PRINCIPLES OF COST ACCOUNTING

17th Edition

ISBN: 9781305280151

Author: Vanderbeck

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 8, Problem 15P

1.

To determine

Prepare the

1.

Expert Solution

Explanation of Solution

Prepare the journal entries to record the transactions.

| Particulars | Debit($) | Credit($) |

| Work in Process—Mixing | 4,400 | |

| Materials Quantity Variance— Mixing | 200(1) | |

| Materials Price Variance— Mixing | 115(1) | |

| Materials | 4,715 | |

| Work in Process-Blending | 1,900 | |

| Materials Price Variance— Blending | 37(2) | |

| Materials Quantity Variance—Blending | 50(2) | |

| Materials | 1,813 | |

| Factory overhead | 1,500 | |

| Materials | 1,500 | |

| Work in Process—Mixing | 22,000 | |

| Labor Rate Variance— Mixing | 430(3) | |

| Labor Efficiency Variance— Mixing | 500(3) | |

| Payroll | 21,930 | |

| Work in Process— Blending | 11,400 | |

| Labor Efficiency Variance— Blending | 600(4) | |

| Labor Rate Variance—Blending | 200(4) | |

| Payroll | 11,800 | |

| Factory overhead (indirect labor) | 2,300 | |

| Payroll | 2,300 | |

| Work in Process—Mixing | 6,600 | |

| Factory Overhead—Flexible-Budget Variance— Mixing | 500(5) | |

| Factory Overhead—Production-Volume Variance— Mixing | 400(5) | |

| Factory Overhead— Mixing | 6,700 | |

| Work in Process— Blending | 3,800 | |

| Factory Overhead—Production-Volume Variance— Blending | 50(6) | |

| Factory Overhead—Flexible-Budget Variance— Blending | 100(6) | |

| Factory Overhead—Blending | 3,750 | |

| Factory Overhead | 6,650 | |

| Various Credits | 6,650 | |

| Factory Overhead— Mixing | 6,700 | |

| Factory Overhead— Blending | 3,750 | |

| Factory Overhead | 10,450 | |

| Work in Process— Blending | 30,000 | |

| Work in Process— Mixing | 30,000 | |

| Finished Goods | 43,200 | |

| Work in Process—Dept. Blending | 43,200 | |

| Accounts Receivable | 51,000 | |

| Sales | 51,000 | |

| Cost of Goods Sold | 40,800 | |

| Finished Goods | 40,800 |

Table (1)

Working notes:

Variances are calculated as follows:

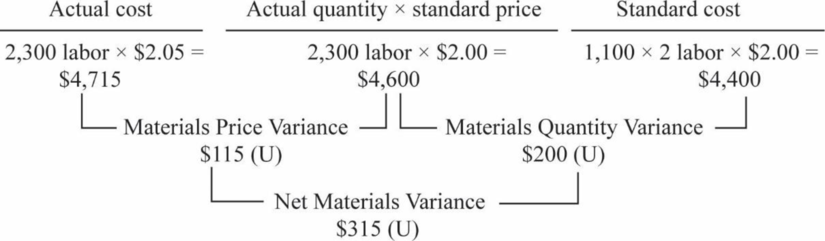

Materials:

- 1) Mixing:

Figure (1)

Equivalent units in mixing:

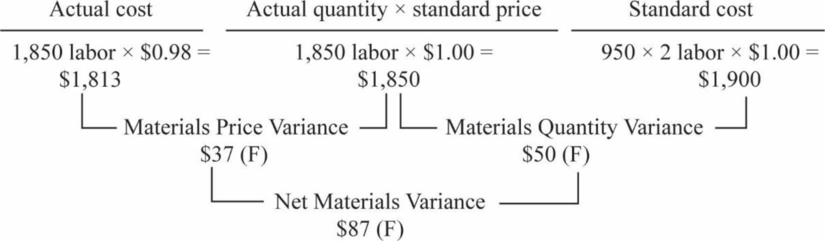

- 2) Blending:

Figure (2)

Equivalent units in blending:

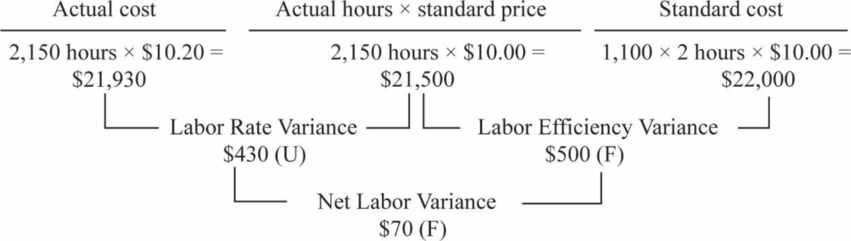

Labor

- 3) Mixing:

Figure (3)

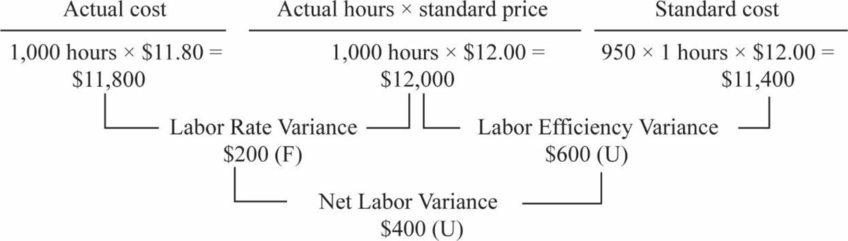

- 4) Blending:

Figure (4)

Factory overhead:

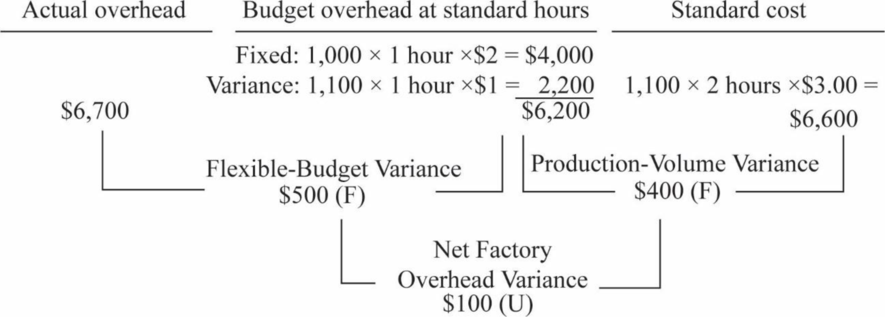

- 5) Mixing:

Figure (5)

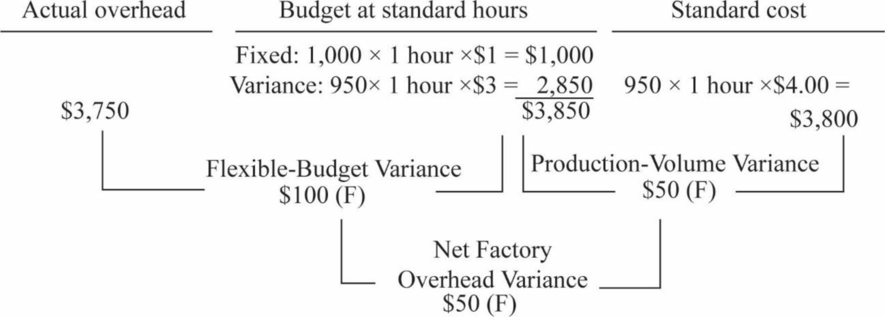

- 6) Blending:

Figure (6)

2.

To determine

Calculate the ending balance of work-in process for every department.

2.

Expert Solution

Explanation of Solution

Calculate the ending balance of work-in process for mixing department.

| Particulars | Amount($) |

| Materials | 400 |

| Labor | 2,000 |

| Factory overhead | 600 |

| Work-in process - Mixing | $3,000 |

Table (2)

Calculate the ending balance of work-in process for blending department.

| Particulars | Amount($) | Amount($) |

| Cost from mixing | $3,000 | |

| Cost in blending: | ||

| Materials | $100 | |

| Labor | 600 | |

| Factory overhead | 200 | 900 |

| Work-in process - Blending | $3,900 |

Table (3)

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Chapter 8 Solutions

PRINCIPLES OF COST ACCOUNTING

Ch. 8 - How does a standard cost accounting system work,...Ch. 8 - What is the difference between the standard cost...Ch. 8 - Prob. 3QCh. 8 - What are the specific procedures on which a...Ch. 8 - How are standards for materials and labor costs...Ch. 8 - What is a variance?Ch. 8 - How do price and quantity variances relate to...Ch. 8 - How do rate and efficiency variances relate to...Ch. 8 - Prob. 9QCh. 8 - How does a materials purchase price variance...

Ch. 8 - Prob. 11QCh. 8 - Prob. 12QCh. 8 - When a company uses a standard cost system, are...Ch. 8 - What two factors must be considered when breaking...Ch. 8 - What might cause the following materials...Ch. 8 - What might cause the following labor variances?

An...Ch. 8 - Prob. 17QCh. 8 - Prob. 18QCh. 8 - Prob. 19QCh. 8 - Prob. 20QCh. 8 - When does a flexible-budget variance occur?

Ch. 8 - Why is it important to determine flexible-budget...Ch. 8 - Prob. 23QCh. 8 - What is the significance of a production-volume...Ch. 8 - If production is more or less than the standard...Ch. 8 - At the end of the current fiscal year, the trial...Ch. 8 - What variances from the four-variance method are...Ch. 8 - What is the primary difference between the...Ch. 8 - What are the four variances in the four-variance...Ch. 8 - In all of the exercises involving variances, use F...Ch. 8 - Prob. 2ECh. 8 - Prob. 3ECh. 8 - Prob. 4ECh. 8 - Prob. 5ECh. 8 - Computing materials variances D-List Calendar Co....Ch. 8 - Computing labor variances LIFT Inc. manufactures...Ch. 8 - Standard cost summary; materials and labor cost...Ch. 8 - Computing labor variances Fill in the missing...Ch. 8 - Standard unit cost and journal entries The normal...Ch. 8 - Making journal entries Assume that during the...Ch. 8 - Using variance analysis and interpretation Last...Ch. 8 - Using variance analysis and interpretation Last...Ch. 8 - Journalizing standard costs in two departments...Ch. 8 - Calculating factory overhead The standard capacity...Ch. 8 - Determining Budgeted Overhead The overhead...Ch. 8 - Calculating factory overhead: two variances Munoz...Ch. 8 - Calculating factory overhead: two variances...Ch. 8 - The normal capacity of a manufacturing plant is...Ch. 8 - Calculating amount of factory overhead applied to...Ch. 8 - Georgia Gasket Co. budgets 8,000 direct labor...Ch. 8 - (Appendix) Calculating factory overhead: four...Ch. 8 - (Appendix) Calculating factory overhead: three...Ch. 8 - Materials and labor variances Branca Inspections...Ch. 8 - Materials and labor variances Fausto Fabricators...Ch. 8 - Zippy Inc. manufactures a fuel additive, Surge,...Ch. 8 - Calculation of materials and labor variances

Fritz...Ch. 8 - High-End Products Inc. uses a standard cost system...Ch. 8 - RDI Products Co. manufactures a variety of...Ch. 8 - The standard cost summary for the most popular...Ch. 8 - Carlo Lee Corp. has established the following...Ch. 8 - USD Inc. has established the following standard...Ch. 8 - Allocation of variances

Costa Brava Manufacturing...Ch. 8 - On May 1, Athens Inc. began the manufacture of a...Ch. 8 - The standard specifications for an electric motor...Ch. 8 - Cardiff Inc. manufactures men’s sport shirts for...Ch. 8 - Fargo Co. manufactures products in batches of 100...Ch. 8 - Prob. 15PCh. 8 - (Appendix) Overhead variances—four variance

Mobile...Ch. 8 - Shinto Corp. uses a standard cost system and...Ch. 8 - Kamen Manufacturing Co. estimates the following...Ch. 8 - Prob. 19PCh. 8 - Jillian Manufacturing Inc. manufactures a single...Ch. 8 - Cost and production data for Binghamton Beverages...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The normal capacity of a manufacturing plant is 30,000 direct labor hours or 20,000 units per month. Standard fixed costs are 6,000, and variable costs are 12,000. Data for two months follow: For each month, make a single journal entry to charge overhead to Work in Process, to close Factory Overhead, and to record variances. Indicate the types of variances and state whether each is favorable or unfavorable. (Hint: You must first compute the flexible-budget and production-volume variances.)arrow_forwardCarlo Lee Corp. has established the following standard cost per unit: Although 10,000 units were budgeted, only 8,800 units were produced. The purchasing department bought 55,000 lb of materials at a cost of $123,750. Actual pounds of materials used were 54,305. Direct labor cost was $186,550 for 18,200 hours worked. Required: Make journal entries to record the materials transactions, assuming that the materials price variance was recorded at the time of purchase. Make journal entries to record the labor variances.arrow_forwardCost and production data for Binghamton Beverages Inc. are presented as follows: Required: Calculate net variances for materials, labor, and factory overhead. Calculate specific materials and labor variances by department, using the diagram format in Figure 8-4. Comment on the possible causes for each of the variances that you computed. Make all journal entries to record production costs in Work in Process and Finished Goods. Determine the balance of ending Work in Process in each department. Assume that 4,000 units were sold at $40 each. Calculate the gross margin based on standard cost. Calculate the gross margin based on actual cost. Why does the gross margin at actual cost differ from the gross margin at standard cost. As the plant controller, you present the variance report in Item 1 above to Paul Crooke, the plant manager. After reading it, Paul states: “If we present this performance report to corporate with that large unfavorable labor variance in Blending, nobody in the plant will receive a bonus. Those standard hours of 5,500 are way too tight for this production process. Fifty-eight hundred hours would be more reasonable, and that would result in a favorable labor efficiency variance that would more than offset the unfavorable labor rate variance. Please redo the variance calculations using 5,800 hours as the standard.” You object, but Paul ends the conversation with, “That is an order.” What standards of ethical professional practice would be violated if you adhered to Paul’s order? How would you attempt to resolve this ethical conflict?arrow_forward

- USD Inc. has established the following standard cost per unit: Although 10,000 units were budgeted, 12,000 units were produced. The Purchasing department bought 50,000 lb of materials at a cost of $237,500. Actual pounds of materials used were 46,000. Direct labor cost was $287,500 for 25,000 hours worked. Required: Make journal entries to record the materials transactions, assuming that the materials price variance was recorded at the time of purchase. Make journal entries to record the labor variances.arrow_forwardFargo Co. manufactures products in batches of 100 units per batch. The company uses a standard cost system and prepares budgets that call for 500 of these batches per period. Budgeted fixed overhead is $60,000 per period. The standard costs per batch follow: During the period, 503 batches were manufactured, and the following costs were incurred: Required: Calculate the variances for materials, labor, and overhead. For overhead, use the two-variance method. (Hint: Please use the information given about the budgeted fixed overhead to compute the variable overhead rate.)arrow_forwardCase made 24,500 units during June, using 32,000 direct labor hours. They expected to use 31,450 hours per the standard cost card. Their employees were paid $15.75 per hour for the month of June. The standard cost card uses $15.50 as the standard hourly rate. A. Compute the direct labor rate and time variances for the month of June, and also calculate the total direct labor variance. B. If the standard rate per hour was $16.00, what would change?arrow_forward

- Direct materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Instructions Determine (A) the standard cost per unit for direct materials and direct labor; (B) the price variance, quantity variance, and total direct materials cost variance; and (C) the rate variance, time variance, and total direct labor cost variance.arrow_forwardDelano Company uses two types of direct labor for the manufacturing of its products: fabricating and assembly. Delano has developed the following standard mix for direct labor, where output is measured in number of circuit boards. During the second week in April, Delano produced the following results: Required: 1. Calculate the yield ratio. 2. Calculate the standard cost per unit of the yield. 3. Calculate the direct labor yield variance. 4. Calculate the direct labor mix variance.arrow_forwardSmith Industries uses a cost system that carries direct materials inventory at a standard cost. The controller has established these standards for the cost of one basket (unit): Smith Industries made 3,000 baskets in July and used 15,500 pounds of material to make these units. Smith Industries paid $39,370 for the 15,500 pounds of material. A. What was the direct materials price variance for July? B. What was the direct materials quantity variance for July? C. What is the total direct materials cost variance? D. If Smith Industries used 15,750 pounds to make the baskets, what would be the direct materials quantity variance?arrow_forward

- Jameson Company produces paper towels. The company has established the following direct materials and direct labor standards for one case of paper towels: During the first quarter of the year, Jameson produced 45,000 cases of paper towels. The company purchased and used 135,700 pounds of paper pulp at 0.38 per pound. Actual direct labor used was 91,000 hours at 12.10 per hour. Required: 1. Calculate the direct materials price and usage variances. 2. Calculate the direct labor rate and efficiency variances. 3. Prepare the journal entries for the direct materials and direct labor variances. 4. Describe how flexible budgeting variances relate to the direct materials and direct labor variances computed in Requirements 1 and 2.arrow_forwardBotella Company produces plastic bottles. The unit for costing purposes is a case of 18 bottles. The following standards for producing one case of bottles have been established: During December, 78,000 pounds of materials were purchased and used in production. There were 15,000 cases produced, with the following actual prime costs: Required: 1. Compute the materials variances. 2. Compute the labor variances. 3. CONCEPTUAL CONNECTION What are the advantages and disadvantages that can result from the use of a standard costing system?arrow_forwardPotter Company has installed a JIT purchasing and manufacturing system and is using back-flush accounting for its cost flows. It currently uses a two-trigger approach with the purchase of materials as the first trigger point and the completion of goods as the second trigger point. During the month of June, Potter had the following transactions: 40,500 labor plus 222,750 overhead. There were no beginning or ending inventories. All goods produced were sold with a 60 percent markup. Any variance is closed to Cost of Goods Sold. (Variances are recognized monthly.) Required: Prepare the journal entries for the month of June using backflush costing, assuming that Potter uses the sale of goods as the second trigger point instead of the completion of goods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY