Foundations of Financial Management

16th Edition

ISBN: 9781259277160

Author: Stanley B. Block, Geoffrey A. Hirt, Bartley Danielsen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 12P

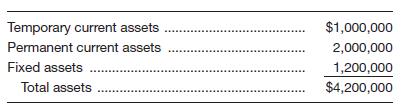

Colter Steel has

Short-term rates are 8 percent. Long-term rates are 13 percent. Earnings before interest and taxes are

If long-term financing is perfectly matched (synchronized) with long-term asset needs, and the same is true of short-term financing, what will earnings after taxes be? For a graphical example of perfectly matched plans, see Figure 6-5.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Your company’s assets have an unlevered value of 25,456,890 USD and the perpetual annual unlevered cash produced is 1,750,000 USD. The Company decides to go through with a recapitalization, after which the debt-to-equity ratio (which the company decides to keep constant) is equal to 2.5. What is the value of debt if the interest rate is 2.45% and the tax rate is 36%?

Assume that Hogan Surgical Instruments Company has $2,300,000 in assets. If it goes with a low-liquidity plan for the assets, it can earn a return of 16 percent, but with a high-liquidity plan, the return will be 12 percent. If the firm goes with a short-term financing plan, the financing costs on the $2,300,000 will be 8 percent, and with a long-term financing plan, the financing costs on the $2,300,000 will be 10 percent.

Compute the anticipated return after financing costs with the most aggressive asset-financing mix.

Compute the anticipated return after financing costs with the most conservative asset-financing mix.

Compute the anticipated return after financing costs with the two moderate approaches to the asset-financing mix.

Last year, Cayman Corporation had sales of $26 million, total variable costs of $15 million, and total fixed costs of $5,000,000. In addition, they paid $4 million in interest to bondholders. Cayman has a marginal tax rate of 21 percent. If Cayman's sales increase by 15%, what should be the increase in operating income?

Chapter 6 Solutions

Foundations of Financial Management

Ch. 6 - Prob. 1DQCh. 6 - Prob. 2DQCh. 6 - Prob. 3DQCh. 6 - Prob. 4DQCh. 6 - “The most appropriate financing pattern would be...Ch. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Prob. 8DQCh. 6 - What are three theories for describing the shape...Ch. 6 - Since the mid-1960s, corporate liquidity has been...

Ch. 6 - Gary’s Pipe and Steel Company expects sales next...Ch. 6 - Prob. 2PCh. 6 - Tobin Supplies Company expects sales next year to...Ch. 6 - Antivirus Inc. expects its sales next year to be...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Boatler Used Cadillac Co. requires $850,000 in...Ch. 6 - Biochemical Corp. requires $550,000 in financing...Ch. 6 - Sauer Food Company has decided to buy a new...Ch. 6 - Assume that Hogan Surgical Instruments Co. has...Ch. 6 - Assume that Atlas Sporting Goods Inc. has $840,000...Ch. 6 - Colter Steel has $4,200,000 in assets. Short-term...Ch. 6 - Prob. 13PCh. 6 - Guardian Inc. is trying to develop an asset...Ch. 6 - Lear Inc. has $840,000 in current assets, $370,000...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Carmen’s Beauty Salon has estimated monthly...Ch. 6 - Prob. 19PCh. 6 - Eastern Auto Parts Inc. has 15 percent of its...Ch. 6 - Bombs Away Video Games Corporation has forecasted...Ch. 6 - Esquire Products Inc. expects the following...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?arrow_forwardOgier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forwardYour division is considering two investment projects, each of which requires an up-front expenditure of 25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): a. What is the regular payback period for each of the projects? b. What is the discounted payback period for each of the projects? c. If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake? d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake? f. What is the crossover rate? g. If the cost of capital is 10%, what is the modified IRR (MIRR) of each project?arrow_forward

- Assume that Hogan Surgical Instruments Co. has $3,100,000 in assets. If it goes with a low-liquidity plan for the assets, it can earn a return of 14 percent, but with a high-liquidity plan, the return will be 10 percent. If the firm goes with a short-term financing plan, the financing costs on the $3,100,000 will be 6 percent, and with a long-term financing plan, the financing costs on the $3,100,000 will be 8 percent. a. Compute the anticipated return after financing costs with the most aggressive asset-financing mix. b. Compute the anticipated return after financing costs with the most conservative asset-financing mix.arrow_forwardParramore Corp has $11 million of sales, $2 million of inventories, $2 million of receivables, and $2.75 million of payables. Its cost of goods sold is 70% of sales, and it finances working capital with bank loans at a 7% rate. Assume 365 days in year for your calculations. How much cash would be freed up, if Parramore could lower its inventories and receivables by 8% each and increase its payables by 8%, all without affecting sales or cost of goods sold? Write out your answer completely. For Example, 13.2 million should be entered as 13,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar. I keep getting 100,000 and its says its wrong can you show me what I am doing wrongarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License