Concept explainers

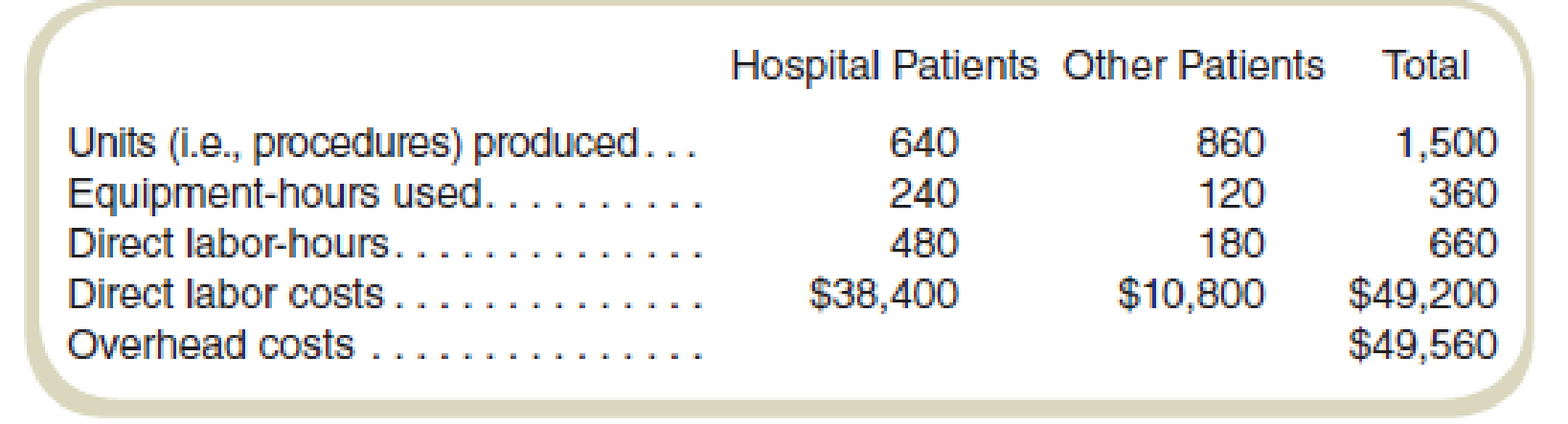

Owl-Eye Radiologists (OR) does various types of diagnostic imaging. Radiologists perform tests using sophisticated equipment. OR’s management wants to compute the costs of performing tests for two different types of patients: those who are hospitalized (including those in emergency rooms) and those who are not hospitalized but are referred by physicians. The data for June for the two categories of patients follow:

The accountant first assigns

Required

- a. Compute the predetermined overhead rates assuming that Owl-Eye Radiologists uses equipment-hours to allocate equipment-related overhead costs and labor-hours to allocate labor-related overhead costs.

- b. Compute the total costs of production and the cost per unit for each of the two types of patients undergoing tests in June.

a.

Calculate the predetermined overhead rates using equipment-hours for the allocation of equipment related overhead costs and labor-hours to allocate labor-related overhead costs.

Answer to Problem 56P

The Cost per unit is $46 for the overhead rates when using equipment-hours for allocation.

The Cost per unit is $50 for the overhead rates when using labor-hours for allocation.

Explanation of Solution

Predetermined overhead rate:

The predetermined overhead rate is the rate computed for applying manufacturing overheads to the work-in-process inventory. This rate can be computed by dividing the total amount of manufacturing overheads by the base of allocation.

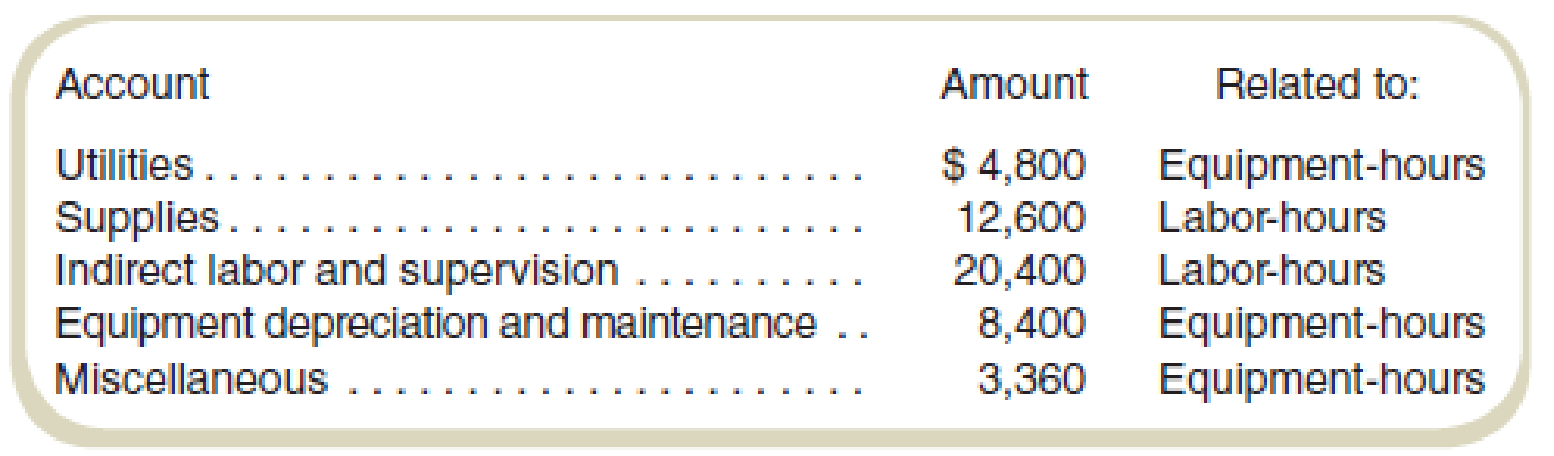

Analysis of overhead accounts by the cost accountant is as follows:

| Account | Amount | Related to: |

| Utilities | $ 4,800 | Equipment hours |

| Supplies | 12,600 | Labor-hours |

| Indirect labor and supervision | 20,400 | Labor-hours |

| Equipment depreciation and maintenance | 8,400 | Equipment hours |

| Miscellaneous | 3,360 | Equipment hours |

Compute equipment-hours related predetermined rate:

Hence, the equipment-hours related predetermined rate is $46.

Compute materials cost related predetermined rate:

Thus, the labor-hours related predetermined rate is $50.

b.

Compute the total costs of production and the cost per unit for each of the two types of patients undergoing tests in June.

Answer to Problem 56P

For hospital patients:

Total cost: $73,440

Cost per unit: $115

For other patients:

Total cost: $25,320

Cost per unit: $29

Explanation of Solution

Product cost:

Product cost includes all the costs that are attributed to the production of the product. All the money that has spent on the process of production or purchase of the product is known as product cost.

Product cost per unit:

The product cost per unit is determined by dividing the total of variable and fixed cost with the total number of units.

Compute the total cost of hospital patients:

Compute total cost of other patients:

Thus, the value of total cost for hospital patients and other patients are $73,440 and $25,320 respectively.

Compute cost per unit for product hospital patients:

Compute cost per unit for the product of other patients:

Working note 1:

Compute equipment hours related cost for hospital patients:

Working note 2:

Compute labor hours related cost for hospital patients:

Working note 3:

Compute equipment hours related cost for other patients:

Working note 4:

Compute labor hours related cost for other patients:

Want to see more full solutions like this?

Chapter 6 Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

- Deepa Dalal opened a free-standing radiology clinic. She had anticipated that the costs for the radiological tests would be primarily fixed, but she found that costs increased with the number of tests performed. Costs for this service over the past nine months are as follows: Required: 1. Prepare a scattergraph based on the preceding data. Use cost for the vertical axis and number of radiology tests for the horizontal axis. Based on an examination of the scattergraph, does there appear to be a linear relationship between the cost of radiology service and the number of tests? 2. Compute the cost formula for radiology services using the high-low method. 3. Calculate the predicted cost of radiology services for October for 3,500 tests using the formula found in Requirement 2.arrow_forwardJohn Fleming, chief administrator for Valley View Hospital, is concerned about the costs for tests in the hospital’s lab. Charges for lab tests are consistently higher at Valley View than at other hospitals and have resulted in many complaints. Also, because of strict regulations on amounts reimbursed for lab tests, payments received from insurance companies and governmental units have not been high enough to cover lab costs. Mr. Fleming has asked you to evaluate costs in the hospital’s lab for the past month. The following information is available: Two types of tests are performed in the lab—blood tests and smears. During the past month, 1,500 blood tests and 4,400 smears were performed in the lab. Small glass plates are used in both types of tests. During the past month, the hospital purchased 22,000 plates at a cost of $52,800. 3,400 of these plates were unused at the end of the month; no plates were on hand at the beginning of the month. During the past month, 3,400 hours of labor…arrow_forwardJohn Fleming, chief administrator for Valley View Hospital, is concerned about the costs for tests in thehospital’s lab. Charges for lab tests are consistently higher at Valley View than at other hospitals andhave resulted in many complaints. Also, because of strict regulations on amounts reimbursed for labtests, payments received from insurance companies and governmental units have not been high enoughto cover lab costs.Mr. Fleming has asked you to evaluate costs in the hospital’s lab for the past month. The followinginformation is available:a. Two types of tests are performed in the lab—blood tests and smears. During the past month, 1,800 bloodtests and 2,400 smears were performed in the lab.b. Small glass plates are used in both types of tests. During the past month, the hospital purchased12,000 plates at a cost of $28,200. This cost is net of a 6% quantity discount. 1,500 of these plateswere unused at the end of the month; no plates were on hand at the beginning of the month.c.…arrow_forward

- Can you help with part 4 of this quesstion? Parts 1, 2, and 3 have been answered. Pleasant Stay Medical Inc. wishes to determine its product costs. Pleasant Stay offers a variety of medical procedures (operations) that are considered its “products.” The overhead has been separated into three major activities. The annual estimated activity costs and activity bases follow: ActivityBudgeted Activity CostActivity BaseScheduling and admitting$432,000 Number of patientsHousekeeping4,212,000 Number of patient daysNursing5,376,000 Weighted care unitTotal costs$10,020,000 Total “patient days” are determined by multiplying the number of patients by the average length of stay in the hospital. A weighted care unit (wcu) is a measure of nursing effort used to care for patients. There were 192,000 weighted care units estimated for the year. In addition, Pleasant Stay estimated 6,000 patients and 27,000 patient days for the year. (The average patient is expected to have a a little more than a…arrow_forwardValley Hospital began using standards to evaluate its Admissions Department. The standard was broken into two types of admissions as follows: Type of Admission Standard Time to CompleteAdmission Record Unscheduled 30 min. Scheduled 20 min. The unscheduled admission took longer because name, address, and insurance information needed to be determined and verified at the time of admission. Information was collected on scheduled admissions prior to admitting the patient, thus requiring less time in admissions. The Admissions Department employs four full-time people for 40 hours per week at $15 per hour. For the most recent week, the department handled 176 unscheduled and 240 scheduled admissions. a. How much was actually spent on labor for the week?$ b. What are the standard hours for the actual volume of work for the week? (Round to the nearest whole hour.) hours c. Compute the direct labor time variance, and report how well the department performed for the…arrow_forwardEnglert Hospital began using standards to evaluate its Admissions Department. The standard was broken into two types of admissions as follows: Type of Admission Standard Time to CompleteAdmission Record Unscheduled admission 30 min. Scheduled admission 15 min. The unscheduled admission took longer because name, address, and insurance information needed to be determined and verified at the time of admission. Information was collected on scheduled admissions prior to the admissions, which was less time-consuming. The Admissions Department employs four full-time people (40 productive hours per week, with no overtime) at $15 per hour. For the most recent week, the department handled 140 unscheduled and 350 scheduled admissions. a. How much was actually spent on labor for the week?$fill in the blank 1 b. What are the standard hours for the actual volume for the week (round to one decimal place)?fill in the blank 2 hours c. Calculate the time…arrow_forward

- McCullough Hospital uses a job-order costing system to assign costs to its patients. Its direct materials include a variety of items such as pharmaceutical drugs, heart valves, artificial hips, and pacemakers. Its direct labor costs (e.g., surgeons, anesthesiologists, radiologists, and nurses) associated with specific surgical procedures and tests are traced to individual patients. All other costs, such as depreciation of medical equipment, insurance, utilities, incidental medical supplies, and the labor costs associated with around-the clock monitoring of patients are treated as overhead costs. Historically, McCullough has used one predetermined overhead rate based on the number of patient-days (each night that a patient spends in the hospital counts as one patient-day) to allocate overhead costs to patients. Recently a member of the hospital’s accounting staff has suggested using two predetermined overhead rates (allocated based on the number of patient-days) to improve the…arrow_forwardMcCullough Hospital uses a job-order costing system to assign costs to its patients. Its direct materials include a variety of items such as pharmaceutical drugs, heart valves, artificial hips, and pacemakers. Its direct labor costs (e.g., surgeons, anesthesiologists, radiologists, and nurses) associated with specific surgical procedures and tests are traced to individual patients. All other costs, such as depreciation of medical equipment, insurance, utilities, incidental medical supplies, and the labor costs associated with around-the-clock monitoring of patients are treated as overhead costs. Historically, McCullough has used one predetermined overhead rate based on the number of patient-days (each night that a patient spends in the hospital counts as one patient-day) to allocate overhead costs to patients. Recently a member of the hospital’s accounting staff has suggested using two predetermined overhead rates (allocated based on the number of patient-days) to improve the…arrow_forwardMcCullough Hospital uses a job-order costing system to assign costs to its patients. Its direct materials include a variety of items such as pharmaceutical drugs, heart valves, artificial hips, and pacemakers. Its direct labor costs (e.g., surgeons, anesthesiologists, radiologists, and nurses) associated with specific surgical procedures and tests are traced to individual patients. All other costs, such as depreciation of medical equipment, insurance, utilities, incidental medical supplies, and the labor costs associated with around-the-clock monitoring of patients are treated as overhead costs.Historically, McCullough has used one predetermined overhead rate based on the number of patientdays (each night that a patient spends in the hospital counts as one patient-day) to allocate overhead costs to patients. For the most recent period, this predetermined rate was based on three estimates—fixed overhead costs of $17,440,000, variable overhead costs of $110 per patient-day, and a…arrow_forward

- McCullough Hospital uses a job-order costing system to assign costs to its patients. Its direct materials include a variety of items such as pharmaceutical drugs, heart valves, artificial hips, and pacemakers. Its direct labor costs (e.g., surgeons, anesthesiologists, radiologists, and nurses) associated with specific surgical procedures and tests are traced to individual patients. All other costs, such as depreciation of medical equipment, insurance, utilities, incidental medical supplies, and the labor costs associated with around-the clock monitoring of patients are treated as overhead costs. Historically, McCullough has used one predetermined overhead rate based on the number of patient-days (each night that a patient spends in the hospital counts as one patient-day) to allocate overhead costs to patients. Recently a member of the hospital’s accounting staff has suggested using two predetermined overhead rates (allocated based on the number of patient-days) to improve the…arrow_forwardPareto chart and cost of quality report for a service company The administrator of Liberty Hospital has been asked to perform an activity analysis of the emergency room (ER). The ER activities include cost of quality and other patient care activities. The lab tests and transportation are hospital services external to the ER for determining external failure costs. The result of the activity analysis is summarized as follows: Activities Activity Cost Patient registration $ 6,500 Verifying patient information 9,700 Assigning patients 13,000 Searching/waiting for doctor 9,200 Doctor exam 4,900 Waiting for transport 17,500 Transporting patients 16,200 Verifying lab orders 14,500 Searching for equipment 8,200 Incorrect labs 11,300 Lab tests 17,000 Counting supplies 19,000 Looking for supplies 8,200 Staff training 4,800 Total $160,000 a. b. c. d. Classify the…arrow_forwardA hospital analyzed their patient data in the ICU and categorized patients into two types: short-term and long-term. The standard quantities of labor and materials for each type of patient for 2011 are: Short term Long term Direct Material (lbs 9 21 Nursing labor (hrs.) 2.5 5 Standard price paid for direct materials (per lb.): $ 10.00 Standard rate for labor (per hour): $ 16.00 Variable overhead rate for ICU (per hour): $ 30.00 Fixed overhead rate for ICU (per hour): $ 40.00 **VOH and FOH are applied (used) on the basis of direct labor hours Actual operating data for 2011 is as follows: Total short-term patients: 4,000…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning