Concept explainers

Contribution margin, break-even sales, cost-volume-profit chart, margin of safety, and operating leverage

Wolsey Industries Inc. expects to maintain the same inventories at the end of 20Y3 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows:

It is expected that 21,875 units will be sold at a price of $160 a unit. Maximum sales within the relevant range are 27,000 units.

Instructions

Prepare an estimated income statement for 20Y3.

What is the expected contribution margin ratio?

Determine the break-even sales in units and dollars.

Construct a cost-volume-profit chart indicating the break-even sales.

What is the expected margin of safety in dollars and as a percentage of sales?

Determine the operating leverage.

It is expected that 12,000 units will be sold a price of $240 a unit. Maximum sales within the relevant range are 18,000 units.

Instructions

Prepare an estimated income statement for 20Y7.

What is the expected contribution margin ratio?

Determine the break-even sales in units and dollars.

Construct a cost-volume-profit chart indicating the break-even sales.

What is the expected margin of safety in dollars and as a percentage of sales?

Determine the operating leverage.

1.

Prepare an estimated income statement for 20Y8.

Explanation of Solution

Cost-Volume-Profit Analysis: It is a method followed to analyze the relationship between the sales, costs, and the related profit or loss at various levels of units sold. In other words, it shows the effect of the changes in the cost and the sales volume on the operating income of the company.

Prepare an estimated income statement for 20Y8.

| W Incorporation | |||

| Estimated Income Statement | |||

| For the year ended December 31, 20Y8 | |||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Sales (1) | 3,500,000 | ||

| Less: Cost of Goods sold: | |||

| Direct Materials (2) | 1,006,250 | ||

| Direct Labor (3) | 875,000 | ||

| Factory Overhead (4) | 637,500 | ||

| Cost of Goods Sold | (2,518,750) | ||

| Gross Profit | 981,250 | ||

| Less: Expenses: | |||

| Selling expenses: | |||

| Sales salaries and commissions (5) | 285,000 | ||

| Advertising | 40,000 | ||

| Travel | 12,000 | ||

| Miscellaneous selling expense (6) | 29,475 | ||

| Total selling expenses | 366,475 | ||

| Administrative expenses: | |||

| Office and Officers’ salaries | 132,000 | ||

| Supplies (7) | 97,500 | ||

| Miscellaneous administrative expenses (8) | 35,275 | ||

| Total administrative expenses | 264,775 | ||

| Total expenses | (631,250) | ||

| Income from operations | 350,000 | ||

Table (1)

Working note (1):

Determine sales.

Number of units to be sold =21,875 units

Selling price per unit =$160 per unit

Working note (2):

Determine the cost of direct materials.

Number of units to be sold =21,875 units

Direct Materials cost per unit =$46 per unit

Working note (3):

Determine the cost of direct labor.

Number of units to be sold =21,875 units

Direct labor cost per unit =$40 per unit

Working note (4):

Determine the cost of factory overhead.

Factory overhead-Fixed =$200,000

Number of units to be sold =21,875 units

Factory overhead-Variable cost per unit =$20 per unit

Working note (5):

Determine the sales salaries and commissions.

Sales salaries and commissions-Fixed =$110,000

Number of units to be sold =21,875 units

Sales salaries and commissions-Variable cost per unit =$8 per unit

Working note (6):

Determine the miscellaneous selling expense.

Miscellaneous selling expense-Fixed =$7,600

Number of units to be sold =21,875 units

Miscellaneous selling expense-Variable cost per unit =$1 per unit

Working note (7):

Determine the supplies.

Supplies-Fixed =$10,000

Number of units to be sold =21,875 units

Supplies-Variable cost per unit =$4 per unit

Working note (8):

Determine the miscellaneous administrative expense.

Miscellaneous administrative expense-Fixed =$13,400

Number of units to be sold =21,875 units

Miscellaneous administrative expense-Variable cost per unit =$1 per unit

2.

Calculate the expected contribution margin ratio.

Explanation of Solution

Determine the expected contribution margin ratio.

Sales =$3,500,000 (1)

Variable cost =$2,625,000 (9)

Working note (9):

Determine the variable cost.

Number of units to be sold =21,875 units

Variable cost per unit =$120 per unit

Therefore, the expected contribution margin ratio is 25%.

3.

Calculate the break-even sales in units and dollars.

Explanation of Solution

Determine the break-even sales in units.

Fixed cost =$525,000

Contribution margin per unit =$40 per unit (10)

Working note (10):

Compute the contribution margin per unit.

Selling price per unit =$160 per unit

Variable cost per unit =$120 per unit

Determine the break-even sales in dollars.

Fixed cost =$525,000

Contribution margin ratio =25% (refer Part 2)

Therefore, the break-even sales in units is 13,125 units and dollars is $2,100,000.

4.

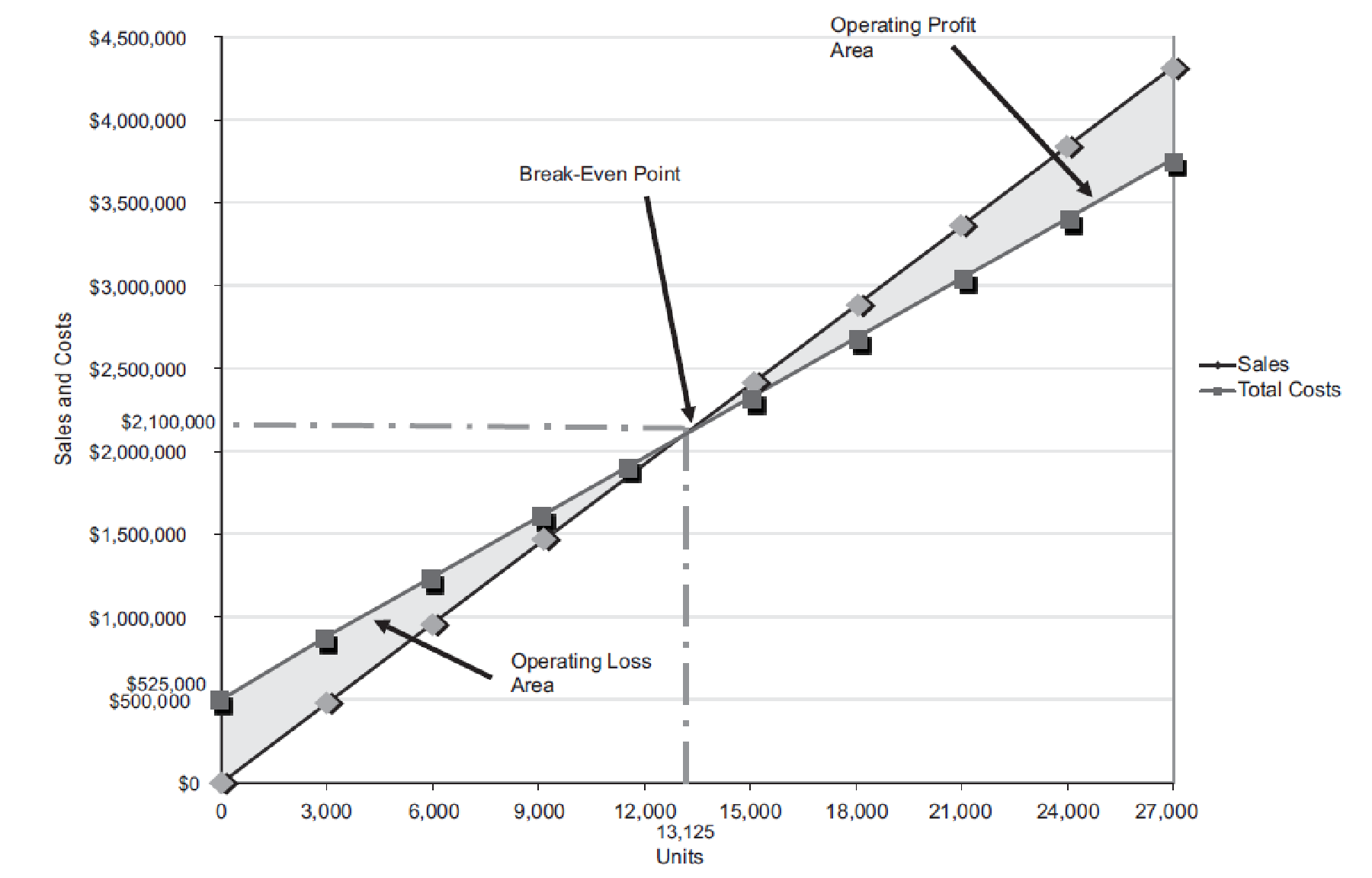

Construct a cost-volume-profit chart indicating the break-even sales.

Explanation of Solution

Construct a cost-volume-profit chart indicating the break-even sales.

Figure (1)

The volume in units of sales is shown on the horizontal axis. The maximum relevant range is 27,000 units. The sales and the total costs (fixed cost and variable cost) in dollars is shown on the vertical axis. The maximum relevant range of sales and total costs is $4,500,000.

The total sales line is drawn right upward by connecting the first point at $0 to the second point at $4,320,000

The total cost line is drawn right upward by connecting the first point at $525,000 (fixed cost) on the vertical axis to the second point at

The break-even point is the intersection point where the total sales line and total cost line meet. The vertical dotted line drawn downward from the intersection point reaches at 13,125 units. It indicates the break-even sales (units). The horizontal line drawn to the left towards the vertical axis reaches at $2,100,000. It indicates the break-even sales (dollars). Refer Part 3 for the break-even values.

The operating profit area is the area where the total sales line exceeds the total cost line. However, the operating loss area is the area where the total cost exceeds the total sales line.

5.

Calculate the expected margin of safety in dollars and as a percentage of sales.

Explanation of Solution

Determine the expected margin of safety in dollars.

Sales =$3,500,000 (1)

Sales at break-even point =$2,100,000 (refer Part 3)

Determine the expected margin of safety as a percentage of sales.

Sales =$3,500,000 (1)

Margin of Safety in dollars =$1,400,000

Therefore, the expected margin of safety in dollars is $1,400,000 and as a percentage of sales is 40%.

6.

Calculate the operating leverage.

Explanation of Solution

Determine the operating leverage.

Contribution margin =$875,000 (11)

Income from operations =$350,000 (refer Table 1)

Working note (11):

Determine the contribution margin

Sales =$3,500,000 (1)

Variable cost =$2,625,000 (9)

Therefore, the operating leverage is 2.5

Want to see more full solutions like this?

Chapter 6 Solutions

Managerial Accounting

- Contribution margin, break-even sales, cost-volume-profit chart, margin of safety, and operating leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: It is expected that 12,000 units will be sold at a price of 240 a unit. Maximum sales within the relevant range are 18,000 units. Instructions 1. Prepare an estimated income statement for 20Y7. 2. What is the expected contribution margin ratio? 3. Determine the break-even sales in units and dollars. 4. Construct a cost-volume-profit chart indicating the break-even sales. 5. What is the expected margin of safety in dollars and as a percentage of sales? (Round to one decimal place.) 6. Determine the operating leverage.arrow_forwardCost-Volume-Profit, Margin of Safety Victoria Company produces a single product. Last years income statement is as follows: Required: 1. Compute the break-even point in units and sales dollars calculated using the break-even units. 2. What was the margin of safety for Victoria last year in sales dollars? 3. Suppose that Victoria is considering an investment in new technology that will increase fixed cost by 250,000 per year but will lower variable costs to 45% of sales. Units sold will remain unchanged. Prepare a budgeted income statement assuming that Victoria makes this investment. What is the new break-even point in sales dollars, assuming that the investment is made?arrow_forwardSales Revenue Approach, Variable Cost Ratio, Contribution Margin Ratio Arberg Companys controller prepared the following budgeted income statement for the coming year: Required: 1. What is Arbergs variable cost ratio? What is its contribution margin ratio? 2. Suppose Arbergs actual revenues are 30,000 more than budgeted. By how much will operating income increase? Give the answer without preparing a new income statement 3. How much sales revenue must Arberg earn to break even? Prepare a contribution margin income statement to verify the accuracy of your answer. 4. What is Arbergs expected margin of safety? 5. What is Arbergs margin of safety if sales revenue is 380,000?arrow_forward

- Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?arrow_forwardIncome Statements under Absorption and Variable Costing In the coming year, Kalling Company expects to sell 28,700 units at 32 each. Kallings controller provided the following information for the coming year: Required: 1. Calculate the cost of one unit of product under absorption costing. 2. Calculate the cost of one unit of product under variable costing. 3. Calculate operating income under absorption costing for next year. 4. Calculate operating income under variable costing for next year.arrow_forwardQuality Cost Report Loring Company had total sales of 2,400,000 for fiscal 20X1. The costs of quality-related activities are given below. Required: 1. Prepare a quality cost report, classifying costs by category and expressing each category as a percentage of sales. What message does the cost report provide? 2. Prepare a bar graph and pie chart that illustrate each categorys contribution to total quality costs. Comment on the significance of the distribution.arrow_forward

- Cost Classification Loring Company incurred the following costs last year: Required: 1. Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, 216,000. 2. What was the total product cost for last year? 3. What was the total period cost for last year? 4. If 30,000 units were produced last year, what was the unit product cost?arrow_forwardVariable-Costing and Absorption-Costing Income Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows: During the year, Borques produced 200,000 wooden pallets and sold 204,300 at 9 each. Borques had 8,200 pallets in beginning finished goods inventory; costs have not changed from last year to this year. An actual costing system is used for product costing. Required: 1. What is the per-unit inventory cost that is acceptable for reporting on Borquess balance sheet at the end of the year ? How many units are in ending inventory? What is the total cost of ending inventory? 2. Calculate absorption-costing operating income. 3. CONCEPTUAL CONNECTION What would the per-unit inventory cost be under variable costing? Does this differ from the unit cost computed in Requirement 1? Why? 4. Calculate variable-costing operating income. 5. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating income?arrow_forwardContribution Margin Ratio, Break-Even Sales, Operating Leverage Elgart Company produces plastic mailboxes. The projected income statement for the coming year follows: Required: 1. Compute the contribution margin ratio for the mailboxes. 2. How much revenue must Elgart earn in order to break even? 3. What is the effect on the contribution margin ratio if the unit selling price and unit variable cost each increase by 15%? 4. CONCEPTUAL CONNECTION Suppose that management has decided to give a 4% commission on all sales. The projected income statement does not reflect this commission. Recompute the contribution margin ratio, assuming that the commission will be paid. What effect does this have on the break-even point? 5. CONCEPTUAL CONNECTION If the commission is paid as described in Requirement 4, management expects sales revenues to increase by 80,000. How will this affect operating leverage? Is it a sound decision to implement the commission? Support your answer with appropriate computations.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,