Refer to the data in Exercise 6-39. The president of Tiger Furnishings is confused about the differences in costs that result from using direct labor costs and machine-hours.

Required

- a. Explain why the two product costs are different.

- b. How would you respond to the president when asked to recommend one allocation base or the other?

- c. The president says to choose the allocation base that results in the highest income. Is this an appropriate basis for choosing an allocation base?

a.

Explain the difference between the two products costs.

Explanation of Solution

Product cost:

Product cost includes all the costs that are attributed to the production of the product. All the money that has spent on the process of production or purchase of the product is known as product cost.

Product cost per unit:

The product cost per unit is determined by dividing the total of variable and fixed cost with the total number of units.

Predetermined overhead rate:

The predetermined overhead rate is the rate computed for applying manufacturing overheads to the work-in-process inventory. This rate can be computed by dividing the total amount of manufacturing overheads by the base of allocation.

Difference between the two products costs:

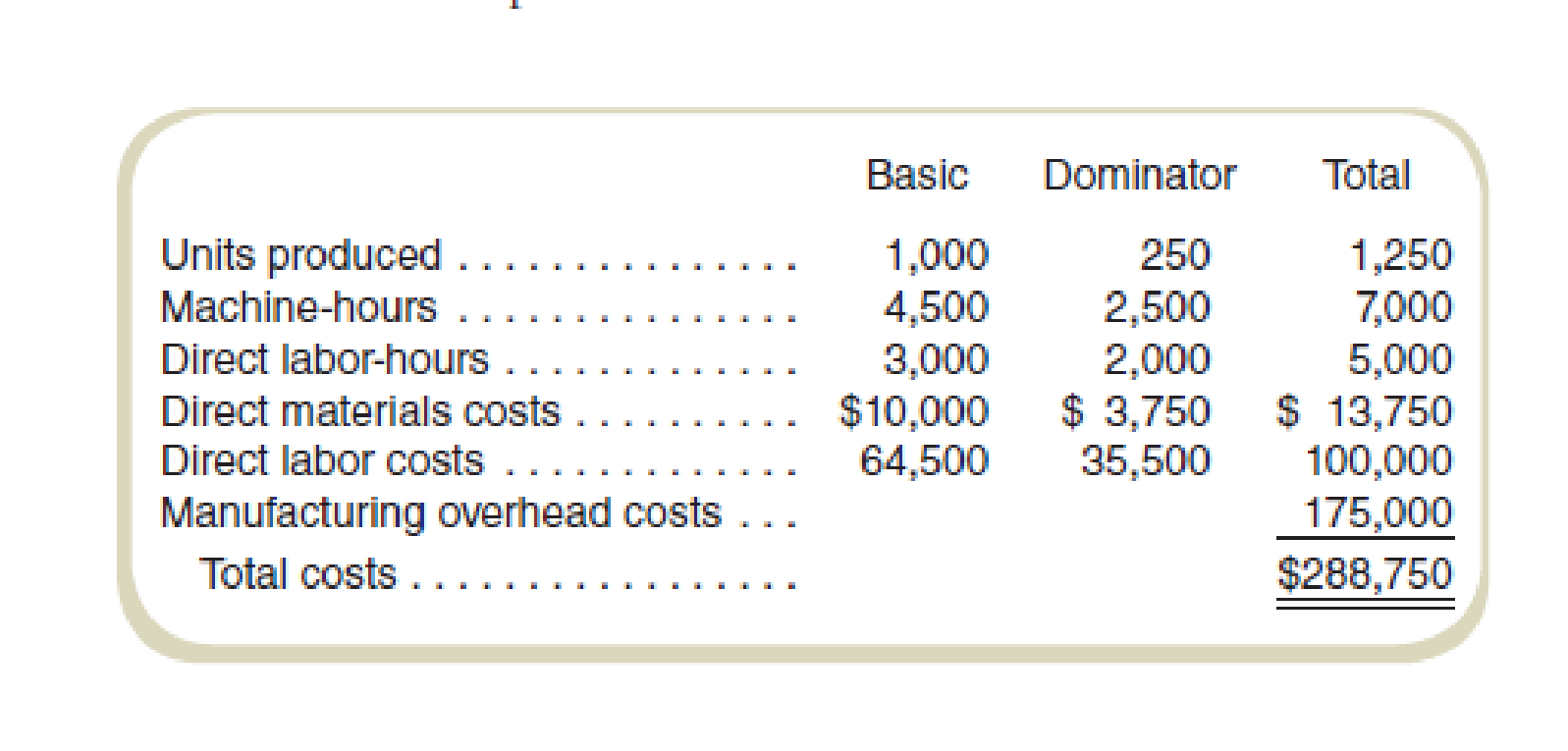

While using direct-labor costs the allocation of overheads is as follows:

For Product B: $112,875 (2)

For Product D: $62,125 (3)

And,

While using Machine-hours the allocation of overheads is as follows:

For Product B: $112,500 (5)

For Product D: $62,500 (6)

This shows the difference between the two methods of allocation is either increase or decrease of $375. This difference exists due to the different bases used for the calculation of predetermined rates. If the direct-labor costs are used then the resulting predetermined rate is $1.75 or 175% approximately. The process is oriented in terms of the base of direct-labor costs.

But, when machine-hours are used for the allocation of overheads with respect to the predetermined rate the resulting $25 will be giving a different result. The base for Compute both the predetermined rates is different.

The sum of allocation would be $175,000 for either method used for Compute cost allocation. But the allocations to both the products using the different methods would be different. The reason for this is that when direct-labor costs are used as a base the result is computed using direct-labor costs. But, when machine-hours are used as a base the computed result would be with respect to the machine-hours.

Thus, the allocation of overheads differs due to a different base of allocation used.

Working note 1:

Compute the predetermined overhead rate using direct labor costs as the base for allocation:

Working note 2:

Allocation of predetermined overhead costs using direct labor costs as the base for allocation:

For Basic:

For Dominator:

Working note 3:

The predetermined overhead rate while using machine-hours for cost allocation:

Working note 4:

Allocation of predetermined overhead costs using machine-hours as the base for allocation:

For Basic:

For Dominator:

b.

Describe the points to be taken into consideration when recommending one allocation base or the other.

Explanation of Solution

The points to be taken into consideration when recommending one allocation base or the other:

1) The method of production that is being used by the company in accordance with the operations and the availability of the resources.

2) The pooling of cost should be done but should correspond to the process of allocation that represents an accurate picture.

3) Either of the cost systems can be used as they both represent an accurate picture. But, if the product is labor intensive then the use of labor-hours cost is recommended. It would present facts clearly.

Hence, the recommendations to use any base for allocation should be in accordance with the production process. The company can use two-stage allocation for allocation of overheads.

c.

Comment on whether using the allocation base that results in the highest income is appropriate or not.

Explanation of Solution

It is not appropriate to choose the highest income generating base for the allocation of cost. The consideration should be to report the data accurately and consistently. While choosing the base to allocate the cost, the cost system should be in accordance with the base that is being used by the process and not the base which is generating more income.

Hence, the base that results in highest income should not be used as this is not an appropriate basis for choosing an allocation base.

Want to see more full solutions like this?

Chapter 6 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- The management of Hartman Company is trying to determine the amount of each of two products to produce over the coming planning period. The following information concerns labor availability, labor utilization, and product profitability: a. Develop a linear programming model of the Hartman Company problem. Solve the model to determine the optimal production quantities of products 1 and 2. b. In computing the profit contribution per unit, management does not deduct labor costs because they are considered fixed for the upcoming planning period. However, suppose that overtime can be scheduled in some of the departments. Which departments would you recommend scheduling for overtime? How much would you be willing to pay per hour of overtime in each department? c. Suppose that 10, 6, and 8 hours of overtime may be scheduled in departments A, B, and C, respectively. The cost per hour of overtime is 18 in department A, 22.50 in department B, and 12 in department C. Formulate a linear programming model that can be used to determine the optimal production quantities if overtime is made available. What are the optimal production quantities, and what is the revised total contribution to profit? How much overtime do you recommend using in each department? What is the increase in the total contribution to profit if overtime is used?arrow_forwardPotterii sells its products to large box stores and recently added a retail line of products to sell directly to consumers. These estimates are to be used in determining the overhead allocation rate for ABC: What would be the predetermined rate for each cost pool?arrow_forwardLarsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forward

- Explain how a plantwide overhead rate, using a unit-based driver, can produce distorted product costs. In your answer, identify two major factors that impair the ability of plantwide rates to assign cost accurately.arrow_forwardDiscuss how, as warehouse manager for Vinnies Vinyls, you view the different rate of allocated costs the warehouse is being charged compared to the West store. Describe the implications of this. What steps could you take to solve this discrepancy? What alternatives would you consider, assuming management is willing to consider making changes in the rate?arrow_forwardWhich of the following is a reason a company would implement activity-based costing? A. The cost of record keeping is high. B. The additional data obtained through traditional allocation are not worth the cost. C. They want to improve the data on which decisions are made. D. A company only has one cost driver.arrow_forward

- Geneva, Inc., makes two products, X and Y, that require allocation of indirect manufacturing costs. The following data were compiled by the accountants before making any allocations: The total cost of purchasing and receiving parts used in manufacturing is 60,000. The company uses a job-costing system with a single indirect cost rate. Under this system, allocated costs were 48,000 and 12,000 for X and Y, respectively. If an activity-based system is used, what would be the allocated costs for each product?arrow_forwardRandy Harris, controller, has been given the charge to implement an advanced cost management system. As part of this process, he needs to identify activity drivers for the activities of the firm. During the past four months, Randy has spent considerable effort identifying activities, their associated costs, and possible drivers for the activities costs. Initially, Randy made his selections based on his own judgment using his experience and input from employees who perform the activities. Later, he used regression analysis to confirm his judgment. Randy prefers to use one driver per activity, provided that an R2 of at least 80 percent can be produced. Otherwise, multiple drivers will be used, based on evidence provided by multiple regression analysis. For example, the activity of inspecting finished goods produced an R2 of less than 80 percent for any single activity driver. Randy believes, however, that a satisfactory cost formula can be developed using two activity drivers: the number of batches and the number of inspection hours. Data collected for a 14-month period are as follows: Required: 1. Calculate the cost formula for inspection costs using the two drivers, inspection hours and number of batches. Are both activity drivers useful? What does the R2 indicate about the formula? 2. Using the formula developed in Requirement 1, calculate the inspection cost when 300 inspection hours are used and 30 batches are produced. Prepare a 90 percent confidence interval for this prediction.arrow_forwardTrail Outfitters has this information for its manufacturing: Its income statement under absorption costing is as follows: Prepare an income statement with variable costing and a reconciliation statement between both methods.arrow_forward

- Good Scent, Inc., produces two colognes: Rose and Violet. Of the two, Rose is more popular. Data concerning the two products follow: The company uses a conventional costing system and assigns overhead costs to products using direct labor hours. Annual overhead costs follow. They are classified as fixed or variable with respect to direct labor hours. Required: 1. Using the conventional approach, compute the number of cases of Rose and the number of cases of Violet that must be sold for the company to break even. 2. Using an activity-based approach, compute the number of cases of each product that must be sold for the company to break even.arrow_forwardA CPA would recommend changing from plantwide overhead rate application to departmental rates under which of the following circumstances? a. The plant produces one product. b. The plant produces multiple products that may or may not pass through all producing departments. c. The plant produces multiple products that pass through all of the producing departments. d. The plant produces many different products that consume the same amount of resources in each producing department.arrow_forwardHappy Trails has this information for its manufacturing: Â Its income statement under absorption costing is: Prepare an income statement with variable costing and a reconciliation statement between both methods.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning