Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 6MAD

Analyze and compare Alphabet (Google) and Microsoft

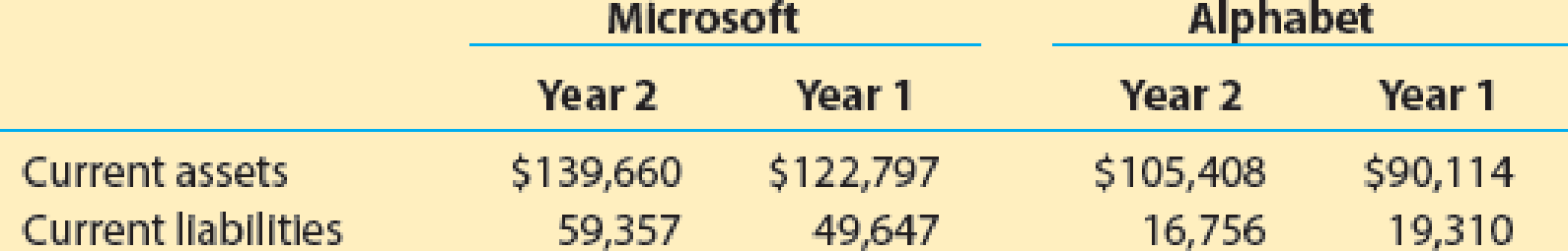

Alphabet Inc. (GOOG) and Microsoft Corporation (MSFT) design and distribute consumer and enterprise software, including overlaps in search, business productivity, and mobile operating systems. Alphabet’s primary source of revenue is from advertising, while Microsoft’s is from software subscription and support fees. The following year-end data (in millions) were taken from recent balance sheets for both companies:

- a. Compute the

working capital for each company for both years. - b. Which company has the larger working capital at the end of Year 2?

- c. Is working capital a good measure of relative liquidity in comparing the two companies? Explain.

- d. Compute the

current ratio for both companies. Round to one decimal place. - e. Which company has the larger relative liquidity based on the current ratio?

- f. Based on your analysis, comment on the short-term debt-paying ability of these two companies.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

[The following information applies to the questions displayed below.]

You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows:

Lydex CompanyComparative Balance Sheet

This Year

Last Year

Assets

Current assets:

Cash

$

1,010,000

$

1,250,000

Marketable securities

0

300,000

Accounts receivable, net

2,900,000

2,000,000

Inventory

3,650,000

2,000,000

Prepaid expenses

270,000

210,000

Total current assets

7,830,000

5,760,000

Plant and equipment, net

9,620,000

9,100,000

Total assets

$

17,450,000

$…

AT&T and Verizon produce and market telecommunications products and are competitors. Key financial figures for these businesses for a recent year follow.Compute return on assets for (a) AT&T and (b) Verizon.

Macon Mills is a division of Bolin Products, Inc. During the most recent year, Macon had a net income of $40 million. Total assets were $470 million, non-interest-bearing current liabilities were $72,000,000. What are the invested capital and ROI for Macon?

Solution

What is the invested capital (Total Assets – Non-Interest-Bearing Current Liabilities)?

What is the ROI (Net Income/Invested Capital)?

Please don't provide answer in image format thank you

Chapter 4 Solutions

Financial And Managerial Accounting

Ch. 4 - Why do some accountants prepare an end-of-period...Ch. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - Which step of the accounting cycle is optional?Ch. 4 - Prob. 10DQ

Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Prob. 2BECh. 4 - Classified balance sheet The following accounts...Ch. 4 - Closing entries After the accounts have been...Ch. 4 - Accounting cycle From the following list of steps...Ch. 4 - Working capital and current ratio Current assets...Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Classifying accounts Balances for each of the...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Income statement The following account balances...Ch. 4 - Income statement; net loss The following revenue...Ch. 4 - Income statement FedEx Corporation (FDX) had the...Ch. 4 - Statement of stockholders equity Climate Control...Ch. 4 - Statement of stockholders equity; net loss...Ch. 4 - Classifying assets Identify each of the following...Ch. 4 - Balance sheet classification At the balance sheet...Ch. 4 - Balance sheet Dynamic Weight Loss Co. offers...Ch. 4 - Balance sheet The following balance sheet was...Ch. 4 - Identifying accounts to be closed From the list...Ch. 4 - Closing entries with net income Automation...Ch. 4 - Closing entries with net loss Summit Services Co....Ch. 4 - Identifying permanent accounts Which of the...Ch. 4 - Post-closing trial balance An accountant prepared...Ch. 4 - Steps in the accounting cycle Rearrange the...Ch. 4 - Completing an end-of-period spreadsheet List (a)...Ch. 4 - Appendix 1 Adjustment data on an end-of-period...Ch. 4 - Prob. 22ECh. 4 - Appendix 1 Financial statements from an...Ch. 4 - Appendix 1 Adjusting entries from an end-of-period...Ch. 4 - Prob. 25ECh. 4 - Reversing entry The following adjusting entry for...Ch. 4 - Adjusting and reversing entries On the basis of...Ch. 4 - Adjusting and reversing entries On the basis of...Ch. 4 - Entries posted to wages expense account Portions...Ch. 4 - Entries posted to wages expense account Portions...Ch. 4 - Financial statements and closing entries Beacons...Ch. 4 - Financial statements and closing entries Foxy...Ch. 4 - T accounts, adjusting entries, financial...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Complete accounting cycle For the past several...Ch. 4 - Financial statements and closing entries Last...Ch. 4 - Financial statements and closing entries The...Ch. 4 - T accounts, adjusting entries, financial...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Complete accounting cycle For the past several...Ch. 4 - The unadjusted trial balance of PS Music as of...Ch. 4 - Kelly Pitney began her consulting business, Kelly...Ch. 4 - Analyze and compare Amazon.com to Best Buy...Ch. 4 - Analyze and compare Zynga, Electronic Arts, and...Ch. 4 - Analyze and compare Foot Locker and The Finish...Ch. 4 - Analyze Under Armour The following year-end data...Ch. 4 - Prob. 5MADCh. 4 - Analyze and compare Alphabet (Google) and...Ch. 4 - Prob. 1TIFCh. 4 - Your friend, Daniel Nat, recently began work as...Ch. 4 - Prob. 4TIFCh. 4 - Prob. 5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Analyze and compare Zynga, Electronic Arts, and Take-Two Data (in millions) from recent financial statements of Zynga Inc. (ZNGA), Electronic Arts Inc. (EA), and Take-Two Interactive Software, Inc. (TTWO) are as follows: a. Compute the working capital for Year 2 and Year 1 for each company. b. Which company has the largest working capital? c. Compute the current ratio for Year 2 and Year 1 for each company. Round to one decimal place. d. For Year 2, rank the companies from most liquid to least liquid based upon the current ratio.arrow_forwardMike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies. To be able to assess the financial capabilities of the company, Mike has been given the companys financial statements for the 2 most recent years. Required: Note: Round all answers to two decimal places. 1. Compute the following for each year: (a) return on assets, (b) return on stockholders equity, (c) earnings per share, (d) price-earnings ratio, (e) dividend yield, and (f ) dividend payout ratio. 2. CONCEPTUAL CONNECTION Based on the analysis in Requirement 1, would you invest in the common stock of Kepler?arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. A. In the correct format, prepare the income statement using the following information: B. Calculate the profit margin, return on investment, and residual income. Assume an investment base of $100,000 and 6% cost of capital. C. Prepare a short response to accompany the income statement that explains why uncontrollable costs are included in the income statement.arrow_forward

- Macon Mills is a division of Bolin Products, Inc. During the most recent year, Macon had a net income of $40 million. Total assets were $470 million, non-interest-bearing current liabilities were $72,000,000. What are the invested capital and ROI for Macon? Solution What is the invested capital (Total Assets – Non-Interest-Bearing Current Liabilities)? What is the ROI (Net Income/Invested Capital)?arrow_forwardYou have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000 $ 3,100,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,770,000 6,200,000…arrow_forwardYou have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000 $ 3,100,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,770,000 6,200,000…arrow_forward

- You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,010,000 $ 1,250,000 Marketable securities 0 300,000 Accounts receivable, net 2,900,000 2,000,000 Inventory 3,650,000 2,000,000 Prepaid expenses 270,000 210,000 Total current assets 7,830,000 5,760,000 Plant and equipment, net 9,620,000 9,100,000 Total assets $ 17,450,000 $ 14,860,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,060,000 $ 3,080,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,760,000 6,180,000…arrow_forwardYou have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,010,000 $ 1,250,000 Marketable securities 0 300,000 Accounts receivable, net 2,900,000 2,000,000 Inventory 3,650,000 2,000,000 Prepaid expenses 270,000 210,000 Total current assets 7,830,000 5,760,000 Plant and equipment, net 9,620,000 9,100,000 Total assets $ 17,450,000 $ 14,860,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,060,000 $ 3,080,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,760,000 6,180,000…arrow_forwardYou have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,010,000 $ 1,250,000 Marketable securities 0 300,000 Accounts receivable, net 2,900,000 2,000,000 Inventory 3,650,000 2,000,000 Prepaid expenses 270,000 210,000 Total current assets 7,830,000 5,760,000 Plant and equipment, net 9,620,000 9,100,000 Total assets $ 17,450,000 $ 14,860,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,060,000 $ 3,080,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,760,000 6,180,000…arrow_forward

- You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,010,000 $ 1,250,000 Marketable securities 0 300,000 Accounts receivable, net 2,900,000 2,000,000 Inventory 3,650,000 2,000,000 Prepaid expenses 270,000 210,000 Total current assets 7,830,000 5,760,000 Plant and equipment, net 9,620,000 9,100,000 Total assets $ 17,450,000 $ 14,860,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,060,000 $ 3,080,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,760,000 6,180,000…arrow_forwardYou have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,010,000 $ 1,250,000 Marketable securities 0 300,000 Accounts receivable, net 2,900,000 2,000,000 Inventory 3,650,000 2,000,000 Prepaid expenses 270,000 210,000 Total current assets 7,830,000 5,760,000 Plant and equipment, net 9,620,000 9,100,000 Total assets $ 17,450,000 $ 14,860,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,060,000 $ 3,080,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,760,000 6,180,000…arrow_forwardTrimax Solutions develops software to support e-commerce. Trimax incurs substantial computer software development costs as well as substantial research and development (R&D) costs related to other aspects of its product line. Under GAAP, if certain conditions are met, Trimax capitalizes software development costs but expenses the other R&D costs. The following information is taken from Trimax’s annual reports ($ in thousands): R&Dcosts....................... Netincome....................... Totalassets(atyear-end) ........... Equity(atyear-end)................ Capitalized software costs Unamortized balance (at year-end) . . Amortization expense . . . . . . . . . . . . Required: 1999 $ 400 312 3,368 2,212 20 4 2000 $ 491 367 3,455 2,460 31 7 2001 $ 216 388 3,901 2,612 2002 $ 212 206 4,012 2,809 2003 $ 355 55 4,045 2,889 31 13 2004 $ 419 81 4,077 2,915 42 15 2005 $ 401 167 4,335 3,146 43 15 2006 $ 455 179 4,650 3,312 36 14 27 22 9 12 CHECK (a) Year2006,$7 CHECK (e)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License