Concept explainers

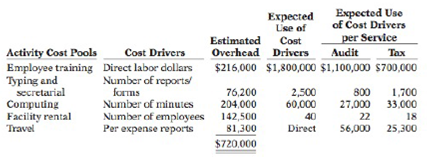

Lewis and Stark is a public accounting firm that offers two primary services, auditing and tax-return preparation. A controversy has developed between the partners of the two service lines as to who is contributing the greater amount to the bottom line. The area of contention is the assignment of

Instructions

(a) Using traditional product costing as proposed by the tax partners, compute the total overhead cost assigned to both services (audit and tax) of Lewis and Stark.

(b) (1) Using activity-based costing, prepare a schedule showing the computations of the

activity-based overhead rates (per cost driver). (2) Prepare a schedule assigning each activity's overhead cost pool to each service based on the use of the cost drivers.

(c) - Comment on the comparative overhead cost for the two services under both traditional costing and ABC.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting: Tools for Business Decision Making

- Winkle, Kotter, and Zale is a small law firm that contains 10 partners and 12 support persons. The firm employs a job-order costing system to accumulate costs chargeable to each client, and it is organized into two departments—the Research and Documents Department and the Litigation Department. The firm uses predetermined overhead rates to charge the costs of these departments to its clients. At the beginning of the current year, the firm's management made the following estimates for the year: Department Researchand Documents Litigation Research-hours 20,400 - Direct attorney-hours 9,300 16,400 Materials and supplies $ 17,700 $ 5,500 Direct attorney cost $ 430,100 $ 799,400 Departmental overhead cost $ 714,000 $ 311,766 The predetermined overhead rate in the Research and Documents Department is based on research-hours, and the rate in the Litigation Department is based on direct attorney cost. The costs charged…arrow_forwardDavid & Cooper, a consulting firm, specializes in providing internal audit services for its clients. It bills the clients $156 per hour for its professional services; it costs the firm $81 per hour to cover the cost of its staff. To cover its MOH costs, the partners have always applied MOH costs to clients based on total direct labor hours. At the beginning of the year, they budgeted for 8,100 direct labor hours and $150,660 of MOH costs.In the current year, the firm’s professional staff worked on three key client projects: All Ways, Inc., for 2,600 hours; My Way, Inc., for 2,100 hours; and High Way, Inc., for 4,300 hours. These clients were billed for this work by the end of the year.Naturally, there were other costs incurred to run the firm, including sales and marketing costs, which added up to $126,000 this year. Actual MOH costs for the year totaled $136,000. Prepare an income statement for the firm for the current year. select an income statement item…arrow_forwardDavid & Cooper, a consulting firm, specializes in providing internal audit services for its clients. It bills the clients $156 per hour for its professional services; it costs the firm $81 per hour to cover the cost of its staff. To cover its MOH costs, the partners have always applied MOH costs to clients based on total direct labor hours. At the beginning of the year, they budgeted for 8,100 direct labor hours and $150,660 of MOH costs.In the current year, the firm’s professional staff worked on three key client projects: All Ways, Inc., for 2,600 hours; My Way, Inc., for 2,100 hours; and High Way, Inc., for 4,300 hours. These clients were billed for this work by the end of the year.Naturally, there were other costs incurred to run the firm, including sales and marketing costs, which added up to $126,000 this year. Actual MOH costs for the year totaled $136,000. Show the effects of the labor and MOH costs through T-accounts for the company’s inventory and Cost of Sales accounts.…arrow_forward

- Pinnacle Consulting employs two CPAs, each having a different area of specialization. Judy specializes in tax consulting and Steve specializes in management consulting. Pinnacle expects to incur total overhead costs of $419,400 during the year and applies overhead based on annual salary costs. Judy is a senior partner, her annual salary is $225,000, and she is expected to bill 2,200 hours during the year. Steve is a senior associate, his annual salary is $124,500, and he is expected to bill 1,500 hours during the year. Required: Calculate the predetermined overhead rate. Assuming that the hourly billing rate should be set to cover the total cost of services plus a 25% markup, compute the hourly billing rates for Judy and Steve.arrow_forwardTAC Industries, Inc. sells heavy equipment to large corporations and federal, state, and local governments. Corporate sales are the result of a competitive bidding process, where TAC competes against other companies based on selling price. Sales to government, however, are determined on a cost plus basis, where the selling price is determined by adding a fixed markup percentage to the total job cost. Tandy Lane is the cost accountant for the Equipment Division of TAC Industries, Inc. The division is under pressure from senior management to improve income from operations. As Tandy reviewed the division's job cost sheets, she realized that she could increase the division's income from operations by moving a portion of the direct labor hours that had been assigned to the job order cost sheets of corporate customers onto the job order cost sheets of government customers. She believed this would create a "win-win" situation for the division by (1) reducing the cost of corporate jobs, and…arrow_forwardTAC Industries, Inc. sells heavy equipment to large corporations and federal, state, and local governments. Corporate sales are the result of a competitive bidding process, where TAC competes against other companies based on selling price. Sales to the government are determined on a cost plus basis, where the selling price is determined by adding a fixed markup percentage to the total job cost. Tandy Lane is the cost accountant for the Equipment Division of TAC Industries Inc. The division is under pressure from senior management to improve operating income. As Tandy reviewed the division's job cost sheets, she realized that she could increase the division's operating income by moving a portion of direct labor hours that had been assigned to the job cost sheets of corporate customers onto the job order cost sheets of government customers. She believed that this would create a "win-win" for the division by (1) reducing the cost of corporate jobs, and (2) increasing the cost of…arrow_forward

- TAC Industries sells heavy equipment to large corporations and to federal, state, and local governments. Corporate sales are the result of a competitive bidding process, where TAC competes against other companies based on selling price. Sales to the government, however, are determined on a cost plus basis, where the selling price is determined byadding a fixed markup percentage to the total job cost. Tandy Lane is the cost accountant for the Equipment Division of TAC Industries Inc. The division is under pressure from senior management to improve income from operations. As Tandy reviewed the division’s job cost sheets, she realized that she couldincrease the division’s income from operations by moving a portion of the direct labor hours that had been assigned to the job order cost sheets of corporate customers onto the job order costs sheets of governmentcustomers. She believed that this would create a win–win for the division by (1) reducing the cost of corporate jobs and (2)…arrow_forwardTAC Industries Inc. sells heavy equipment to large corporations and federal, state, and local governments. Corporate sales are the result of a competitive bidding process, where TAC competes against other companies based on selling price. Sales to the government, however, are determined on a cost-plus basis, where the selling price is determined by adding a fixed markup percentage to the total job cost. Tandy Lane is the cost accountant for the Equipment Division of TAC Industries Inc. The division is under pressure from senior management to improve income from operations. As Tandy reviewed the division's job cost sheets, she realized that she could increase the division's income from operations by moving a portion of the direct labor hours that had been assigned to the job order cost sheets of corporate customers onto the job order costs sheets of government customers. She believed that this would create a “win–win” for the division by (1) reducing the cost of corporate jobs, and (2)…arrow_forwardBoise, a division of Price Enterprises, currently performs computer services for various departments of the firm. One of the services has created a number of operating problems, and management is exploring whether to outsource the service to a consultant. Traceable variable and fixed operating costs total $103,000 and $48,000, respectively, in addition to $41,000 of corporate administrative overhead allocated from Price. If Boise were to use the outside consultant, fixed operating costs would be reduced by 70%. What are the irrelevant costs in Boise’s outsourcing decision?arrow_forward

- The State Department of Taxation processes and audits income-tax returns for state residents. The state tax commissioner has recently begun a program of work measurement to help in estimating the costs of running the department. The independent variable used in the program is the number of returns processed. The analysis revealed that the following variable costs are incurred in auditing a typical tax return. Time spent by clerical employees, 10 hours at $12 per hourTime spent by tax professional, 20 hours at $25 per hourComputer time, $50 per auditTelephone charges, $10 per auditPostage, $2 per audit In addition, the department incurs $10,000 of fixed costs each month that are associated with the process of auditing returns.Required: Draw a graph depicting the monthly costs of auditing state tax returns. Label the horizontal axis “Tax returns audited.”arrow_forwardTAC Industries Inc. sells heavy equipment to large corporations and federal, state, and local governments. Corporate sales are the result of a competitive bidding process, where TAC competes against other companies based on selling price. Sales to the government, however, are determined on a cost plus basis, where the selling price is determined by adding a fixed markup percentage to the total job cost. Tandy Lane is the cost accountant for the Equipment Division of TAC Industries Inc. The division is under pressure from senior management to improve income from operations. As Tandy reviewed the division's job cost sheets, she realized that she could increase the division's income from operations by moving a portion of the direct labor hours that had been assigned to the job order cost sheets of corporate customers onto the job order costs sheets of government customers. She believed that this would create a “win–win” for the division by (1) reducing the cost of corporate jobs, and (2)…arrow_forwardCommunicationTAC Industries sells heavy equipment to large corporations and to federal, state, and local governments. Corporate sales are the result of a competitive bidding process, where TAC competes against other companies based on selling price. Sales to the government, however, are determined on a cost plus basis, where the selling price is determined by adding a fixed markup percentage to the total job cost.Tandy Lane is the cost accountant for the Equipment Division of TAC Industries Inc. The division is under pressure from senior management to improve income from operations.As Tandy reviewed the division’s job cost sheets, she realized that she could increase the division’s income from operations by moving a portion of the direct labor hours that had been assigned to the job order cost sheets of corporate customers onto the job order costs sheets of government customers. She believed that this would create a win-win for the division by (1) reducing the cost of corporate jobs…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning