Concept explainers

Analysis of

Kansas Company uses a

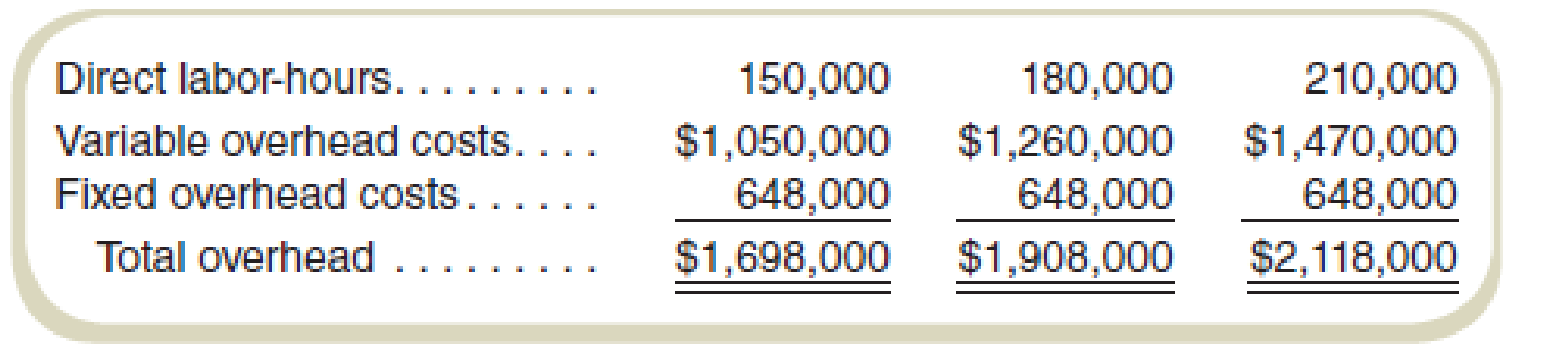

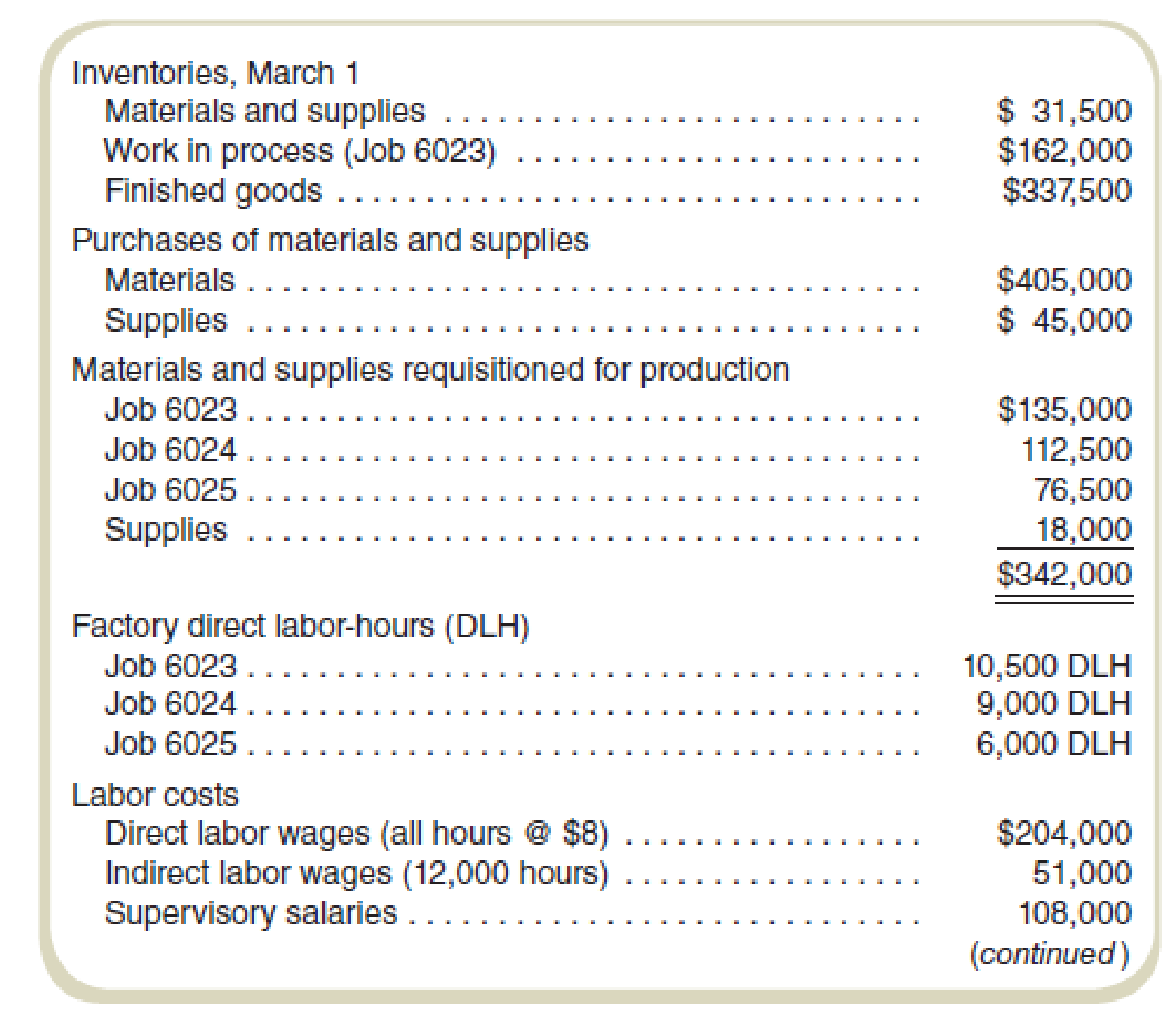

The expected volume is 180,000 direct labor-hours for the entire year. The following information is for March, when Jobs 6023 and 6024 were completed:

Required

Answer the following questions:

- a. Compute the predetermined overhead rate (combined fixed and variable) to be used to apply overhead to individual jobs during the year. (Note: Regardless of your answer to requirement [a], assume that the predetermined overhead rate is $9 per direct labor-hour. Use this amount in answering requirements [b] through [e].)

- b. Compute the total cost of Job 6023 when it is finished.

- c. How much of

factory overhead cost was applied to Job 6025 during March? - d. What total amount of overhead was applied to jobs during March?

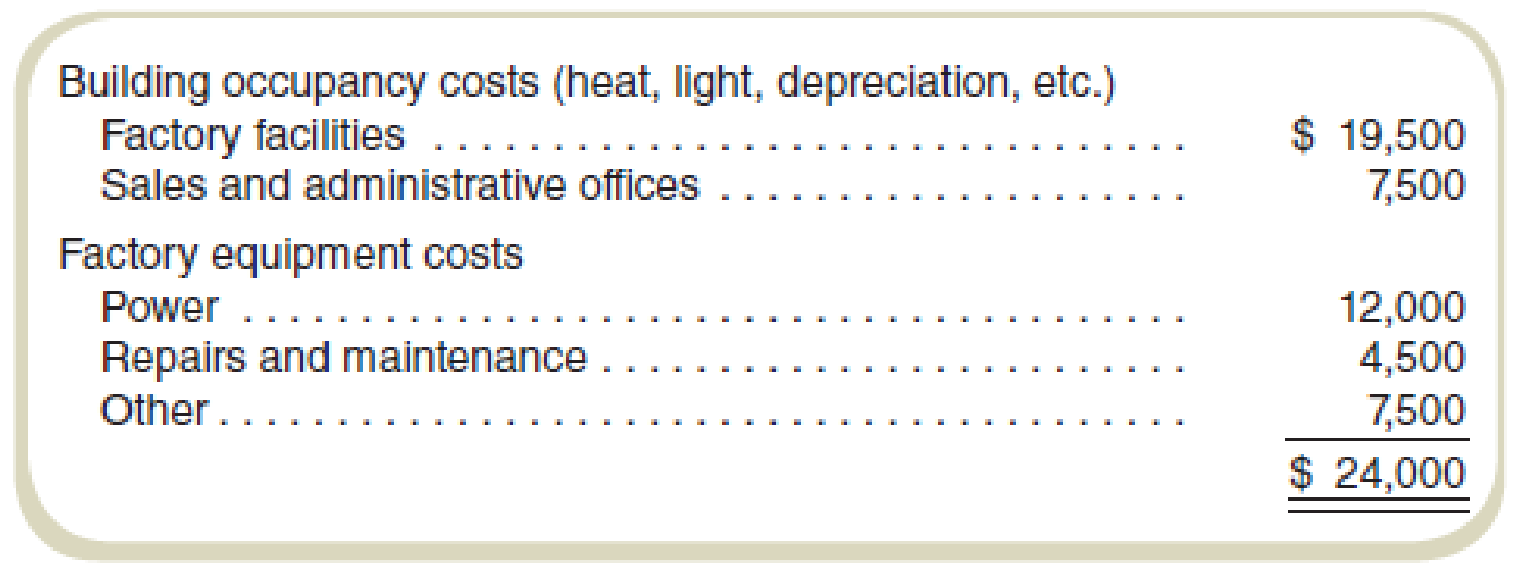

- e. Compute actual factory overhead incurred during March.

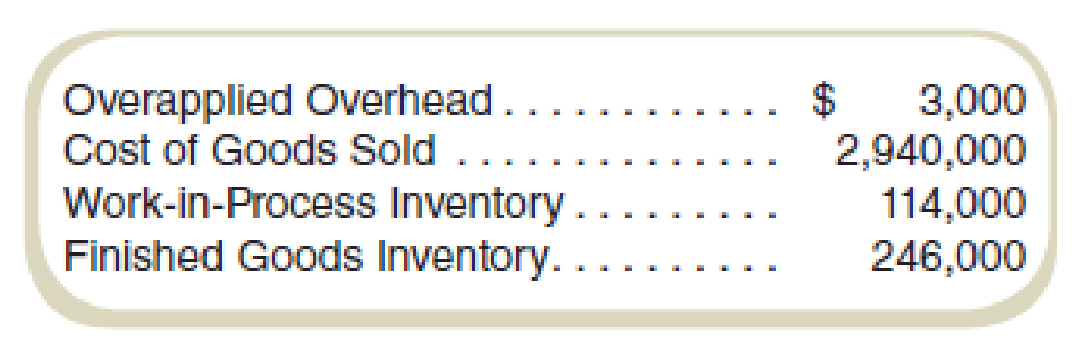

- f. At the end of the year, Kansas Company had the following account balances:

How would you recommend treating the overapplied overhead, assuming that it is not material? Show the new account balances in the following table:

a.

Compute the predetermined overhead rate to be used to apply overhead to individual jobs during the year fixed and variable both.

Answer to Problem 52P

The predetermined overhead rate to be used to apply overhead to individual jobs during the year fixed and variable both is $10.60.

Explanation of Solution

Predetermined overhead rate: The predetermined overhead rate is the rate computed for applying manufacturing overheads to the work-in-process inventory. This rate can be computed by dividing the total amount of manufacturing overheads by the base of allocation. The formula for calculating the predetermined overhead rate is:

Compute the predetermined overhead rate to be used to apply overhead to individual jobs during the year fixed and variable both:

Thus, the value of the predetermined overhead rate to be used to apply overheads to individual jobs during the year fixed and variable both is $10.60.

b.

Compute the total cost of Job 6023 when it is finished.

Answer to Problem 52P

The total cost of Job 6023 when it is finished is $475,500.

Explanation of Solution

Job costing: Job costing is a method of tracking and allocating costs to different jobs in the manufacturing process. This method of costing is used in entities where different jobs are incurred in each period.

Compute the total cost of Job 6023 when it is finished:

Thus, the value of the total cost of Job 6023 when it is finished is $475,500.

Working note 1:

Compute the direct labor:

Working note 2:

Compute the overhead applied:

c.

Find the value of factory overhead cost that was applied to Job 6025 during March.

Answer to Problem 52P

The value of factory overhead cost that was applied to Job 6025 during March is $54,000.

Explanation of Solution

Job costing: Job costing is a method of tracking and allocating costs to different jobs in the manufacturing process. This method of costing is used in entities where different jobs are incurred in each period.

Compute the value of factory overhead cost that was applied to Job 6025 during March:

Thus, the value of factory overhead cost that was applied to Job 6025 during March is $54,000.

d.

Find the total amount of overhead applied to jobs during March.

Answer to Problem 52P

The total amount of overhead applied to jobs during March is $229,500.

Explanation of Solution

Manufacturing overhead applied: the applied overheads refer to the overheads which have been allocated on the basis of the predetermined overhead rate.

Compute the total amount of overhead applied to jobs during March:

Thus, the total amount of overhead applied to jobs during March is $229,500.

e.

Compute the value of actual factory overhead incurred during March.

Answer to Problem 52P

The value of actual factory overhead incurred during March is $220,500.

Explanation of Solution

Overhead incurred: the amount of overheads which have actually occurred during a particular period of time. The overhead incurred are recorded at the end of the period when the overheads have been already applied to the jobs.

Compute the value of actual factory overhead incurred during March:

Thus, the value of actual factory overhead incurred during March is $220,500.

f.

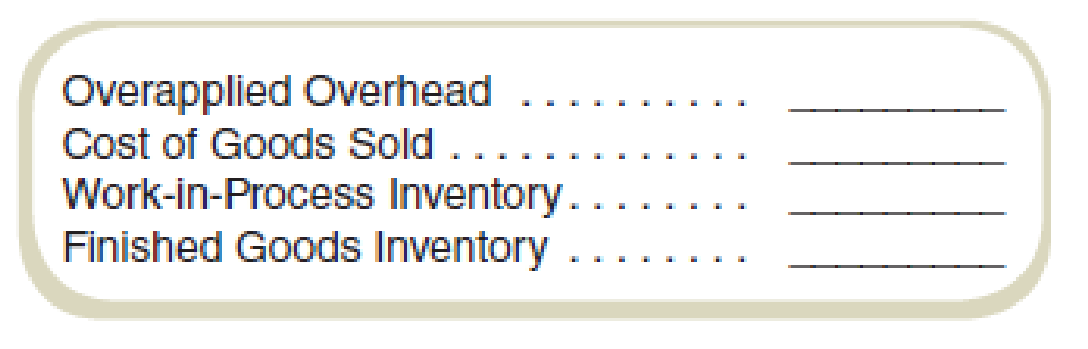

Find the new account balances of the table given in the question and provide recommendations.

Answer to Problem 52P

New balances according to the given information in the question:

| Particulars | Amount |

| Over-applied overhead | $ - |

| Cost of goods sold | $ 2,937,000 |

| Work-in-process inventory | $ 114,000 |

| Finished goods inventory | $ 246,000 |

Table: (1)

It would not be recommended to prorate 0.1% of the cost of goods sold

Explanation of Solution

New balances according to the given information in the question:

| Particulars | Amount |

| Over-applied overhead | $ - |

| Cost of goods sold | $ 2,937,000 (3) |

| Work-in-process inventory | $ 114,000 |

| Finished goods inventory | $ 246,000 |

Table: (2)

The over-applied overheads are $3,000 which is 0.1% of the cost of goods sold. Hence, it would not be recommended to prorate such small percentage.

Working note 3:

Want to see more full solutions like this?

Chapter 7 Solutions

FUNDAMENTALS OF COST ACCOUNTING

- Applying factory overhead Bergan Company estimates that total factory overhead costs will be 620,000 for the year. Direct labor hours are estimated to be 80,000. For Bergan Company, (A) determine the predetermined factory overhead rate using direct labor hours as the activity base, (B) determine the amount of factory overhead applied to Jobs 200 and 305 in May using the data on direct labor hours from BE 16-2, and (C) prepare the journal entry to apply factory overhead to both jobs in May according to the predetermined overhead rate.arrow_forwardOverhead application rate Creole Manufacturing Inc. uses a job order cost system and standard costs. It manufactures one product, whose standard cost follows: The standards are based on normal capacity of 2,400 direct labor hours. Actual activity for October follows: Required: 1. Compute the variable and fixed factory overhead rates per unit. 2. Compute the variable and fixed overhead rates per direct labor hour. 3. Determine the total fixed factory overhead based on normal capacity.arrow_forwardPREDETERMINED FACTORY OVERHEAD RATE Marston Enterprises calculates a predetermined factory overhead rate so that factory overhead may be applied to production during the month. It calculates the overhead using three different methods and then decides which one to use. Total estimated factory overhead costs are 600,000. Total estimated direct labor hours are 30,000. Total estimated direct labor costs are 1,200,000. Total machine hours are estimated to be 200,000. Calculate the predetermined overhead application rates based on (1) direct labor hours, (2) direct labor costs, and (3) machine hours.arrow_forward

- Determining job costcalculation of predetermined rate for applying overhead by direct labor cost and direct labor hour methods Beemer Products Inc. has its factory divided into three departments, with individual factory overhead rates for each department. In each department, all the operations are sufficiently alike for the department to be regarded as a cost center. The estimated monthly factory overhead for the departments is as follows: Forming, 64,000; Shaping, 36,000; and Finishing, 10,080. The estimated production data include the following: The job cost ledger shows the following data for X6, which was completed during the month: Required: Determine the cost of X6. Assume that the factory overhead is applied to production orders, based on the following: 1. Direct labor cost 2. Direct labor hours (Hint: You must first determine overhead rates for each department, rounding rates to the nearest cent.)arrow_forwardPREDETERMINED FACTORY OVERHEAD RATE Millerlile Enterprises calculates a predetermined factory overhead rate so that factory overhead may be applied to production during the month. It calculates the overhead using three different methods and then decides which one to use. Total estimated factory overhead costs are 540,000. Total estimated direct labor hours are 50,000. Total estimated direct labor costs are 900,000. Total machine hours are estimated to be 80,000. Calculate the predetermined overhead application rates based on (1) direct labor hours, (2) direct labor costs, and (3) machine hours.arrow_forwardEntry for factory labor costs The weekly time tickets indicate the following distribution of labor hours for three direct labor employees: The direct labor rate earned per hour by the three employees is as follows: The process improvement category includes training, quality improvement, and other indirect tasks. A. Journalize the entry to record the factory labor costs for the week. B. Assume that Jobs 301 and 302 were completed but not sold during the week and that Job 303 remained incomplete at the end of the week. How would the direct labor costs for all three jobs be reflected on the financial statements at the end of the week?arrow_forward

- Channel Products Inc. uses the job order cost system of accounting. The following is a list of the jobs completed during March, showing the charges for materials issued to production and for direct labor. Assume that factory overhead is applied on the basis of direct labor costs and that the predetermined rate is 200%. Required: Compute the amount of overhead to be added to the cost of each job completed during the month. Compute the total cost of each job completed during the month. Compute the total cost of producing all the jobs finished during the month.arrow_forwardWhen setting its predetermined overhead application rate. Tasty Turtle estimated its overhead would be $75,000 and manufacturing would require 25,000 machine hours in the next year. At the end of the year, it found that actual overhead was $74,000 and manufacturing required 24,000 machine hours. Determine the predetermined overhead rate. What is the overhead applied during the year? Prepare the journal entry to eliminate the under- or over applied overhead.arrow_forwardPrepare Job-Order Cost Sheets, Predetermined Overhead Rate, Ending Balance of WIP, Finished Goods, and COGS At the beginning of March, Mendez Company had two jobs in process, Job 86 and Job 87, with the following accumulated cost information: During March, two more jobs (88 and 89) were started. The following direct materials and direct labor costs were added to the four jobs during the month of March: At the end of March, Jobs 86, 87, and 89 were completed. Only Job 87 was sold. On March 1, the balance in Finished Goods was zero. Required: 1. Calculate the overhead rate based on direct labor cost. (Note: Round to three decimal places.) 2. Prepare a brief job-order cost sheet for the four jobs. Show the balance as of March 1 as well as direct materials and direct labor added in March. Apply overhead to the four jobs for the month of March, and show the ending balances. 3. Calculate the ending balances of Work in Process and Finished Goods as of March 31. 4. Calculate the Cost of Goods Sold for March.arrow_forward

- Entries and schedules for unfinished jobs and completed jobs Hildreth Company uses a job order cost system. The following data summarize the operations related to production for April, the first month of operations: A. Materials purchased on account, 147,000. B. Materials requisitioned and factory labor used: C. Factory overhead costs incurred on account, 6,000. D. Depreciation of machinery and equipment, 4,100. E. The factory overhead rate is 40 per machine hour. Machine hours used: F. Jobs completed: 101, 102, 103, and 105. G. Jobs were shipped and customers were billed as follows: Job 101, 62,900; Job 102, 80,700; Job 105, 45,500. Instructions 1. Journalize the entries to record the summarized operations. 2. Post the appropriate entries to T accounts for Work in Process and Finished Goods, using the identifying letters as transaction codes. Insert memo account balances as of the end of the month. 3. Prepare a schedule of unfinished jobs to support the balance in the work in process account. 4. Prepare a schedule of completed jobs on hand to support the balance in the finished goods account.arrow_forwardOverhead Assignment: Actual and Normal Activity Compared Reynolds Printing Company specializes in wedding announcements. Reynolds uses an actual job-order costing system. An actual overhead rate is calculated at the end of each month using actual direct labor hours and overhead for the month. Once the actual cost of a job is determined, the customer is billed at actual cost plus 50%. During April, Mrs. Lucky, a good friend of owner Jane Reynolds, ordered three sets of wedding announcements to be delivered May 10, June 10, and July 10, respectively. Reynolds scheduled production for each order on May 7, June 7, and July 7, respectively. The orders were assigned job numbers 115, 116, and 117, respectively. Reynolds assured Mrs. Lucky that she would attend each of her daughters weddings. Out of sympathy and friendship, she also offered a lower price. Instead of cost plus 50%, she gave her a special price of cost plus 25%. Additionally, she agreed to wait until the final wedding to bill for the three jobs. On August 15, Reynolds asked her accountant to bring her the completed job-order cost sheets for Jobs 115, 116, and 117. She also gave instructions to lower the price as had been agreed upon. The cost sheets revealed the following information: Reynolds could not understand why the overhead costs assigned to Jobs 116 and 117 were so much higher than those for Job 115. She asked for an overhead cost summary sheet for the months of May, June, and July, which showed that actual overhead costs were 20,000 each month. She also discovered that direct labor hours worked on all jobs were 500 hours in May and 250 hours each in June and July. Required: 1. How do you think Mrs. Lucky will feel when she receives the bill for the three sets of wedding announcements? 2. Explain how the overhead costs were assigned to each job. 3. Assume that Reynoldss average activity is 500 hours per month and that the company usually experiences overhead costs of 240,000 each year. Can you recommend a better way to assign overhead costs to jobs? Recompute the cost of each job and its price, given your method of overhead cost assignment. Which method do you think is best? Why?arrow_forwardFeldspar Company uses an ABC system to apply overhead. There are three activity rates, shown on page 251. During September, Feldspar worked on three jobs. Data relating to these jobs follow: During September, Jobs 13-280 and 13-282 were completed and transferred to Finished Goods Inventory. Job 13-280 was sold by the end of the month. Job 13-281 was the only unfinished job at the end of the month. Required: 1. Calculate the per-unit cost of Jobs 13-280 and 13-282. (Round unit cost to nearest cent.) 2. Compute the ending balance in the work-in-process inventory account. 3. Prepare the journal entries reflecting the completion of Jobs 13-280 and 13-282 and the sale of Job 13-280 on account. The selling price is 150 percent of cost.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College