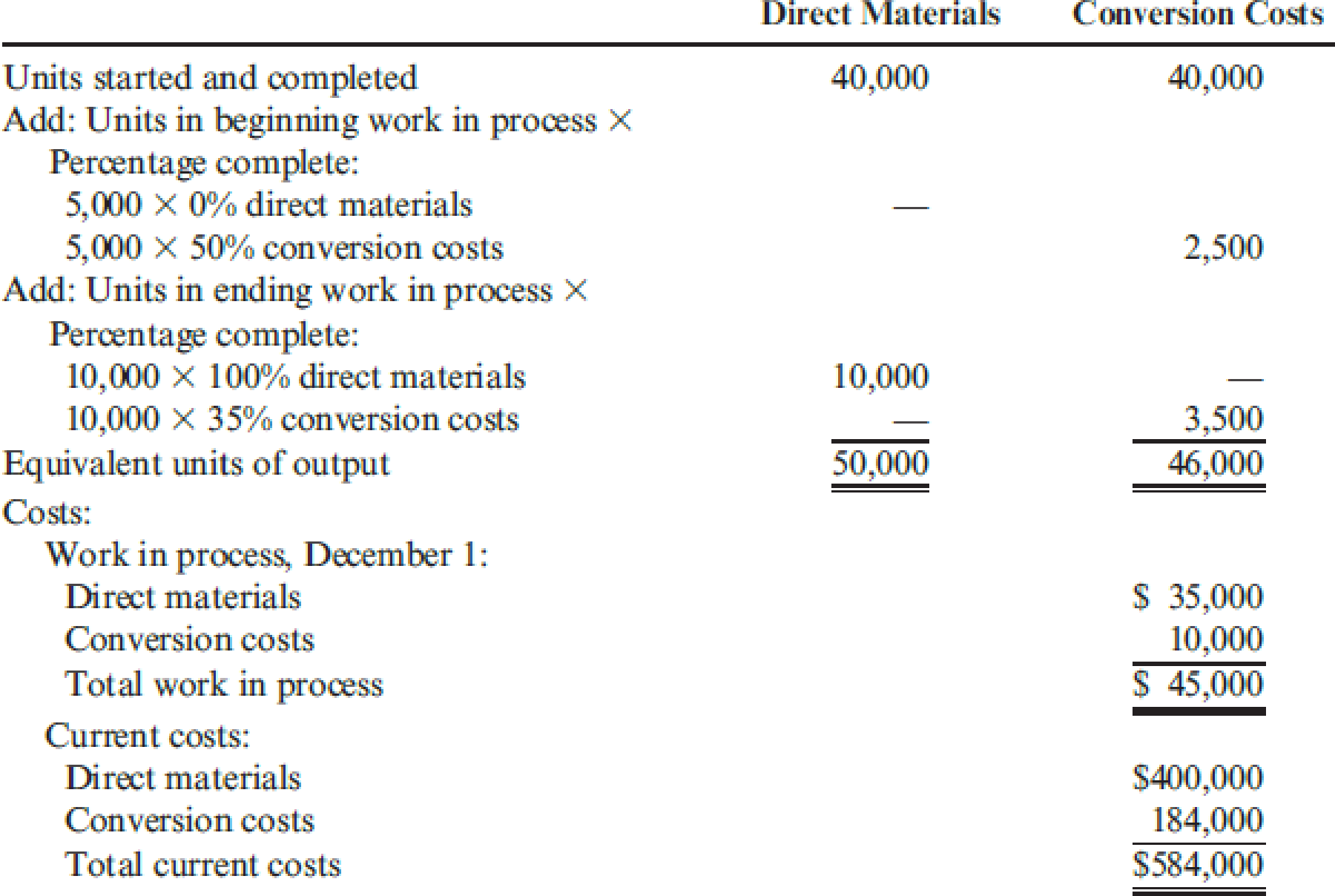

Gunnison Company had the following equivalent units schedule and cost information for its Sewing Department for the month of December:

Required:

- 1. Calculate the unit cost for December, using the FIFO method.

- 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for.

- 3. What if you were asked for the unit cost from the month of November? Calculate November’s unit cost and explain why this might be of interest to management.

1.

Ascertain the unit cost for December using First-in-first-out (FIFO) method for company G.

Explanation of Solution

Cost per unit: Total unit cost is the cost incurred by the company to produce one unit of product. The unit cost is calculated by dividing the units produced with the total cost.

Compute unit cost using FIFO method:

Thus, the cost per equivalent unit for company G is $12 per equivalent unit.

2.

Determine the cost of EWIP, compute the cost of goods transferred out, and reconcile the cost assigned with the costs to account for.

Explanation of Solution

Ascertain the cost of EWIP (Ending Work-In Process):

Calculate the cost of goods transferred out:

| Particulars | Amount ($) |

| From BWIP | $ 45,000 |

| To complete BWIP | |

| $ 10,000 | |

| Started and completed | |

| $ 480,000 | |

| Total cost of goods transferred out | $ 535,000 |

Table (1)

Determine the total cost assigned.

Reconcile the cost assigned with the costs to account for:

| Particulars | Amount ($) |

| Cost to account for: | |

| BWIP | $ 45,000 |

| Current (December) | $ 584,000 |

| Total | $ 629,000 |

Table (2)

3.

Determine the unit cost for November and determine in what manner it might be of interest to management.

Explanation of Solution

There are 5,000 equivalent units of materials (100% complete) and 2,500

Therefore, November unit cost will be,

The managers can obtain the trends in cost and thereby they can implement better control over costs by recognizing last month’s unit cost. If costs are diminishing, it may disclose that continuous development effort is succeeding. If increasing, it may show obstacles that can be corrected.

Want to see more full solutions like this?

Chapter 6 Solutions

CengageNOWv2, 1 term Printed Access Card for Hansen/Mowen’s Cornerstones of Cost Management, 4th

- Morrison Company had the equivalent units schedule and cost information for its Sewing Department for the month of December, as shown on the next page. Required: 1. Calculate the unit cost for December, using the weighted average method. 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for. 3. What if you were asked to show that the weighted average unit cost for materials is the blend of the November unit materials cost and the December unit materials cost? The November unit materials cost is 6.60 (66,000/10,000), and the December unit materials cost is 12.22 (550,000/45,000). The equivalent units in BWIP are 10,000, and the FIFO equivalent units are 45,000. Calculate the weighted average unit materials cost using weights defined as the proportion of total units completed from each source (BWIP output and current output).arrow_forwardTanaka Manufacturing Co. uses the process cost system. The following information for the month of December was obtained from the company’s books and from the production reports submitted by the department heads: Required: Prepare cost of production summaries for the Mixing, Blending, and Bottling (Hint: You must calculate the adjusted unit cost from Blending.) departments. Prepare a departmental cost work sheet. Draft the journal entries required to record the month’s operations. Prepare a statement of cost of goods manufactured for December. (Hint: Goods finished but not transferred to finished goods are considered part of work in process inventory.)arrow_forwardCassien Inc. manufactures products that pass through two or more processes. During June, equivalent units were computed using the weighted average method: Required: 1. Calculate the unit cost for June using the weighted average method. 2. Using the weighted average method, determine the cost of EWIP and the cost of the goods transferred out. 3. CONCEPTUAL CONNECTION Cassien had just finished implementing a series of measures designed to reduce the unit cost to 2.00 and was assured that this had been achieved and should be realized for Junes production. Yet, upon seeing the unit cost for June, the president of the company was disappointed. Can you explain why the full effect of the cost reductions may not show up in June? What can you suggest to overcome this problem?arrow_forward

- Foamy Inc. manufactures shaving cream and uses the weighted average cost method. In November, production is 14,800 equivalent units for materials and 13,300 units for labor and overhead. During the month, materials, labor, and overhead costs were as follows: Beginning work in process for November had a cost of 11,360 for materials, 11,666 for labor, and 9,250 for overhead. Compute the following: a. Weighted average cost per unit for materials b. Weighted average cost per unit for labor c. Weighted average cost per unit for overhead d. Total unit cost for the montharrow_forwardPrepare a cost of production report for the Cutting Department of Dalton Carpet Company for January. Assuming that direct materials are placed in process during production, use the weighted average method with the following data:arrow_forwardKokomo Kayak Inc. uses the process cost system. The following data, taken from the organizations books, reflect the results of manufacturing operations during the month of March: Production Costs Work in process, beginning of period: Costs incurred during month: Production Data: 18,000 units finished and transferred to stockroom. Work in process, end of period, 3,000 units, two-thirds completed. Required: Prepare a cost of production summary for March.arrow_forward

- Dama Company produces womens blouses and uses the FIFO method to account for its manufacturing costs. The product Dama makes passes through two processes: Cutting and Sewing. During April, Damas controller prepared the following equivalent units schedule for the Cutting Department: Costs in beginning work in process were direct materials, 20,000; conversion costs, 80,000. Manufacturing costs incurred during April were direct materials, 240,000; conversion costs, 320,000. Required: 1. Prepare a physical flow schedule for April. 2. Compute the cost per equivalent unit for April. 3. Determine the cost of ending work in process and the cost of goods transferred out. 4. Prepare the journal entry that transfers the costs from Cutting to Sewing.arrow_forwardUsing the same data found in Exercise 6.22, assume the company uses the FIFO method. Required: Prepare a schedule of equivalent units, and compute the unit cost for the month of December. Fordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was 40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments. The second department (Polishing) had the following physical flow schedule for December: Costs in beginning work in process for the Polishing Department were direct materials, 5,000; conversion costs, 6,000; and transferred in, 8,000. Costs added during the month: direct materials, 32,000; conversion costs, 50,000; and transferred in, 40,000.arrow_forwardYellowstone Fabricators uses a process cost system and applies actual factory overhead to work in process at the end of the month. The following data came from the records for March: There were no beginning inventories and no ending work in process inventory. From the information presented, compute the following: 1. Unit cost of production under absorption costing and variable costing. 2. Cost of the ending inventory under absorption costing and variable costing.arrow_forward

- Holmes Products, Inc., produces plastic cases used for video cameras. The product passes through three departments. For April, the following equivalent units schedule was prepared for the first department: Costs assigned to beginning work in process: direct materials, 90,000; conversion costs, 33,750. Manufacturing costs incurred during April: direct materials, 75,000; conversion costs, 220,000. Holmes uses the weighted average method. Required: 1. Compute the unit cost for April. 2. Determine the cost of ending work in process and the cost of goods transferred out.arrow_forwardCost flow relationships The following information is available for the first month of operations of Bahadir Company, a manufacturer of mechanical pencils: Using the information given, determine the following missing amounts: A. Cost of goods sold B. Finished goods inventory at the end of the month C. Direct materials cost D. Direct labor cost E. Work in process inventory at the end of the montharrow_forwardGeneva, Inc., makes two products, X and Y, that require allocation of indirect manufacturing costs. The following data were compiled by the accountants before making any allocations: The total cost of purchasing and receiving parts used in manufacturing is 60,000. The company uses a job-costing system with a single indirect cost rate. Under this system, allocated costs were 48,000 and 12,000 for X and Y, respectively. If an activity-based system is used, what would be the allocated costs for each product?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,