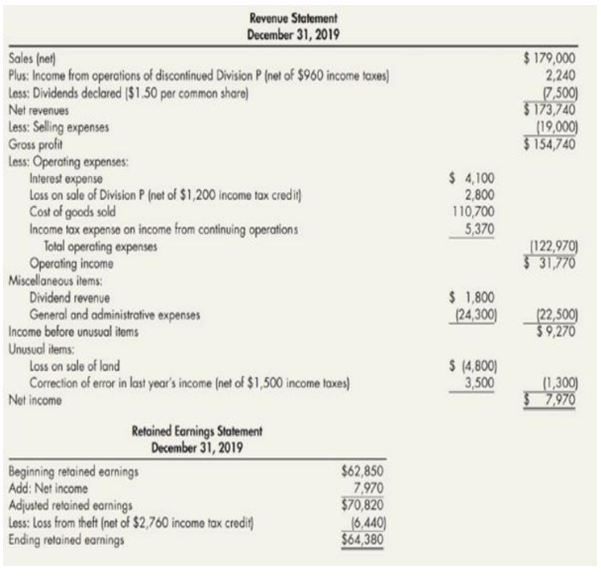

Revenue Statement December 31, 2019 $ 179,000 2,240 7,500) $173,740 (19,000) $ 154,740 Sales (net) Plus: Income from operations of discontinued Division P (net of $960 income taxes) Less: Dividends declared ($1.50 per common share) Net revenues Less: Selling expenses Gross profit Less: Operating expenses: Interest expense Loss on sale of Division P (net of $1,200 income tax credit) Cost of goods sold Income tax expense on income from continuing operations Tolal operating expenses Operating income Miscellaneous items: Dividend revenue General and administrafive expenses Income before unusual items Unusual items: Loss on sale of land Correction of errin last year's income (net of $1,500 income toxes) Net income $ 4,100 2,800 110,700 5,370 (122,970) $31,770 $ 1,800 (24,300) (22,500) $9,270 $ (4,800) 3,500 (1,300) 7,970 Retained Earnings Statement December 31, 2019 Beginning retained earnings Add: Net income Adjusted retained earnings Loss: Loss from theft (net of $2,760 income tax credit) Ending retained earnings $62,850 7,970 $70,820 (6,440) $64,380

Misclassifcations Roz Corporation's Multiple- Step income statement and

You determine that the account balances listed on the statements are correct but are incorrectly calssified in certain cases. The company laces a 30% tax rate. No shares of common stock were issued or retired during 2019

Required:

1. Review both statements and indicate where each incorrectly classified item should be classified.

2 Preoare a correct multiple - step income statement for 2019

3. Determine the correct beginning balance in retained earnings and then prepare a correct 2019 retained earnings statement.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images