EXERCISE 5-12 Multiproduct Break-Even Analysis LO5-9

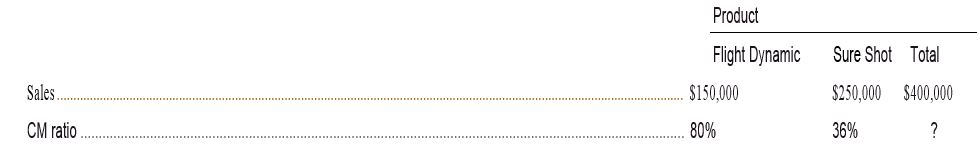

Olongapo Sports Corporation distributes two premium golf balls—Flight Dynamic and Sure Shot. Monthly sales and the contribution margin ratios for the two products follow:

Fixed expenses total $183,750 per month.

Required:

- Prepare a contribution format income statement for the company as a whole. Carry computations to one decimal place.

- What is the company's break-even point in dollar sales based on the current sales mix?

- If sales increase by $100,000 a month, by how much would you expect the monthly net operating income to increase? What are your assumptions?

Break-even analysis: It is an analysis of sales revenue or unit where a company is neither earning profits nor incurring any loss.

The preparation of contribution format income statement and break-even analysis.

Answer to Problem 12E

Solution:

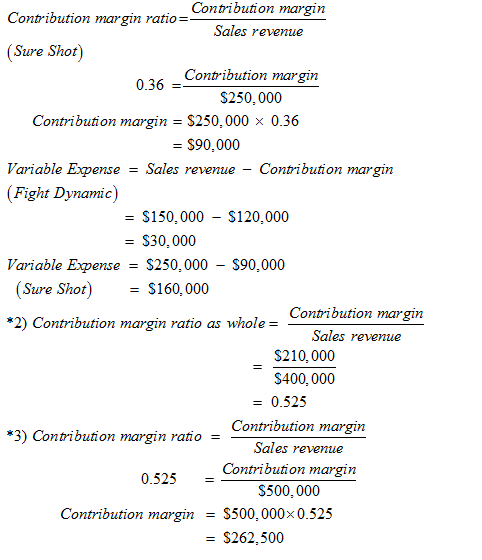

1) Contribution formal income statement for the company as a whole. Carry computations to one decimal place is shown below:-

| Product | |||

| Fight Dynamic | Sure Shot | Total | |

| Sales | $150,000 | $250,000 | $400,000 |

| CM ratio | 80% | 36% | 52.5% |

| Olongapo Sports Corporation’s Contribution format income statement | |

| Total | |

| Sales | $400,000 |

| Variable expenses | $190,000 |

| Contribution Margin | $210,000 |

| Fixed expenses | $183,750 |

| Net operating income | $26,250 |

2) The Break-even point in dollar sales based on the current sales mix is $ 350,000

3) The contribution format income statement with increase in sales by $ 100,000 is shown below:-

| Olongapo Sports Corporation’s Contribution format income statement | |

| Total | |

| Sales | $500,000 |

| Variable expenses | $237,500 |

| Contribution Margin | $262,500 |

| Fixed expenses | $183,750 |

| Net operating income | $78,750 |

It is assume that when sales increase by $100,000, the variable expense increase by 25% and the net operating income increases by 200%.

Explanation of Solution

Given:

| Product | |||

| Fight Dynamic | Sure Shot | Total | |

| Sales | $150,000 | $250,000 | $400,000 |

| CM ratio | 80% | 36% | ? |

Fixed expenses total $183,750 per month.

Hence it is concluded that the Mauro Products will neither earn profit nor incur loss at $350,000sales revenue. But if the company earns beyond this point, it will make profit and if it falls below the point, the company will suffer loss. A break-even point is technique used the companies to predict the outcome of a decision based on the analysis. It shows the exact point where a company will neither make profit nor suffer loss.

Want to see more full solutions like this?

Chapter 5 Solutions

MANAGERIAL ACCOUNTING

- Salespersons' report and analysis Walthman Industries Inc. employs seven salespersons to sell and distribute- its product throughout the state. Data taken from reports received from the .salespersons during the year ended December 31 are as follows: Instructions 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.) 2. Which salesperson generated the highest contribution margin ratio for the year and why? 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.arrow_forwardRefer to Cornerstone Exercise 7.10. (Round percentages to four significant digits and cost allocations to the nearest dollar.) Required: 1. Calculate the total revenue, total costs, and total gross profit the company will earn on the sale of L-Ten, Triol, and Pioze. 2. Allocate the joint cost to L-Ten, Triol, and Pioze using the constant gross margin percentage method. 3. What if it cost 2 to process each gallon of Triol beyond the split-off point? How would that affect the allocation of joint cost to these three products?arrow_forward

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning