EBK CORNERSTONES OF COST MANAGEMENT

4th Edition

ISBN: 8220103648561

Author: MOWEN

Publisher: Cengage Learning US

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 1CE

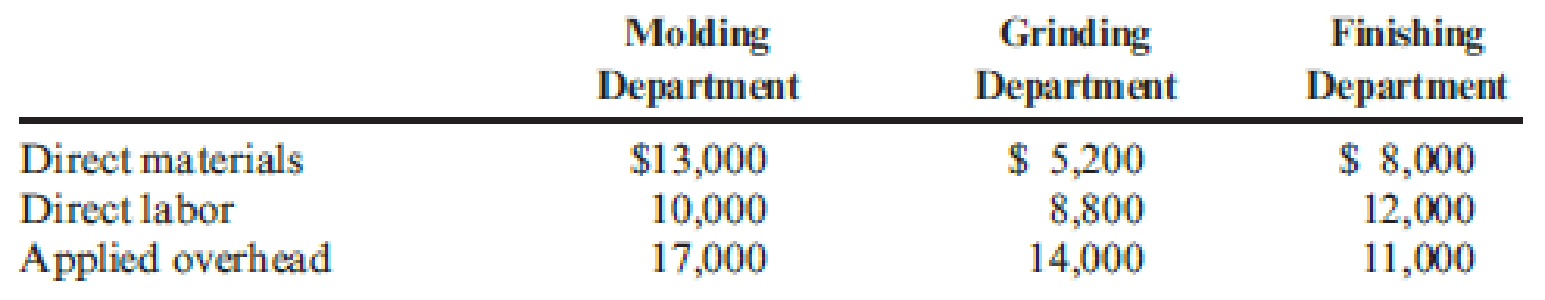

Lamont Company produced 80,000 machine parts for diesel engines. There were no beginning or ending work-in-process inventories in any department. Lamont incurred the following costs for May:

Required:

- 1. Calculate the costs transferred out of each department.

- 2. Prepare the journal entries corresponding to these transfers. Also, prepare the

journal entry for Grinding that reflects the costs added to the transferred-in goods received from Molding. - 3. What if the Grinding Department had an ending WIP of $12,000? Calculate the cost transferred out and provide the journal entry that would reflect this transfer. What is the effect on finished goods calculated in Requirement 1, assuming the other two departments have no ending WIP?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Leandro Corp. manufactures wooden desks. Production consists of three processes: cutting, assembly, and finishing. The following costs are given for April:

Cutting

Assembly

Finishing

direct materials

$7,000

$10,000

$3,000

direct labor

3,000

14,000

2,000

applied overhead

4,000

5,000

6,000

There were no work in process inventories and 1,000 podiums were produced.Record the journal entries to record the transfer of goods from process to process.

a.

Work in Process - Assembly 29,000

Work in Process - Cutting 29,000

Work in Process - Finishing 11,000

Work in Process - Assembly 11,000

Finished Goods 54,000

Work in Process - Finishing 54,000

b.

Work in Process - Assembly 14,000

Work in Process - Cutting 14,000

Work in Process - Finishing 43,000

Work in Process - Assembly 43,000

Finished Goods 54,000

Work in Process - Finishing 54,000

c.

Work in Process - Cutting 14,000

Raw Materials 14,000

Work in Process - Assembly 29,000

Raw Materials 29,000

Work in Process -…

1. How much overhead would have been charged to the company’s Work-in-Process account during the year?

2. Comment on the appropriateness of the company’s cost drivers (i.e., the use of machine hours in Machining and direct-labor cost in Assembly).

Leandro Corp. manufactures wooden desks. Production consists of three processes: cutting, assembly, and finishing. The following costs are given for April:

Cutting

Assembly

Finishing

direct materials

$7,000

$10,000

$3,000

direct labor

3,000

14,000

2,000

applied overhead

4,000

5,000

6,000

There were no work in process inventories and 1,000 podiums were produced.The journal entry to assign costs to the Assembly process would be

a.

Raw Materials 20,000

Payroll 19,000

Overhead Control 15,000

Work in Process - Assembly 54,000

b.

Raw Materials 10,000

Payroll 14,000

Overhead Control 5,000

Work in Process - Assembly 29,000

c.

Work in Process - Assembly 29,000

Raw Materials 10,000

Payroll 14,000

Overhead Control 5,000

d.

Work in Process - Assembly 54,000

Raw Materials 20,000

Payroll 19,000

Overhead Control 15,000

e. None of these choices are correct.

Chapter 6 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

Ch. 6 - What is a process? Provide an example that...Ch. 6 - Describe the differences between process costing...Ch. 6 - Prob. 3DQCh. 6 - What are transferred-in costs?Ch. 6 - Explain why transferred-in costs are a special...Ch. 6 - What is a production report? What purpose does...Ch. 6 - Can process costing be used for a service...Ch. 6 - What are equivalent units? Why are they needed in...Ch. 6 - How is the equivalent unit calculation affected...Ch. 6 - Describe the five steps in accounting for the...

Ch. 6 - Under the weighted average method, how are...Ch. 6 - Under what conditions will the weighted average...Ch. 6 - In assigning costs to goods transferred out, how...Ch. 6 - Prob. 14DQCh. 6 - What is operation costing? When is it used?Ch. 6 - Lamont Company produced 80,000 machine parts for...Ch. 6 - Lising Therapy has a physical therapist who...Ch. 6 - Fleming, Fleming, and Johnson, a local CPA firm,...Ch. 6 - During October, McCourt Associates incurred total...Ch. 6 - Tomar Company produces vitamin energy drinks. The...Ch. 6 - Apeto Company produces premium chocolate candy...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Gunnison Company had the following equivalent...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Morrison Company had the equivalent units schedule...Ch. 6 - Shorts Company has three process departments:...Ch. 6 - A local barbershop cuts the hair of 1,200...Ch. 6 - Friedman Company uses JIT manufacturing. There are...Ch. 6 - Lacy, Inc., produces a subassembly used in the...Ch. 6 - Softkin Company manufactures sun protection...Ch. 6 - Heap Company manufactures a product that passes...Ch. 6 - K-Briggs Company uses the FIFO method to account...Ch. 6 - The following data are for four independent...Ch. 6 - Using the data from Exercise 6.18, compute the...Ch. 6 - Holmes Products, Inc., produces plastic cases used...Ch. 6 - Dama Company produces womens blouses and uses the...Ch. 6 - Fordman Company has a product that passes through...Ch. 6 - Using the same data found in Exercise 6.22, assume...Ch. 6 - Baxter Company has two processing departments:...Ch. 6 - Tasty Bread makes and supplies bread throughout...Ch. 6 - Under either weighted average or FIFO, when...Ch. 6 - During the month of June, the mixing department...Ch. 6 - As goods are transferred from a prior process to a...Ch. 6 - During March, Hanks Manufacturing started and...Ch. 6 - Proteger Company manufactures insect repellant...Ch. 6 - Swasey Fabrication, Inc., manufactures frames for...Ch. 6 - Refer to the data in Problem 6.31. Assume that the...Ch. 6 - Hatch Company produces a product that passes...Ch. 6 - FIFO Method, Single Department Analysis, One Cost...Ch. 6 - Hepworth Credit Corporation is a wholly owned...Ch. 6 - Muskoge Company uses a process-costing system. The...Ch. 6 - Prob. 37PCh. 6 - Healthway uses a process-costing system to compute...Ch. 6 - FIFO Method, Two-Department Analysis Refer to the...Ch. 6 - Jacson Company produces two brands of a popular...Ch. 6 - Golding Manufacturing, a division of Farnsworth...Ch. 6 - Larkin Company produces leather strips for western...Ch. 6 - Novel Toys, Inc., manufactures plastic water guns....Ch. 6 - Prob. 44P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kenkel, Ltd. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 80,000. b. Requisitioned raw materials to production, 80,000. c. Distributed direct labor costs, 10,000. d. Factory overhead costs incurred, 60,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 225,000, on account.arrow_forwardDavis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forwardGeneva, Inc., makes two products, X and Y, that require allocation of indirect manufacturing costs. The following data were compiled by the accountants before making any allocations: The total cost of purchasing and receiving parts used in manufacturing is 60,000. The company uses a job-costing system with a single indirect cost rate. Under this system, allocated costs were 48,000 and 12,000 for X and Y, respectively. If an activity-based system is used, what would be the allocated costs for each product?arrow_forward

- A manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardLansing. Inc., provided the following data for its two producing departments: Machine hours are used to assign the overhead of the Molding Department, and direct labor hours are used to assign the overhead of the Polishing Department. There are 30,000 units of Form A produced and sold and 50,000 of Form B. Required: 1. Calculate the overhead rates for each department. 2. Using departmental rates, assign overhead to live two products and calculate the overhead cost per unit. How does this compare with the plantwide rate unit cost, using direct labor hours? 3. What if the machine hours in Molding were 1,200 for Form A and 3,800 for Form B and the direct labor hours used in Polishing were 5,000 and 15,000, respectively? Calculate the overhead cost per unit for each product using departmental rates, and compare with the plantwide rate unit costs calculated in Requirement 2. What can you conclude from this outcome?arrow_forwardFor E2-17, prepare any journal entries that would have been different if the only trigger points had been the purchase of materials and the sale of finished goods. Davis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forward

- The following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardA manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardShorts Company has three process departments: Mixing, Encapsulating, and Bottling. At the beginning of the year, there were no work-in-process or finished goods inventories. The following data are available for the month of July: Includes only the direct materials, direct labor, and the overhead used to process the partially finished goods received from the prior department. The transferred-in cost is not included. Required: 1. Prepare journal entries that show the transfer of costs from one department to the next (including the entry to transfer the costs of the final department). 2. Prepare T-accounts for the entries made in Requirement 1. Use arrows to show the flow of costs.arrow_forward

- AAA Appliances Inc. has two production departments. The nature of the process is such that no units remain in process in Finishing at the end of the period. At the beginning of the period, 10,000 units with a cost of 30,000 were transferred from Assembly to Finishing. Finishing incurred costs of 8,800 for materials, 7,200 for labor, and 8,800 for factory overhead, and finished 10,000 units during the month. a. Determine the unit cost for the month in Finishing. b. Determine the unit cost of the products transferred to finished goods.arrow_forwardSonoma Products Inc. manufactures a liquid product in one department. Due to the nature of the product and the process, units are regularly lost during production. Materials and conversion costs are added evenly throughout the process. The following summaries were prepared for March: Calculate the unit cost for materials, labor, and factory overhead for March and show the costs of units transferred to finished goods and to ending work in process inventory.arrow_forwardAmberjack Company is trying to decide on an allocation base to use to assign manufacturing overhead to jobs. The company has always used direct labor hours to assign manufacturing overhead to products, but it is trying to decide whether it should use a different allocation base such as direct labor dollars or machine hours. Actual and estimated data for manufacturing overhead, direct labor cost, direct labor hours, and machine hours for the most recent fiscal year are summarized here: Estimated Value Actual Value Manufacturing overhead cost $ 597,000 $ 658,000 Direct labor cost $ 399,000 $ 453,000 Direct labor hours 16,800 hours 18,300 hours Machine hours 7,800 hours 8,800 hours Required: Based on the company’s current allocation base (direct labor hours), compute the following:Predetermined overhead rate. Note: Round your answer to 2 decimal places. Applied manufacturing overhead. Note: Round your intermediate calculations to 2 decimal places and final answer…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY