that would make it profitable. Total variable cost is $61.7

Compute the break-even point:

Thus, Company F should sell 5,769 units in order to make the business profitable.

Working note 4:

Compute the contribution margin:

Want to see more full solutions like this?

Chapter 4 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Kaune Food Products Company manufactures canned mixed nuts with an average manufacturing cost of 52 per case (a case contains 24 cans of nuts). Kaune sold 150,000 cases last year to the following three classes of customer: The supermarkets require special labeling on each can costing 0.04 per can. They order through electronic data interchange (EDI), which costs Kaune about 61,000 annually in operating expenses and depreciation. Kaune delivers the nuts to the stores and stocks them on the shelves. This distribution costs 45,000 per year. The small grocers order in smaller lots that require special picking and packing in the factory; the special handling adds 25 to the cost of each case sold. Sales commissions to the independent jobbers who sell Kaune products to the grocers average 8 percent of sales. Bad debts expense amounts to 9 percent of sales. Convenience stores also require special handling that costs 30 per case. In addition, Kaune is required to co-pay advertising costs with the convenience stores at a cost of 15,000 per year. Frequent stops are made to each convenience store by Kaune delivery trucks at a cost of 30,000 per year. Required: 1. Calculate the total cost per case for each of the three customer classes. (Round unit costs to four significant digits.) 2. Using the costs from Requirement 1, calculate the profit per case per customer class. Does the cost analysis support the charging of different prices? Why or why not? 3. What if Kaune charged the average price per case to all customer classes? How would that affect the profit percentages?arrow_forwardJansen Crafters has the capacity to produce 50,000 oak shelves per year and is currently selling 44,000 shelves for $32 each. Cutrate Furniture approached Jansen about buying 1,200 shelves for bookcases it is building and is willing to pay $26 for each shelf. No packaging will be required for the bulk order. Jansen usually packages shelves for Home Depot at a price of $1.50 per shell. The $1.50 per-shelf cost is included in the unit variable cost of $27, with annual fixed costs of $320.000. However, the $130 packaging cost will not apply in this case. The fixed costs will be unaffected by the special order and the company has the capacity to accept the order. Based on this information, what would be the profit if Jansen accepts the special order? A. Profits will decrease by $1,200. B. Profits will increase by $31,200. C. Profits will increase by $600. D. Profits will increase by $7,200.arrow_forwardThe Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $18.00 each with a minimum order of 174 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 174. Since Hooper’s plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $36.00 each. Hooper would pay the students a commission of $5.00 for each shirt sold. Required: 1.What level of unit sales and dollar sales is needed to attain a target profit of $9,048? 2.…arrow_forward

- Diamond Boot Factory normally sells its specialty boots for $32 a pair. An offer to buy 120 boots for $26 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $13, and special stitching will add another $1 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organization.$ Should Diamond Boot Factory accept or reject the special offer?arrow_forwardThe Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $17.00 each with a minimum order of 152 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 152. Since Hooper’s plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $34.00 each. Hooper would pay the students a commission of $4.00 for each shirt sold. Required: 1. What level of unit sales and dollar sales is needed to attain a target profit of $7,904?…arrow_forwardJCBilco Manufacturing produces and sells oil filters for $3.30 each. A retailer has offered to purchase 25,000 oil filters for $1.36 per filter. Of the total manufacturing cost per filter of $2.15, $1.35 is the variable manufacturing cost per filter. For this special order, JCBilco would have to buy a special stamping machine that costs $8,500 to mark the customer's logo on the special-order oil filters. The machine would be scrapped when the special order is complete. This special order would use manufacturing capacity that would otherwise be idle. No variable nonmanufacturing costs would be incurred by the special order. Regular sales would not be affected by the special order. Would you recommend that JCBilco accept the special order under these conditions?arrow_forward

- The Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $20.00 each with a minimum order of 151 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 151. Since Hooper’s plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $40.00 each. Hooper would pay the students a commission of $8.00 for each shirt sold. Required: 1. What level of unit sales and dollar sales is needed to attain a target profit of…arrow_forwardThe I-75 Carpet Discount Store has an annual demand of 10,000 yards of Super Shag carpet. The annual carrying cost for a yard of this carpet is $0.75, and the ordering cost is $150. The carpet manufacturer normally charges the store $8 per yard for the carpet; however, the manufacturer has offered a discount price of $6.50 per yard if the store will order 5,000 yards. How much should the store order, and what will be the total annual inventory cost for that order quantity?arrow_forwardRugged Outfitters purchases one model of mountain bike at a wholesale cost of $520 per unit and resells it to end consumers. The annual demand for the company’s product is 49,000 units. Ordering costs are $500 per order and carrying costs are $100 per bike per year, including $40 in the opportunity cost of holding inventory. Q. Assume that when evaluating the manager, the company excludes the opportunity cost of carrying inventory. If the manager makes the EOQ decision excluding the opportunity cost of carrying inventory, the relevant carrying cost would be $60, not $100. How would this affect the EOQ amount and the actual annual relevant cost of ordering and carrying inventory?arrow_forward

- Special Order Pope Company manufactures a variety of hiking boots and has received a special one-time-only order from a new customer. Pope has sufficient idle capacity to accept the special order to manufacture 1,200 pairs of boots at a price of $52.00 per pair. Pope’s normal selling price is $65.00 per pair of boots. Variable manufacturing costs are $35.00 per pair and fixed manufacturing costs are $12.00 a pair. Pope’s variable selling expense for its normal line of boots is $1.00 per pair. What would the effect on Pope’s operating income be if the company accepted the special order? Pope's operating income would (Increase/ Decrease) by $______ if the order was acceptedarrow_forwardThe Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking ofexpanding his sales by hiring local high school students, on a commission basis, to sell sweatshirts bearingthe name and mascot of the local high school.These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and theycould not be returned because of the unique printing required. The sweatshirts would cost Mr. Hooper$8 each with a minimum order of 75 sweatshirts. Any additional sweatshirts would have to be ordered inincrements of 75.Since Mr. Hooper’s plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $13.50 each. Mr. Hooper would pay the students a commission of $1.50 for each shirt sold.Required:1. To make the project worthwhile, Mr. Hooper would require a $1,200 profit for the first…arrow_forwardDiamond Boot Factory normally sells its specialty boots for $35 a pair. An offer to buy 125 boots for $31 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $12, and special stitching will add another $2 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organizatioarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning