Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 26E

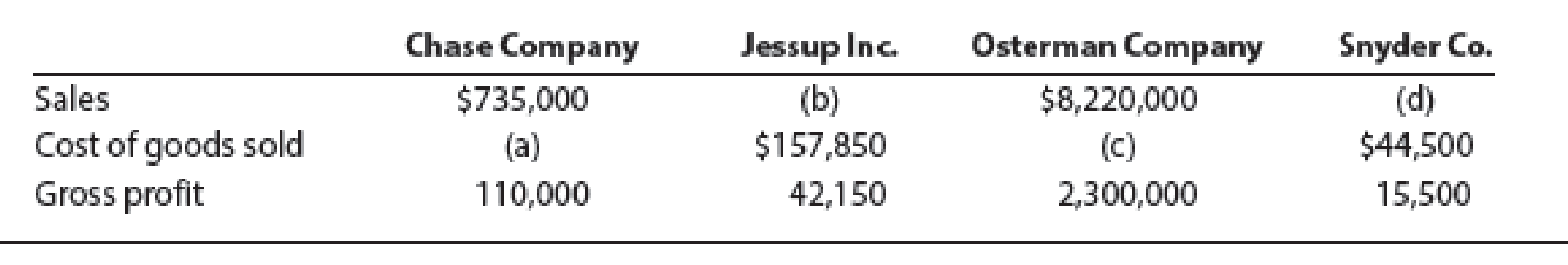

Determining amounts for items omitted from income statement

One item is omitted in each of the following four lists of income statement data. Determine the amounts of the missing items, identifying them by letter.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Determining amounts for items omitted from income statement

One item is omitted in each of the following four lists of income statement data. Determine the amounts of the missing items, identifying them by ietter.

Using your accounting knowledge, find the missing amounts in the following separate income statements. (Amounts to be deducted should be indicated by a minus sign.)

Fill in the blanks in the following separate income statements a through e.

Chapter 5 Solutions

Financial And Managerial Accounting

Ch. 5 - Prob. 1DQCh. 5 - Can a business earn a gross profit but incur a net...Ch. 5 - The credit period during which the buyer of...Ch. 5 - What is the meaning of (A) 1/15, n/60; (B) n/30;...Ch. 5 - How are sales to customers using MasterCard and...Ch. 5 - What is the nature of (A) a credit memo issued by...Ch. 5 - Who is responsible for freight when the terms of...Ch. 5 - Name three accounts that would normally appear in...Ch. 5 - Audio Outfitter Inc., which uses a perpetual...Ch. 5 - Assume that Audio Outfitter Inc. in Discussion...

Ch. 5 - Gross profit During the current year, merchandise...Ch. 5 - Purchases transactions Elkhorn Company purchased...Ch. 5 - Prob. 3BECh. 5 - Freight terms Determine the amount to be paid in...Ch. 5 - Transactions for buyer and seller Shore Co. sold...Ch. 5 - Adjusting entries Hahn Flooring Company uses a...Ch. 5 - Asset turnover ratio Financial statement data for...Ch. 5 - Determining gross profit During the current year,...Ch. 5 - Determining cost of goods sold For a recent year,...Ch. 5 - Chart of accounts Monet Paints Co. is a newly...Ch. 5 - Purchase-related transactions The Stationery...Ch. 5 - Purchase-related transactions A retailer is...Ch. 5 - Purchase-related transactions The debits and...Ch. 5 - Prob. 7ECh. 5 - Purchase-related transactions Journalize entries...Ch. 5 - Sales-related transactions, including the use of...Ch. 5 - Customer refund Senger Company sold merchandise of...Ch. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Sales-related transactions The debits and credits...Ch. 5 - Prob. 14ECh. 5 - Determining amounts to be paid on invoices...Ch. 5 - Sales-related transactions Showcase Co., a...Ch. 5 - Purchase-related transactions Based on the data...Ch. 5 - Prob. 18ECh. 5 - Prob. 19ECh. 5 - Normal balances of accounts for retail business...Ch. 5 - Income statement and accounts for retail business...Ch. 5 - Adjusting entry for inventory shrinkage Omega Tire...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Income statement for retail business The following...Ch. 5 - Determining amounts for items omitted from income...Ch. 5 - Multiple-step income statement On March 31, 20Y9,...Ch. 5 - Multiple-step income statement The following...Ch. 5 - Single-step income statement Summary operating...Ch. 5 - Closing the accounts of a retail business From the...Ch. 5 - Closing entries; net income Based on the data...Ch. 5 - Closing entries On July 31, the close of the...Ch. 5 - Prob. 33ECh. 5 - Prob. 34ECh. 5 - Appendix 1 Adjusting entry for gross method The...Ch. 5 - Appendix 1 Discount taken in next fiscal year...Ch. 5 - Prob. 37ECh. 5 - Rules of debit and credit for periodic inventory...Ch. 5 - Journal entries using the periodic inventory...Ch. 5 - Identify items missing in determining cost of...Ch. 5 - Cost of goods sold and related items The following...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Appendix 2 Cost of goods sold Identify the errors...Ch. 5 - Closing entries using periodic inventory system...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - A Sales and purchase-related transactions for...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income statement and balance sheet...Ch. 5 - Appendix 2 Purchase-related transactions using...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Appendix 2 PR 5-9A Sales and purchase-related...Ch. 5 - 2. Net income, 185,000 Appendix 2 PR 5-10A...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Sales and purchase-related transactions for seller...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income Statement and balance sheet...Ch. 5 - Purchase-related transactions using periodic...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Appendix 2 Sales and purchase-related transactions...Ch. 5 - Appendix 2 PR 5-10B Periodic inventory accounts,...Ch. 5 - Palisade Creek Co. is a retail business that uses...Ch. 5 - Analyze and compare Amazon.com and Netflix...Ch. 5 - Analyze Dollar General Dollar General Corporation...Ch. 5 - Compare Dollar Tree and Dollar General The asset...Ch. 5 - Analyze and compare CSX, Union Pacific, and YRC...Ch. 5 - Analyze Home Depot The Home Depot (HD) reported...Ch. 5 - Analyze and compare Kroger and Tiffany The Kroger...Ch. 5 - Prob. 7MADCh. 5 - Ethics in Action Margie Johnson is a staff...Ch. 5 - Prob. 2TIFCh. 5 - Prob. 5TIFCh. 5 - Prob. 6TIFCh. 5 - Prob. 7TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- One item is omitted in each of the following four lists of income statement data. Determine the amounts of the missing items, identifying them by letter.arrow_forwardFill in the blanks in the following separate income statements a through e. (Amounts to be deducted should be indicated by a minus sign.)arrow_forwardThe amount found in the Income Statement debit column on the worksheet for Income Summary is the: A.ending inventory. B.beginning inventory. C.total amount of expenses. D.total amount of revenues.arrow_forward

- Which of the following expenses is usually listed last on the income statement? a. Advertising expense b. Income tax expense c. Salaries and benefits expense d. Cost of salesarrow_forwardListed below are eight technical accounting terms introduced in this chapter:Realization principle CreditTime period principle Accounting periodMatching principle ExpensesNet income Accounting cycleEach of the following statements may (or may not) describe one of these technical terms. Foreach statement, indicate the term described, or answer “None” if the statement does not correctlydescribe any of the terms.a. The span of time covered by an income statement.b. The sequence of accounting procedures used to record, classify, and summarize accountinginformation.c. The traditional accounting practice of resolving uncertainty by choosing the solution thatleads to the lowest amount of income being recognized.d. An increase in owners’ equity resulting from profitable operations.e. The underlying accounting principle that determines when revenue should be recorded in theaccounting records.f. The type of entry used to decrease an asset or increase a liability or owners’ equity account.g. The…arrow_forwardwhy adjusting of the income statement, and give three examples of items that are recasted?arrow_forward

- indicate whether the statement describes a multiple-step income statement or asingle-step income statement.a. Multiple-step income statement b. Single-step income statement Statement limited to two main categories (revenues and expenses).arrow_forwardThe worksheet consisted of five pairs of debit and credit columns. The amount of one item appeared in both the credit column of the income statement and the debit column of the statement of financial positions section. What is this item? Net income Beginning inventory Cost of goods sold Net lossarrow_forwardWhat is reported in the discontinued operations section of the income statement?arrow_forward

- The income statement line gross profit will appear on which income statement format? Select one: a. Receipt and payment account b. Multiple step income statement c. Single step income statement d. Income and expenditure accountarrow_forwardWhich of the following accounts would not be reported under revenue on a simple income statement? A. interest revenue B. net sales C. rent revenue D. operating expensesarrow_forwardIndicate with an X whether each of the following would appear on the income statement, statement of owners equity, or balance sheet. An item may appear on more than one statement. The first item is provided as an example.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License