MANAGERIAL ACCOUNTING

16th Edition

ISBN: 9781260936322

Author: Garrison

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 10E

EXERCISE 5-10 Multiproduct Break-Even Analysis LO5-9

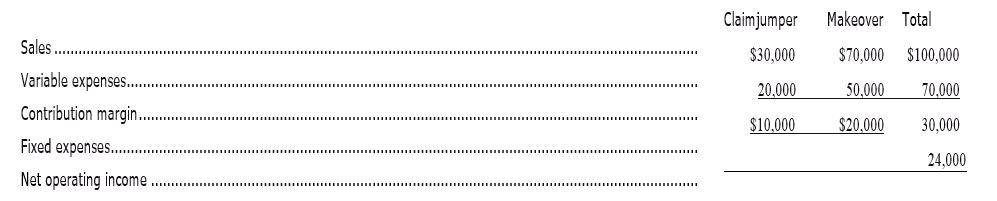

Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below:

Required:

- What is the overall contribution margin (CM) ratio for the company?

- What is the company's overall break-even point in dollar sales?

- Verify' the overall break-even point for the company by constructing a contribution format income statement showing the appropriate levels of sales for the two products.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Exercise 6-10 Multiproduct Break-Even Analysis [LO6-9]

Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below:

Claimjumper

Makeover

Total

Sales

$

30,000

$

70,000

$

100,000

Variable expenses

20,000

50,000

70,000

Contribution margin

$

10,000

$

20,000

30,000

Fixed expenses

24,000

Net operating income

$

6,000

Required:

1. What is the overall contribution margin (CM) ratio for the company?

2. What is the company's overall break-even point in dollar sales?

3. Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products.

Exercise 5-1 (Algo) The Effect of Changes in Sales Volume on Net Operating Income [LO5-1]

Whirly Corporation’s contribution format income statement for the most recent month is shown below:

Total

Per Unit

Sales (7,300 units)

$ 240,900

$ 33.00

Variable expenses

131,400

18.00

Contribution margin

109,500

$ 15.00

Fixed expenses

54,800

Net operating income

$ 54,700

Required:

(Consider each case independently):

1. What would be the revised net operating income per month if the sales volume increases by 40 units?

2. What would be the revised net operating income per month if the sales volume decreases by 40 units?

3. What would be the revised net operating income per month if the sales volume is 6,300 units?

1. Revised net operating income

2. Revised net operating income

3. Revised net operating income

EXERCISE 5–18 Break-Even and Target Profit Analysis; Margin of Safety; CM Ratio [LO5–1, LO5–3, LO5–5, LO5–6, LO5–7]

Menlo Company distributes a single product. The company’s sales and expenses for last monthfollow:

{picture11}

Required:1. What is the monthly break-even point in unit sales and in dollar sales?2. Without resorting to computations, what is the total contribution margin at the break-even point?3. How many units would have to be sold each month to earn a target profit of $90,000? Use the formula method. Verify your answer by preparing a contribution format income statement at the target sales level.4. Refer to the original data. Compute the company’s margin of safety in both dollar and percentage terms.5. What is the company’s CM ratio? If sales increase by $50,000 per month and there is no change in fixed expenses, by how much would you expect monthly net operating income to increase?

Chapter 5 Solutions

MANAGERIAL ACCOUNTING

Ch. 5.A - EXERCISE 5A-1 High-Low Method LO5-10 The Cheyenne...Ch. 5.A - EXERCISE 5A-2 Least-Squares Regression LO5-11...Ch. 5.A - EXERCISE 5A-3 Cost Behavior; High-Low Method...Ch. 5.A - Prob. 4ECh. 5.A - EXERCISE 5A-5 Least-Squares Regression LO5-11...Ch. 5.A - Prob. 6PCh. 5.A - Problem 5A-7 Cost Behavior; High-Low Method;...Ch. 5.A - Problem 5A-8 High-Low Method; Predicting Cost...Ch. 5.A - Prob. 9PCh. 5.A - Prob. 10P

Ch. 5.A - Case 5A-11 Mixed Cost Analysis and the Relevant...Ch. 5.A - CASE 5A-12 Analysis of Mixed Costs in a Pricing...Ch. 5 - Prob. 1QCh. 5 - Often the most direct route to a business decision...Ch. 5 - Prob. 3QCh. 5 - What is the meaning of operating leverage?Ch. 5 - What is the meaning of break-even point?Ch. 5 - 5-6 In response to a request from your immediate...Ch. 5 - Prob. 7QCh. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - Prob. 1AECh. 5 - Prob. 2AECh. 5 - Prob. 3AECh. 5 - Prob. 4AECh. 5 - Prob. 5AECh. 5 - Prob. 1F15Ch. 5 - Prob. 2F15Ch. 5 - Prob. 3F15Ch. 5 - Prob. 4F15Ch. 5 - Prob. 5F15Ch. 5 - Prob. 6F15Ch. 5 - Prob. 7F15Ch. 5 - Prob. 8F15Ch. 5 - Prob. 9F15Ch. 5 - Prob. 10F15Ch. 5 - Prob. 11F15Ch. 5 - Prob. 12F15Ch. 5 - Prob. 13F15Ch. 5 - Prob. 14F15Ch. 5 - Prob. 15F15Ch. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Prob. 5ECh. 5 - Prob. 6ECh. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - EXERCISE 5-10 Multiproduct Break-Even Analysis...Ch. 5 - Prob. 11ECh. 5 - EXERCISE 5-12 Multiproduct Break-Even Analysis...Ch. 5 - EXERCISE 5-13 Changes in Selling Price, Sales...Ch. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Prob. 17ECh. 5 - Prob. 18ECh. 5 - Prob. 19PCh. 5 - PROBLEM 5-20 CVP Applications: Break-Even...Ch. 5 - PROBLEM 5-21 Sales Mix; Multiproduct Break-Even...Ch. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 -

PROBLEM 5-25 Changes in Fixed and Variable Costs;...Ch. 5 -

PROBLEM 5-26 CVP Applications; Break-Even...Ch. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 -

PROBLEM 5-31 Interpretive Questions on the CVP...Ch. 5 -

CASE 5-32 Break-Even Analysis for Individual...Ch. 5 - Prob. 33C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Salespersons' report and analysis Pachec Inc. employs seven salespersons to sell and distribute its product throughout the slate. Data taken from reports received from the salespersons during the year ended June 30 are as Follows: Instructions 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. 2. Which salesperson generated the highest contribution margin ratio for the year and why? 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.arrow_forwardSalespersons' report and analysis Walthman Industries Inc. employs seven salespersons to sell and distribute- its product throughout the state. Data taken from reports received from the .salespersons during the year ended December 31 are as follows: Instructions 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.) 2. Which salesperson generated the highest contribution margin ratio for the year and why? 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.arrow_forwardContribution margin analysis sales Select Audio Inc. sells electronic equipment. Management decided curly in the year to reduce the price of the speakers in order to increase sales volume. As a result, for the year ended December 31, the .sales increased by 31,875 from the planned level of 1,048,125. The following information is available from the accounting records for the year ended December 31. A. Prepare an analysis of the sales quantity and unit price factors. B. Did the price decrease generate sufficient volume to result in a net increase in contribution margin if the actual variable cost per unit was 10, as planned?arrow_forward

- EXERCISE 5–12 Multiproduct Break-Even Analysis [LO5–9]Olongapo Sports Corporation distributes two premium golf balls—the Flight Dynamic and the Sure Shot. Monthly sales and the contribution margin ratios for the two products follow: {picture11} Fixed expenses total $183,750 per month. Required:1. Prepare a contribution format income statement for the company as a whole. Carry computations to one decimal place.2. Compute the break-even point for the company based on the current sales mix.3. If sales increase by $100,000 a month, by how much would you expect net operating incometo increase? What are your assumptions?arrow_forwardAssignment 5.1: Session 5 Comprehensive Problem Problem 5-1 Redlands Inc. sells one product for $5. The variable cost per item is $3, and the fixed costs for the firm are $40. Required: a. Compute the breakeven point in units. b. Compute the number of units and sales revenue needed to achieve a $20 profit. (Ignore income taxes.) c. Assume that the income tax rate for Redlands is 40%. Compute the number of units and sales revenue needed to achieve an $18 net profit. d. Compute the number of units and sales revenue needed to achieve an 8% profit margin. (Ignore income taxes.) e. Compute the number of units and sales revenue needed to achieve a 12% net profit margin. (Assume a 40% income tax rate.) f. Assume that Redlands currently sells 40 units. Redlands estimates that if it increased sales price to $6 per unit demand would decrease by 10%. Determine if Redlands should increase its selling price. (Ignore income taxes.) g. Assume that Redlands currently sells 30 units and has a 40%…arrow_forwardExercise 5-18 (Algo) Break-Even and Target Profit Analysis; Margin of Safety; CM Ratio [LO5-1, LO5-3, LO5-5, LO5-6, LO5-7] Menlo Company distributes a single product. The company’s sales and expenses for last month follow: Total Per Unit Sales $ 616,000 $ 40 Variable expenses 431,200 28 Contribution margin 184,800 $ 12 Fixed expenses 154,800 Net operating income $ 30,000 Required: 1. What is the monthly break-even point in unit sales and in dollar sales? 2. Without resorting to computations, what is the total contribution margin at the break-even point? 3-a. How many units would have to be sold each month to attain a target profit of $66,000? 3-b. Verify your answer by preparing a contribution format income statement at the target sales level. 4. Refer to the original data. Compute the company's margin of safety in both dollar and percentage terms. 5. What is the company’s CM ratio? If the company can sell more units thereby increasing sales by $83,000 per…arrow_forward

- Exercise 5-5 (Algo) Changes in Variable Costs, Fixed Costs, Selling Price, and Volume [LO5-4] [The following information applies to the questions displayed below.] Data for Hermann Corporation are shown below: Per Unit Percent of Sales Selling price $ 105 100% Variable expenses 63 60 Contribution margin $ 42 40% Fixed expenses are $81,000 per month and the company is selling 3,800 units per month. Exercise 5-5 (Algo) Part 2 2-a. Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher-quality components that increase the variable expense by $4 per unit and increase unit sales by 20%. 2-b. Should the higher-quality components be used?arrow_forwardExercise 6-1 The Effect of Changes in Activity on Net Operating Income [LO6-1] Whirly Corporation’s contribution format income statement for the most recent month is shown below: Total Per Unit Sales (8,100 units) $ 251,100 $ 31.00 Variable expenses 145,800 18.00 Contribution margin 105,300 $ 13.00 Fixed expenses 54,600 Net operating income $ 50,700 Required: (Consider each case independently): 1. What would be the revised net operating income per month if the sales volume increases by 80 units? 2. What would be the revised net operating income per month if the sales volume decreases by 80 units? 3. What would be the revised net operating income per month if the sales volume is 7,100 units?arrow_forwardExercise 5-18 (Algo) Break-Even and Target Profit Analysis; Margin of Safety; CM Ratio [LO5-1, LO5-3, LO5-5, LO5-6, LO5-7] Menlo Company distributes a single product. The company’s sales and expenses for last month follow: Total Per Unit Sales $ 616,000 $ 40 Variable expenses 431,200 28 Contribution margin 184,800 $ 12 Fixed expenses 154,800 Net operating income $ 30,000 Required: 3-b. Verify your answer by preparing a contribution format income statement at the target sales level. 4. Refer to the original data. Compute the company's margin of safety in both dollar and percentage terms. 5. What is the company’s CM ratio? If the company can sell more units thereby increasing sales by $83,000 per month and there is no change in fixed expenses, by how much would you expect monthly net operating income to increase?arrow_forward

- Exercise 12-16 (Algo) Calculate selling price of new product; what-if questions; breakeven LO 8, 9, 10, 11 D&R Corp. has annual revenues of $262,000, an average contribution margin ratio of 33%, and fixed expenses of $101,800. Required: Management is considering adding a new product to the company's product line. The new item will have $8.7 of variable costs per unit. Calculate the selling price that will be required if this product is not to affect the average contribution margin ratio. If the new product adds an additional $29,100 to D&R's fixed expenses, how many units of the new product must be sold at the price calculated in part a to break even on the new product? If 20,900 units of the new product could be sold at a price of $14.2 per unit, and the company's other business did not change, calculate D&R's total operating income and average contribution margin ratio.arrow_forwardEXERCISE 6–12 Target Profi t and Break-Even Analysis; Margin of Safety; CM Ratio [ LO1 , LO3 , LO5 , LO6 , LO7 ] Menlo Company distributes a single product. The company’s sales and expenses for last month follow: Total Per UnitSales. . . . . . . . . . . . . . . . . . . . . . . . $450,000 $30Variable expenses . . . . . . . . . . . . . 180,000 12Contribution margin . . . . . . . . . . . . 270,000 $18Fixed expenses. . . . . . . . . . . . . . . . 216,000Net operating income . . . . . . . . . . . $ 54,000 Required: 1. What is the monthly break-even point in units sold and in sales dollars? 2. Without resorting to computations, what is the total contribution margin at the break-even point? 3. How many units would have to be sold each month to earn a target profi t of $90,000? Use the formula method. Verify your answer by preparing a contribution format income statement at the target sales level4. Refer to the original data. Compute the company’s margin of safety in both dollar and…arrow_forwardExercise 6-5 Changes in Variable Costs, Fixed Costs, Selling Price, and Volume [LO6-4] Skip to question [The following information applies to the questions displayed below.] Data for Hermann Corporation are shown below: Per Unit Percent of Sales Selling price $ 125 100 % Variable expenses 80 64 Contribution margin $ 45 36 % Fixed expenses are $85,000 per month and the company is selling 2,700 units per month. rev: 06_04_2020_QC_CS-205709, 06_18_2020_QC_CS-216765, 07_14_2020_QC_CS-216765 Exercise 6-5 Part 1 Required: 1-a. How much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,000 and monthly sales increase by $20,000? 1-b. Should the advertising budget be increased?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license