Concept explainers

Binghamton Beverages Inc.

Variance analysis;

Required:

- 1. a. Calculate net variances for materials, labor, and factory overhead.

b. Calculate specific materials and labor variances by department, using the diagram format in Figure 8-4.

c. Comment on the possible causes for each of the variances that you computed.

- 2. Make all journal entries to record production costs in Work in Process and Finished Goods.

- 3. Determine the balance of ending Work in Process in each department.

- 4. Assume that 4,000 units were sold at $40 each.

- a. Calculate the gross margin based on

standard cost. - b. Calculate the gross margin based on actual cost.

- c. Why does the gross margin at actual cost differ from the gross margin at standard cost.

- 5. As the plant controller, you present the variance report in Item 1 above to Paul Crooke, the plant manager. After reading it, Paul states: “If we present this performance report to corporate with that large unfavorable labor variance in Blending, nobody in the plant will receive a bonus. Those standard hours of 5,500 are way too tight for this production process. Fifty-eight hundred hours would be more reasonable, and that would result in a favorable labor efficiency variance that would more than offset the unfavorable labor rate variance. Please redo the variance calculations using 5,800 hours as the standard.” You object, but Paul ends the conversation with, “That is an order.”

- a. What standards of ethical professional practice would be violated if you adhered to Paul’s order?

- b. How would you attempt to resolve this ethical conflict?

- a. Calculate the gross margin based on

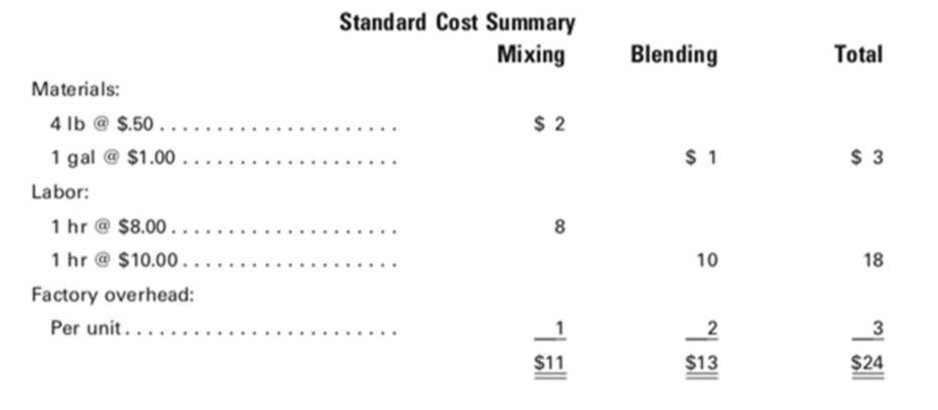

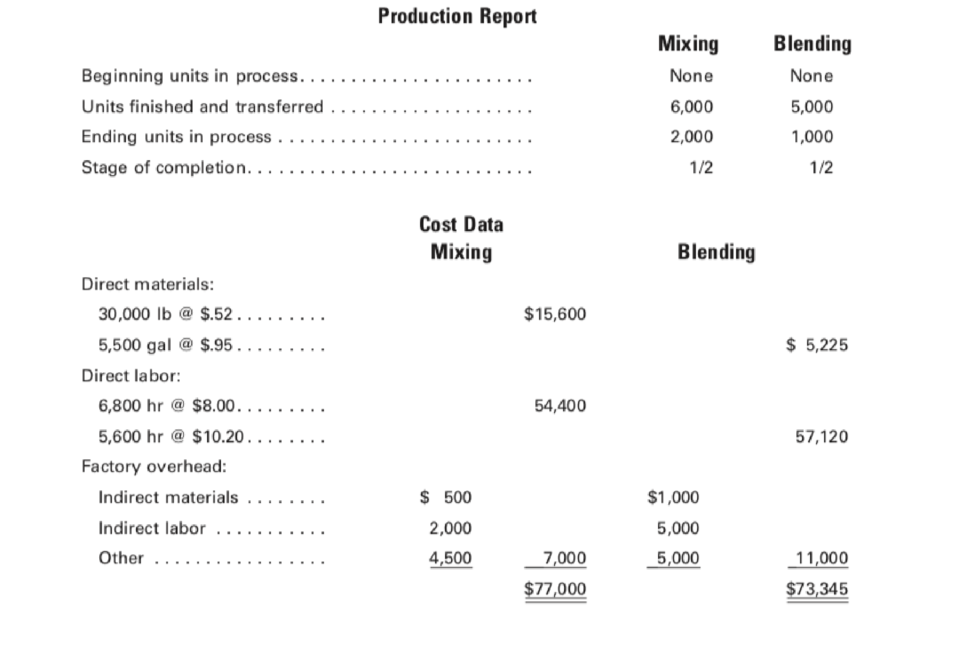

- 1 A)

Compute the net variances for materials, labor, and factory overhead.

Explanation of Solution

Compute the net variances for materials, labor, and factory overhead.

Figure (1)

Working note:

Calculate the equivalent units in Mixing:

Calculate the equivalent units in Blending:

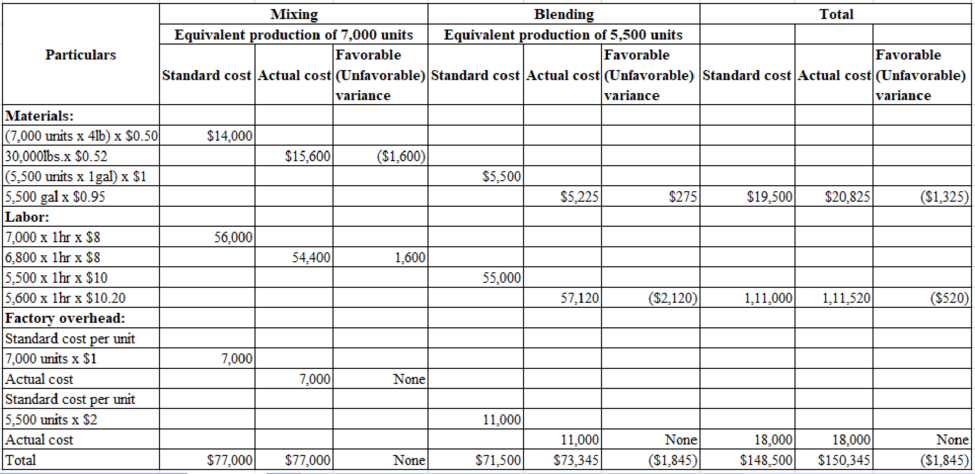

1 B)

Compute the specific materials and labor variances by department.

Explanation of Solution

Compute the specific materials and labor variances by department.

Materials:

Mixing:

Figure (2)

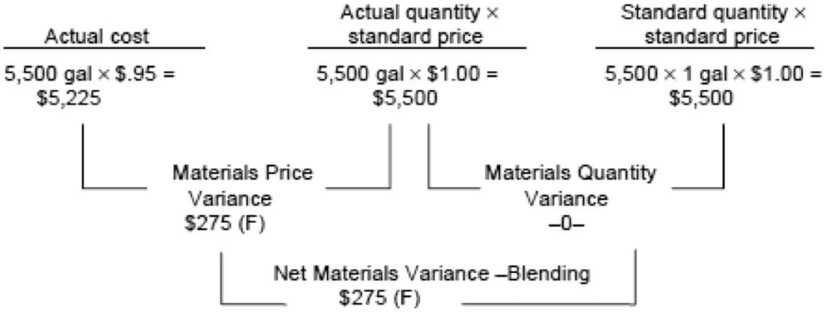

Blending:

Figure (3)

Labor:

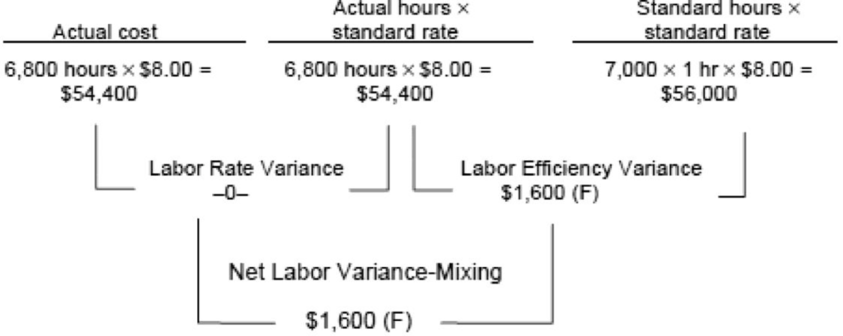

Mixing:

Figure (4)

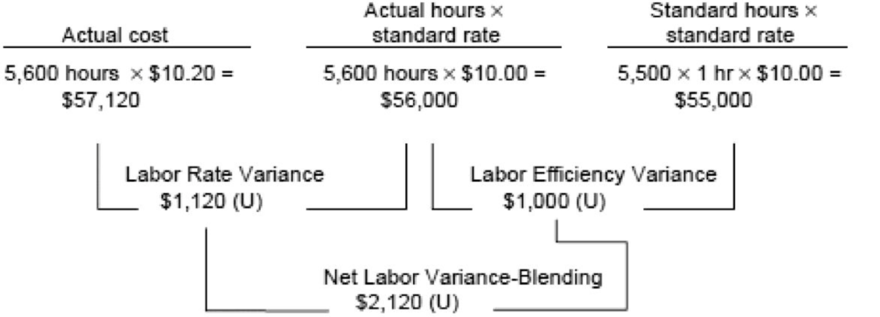

Blending:

Figure (5)

1 C)

Describe the possible causes for every variance from the computation.

Explanation of Solution

Possible causes for every variance from the computation.

In the mixing department, both the materials price variance and the materials quantity variance are unfavorable. If they willing to pay more amount for a superior quality material in anticipation to have a minimum amount of waste and spoilage, and that the strategy is unsuccessful and it is possible to increase the price for material that is not predict while the standards to determine. In the mixing department labor variances is more satisfied. There is no labor rate variance and the labor efficiency variance is favorable. So, this shows that the given ability of labor they budgeted for, the amount of labor time need to complete the production is less than the budgeted and there is a favorable variance due to a learning effect.

In the blending department, there is a favorable materials price variance and no materials quantity variance. This shows that they are capable to use minimum expensive materials than the budgeted for, while maintaining good control over materials usage. It is also probable that the price of materials of the quality that is planned to declined. A difficulty faced in the blending department is labor cost. So, the labor rate variance and the labor efficiency variance are unfavorable. If the strategy is to employ more expensive labor to complete the production of product by short time period is unsuccessful.

2.

Prepare the journal entry to record the production cost in work in process and finished goods.

Explanation of Solution

Prepare the journal entry to record the transaction.

| Particulars | Debit($) | Credit($) |

| Work in Process—Mixing | 14,000 | |

| Materials Quantity Variance— Mixing | 1,000 | |

| Materials Price Variance— Mixing | 600 | |

| Materials | 15,600 | |

| Work in Process-Blending | 5,500 | |

| Materials Price Variance— Blending | 275 | |

| Materials | 5,225 | |

| Factory overhead | 1,500 | |

| Materials | 1,500 | |

| Work in Process—Mixing | 56,000 | |

| Labor Efficiency Variance— Mixing | 1,600 | |

| Payroll | 54,400 | |

| Work in Process— Blending | 55,000 | |

| Labor Efficiency Variance— Blending | 1,000 | |

| Labor Rate Variance—Blending | 1,120 | |

| Payroll | 57,120 | |

| Factory overhead | 7,000 | |

| Payroll | 7,000 | |

| Factory overhead | 9,500 | |

| Various credits (Accounts payable, prepaid insurance, etc) | 9,500 | |

| Work in Process—Mixing | 7,000 | |

| Work in Process—Blending | 11,000 | |

| Applied Factory Overhead | 18,000 | |

| Work in Process—Blending | 66,000 | |

| Work in Process—Mixing | 66,000 | |

| Finished Goods | 1,20,000 | |

| Work in Process—Blending | 1,20,000 |

Table (1)

3.

Calculate the ending work-in process for every department.

Explanation of Solution

Calculate the ending work-in process for every department.

| Particulars | Mixing | Blending |

| Costs charged to departments: | ||

| Materials | $14,000 | $5,500 |

| Labor | 56,000 | 55,000 |

| Factory overhead | 7,000 | 11,000 |

| Prior department | 0 | 66,000 |

| $77,000 | $137,500 | |

| Less: Costs transferred out of departments | 66,000 | 120,000 |

| Balance of work in process | $11,000 | $17,500 |

Table (2)

4 A) & B)

Calculate the gross margin for standard cost and for actual cost.

Explanation of Solution

Calculate the gross margin for standard cost and for actual cost.

| S. no | Particulars | Amount |

| Sales | $160,000 | |

| Less: Cost of goods sold at standard | 96,000 | |

| a. | Gross margin at standard cost | $64,000 |

| Net unfavorable variance | 1,845 | |

| b. | Gross margin at actual cost | $62,155 |

Table (3)

4 C)

Explain the reason that the gross margin at actual cost differ from the standard cost,

Explanation of Solution

Reason for the difference:

Actual cost goes beyond the standard cost and results the unfavorable variance of $1,845, it is the reason for gross margin at actual cost is a lesser amount than the gross margin standard cost. In a standard cost system, the cost of production runs through the system at standard during the accounting period. During the ending period, standard cost is adjusted toward the actual while preparing the financial statements for external users.

5 a)

Explain the violation of ethical professional practice if hold on to P order.

Explanation of Solution

No, P told to act as unethical. The labor standards are used to for the earlier agreed to P and other superior. Specific IMA ethical standards will be violated by making the following changes,

Competence: Provide the support to make decision and suggestions are accurate, clear, concise, and timely.

Integrity: Withdraw from the engage in or underneath any activity that discredit the profession.

Credibility: 1) Information needs to communicate fairly and objectively. 2) Reveal all information that is expected by user’s to understand the reports, analyses, or recommendations.

5 b)

Describe the method to resolve this ethical conflict.

Explanation of Solution

Method to resolve this ethical conflict:

Follow the organization policy to resolve the conflict. If the organization policy does not resolve the conflict then other option is IMA’s suggested resolution of ethical conflict. In this case, present the information to the next level of management above P to the VP of manufacturing. This will be resolving this issue.

Want to see more full solutions like this?

Chapter 8 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Principles of Accounting Volume 2

Managerial Accounting: Creating Value in a Dynamic Business Environment

Intermediate Accounting (2nd Edition)

Intermediate Accounting

Principles Of Taxation For Business And Investment Planning 2020 Edition

- The president of McGrade Industries wants an analysis prepared to help explain why the variances computed in requirement 1 occurred. Using the worksheet called PRIMEVAR that follows these requirements, calculate the material and labor variances for McGrade Industries. The problem requires you to enter the input in the Data Section as well as formulas in the Answer Section.arrow_forwardWhich of the following is true concerning labor variances that are not material in amount? a. They are closed to Cost of Goods Sold. b. They are prorated among Work in Process, Finished Goods, and Cost of Goods Sold. c. They are prorated among Materials, Work in Process, Finished Goods, and Cost of Goods Sold. d. They are reported as part of Overall Variance on the balance sheet at the end of the year.arrow_forwardUsing variance analysis and interpretation Last year, Endicott Corp. adopted a standard cost system. Labor standards were set on the basis of time studies and prevailing wage rates. Materials standards were determined from materials specifications and the prices then in effect. On June 30, the end of the current fiscal year, a partial trial balance revealed the following: Standards set at the beginning of the year have remained unchanged. All inventories are priced at standard cost. What conclusions can be drawn from each of the four variances shown in Endicotts trial balance?arrow_forward

- Direct materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Instructions Determine (A) the standard cost per unit for direct materials and direct labor; (B) the price variance, quantity variance, and total direct materials cost variance; and (C) the rate variance, time variance, and total direct labor cost variance.arrow_forwardDirect materials, direct labor, and factory overhead cost variance analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 40,000 units of product were as follows: Each unit requires 0.3 hour of direct labor. Instructions Determine (A) the direct materials price variance, direct materials quantity variance, and total direct materials cost variance; (B) the direct labor rate variance, direct labor time variance, and total direct labor cost variance; and (C) the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance.arrow_forwardThe worksheet you have developed will handle most simple variance analysis problems. Try the problem below for Pscheidl, Inc.: Actual production for October was 11,500 units. Compute the direct materials and direct labor variances for Pscheidl, Inc. Be careful when entering your input because this problem presents the information in a different format from the McGrade Industries data. Save the file as PRIMEVAR4. Print the worksheet when done.arrow_forward

- Using variance analysis and interpretation Last year, Wrigley Corp. adopted a standard cost system. Labor standards were set on the basis of time studies and prevailing wage rates. Materials standards were determined from materials specifications and the prices then in effect. On June 30, the end of the current fiscal year, a partial trial balance revealed the following: Standards set at the beginning of the year have remained unchanged. All inventories are priced at standard cost. What conclusions can be drawn from each of the four variances shown in Wrigleys trial balance?arrow_forwardMarten Company has a cost-benefit policy to investigate any variance that is greater than 1,000 or 10% of budget, whichever is larger. Actual results for the previous month indicate the following: The company should investigate: a. neither the materials variance nor the labor variance. b. the materials variance only. c. the labor variance only. d. both the materials variance and the labor variance.arrow_forwardThe management of Golding Company has determined that the cost to investigate a variance produced by its standard cost system ranges from 2,000 to 3,000. If a problem is discovered, the average benefit from taking corrective action usually outweighs the cost of investigation. Past experience from the investigation of variances has revealed that corrective action is rarely needed for deviations within 8% of the standard cost. Golding produces a single product, which has the following standards for materials and labor: Actual production for the past 3 months follows, with the associated actual usage and costs for materials and labor. There were no beginning or ending raw materials inventories. Required: 1. What upper and lower control limits would you use for materials variances? For labor variances? 2. Compute the materials and labor variances for April, May, and June. Identify those that would require investigation by comparing each variance to the amount of the limit computed in Requirement 1. Compute the actual percentage deviation from standard. Round all unit costs to four decimal places. Round variances to the nearest dollar. Round variance rates to three decimal places so that percentages will show to one decimal place. 3. CONCEPTUAL CONNECTION Let the horizontal axis be time and the vertical axis be variances measured as a percentage deviation from standard. Draw horizontal lines that identify upper and lower control limits. Plot the labor and material variances for April, May, and June. Prepare a separate graph for each type of variance. Explain how you would use these graphs (called control charts) to assist your analysis of variances.arrow_forward

- Income statement indicating standard cost variances The following data were taken from the records of Griggs Company for December: Prepare an income statement for presentation to management.arrow_forwardRibcos labor cost information for making its only product for March is as follows: A. What is the direct labor rate variance? B. What is the direct labor time variance? C. What is the total direct labor variance?arrow_forwardMadison Company uses the following rule to determine whether direct labor efficiency variances ought to be investigated. A direct labor efficiency variance will be investigated anytime the amount exceeds the lesser of 12,000 or 10 percent of the standard labor cost. Reports for the past five weeks provided the following information: Required: 1. Using the rule provided, identify the cases that will be investigated. 2. Suppose that investigation reveals that the cause of an unfavorable direct labor efficiency variance is the use of lower quality direct materials than are usually used. Who is responsible? What corrective action would likely be taken? 3. Suppose that investigation reveals that the cause of a significant favorable direct labor efficiency variance is attributable to a new approach to manufacturing that takes less labor time but causes more direct materials waste. Upon examining the direct materials usage variance, it is discovered to be unfavorable, and it is larger than the favorable direct labor efficiency variance. Who is responsible? What action should be taken? How would your answer change if the unfavorable variance were smaller than the favorable?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning