MANAGERIAL ACCT.F/MANAGERS>CUSTOM<

4th Edition

ISBN: 9781307090147

Author: Noreen

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4A, Problem 4A.4P

Activity-Based Absorption Costing as an Alternative to Traditional Product Costing LO3-5

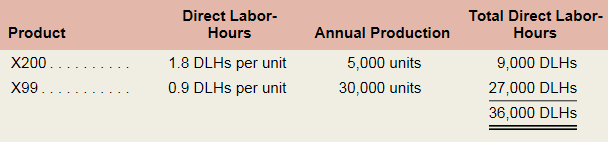

Elix Company manufactures two models of ultra-high fidelity speakers—the X200 model and the X99 model. Data regarding the two products follow:

Additional information about the company follows:

- Model X200 requires S72 in direct materials per unit, and model X99 requires $50.

- The direct labor workers are paid S20 per hour.

- The company has always used direct labor-hours as the base for applying

manufacturing overhead cost to products. - Model X200 is more complex to manufacture than model X99 and requires the use of special equipment.

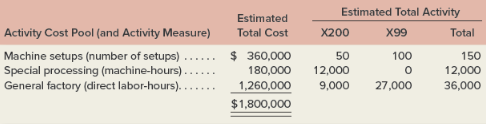

- Because of the special work required in (d) above, the company is considering the use of activity-based absorption costing to apply manufacturing overhead cost to products. Three activity cost pools have been identified as follows:

Required:

- Assume that the company continues to use direct labor-hours as the base for applying overhead cost to products.

- Compute the plantwide predetermined overhead rate.

- Compute the unit product cost of each model.

- Assume that the company decides to use activity-based absorption costing to apply overhead cost to products.

- Compute the activity rate for each activity cost pool and determine the amount of overhead cost that would be applied to each model using the activity-based approach.

- Compute the unit product cost of each model.

- Explain why overhead cost shifted from the high-volume model to the low-volume model under the activity-based approach.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Activity-Based Costing and Conventional Costs ComparedHickory Grill Company manufactures two types of cooking grills: the Gas Cooker and the Charcoal Smoker. The Cooker is a premium product sold in upscale outdoor shops; the Smoker is sold in major discount stores. Following is information pertaining to the manufacturing costs for the current month.

Gas Cooker

Charcoal Smoker

Units

1,000

5,000

Number of batches

50

10

Number of batch moves

80

20

Direct materials

$90,000

$150,000

Direct labor

$20,000

$25,000

Manufacturing overhead follows:

Activity

Cost

Cost Driver

Materials acquisition and inspection

$80,800

Amount of direct materials cost

Materials movement

16,200

Number of batch moves

Scheduling

36,000

Number of batches

$133,000

a. Determine the total and per-unit costs of manufacturing the Gas Cooker and Charcoal Smoker for the month, assuming all manufacturing overhead is assigned on the basis of direct labor dollars.Round…

Relevant costs; special order pricingKantrovitz Company is a manufacturer of industrial components. One of its products, AP110, is used as a subcomponent in appliance manufacturing. This product has the following information per unit:

Selling price

$150.00

Costs:

Direct material

$20.00

Direct labor

15.00

Variable manufacturing overhead

12.00

Fixed manufacturing overhead

30.00

Shipping and handling

3.00

Fixed selling and administrative

10.00

Total per-unit cost

$90.00

a. Kantrovitz has received a special, one-time order for 1,600 AP110 parts. Assuming Kantrovitz has excess capacity, what is the minimum price that is acceptable for beginning negotiations on this order?

Answer: $50

d. Referring to (a), Kantrovitz has received a special, one-time order for 1,600 AP110 parts. Assume that Kantrovitz is operating at full capacity, and that the contribution of the output would be displaced by the one-time special order. Using the original data, compute the minimum…

Relevant costs; special order pricingKantrovitz Company is a manufacturer of industrial components. One of its products, AP110, is used as a subcomponent in appliance manufacturing. This product has the following information per unit:

Selling price

$150.00

Costs:

Direct material

$20.00

Direct labor

15.00

Variable manufacturing overhead

12.00

Fixed manufacturing overhead

30.00

Shipping and handling

3.00

Fixed selling and administrative

10.00

Total per-unit cost

$90.00

a. Kantrovitz has received a special, one-time order for 1,000 AP110 parts. Assuming Kantrovitz has excess capacity, what is the minimum price that is acceptable for beginning negotiations on this order? $Answer

b. Kantrovitz has 5,000 units of AP110 in inventory that have some defects. The units cannot be sold through regular channels without a significant price reduction. What per-unit cost figure is relevant for setting a minimum selling price on these units? $Answer

c. During the next…

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Functional-Based versus Activity-Based Costing For years, Tamarindo Company produced only one product: backpacks. Recently, Tamarindo added a line of duffel bags. With this addition, the company began assigning overhead costs by using departmental rates. (Prior to this, the company used a predetermined plantwide rate based on units produced.) Surprisingly, after the addition of the duffel-bag line and the switch to departmental rates, the costs to produce the backpacks increased, and their profitability dropped. Josie, the marketing manager, and Steve, the production manager, both complained about the increase in the production cost of backpacks. Josie was concerned because the increase in unit costs led to pressure to increase the unit price of backpacks. She was resisting this pressure because she was certain that the increase would harm the companys market share. Steve was receiving pressure to cut costs also, yet he was convinced that nothing different was being done in the way the backpacks were produced. After some discussion, the two managers decided that the problem had to be connected to the addition of the duffel-bag line. Upon investigation, they were informed that the only real change in product-costing procedures was in the way overhead costs are assigned. A two-stage procedure was now in use. First, overhead costs are assigned to the two producing departments, Patterns and Finishing. Second, the costs accumulated in the producing departments are assigned to the two products by using direct labor hours as a driver (the rate in each department is based on direct labor hours). The managers were assured that great care was taken to associate overhead costs with individual products. So that they could construct their own example of overhead cost assignment, the controller provided them with the information necessary to show how accounting costs are assigned to products: The controller remarked that the cost of operating the accounting department had doubled with the addition of the new product line. The increase came because of the need to process additional transactions, which had also doubled in number. During the first year of producing duffel bags, the company produced and sold 100,000 backpacks and 25,000 duffel bags. The 100,000 backpacks matched the prior years output for that product. Required: (Note: Round rates and unit cost to the nearest cent.) 1. CONCEPTUAL CONNECTION Compute the amount of accounting cost assigned to a backpack before the duffel-bag line was added by using a plantwide rate approach based on units produced. Is this assignment accurate? Explain. 2. Suppose that the company decided to assign the accounting costs directly to the product lines by using the number of transactions as the activity driver. What is the accounting cost per unit of backpacks? Per unit of duffel bags? 3. Compute the amount of accounting cost assigned to each backpack and duffel bag by using departmental rates based on direct labor hours. 4. CONCEPTUAL CONNECTION Which way of assigning overhead does the best jobthe functional-based approach by using departmental rates or the activity-based approach by using transactions processed for each product? Explain. Discuss the value of ABC before the duffel-bag line was added.arrow_forwardVariable-Costing and Absorption-Costing Income Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows: During the year, Borques produced 200,000 wooden pallets and sold 204,300 at 9 each. Borques had 8,200 pallets in beginning finished goods inventory; costs have not changed from last year to this year. An actual costing system is used for product costing. Required: 1. What is the per-unit inventory cost that is acceptable for reporting on Borquess balance sheet at the end of the year ? How many units are in ending inventory? What is the total cost of ending inventory? 2. Calculate absorption-costing operating income. 3. CONCEPTUAL CONNECTION What would the per-unit inventory cost be under variable costing? Does this differ from the unit cost computed in Requirement 1? Why? 4. Calculate variable-costing operating income. 5. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating income?arrow_forwardWrappers Tape makes two products: Simple and Removable. It estimates it will produce 369,991 units of Simple and 146,100 of Removable, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: Â How much is the overhead allocated to each unit of Simple and Removable?arrow_forward

- Activity-based costing and product cost distortion The management of Four Finger Appliance Company in Exercise 14 has asked you to use activity-based costing instead of direct labor hours to allocate factory overhead costs to the two products. You have determined that 81,000 of factory overhead from each of the production departments can be associated with setup activity (162,000 in total). Company records indicate that blenders required 135 setups, while the toaster ovens required only 45 setups. Each product has a production volume of 7,500 units. Determine the three activity rates (assembly, test and pack, and setup). Determine the total factory overhead and factory overhead per unit allocated to each product using the activity rates in (A).arrow_forwardVariable and Fixed Costs, Cost Formula, High-Low Method Li Ming Yuan and Tiffany Shaden are the department heads for the accounting department and human resources department, respectively, at a large textile firm in the southern United States. They have just returned from an executive meeting at which the necessity of cutting costs and gaining efficiency has been stressed. After talking with Tiffany and some of her staff members, as well as his own staff members, Li Ming discovered that there were a number of costs associated with the claims processing activity. These costs included the salaries of the two paralegals who worked full time on claims processing, the salary of the accountant who cut the checks, the cost of claims forms, checks, envelopes, and postage, and depreciation on the office equipment dedicated to the processing. Some of the paralegals time appears to vary with the routine processing of uncontested claims, but considerable time also appears to be spent on the claims that have incomplete documentation or are contested. The accountants time appears to vary with the number of claims processed. Li Ming was able to separate the costs of processing claims from the costs of running the departments of accounting and human resources. He gathered the data on claims processing cost and the number of claims processed per month for the past 6 months. These data are as follows: Required: 1. Classify the claims processing costs that Li Ming identified as variable and fixed. 2. What is the independent variable? The dependent variable? 3. Use the high-low method to find the fixed cost per month and the variable rate. What is the cost formula? 4. CONCEPTUAL CONNECTION Suppose that an outside company bids on the claims processing business. The bid price is 4.60 per claim. If Tiffany expects 75,600 claims next year, should she outsource the claims processing or continue to do it in-house?arrow_forwardActivity-based costing in an insurance company Umbrella Insurance Company carries three major lines of insurance: auto, workers' compensation, and homeowners. The company has prepared the following report for 20Y2: Management is concerned that the administrative expenses may make some of the insurance lines unprofitable. However, the administrative expenses have not been allocated to the insurance lines. The controller has suggested that the administrative expenses could be assigned to the insurance lines using activity-based costing. The administrative expenses are comprised of five activities. The activities and their rates are as follows: Activity-base usage data for each line of insurance were retrieved from the corporate records and are shown below. a.Complete the product profitability report through the administrative activities. b.Determine the underwriting income as a percent of premium revenue. C.Determine the Operating income as a percent of premium revenue, rounded to one decimal place. d.Interpret the report.arrow_forward

- Grand Canyon Manufacturing Inc. produces and sells a product with a price of 100 per unit. The following cost data have been prepared for its estimated upper and lower limits of activity: Overhead: Selling and administrative expenses: Required: 1. Classify each cost element as either variable, fixed, or semi-variable. (Hint: Recall that variable expenses must go up in direct proportion to changes in the volume of activity.) 2. Calculate the break-even point in units and dollars. (Hint: First use the high-low method illustrated in Chapter 4 to separate costs into their fixed and variable components.) 3. Prepare a break-even chart. 4. Prepare a contribution income statement, similar in format to the statement appearing on page 540, assuming sales of 5,000 units. 5. Recompute the break-even point in units, assuming that variable costs increase by 20% and fixed costs are reduced by 50,000.arrow_forwardActivity-Based Supplier Costing Levy Inc. manufactures tractors for agricultural usage. Levy purchases the engines needed for its tractors from two sources: Johnson Engines and Watson Company. The Johnson engine has a price of 1,000. The Watson engine is 900 per unit. Levy produces and sells 22,000 tractors. Of the 22,000 engines needed for the tractors, 4,000 are purchased from Johnson Engines, and 18,000 are purchased from Watson Company. The production manager, Jamie Murray, prefers the Johnson engine. However, Jan Booth, purchasing manager, maintains that the price difference is too great to buy more than the 4,000 units currently purchased. Booth also wants to maintain a significant connection with the Johnson source just in case the less expensive source cannot supply the needed quantities. Jamie, however, is convinced that the quality of the Johnson engine is worth the price difference. Frank Wallace, the controller, has decided to use activity costing to resolve the issue. The following activity cost and supplier data have been collected: Required: 1. CONCEPTUAL CONNECTION Calculate the activity-based supplier cost per engine (acquisition cost plus supplier-related activity costs). (Round to the nearest cent.) Which of the two suppliers is the low-cost supplier? Explain why this is a better measure of engine cost than the usual purchase costs assigned to the engines. 2. CONCEPTUAL CONNECTION Consider the supplier cost information obtained in Requirement 1. Suppose further that Johnson can only supply a total of 20,000 units. What actions would you advise Levy to undertake with its suppliers?arrow_forwardManufacturing builds and sells switch harnesses for glove boxes. The sales price and variable cost for each follows: Their sales mix is reflected in the ratio 4:4:1. If annual fixed costs shared by the three products are $1 8840 how many units of each product will need to be sold in order forJj to break even?arrow_forward

- Variable and Fixed Costs What follows are a number of resources that are used by a manufacturer of futons. Assume that the output measure or cost driver is the number of futons produced. All direct labor is paid on an hourly basis, and hours worked can be easily changed by management. All other factory workers are salaried. a. Power to operate a drill (to drill holes in the wooden frames of the futons) b. Cloth to cover the futon mattress c. Salary of the factory receptionist d. Cost of food and decorations for the annual Fourth of July party for all factory employees e. Fuel for a forklift used to move materials in a factory f. Depreciation on the factory g. Depreciation on a forklift used to move partially completed goods h. Wages paid to workers who assemble the futon frame i. Wages paid to workers who maintain the factory equipment j. Cloth rags used to wipe the excess stain off the wooden frames Required: Classify the resource costs as variable or fixed.arrow_forwardRelevant costs; special order pricingKantrovitz Company is a manufacturer of industrial components. One of its products, AP110, is used as a subcomponent in appliance manufacturing. This product has the following information per unit: Selling price $150.00 Costs: Direct material $20.00 Direct labor 15.00 Variable manufacturing overhead 12.00 Fixed manufacturing overhead 30.00 Shipping and handling 3.00 Fixed selling and administrative 10.00 Total per-unit cost $90.00 a. Kantrovitz has received a special, one-time order for 1,600 AP110 parts. Assuming Kantrovitz has excess capacity, what is the minimum price that is acceptable for beginning negotiations on this order? $Answerb. Kantrovitz has 8,000 units of AP110 in inventory that have some defects. The units cannot be sold through regular channels without a significant price reduction. What per-unit cost figure is relevant for setting a minimum selling price on these units? $Answerc. During the next year,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY