Concept explainers

Sales-related transactions using perpetual inventory system

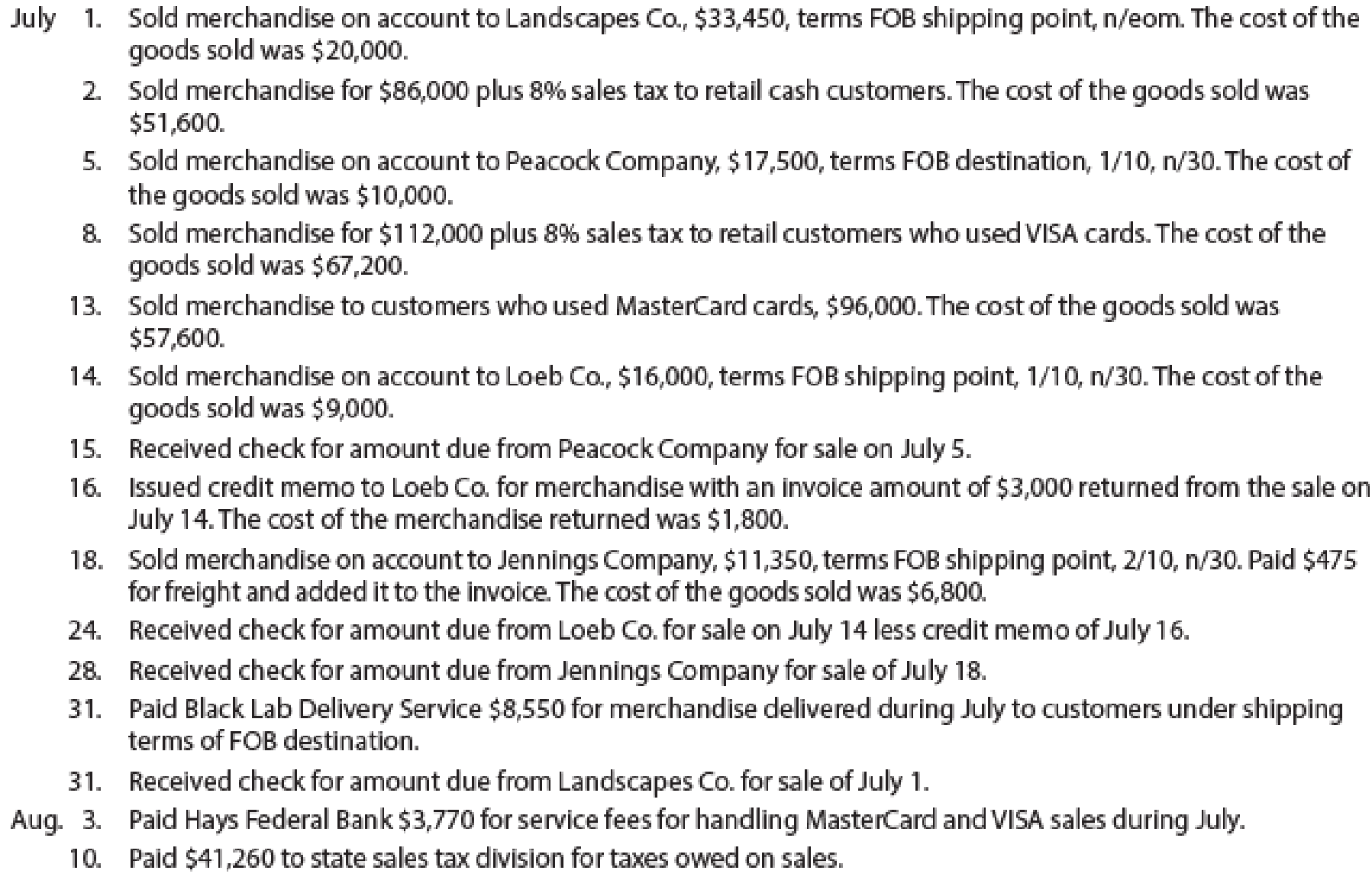

The following selected transactions were completed by Green Lawn Supplies Co., which sells irrigation supplies primarily to other businesses and occasionally to retail customers:

Instructions

Sales is an activity of selling the inventory of a business.

To Record: The sale transactions of the company.

Explanation of Solution

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 2 | Accounts receivable | 18,711 (1) | |

| Sales Revenue | 18,711 | ||

| (To record the sale of inventory on account) |

Table (1)

Working Note:

Calculate the amount of accounts receivable.

Sales = $18,900

Discount percentage = 1%

- Accounts Receivable is an asset and it is increased by $18,711. Therefore, debit accounts receivable with $18,711.

- Sales revenue is revenue and it increases the value of equity by $18,711. Therefore, credit sales revenue with $18,711.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 2 | Cost of Sold | 13,300 | |

| Inventory | 13,300 | ||

| (To record the cost of goods sold) |

Table (2)

- Cost of sold is an expense account and it decreases the value of equity by $13,300. Therefore, debit cost of sold account with $13,300.

- Inventory is an asset and it is decreased by $13,300. Therefore, credit inventory account with $13,300.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 3 | Cash | 12,031 (3) | |

| Sales Revenue | 11,350 | ||

| Sales Tax Payable | 681 (2) | ||

| (To record the sale of inventory for cash) |

Table (3)

Working Notes:

Calculate the amount of sales tax payable.

Sales revenue = $11,350

Sales tax percentage = 6%

(2)

Calculate the amount of cash received.

Sales revenue = $11,350

Sales tax payable = $681 (2)

(3)

- Cash is an asset and it is increased by $12,031. Therefore, debit cash account with $12,031.

- Sales revenue is revenue and it increases the value of equity by $11,350. Therefore, credit sales revenue with $11,350.

- Sales tax payable is a liability and it is increased by $681. Therefore, credit sales tax payable account with $681.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 3 | Cost of Sold | 7,000 | |

| Inventory | 7,000 | ||

| (To record the cost of goods sold) |

Table (4)

- Cost of sold is an expense account and it decreases the value of equity by $7,000. Therefore, debit cost of sold account with $7,000.

- Inventory is an asset and it is decreased by $7,000. Therefore, credit inventory account with $7,000.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 4 | Accounts receivable | 55,400 | |

| Sales Revenue | 55,400 | ||

| (To record the sale of inventory on account) |

Table (5)

- Accounts Receivable is an asset and it is increased by $55,400. Therefore, debit accounts receivable with $55,400.

- Sales revenue is revenue and it increases the value of equity by $55,400. Therefore, credit sales revenue with $55,400.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 4 | Cost of Sold | 33,200 | |

| Inventory | 33,200 | ||

| (To record the cost of goods sold) |

Table (6)

- Cost of sold is an expense account and it decreases the value of equity by $33,200. Therefore, debit cost of sold account with $33,200.

- Inventory is an asset and it is decreased by $33,200. Therefore, credit inventory account with $33,200.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 5 | Cash | 31,800 (5) | |

| Sales Revenue | 30,000 | ||

| Sales Tax Payable | 1,800 (4) | ||

| (To record the sale of inventory for cash) |

Table (7)

Working Notes:

Calculate the amount of sales tax payable.

Sales revenue = $30,000

Sales tax percentage = 6%

(4)

Calculate the amount of cash received.

Sales revenue = $30,000

Sales tax payable = $1,800 (2)

(5)

- Cash is an asset and it is increased by $31,800. Therefore, debit cash account with $31,800.

- Sales revenue is revenue and it increases the value of equity by $30,000. Therefore, credit sales revenue with $30,000.

- Sales tax payable is a liability and it is increased by $1,800. Therefore, credit sales tax payable account with $1,800.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 5 | Cost of Sold | 19,400 | |

| Inventory | 19,400 | ||

| (To record the cost of goods sold) |

Table (8)

- Cost of sold is an expense account and it decreases the value of equity by $19,400. Therefore, debit cost of sold account with $19,400.

- Inventory is an asset and it is decreased by $19,400. Therefore, credit inventory account with $19,400.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 12 | Cash | 18,711 | |

| Accounts Receivable | 18,711 | ||

| (To record the receipt of cash against accounts receivables) |

Table (9)

- Cash is an asset and it is increased by $18,711. Therefore, debit cash account with $18,711.

- Accounts Receivable is an asset and it is increased by $18,711. Therefore, debit accounts receivable with $18,711.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 14 | Cash | 13,700 | |

| Sales Revenue | 13,700 | ||

| (To record the sale of inventory for cash) |

Table (10)

- Cash is an asset and it is increased by $13,700. Therefore, debit cash account with $13,700.

- Sales revenue is revenue and it increases the value of equity by $13,700. Therefore, credit sales revenue with $13,700.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 14 | Cost of Sold | 8,350 | |

| Inventory | 8,350 | ||

| (To record the cost of goods sold) |

Table (11)

- Cost of sold is an expense account and it decreases the value of equity by $8,350. Therefore, debit cost of sold account with $8,350.

- Inventory is an asset and it is decreased by $8,350. Therefore, credit inventory account with $8,350.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 16 | Accounts receivable | 27,225 (6) | |

| Sales Revenue | 27,225 | ||

| (To record the sale of inventory on account) |

Table (12)

Working Note:

Calculate the amount of accounts receivable.

Sales = $27,500

Discount percentage = 1%

- Accounts Receivable is an asset and it is increased by $27,225. Therefore, debit accounts receivable with $27,225.

- Sales revenue is revenue and it increases the value of equity by $27,225. Therefore, credit sales revenue with $27,225.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 16 | Cost of Sold | 16,000 | |

| Inventory | 16,000 | ||

| (To record the cost of goods sold) |

Table (13)

- Cost of sold is an expense account and it decreases the value of equity by $16,000. Therefore, debit cost of sold account with $16,000.

- Inventory is an asset and it is decreased by $16,000. Therefore, credit inventory account with $16,000.

Record the journal entry for sales return.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 18 | Customer Refunds Payable | 4,752 (7) | ||

| Accounts Receivable | 4,752 | |||

| (To record sales returns) |

Table (14)

Calculate the amount of refund owed to the customer.

Sales return = $4,800

Discount percentage = 1%

(7)

- Customer refunds payable is a liability account and it is decreased by $4,752. Therefore, debit customer refunds payable account with $4,752.

- Accounts Receivable is an asset and it is decreased by $4,752. Therefore, credit account receivable with $4,752.

Record the journal entry for the return of the .

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 18 | Inventory | 2,900 | |

| Estimated Returns Inventory | 2,900 | ||

| (To record the return of the ) |

Table (15)

- Inventory is an asset and it is increased by $2,900. Therefore, debit inventory account with $2,900.

- Estimated retunrs inventory is an expense account and it increases the value of equity by $2,900. Therefore, credit estimated returns inventory account with $2,900.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 19 | Accounts receivable | 8,085 (8) | |

| Sales Revenue | 8,085 | ||

| (To record the sale of inventory on account) |

Table (16)

Working Note:

Calculate the amount of accounts receivable.

Sales = $8,250

Discount percentage = 2%

- Accounts Receivable is an asset and it is increased by $8,085. Therefore, debit accounts receivable with $8,085.

- Sales revenue is revenue and it increases the value of equity by $8,085. Therefore, credit sales revenue with $8,085.

Record the journal entry.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 19 | Accounts Receivable | 75 | ||

| Cash | 75 | |||

| (To record freight charges paid) |

Table (17)

- Accounts Receivable is an asset and it is increased by $75. Therefore, debit accounts receivable with $75.

- Cash is an asset and it is decreased by $75. Therefore, credit cash account with $75.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 19 | Cost of Sold | 5,000 | |

| Inventory | 5,000 | ||

| (To record the cost of goods sold) |

Table (18)

- Cost of sold is an expense account and it decreases the value of equity by $5,000. Therefore, debit cost of sold account with $5,000.

- Inventory is an asset and it is decreased by $5,000. Therefore, credit inventory account with $5,000.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 26 | Cash | 22,473 (9) | |

| Accounts Receivable | 22,473 | ||

| (To record the receipt of cash against accounts receivables) |

Table (19)

Calculate the amount of cash received.

Net accounts receivable = $22,473

Customer refunds payable = $4,752

(9)

- Cash is an asset and it is increased by $22,473. Therefore, debit cash account with $22,473.

- Accounts Receivable is an asset and it is increased by $22,473. Therefore, debit accounts receivable with $22,473.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 28 | Cash | 8,160 (10) | |

| Accounts Receivable | 8,160 | ||

| (To record the receipt of cash against accounts receivables) |

Table (20)

Calculate the amount of cash received.

Net accounts receivable = $8,085

Freight charges = $75

(10)

- Cash is an asset and it is increased by $8,160. Therefore, debit cash account with $8,160.

- Accounts Receivable is an asset and it is increased by $8,160. Therefore, debit accounts receivable with $8,160.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 31 | Cash | 55,400 | |

| Accounts Receivable | 55,400 | ||

| (To record the receipt of cash against accounts receivables) |

Table (21)

- Cash is an asset and it is increased by $55,400. Therefore, debit cash account with $55,400.

- Accounts Receivable is an asset and it is increased by $55,400. Therefore, debit accounts receivable with $55,400.

Record the journal entry for delivery expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 31 | Delivery expense | 5,600 | |

| Cash | 5,600 | ||

| (To record the payment of delivery expenses) |

Table (22)

- Delivery expense is an expense account and it decreases the value of equity by $5,600. Therefore, debit delivery expense account with $5,600.

- Cash is an asset and it is decreased by $5,600. Therefore, credit cash account with $5,600.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| April 3 | Credit card expense | 940 | |

| Cash | 940 | ||

| (To record the payment of credit card expenses) |

Table (23)

- Credit card expense is an expense account and it decreases the value of equity by $940. Therefore, debit credit card expense account with $940.

- Cash is an asset and it is decreased by $940. Therefore, credit cash account with $940.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| April 15 | Sales tax payable | 6,544 | |

| Cash | 6,544 | ||

| (To record the payment of credit card expenses) |

Table (24)

- Sales tax payable is a liability account and it is decreased by $6,544. Therefore, debit customer refunds payable account with $6,544.

- Cash is an asset and it is decreased by $6,544. Therefore, credit cash account with $6,544.

Want to see more full solutions like this?

Chapter 5 Solutions

Financial And Managerial Accounting

- Purchase-related transactions using perpetual inventory system The following selected transactions were completed by Niles Co. during March of the current year: Instructions Journalize the entries to record the transactions of Niles Co. for March.arrow_forwardBrown Inc. records purchases in a purchases journal and purchase returns in the general journal. Record the following transactions using a purchases journal, a general journal, and an accounts payable subsidiary ledger. The company uses the periodic method of accounting for inventory.arrow_forwardSales and purchase-related transactions using perpetual inventory system The following were selected from among the transactions completed by Babcock Company during November of the current year: Instructions Journalize the transactions.arrow_forward

- ( Appendix 6A) Recording Purchase and Sales Transactions Refer to the information for Raymond Company in Brief Exercise 6-34 and assume that the company uses the periodic inventory system. Required: Prepare the journal entries to record these transactions on the books of Raymond Company.arrow_forwardSales and purchase-related transactions using perpetual inventory system The following were selected from among the transactions completed by Essex Company during July of the current year: Instructions Journalize the transactions.arrow_forwardPurchase-related transactions using periodic inventory system Selected transactions for Niles Co. during March of the current year are listed in Problem 5-1B. Instructions Journalize the entries to record the transactions of Niles Co. for March using the periodic inventory system.arrow_forward

- Costume Warehouse sells costumes and accessories and purchases their merchandise from a manufacturer. Review the following transactions and prepare the journal entry or entries if Costume Warehouse uses A. the perpetual inventory system B. the periodic inventory systemarrow_forwardSales and purchase-related transactions using periodic inventory system Selected transactions for Babcock Company during November of the current year are listed in Problem 5-3A. Instructions Journalize the entries to record the transactions of Babcock Company for November using the periodic inventory system.arrow_forwardJOURNAL ENTRIES UNDER THE PERPETUAL INVENTORY SYSTEM Sunita Computer Supplies entered into the following transactions. Prepare journal entries under the perpetual inventory system. May 1 Purchased merchandise on account from Anju Enterprises, 200,000. 8 Purchased merchandise for cash, 100,000. 15 Sold merchandise on account to Salils Pharmacy for 8,000. The merchandise cost 5,000.arrow_forward

- Sales and purchase-related transactions using periodic inventory system Selected transactions for Essex Company during July of the current year are listed in Problem 5-3B. Instructions Journalize the entries to record the transactions of Essex Company for July using the periodic inventory system.arrow_forwardPerpetual inventory using FIFO Assume that the business in Exercise 6-5 maintains a perpetual inventory system, costing by the first-in, first-out method. Determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3.arrow_forwardMerchandise Accounting Merchandise Inventory Raw materials Work in process Finished goods Gross profit Net sales Sales revenue Cost of goods available for sale Cost of goods sold Perpetual system Periodic system Transportation-In Purchases FOB destination point FOB shipping point Gross profit ratio An adjunct account used to record freight costs paid by the buyer. A system in which the Inventory account is increased at the time of each purchase and decreased at the time of each sale. Terms that require the seller to pay for the cost of shipping the merchandise to the buyer. Terms that require the buyer to pay for the shipping costs. A system in which the Inventory account is updated only at the end of the period. Beginning inventory plus cost of goods purchased. An account used in a periodic inventory system to record acquisitions of merchandise. Sales revenue less sales returns and allowances and sales discounts. Cost of goods available for sale minus ending inventory. Gross profit divided by net sales. Net sales less cost of goods sold. The cost of unfinished products in a manufacturing company. The account wholesalers and retailers use to report inventory held for sale. The inventory of a manufacturer before the addition of any direct labor or manufacturing overhead. A manufacturers inventory that is complete and ready for sale. A representation of the inflow of assets from the sale of a product.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage