Foundations of Financial Management

16th Edition

ISBN: 9781259277160

Author: Stanley B. Block, Geoffrey A. Hirt, Bartley Danielsen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 16P

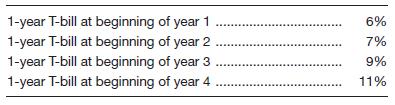

Using the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. Do an analysis similar to that in Table 6-6.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Using the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data.

Note: Input your answers as a percent rounded to 2 decimal places.

Interest Rate

1-year T-bill at beginning of year 1

6%

1-year T-bill at beginning of year 2

9%

1-year T-bill at beginning of year 3

10%

1-year T-bill at beginning of year 4

12%

Expected Return

2 year security

%

3 year security

%

4 year security

%

Suppose that the current one-year rate and expected one-year T-bill rates over the following three years (i.e., year 2, 3, and 4, respectively) are as follows: 1R1 = 5%, E(2r1)=6%, E(3r1)= 7%, E(4r1)=7.5%

Using the unbiased expectations theory, calculate the current rates for three-year and four-year Treasury securities.

An analyst evaluating securities has obtained the following information. The real rate of interest is 2.4% and is expected to remain constant for the next 5 years. Inflation is expected to be 2.3% next year, 3.3% the following year, 4.3% the third year, and 5.3% every year thereafter. The maturity risk premium is estimated to be 0.1 × (t – 1)%, where t = number of years to maturity. The liquidity premium on relevant 5-year securities is 0.5% and the default risk premium on relevant 5-year securities is 1%.

a. What is the yield on a 1-year T-bill? Round your answer to one decimal place.

b. What is the yield on a 5-year T-bond? Round your answer to one decimal place.

c. What is the yield on a 5-year corporate bond? Round your answer to one decimal place.

Chapter 6 Solutions

Foundations of Financial Management

Ch. 6 - Prob. 1DQCh. 6 - Prob. 2DQCh. 6 - Prob. 3DQCh. 6 - Prob. 4DQCh. 6 - “The most appropriate financing pattern would be...Ch. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Prob. 8DQCh. 6 - What are three theories for describing the shape...Ch. 6 - Since the mid-1960s, corporate liquidity has been...

Ch. 6 - Gary’s Pipe and Steel Company expects sales next...Ch. 6 - Prob. 2PCh. 6 - Tobin Supplies Company expects sales next year to...Ch. 6 - Antivirus Inc. expects its sales next year to be...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Boatler Used Cadillac Co. requires $850,000 in...Ch. 6 - Biochemical Corp. requires $550,000 in financing...Ch. 6 - Sauer Food Company has decided to buy a new...Ch. 6 - Assume that Hogan Surgical Instruments Co. has...Ch. 6 - Assume that Atlas Sporting Goods Inc. has $840,000...Ch. 6 - Colter Steel has $4,200,000 in assets. Short-term...Ch. 6 - Prob. 13PCh. 6 - Guardian Inc. is trying to develop an asset...Ch. 6 - Lear Inc. has $840,000 in current assets, $370,000...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Carmen’s Beauty Salon has estimated monthly...Ch. 6 - Prob. 19PCh. 6 - Eastern Auto Parts Inc. has 15 percent of its...Ch. 6 - Bombs Away Video Games Corporation has forecasted...Ch. 6 - Esquire Products Inc. expects the following...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An analyst evaluating securities has obtained the following information. The real rate of interest is 2.9% and is expected to remain constant for the next 5 years. Inflation is expected to be 2.4% next year, 3.4% the following year, 4.4% the third year, and 5.4% every year thereafter. The maturity risk premium is estimated to be 0.1 × (t – 1)%, where t = number of years to maturity. The liquidity premium on relevant 5-year securities is 0.5% and the default risk premium on relevant 5-year securities is 1%. a. What is the yield on a 1-year T-bill? Round your intermediate calculations and final answer to two decimal places. % b. What is the yield on a 5-year T-bond? Round your intermediate calculations and final answer to two decimal places. % c. What is the yield on a 5-year corporate bond? Round your intermediate calculations and final answer to two decimal places. %arrow_forwardAn analyst evaluating securities has obtained the following information. The real rate of interest is 2.9% and is expected to remain constant for the next 5 years. Inflation is expected to be 2% next year, 3% the following year, 4% the third year, and 5% every year thereafter. The maturity risk premium is estimated to be 0.1 \times (t-1)%, where t = number of years to maturity. The liquidity premium on relevant 5-year securities is 0.5% and the default risk premium on relevant 5 - year securities is 1%. a. What is the yield on a 1-year T-bill? Round your answer to one decimal place. % b. What is the yield on a 5-year T-bond? Round your answer to one decimal place. % c. What is the yield on a 5-year corporate bond? Round your answer to one decimal place. %arrow_forwardAssuming the expectations theory is the correct theoryof the term structure, calculate the interest rates in theterm structure for maturities of one to four years, andplot the resulting yield curves for the following paths ofone-year interest rates over the next four years:a. 5%; 7%; 12%; 12%b. 7%; 5%; 3%; 5%How would your yield curves change if people preferred shorter-term bonds to longer-term bonds?arrow_forward

- Suppose that the current 1-year rate ( 1-year spot rate) and expected 1-year T-bill rates over the following three years (i.e years 2,3, and 4 respectively) as follows: 1R1=3.22%, E(2r1)=4.65%,E(3r1)=5.15%,E(4r1)=6.65% Using the unbiased expectations theory, calculate the current (long-term) for one-, two-, three-, and four- year- maturity treasury securities. ( Round your answers to 2 decimal places.)arrow_forwardBond valuation related problems should be solved by using a financial calculator or MS excel spreadsheet. Accordingly, you must show the values of all relevant time valu of money variables If D1 = $1.50 g (which is constant) = 6.5%, Po = $56, what is the stock's expected capital gains yield for the coming year?arrow_forwardBond valuation related problems should be solved by using a financial calculator or MS excel spreadsheet. Accordingly, you must show the values of all relevant time valu of money variables If D1 = $1.25, g(which is constant) = 4.7%, and Po= $26.00 what is the stocks expected dividend yield for the coming year?arrow_forward

- For an investor who plans to purchase a bond that matures in one year, the primary concern should be Select one: a. Interest rate risk b. Coupon rate risk c. Exchange rate risk d. Yield to maturityarrow_forwardAssuming the expectations theory is the correct theory of the term structure, calculate the interest rates in the term structure for maturities of one to four years, and plot the resulting yield curves for the following paths of one-year interest rates over the next four years: 3%, 5%, 13%, 15%arrow_forwardUnbiased Expectations Theory Suppose that the current one-year rate (one-year spot rate) and expected one-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows: 1R1=4.25%, E(2r1) =5.25%, E(3r1) =5.75%, E(4r1)=6.10% Using the unbiased expectations theory, what is the current (long-term) rate for four-year-maturity Treasury securities?arrow_forward

- The following information is to be used in the following two questions: Using the expectations hypothesis: You observe the following bonds trading in the market: a 1-year zero priced at $913.24 a two-year 10% coupon bond trading at a par value of $10,00 What is the one-year interest rate (expressed in % without the sign)? Based on the prior information, what is the expected one-year rate for the second year?arrow_forwardWhich of the following is the correct ranking of the price risk. Bond Coupon Rate Maturity (years) A 8% 5 B 6% 5 C 6% 10 A>B>C C>B>A A>C>Barrow_forwardThe following table summarizes the prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Bond Valuation - A Quick Review; Author: Pat Obi;https://www.youtube.com/watch?v=xDWTPmqcWW4;License: Standard Youtube License